Basel III: International Regulatory Framework for Banks

October 27, 2020

Happy to announce new partnership with Sumsub

November 5, 2020Risk definition

- Possibility that an outcome or investment’s actual gains will differ from an expected outcome or return.

- Includes the possibility of losing some or all of an original investment.

- It measures the uncertainty that an investor is willing to take to realize a gain

Risk management is the process of identifying, assessing and controlling threats to an organization’s capital and earnings. These threats, or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents and natural disasters. IT security threats and data-related risks, and the risk management strategies to alleviate them, have become a top priority for digitized companies. As a result, a risk management plan increasingly includes companies’ processes for identifying and controlling threats to its digital assets, including proprietary corporate data, a customer’s personally identifiable information (PII) and intellectual property.

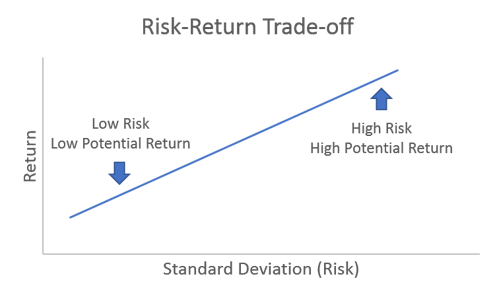

Risk vs. Reward

Broker-dealers, like all businesses, live in a world of risk – operational risk, legal risk, reputation risk, managerial risk, credit risk, among others. Of course, the overarching concern – regulatory risk – is something unique to regulated entities. In many respects, management of any type of risk comes down to the same calculus faced by a broker-dealer’s customers, that is, the ability to balance risk against the potential rewards. Both in theory, and typically in practice, investors make investments hoping the potential reward – profits – outweighs the risks attendant to their particular investments.

Risk return tradeoff is the balance between the desire for lowest possible risk and highest possible return.

- This is only a theoretical approach – high risk does not necessarily mean high return.

- Consider expected return and volatility compared to the rate of return

Sources of risk in the Brokerage Business:

- Internal (failing to gain expected market share, compliance risks, credit risks)

- Competition risks (banks, other security traders, copied innovations, constraints on innovation)

- Loss of a favorable business environment (macroeconomic changes)

Management of customer risk

An accurate customer risk assessment will help you acquire the most profitable consumers while minimizing risk.

Management of customer risk includes:

- Establishing margin requirements and position limits at adequate levels

- Reviewing significant market exposures at least daily

- Calling for additional collateral modifying margin requirements or position limits, reducing position size

- Identifying and protecting customer property in their custody

- Identifying cheating and arbitrage trading

Download our Presentation below to find out more about:

- Risk Profile

- Financial Risk – types and evaluation

- Tools and measures to control financial risk

- Risk for Brokerage Firms – market and customers