Introduction

In today’s competitive forex landscape, acquiring new traders is just the beginning—the real challenge lies in retaining them. With rising customer acquisition costs, tighter spreads, and countless broker options, even minor issues like login troubles or delayed withdrawals can drive clients away. That’s why forward-thinking brokers now rely on forex CRM software not just for operations, but as a strategic tool to boost client retention and long-term engagement.

A well-designed forex CRM software centralizes every client interaction—from onboarding and compliance to trading updates and marketing—creating a seamless, personalized experience. By integrating data, communication, and support into one platform, brokers can anticipate needs, respond quickly, and build lasting trust. In the sections that follow, we’ll explore five key ways this technology helps brokers keep traders engaged and loyal.

Related articles:

- Unlock Your Brokerage Potential: Top Forex CRM Solutions Revealed!

- Why EAERA Is the Best Forex CRM Solution for FX Brokers?

What Is Forex CRM Software?

Forex CRM software is a specialized customer relationship management platform created exclusively for the fast-moving world of online currency trading. Unlike generic CRMs that only store contacts and emails, a forex CRM connects directly with MetaTrader 4/5 (MT4/MT5), cTrader, or other trading platforms to synchronize trade data, deposits, withdrawals, and account changes in real time.

It also integrates built-in KYC/AML verification, payment gateways, ticketing systems, and multi-level partner management. In practice, this means every trader interaction—from first sign-up through funding, trading, and long-term account management—sits on a single, transparent system.

For brokerage owners, it’s like replacing a patchwork of spreadsheets and emails with one intelligent control center. Traders, in turn, experience smoother onboarding, faster support, and consistent communications. By putting all client and trade information under one roof, forex CRM software removes silos, reduces manual work, and creates the foundation for sustainable growth and retention.

Why Client Retention Beats Acquisition in FX?

In retail FX, marketing costs climb as competition and compliance tighten. Acquiring a single active trader can cost hundreds of dollars in ads, IB commissions, and promotions. Losing that trader after the first month erases your investment and forces you to spend again just to stay even. Retention flips the math. Every extra month that a funded trader stays active multiplies lifetime value (LTV) while lowering your customer acquisition cost (CAC) over time.

Loyal traders also tend to deposit larger amounts, trade more frequently, and bring in friends or introduce brokers, creating a self-reinforcing growth cycle. In volatile markets, where spreads fluctuate and new leads may slow, a high retention rate provides predictable revenue and healthier cash flow. In short, while acquisition drives short-term spikes, retention is the compounding engine of a brokerage’s long-term profitability.

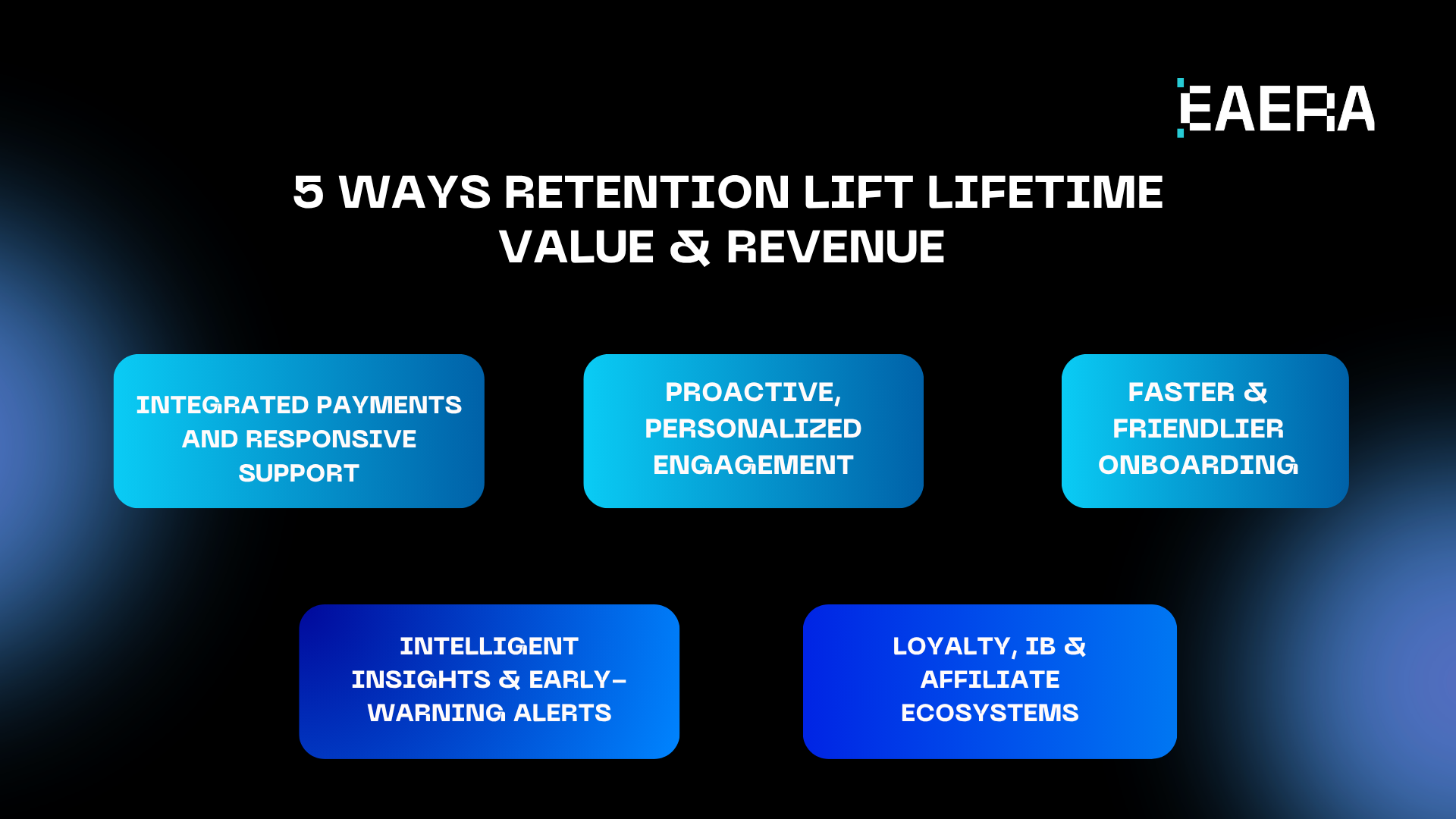

How Retention Lifts Lifetime Value & Revenue?

A client’s lifetime value isn’t only about how long someone trades; it’s about the depth of the relationship. A broker who keeps traders engaged for three, six, or twelve additional months benefits from more deposits, higher average trade volume, and a steady stream of referral business. Forex CRM software directly influences these metrics by making every stage of the client journey—from the first KYC upload to complex multi-account management—smooth and personal.

Automatic reminders encourage repeat funding, while real-time analytics identify opportunities for upselling new account types or value-added services. Better data means better decisions: managers can target high-potential clients with personalized offers and proactively address issues before traders leave. Over time, this creates not only more revenue per account but also a stronger brand reputation, making new acquisitions easier and less expensive.

Way 1: Faster, Friendlier Onboarding

First impressions determine whether a prospect becomes a long-term client. Forex CRM software accelerates onboarding with automated KYC/AML checks that verify IDs and proof-of-address documents in minutes, not days. The system tracks progress, sends reminders, and flags missing steps, so both the client and compliance team always know where things stand.

Once verified, guided account setup walks traders through funding options, platform downloads, and a “first trade” checklist. Helpful tooltips and micro-rewards turn a potentially intimidating process into a smooth, confidence-building experience. By the time clients finish onboarding, they’re already trading—reducing the risk of drop-off and signaling a positive journey ahead.

Way 2: Proactive, Personalized Engagement

Clients stay when they feel understood. Forex CRM software provides a 360-degree profile of every trader: demographics, trading habits, favorite instruments, funding frequency, and support history. Brokers can segment clients into groups like “new but inactive,” “high-volume scalpers,” or “education seekers” and tailor content accordingly.

Automated journeys—welcome sequences, deposit nudges, or re-engagement campaigns—trigger based on real behavior, such as inactivity or sharp drawdowns. Instead of blasting generic emails, you can send the right message at the right moment, whether it’s a strategy webinar invite or a personalized bonus. This proactive engagement builds trust and keeps traders active well beyond the typical first few months.

Way 3: Integrated Payments & Responsive Support

Nothing drives traders away faster than slow deposits, delayed withdrawals, or poor support. Forex CRM software integrates with multiple global and regional payment service providers to enable instant, transparent funding and withdrawals. Clients can save preferred methods, track every transaction, and receive immediate confirmation, which builds trust.

At the same time, omnichannel support—live chat, email, phone, and even social messaging—is centralized in one dashboard. Tickets are automatically routed to the right team member with service-level agreements (SLAs) to guarantee quick resolution. A self-service knowledge base handles common questions 24/7. The result is a seamless money flow and dependable help when it matters most.

Way 4: Intelligent Insights & Early-Warning Alerts

Retention isn’t guesswork when you have the right data. Modern forex CRM software collects signals such as login frequency, trading activity, deposit patterns, and support tickets to create a health score for each account. If the score dips—indicating churn risk—automated playbooks alert managers or trigger targeted offers like personalized coaching or risk-management tips.

Manager dashboards display KPIs such as activation rates, 30/60/90-day retention, and average revenue per user, all segmented by cohort, channel, or geography. With these insights, brokers can shift resources to where they have the most impact, catching problems early and turning at-risk clients back into loyal traders.

Way 5: Loyalty, IB & Affiliate Ecosystems

A thriving partner network is one of the best retention tools in FX. Forex CRM software supports multi-tier introducing broker (IB) and affiliate structures, calculating commissions automatically and providing real-time performance dashboards. This transparency builds trust among partners and eliminates disputes over payouts.

For traders, brokers can create loyalty programs—such as reward points for consistent trading or completing educational modules—that encourage long-term engagement. Community features like webinars, chat rooms, and social trading events further strengthen ties. Together, these elements turn your brokerage from a transactional platform into a vibrant ecosystem clients are proud to stay with.

Conclusion

In the fiercely competitive forex market, retention is the true driver of sustainable growth. By streamlining onboarding, personalizing engagement, ensuring seamless payments and support, delivering intelligent early-warning insights, and nurturing vibrant IB and affiliate ecosystems, forex CRM software transforms client relationships from short-term transactions into lasting partnerships.

Now is the time to put these strategies to work. EAERA’s Forex CRM is purpose-built to help brokers increase lifetime value and keep traders active for the long run. From automated KYC to real-time analytics and multi-tier partner management, it provides every tool you need to build trust and boost profitability.

Request a personalized demo today to see how our Forex CRM can elevate retention, strengthen loyalty, and help your brokerage grow with confidence.