Forex Sales Team – How to choose and train the right people?

September 2, 2021

Blueprint – how it made programming easy?

November 4, 2022Regardless of your experience level in the trading industry, it’d be difficult not to have heard of MetaTrader or MetaQuotes Software.

MetaQuotes Software Corp., a significant supplier of software applications for brokerages, banks, and exchanges, was formed in 2000. The company has built several well-known products, from a simple FX Charts platform to the MetaTrader 4 and MetaTrader 5 platforms (commonly known as MT4 and MT5).

Both MT4 and MT5 offer lightning-fast execution and a variety of trading tools to their users. Clients may trade on award-winning platforms, examine live streaming prices and charts, place orders, and manage their accounts with this software, which most brokers use throughout the world.

Despite this, there are a few comparisons between the two programs that are worth noting.

What are MT4 & MT5?

MT4, released on July 1, 2005, is a simple and easy-to-use electronic trading platform reserved primarily for the online retail forex market. A new trading platform called MT5, which was released five years later, on June 1, 2010, is a state of the art multi-asset platform.

Both trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are used by third-party traders. After downloading the interface to your computer, you’ll be able to connect to your chosen broker . Therefore, MT4 and MT5 are research and analysis tools and trading platforms that facilitate transactions, but they are not broker systems per se. They will instead send your orders in real-time to your selected brokerage firm.

Both MT4 and MT5 support automated trading robots. An expert advisor, also known as a forex EA (Expert Advisor), allows you to trade 100% automatically. Your chosen trading robot will enter buy-and-sell positions around the clock without you having to lift a finger to make them.

MetaTrader 5 strong points

MT5 Is Superior, No Doubt in That:

MT5, is no doubt, a superior trading platform than MT4. The new version supports trading in a wide range of markets, compared to MT4, which only supports forex and CFDs trading. In addition, the platform provides better control with the need for fewer third-party plugins and comes with an STP Gateway that allows any MT5 broker to connect directly to any other MT5 broker for liquidity.

Better control (fewer third-party plugins):

MT5 comes with ‘built-in order routing’. Brokers using MT4 would either need MetaQuotes’ own ‘Virtual Dealing Desk’ to handle this function or require third-party plugins like ‘Panda’ or ‘Ashira’ to provide the same features. The built-in order routing available in MT5 is astoundingly powerful. MT5 also offers extensive API support, allowing brokers to build custom applications, reporting tools, and even integrate MT5 with their websites. Customization and control are two very apparent themes that come to the surface with even the most cursory review of MetaTrader 5.

MetaTrader 5 becomes more popular than MetaTrader 4 among brokers:

MetaTrader 5 has become the most popular trading platform. The number of companies using MetaTrader 5 has exceeded the ones using MetaTrader 4 in June 2021. This is an expected result since the trading platform is constantly evolving, becoming even more powerful. For instance, the amount of MetaTrader 5 code has already reached 7 million lines, while the previous version had only 2 million.

Distributed architecture and 64-bit versions of platform components enable the usage of all hardware capabilities:

All MetaTrader 4 components are provided as 32-bit applications, due to which the available RAM amount is limited. The MetaTrader 5 was originally created to benefit from 64-bit opportunities provided by modern CPUs. Therefore, the platform has overcome the limitation of 10 million orders, as well as the limitations on the number of symbols and groups. Another limitation in MetaTrader 4 relates to the chart and tick history volume stored on the server side. The more symbols on the MetaTrader 4 server, the less space is left to store each symbol’s history. In MetaTrader 5, chart and tick history is only limited by the disk volume.

Algorithmic trading:

- Traders’ needs and requirements for writing trading programs are addressed by MetaQuotes Language 4 (MQL4) and MetaQuotes Language 5 (MQL5). Expert Advisers can be created by adopting and understanding this language used by traders (EA). As an EA, you can automate almost any trading strategy. Traders can also create their own custom indicators. Systems coded with MQL4 are not compatible with MQL5 programs.

- Another important difference to note is the trading system setup. MQL4 is used to develop trading programs based on the order system, while MQL5 implements a positional system.

- There’s a lot of talk about MQL5 being faster and easier to use than MQL4. Multiple functions are required in order to complete each trading operation in MQL4. In addition, the improved Strategy Tester for EAs on MT5 should be considered, as well as the Agent Manager for remote optimization.

MT4 Pros & Cons

The most appealing aspects of MT4:

- Over 1,200 online brokers back it up.

- Ideal for FX traders.

- There are a plethora of technical indicators and chart drawing tools available.

- MT4 is used by the vast majority of robot and EA providers.

- It is available online or via desktop software.

- Android and iOS apps are available.

Areas where MT4 falls short:

- MT4 has fewer technical indicators.

- Forex is better suited than other asset classes.

- Support for MT4 has been discontinued

MT5 Pros & Cons

The most appealing features of MT5:

- MT5 has more technical indicators and charting tools than MT4.

- Order types and execution models are highly advanced.

- Increased support for non-foreign currency CFDs.

- Compatibility with Windows and MAC desktop computers.

- Available online and as a mobile app.

- Ideal for experienced technical traders.

- MetaTrader 5 Platform for Hedge Fund is a turnkey solution for mutual funds, prop trading and investment companies right out of the box.

Areas where MT5 falls short:

- Few robots and EA developers use MT5 comparing to MT4

- Not beginner-friendly.

In conclusion, both MT4 and MT5 serve a common purpose. That is, both platforms are ideal for those who want to conduct advanced technical analysis and implement custom trading strategies. They are available as desktop software, web browsers, and mobile apps – and both provide full support for forex EAs and robots.

Having said that, MT5 is gradually dominating the market share and it can help brokers meet the current market trend (Crypto, Shares trading) since Metaquotes constantly monitor changes in the industry, and introduce new technologically advanced features.

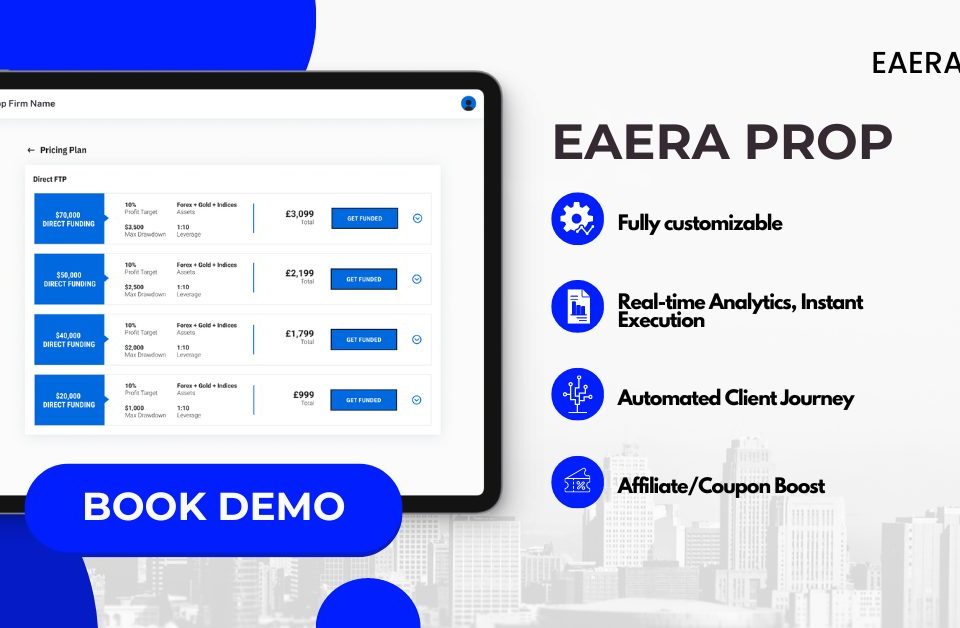

Opening your own FX brokerage

After reading the above MT4 and MT5 comparison, the answer to this question should be pretty obvious. If you want to do a lot of backtesting using the platform offline or want access to stock and commodity exchanges that Metatrader 4 does not support, Metatrader 5 is the obvious choice for you.

In any case, Metatrader 4 is still a tried and tested the gold standard platform in the industry. It is far more popular than Metatrader 5, and for a good reason: it is simple to use and manage, with fewer bugs than its browser-based competitor platform.

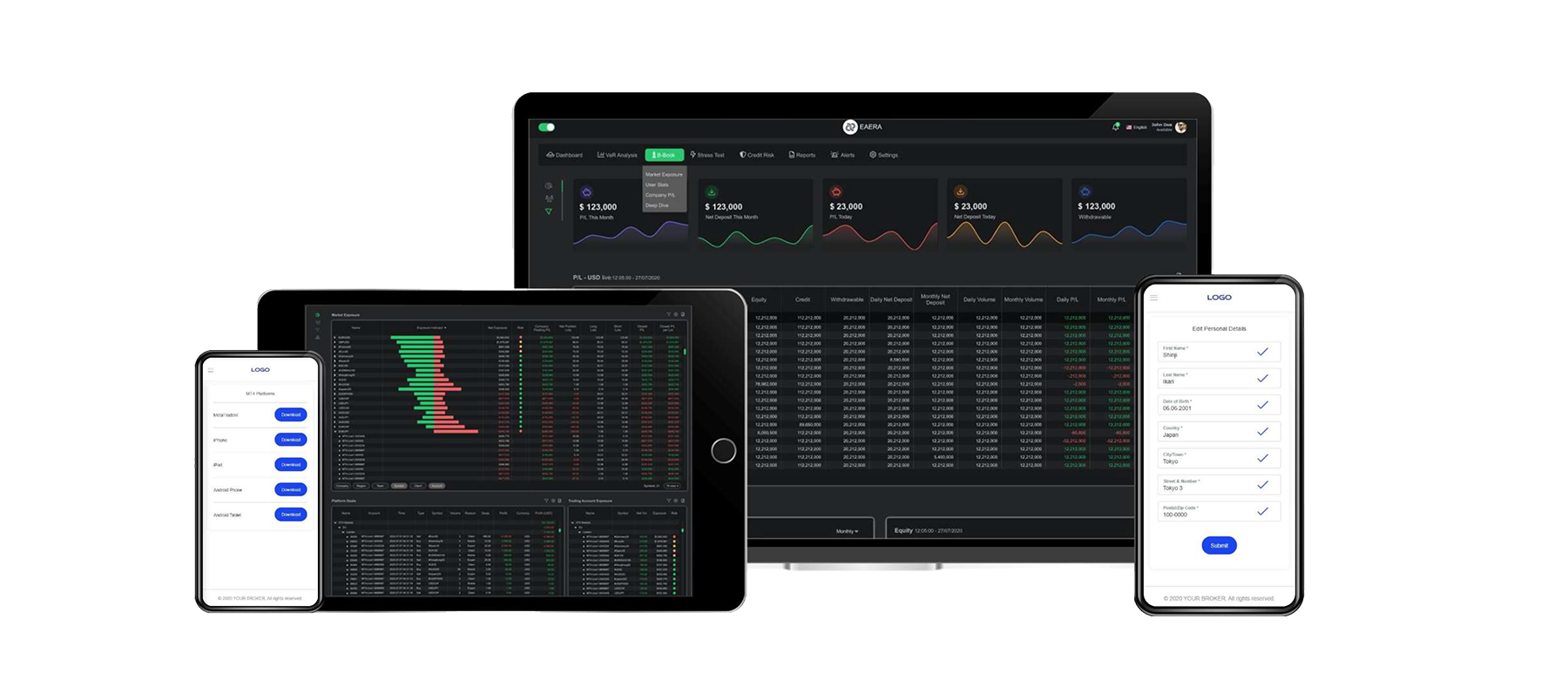

Choose your target audience, and voila – you are good to go! Whatever your choice is, EAERA One is there to fully support your business.

It has all essential features to help you run your business smoothly, including:

- MT4, MT5 White Label

- Website

- Back-office

- Client Portal

- All payment methods

- PAMM System

- Multi-Level Affiliate System

You can delegate company registration, law, and even finding the office space to EAERA, freeing up your time to focus entirely on building and presenting your brand to clients.

Our White Label solution allows you to personalize our system to fit your brand completely. A Forex white label helps you lower your operating expenses on the whole as you don’t have to comply with capital requirements since you will not be processing trading operations. Furthermore, you pay significantly less for a license compared with developing it on your own.

So, what are you waiting for? Let’s get started!

Follow the link and find out more about our offer:

eaera.com/core-brokerage-system/

Contact us and set up your own Forex company within 2 weeks!