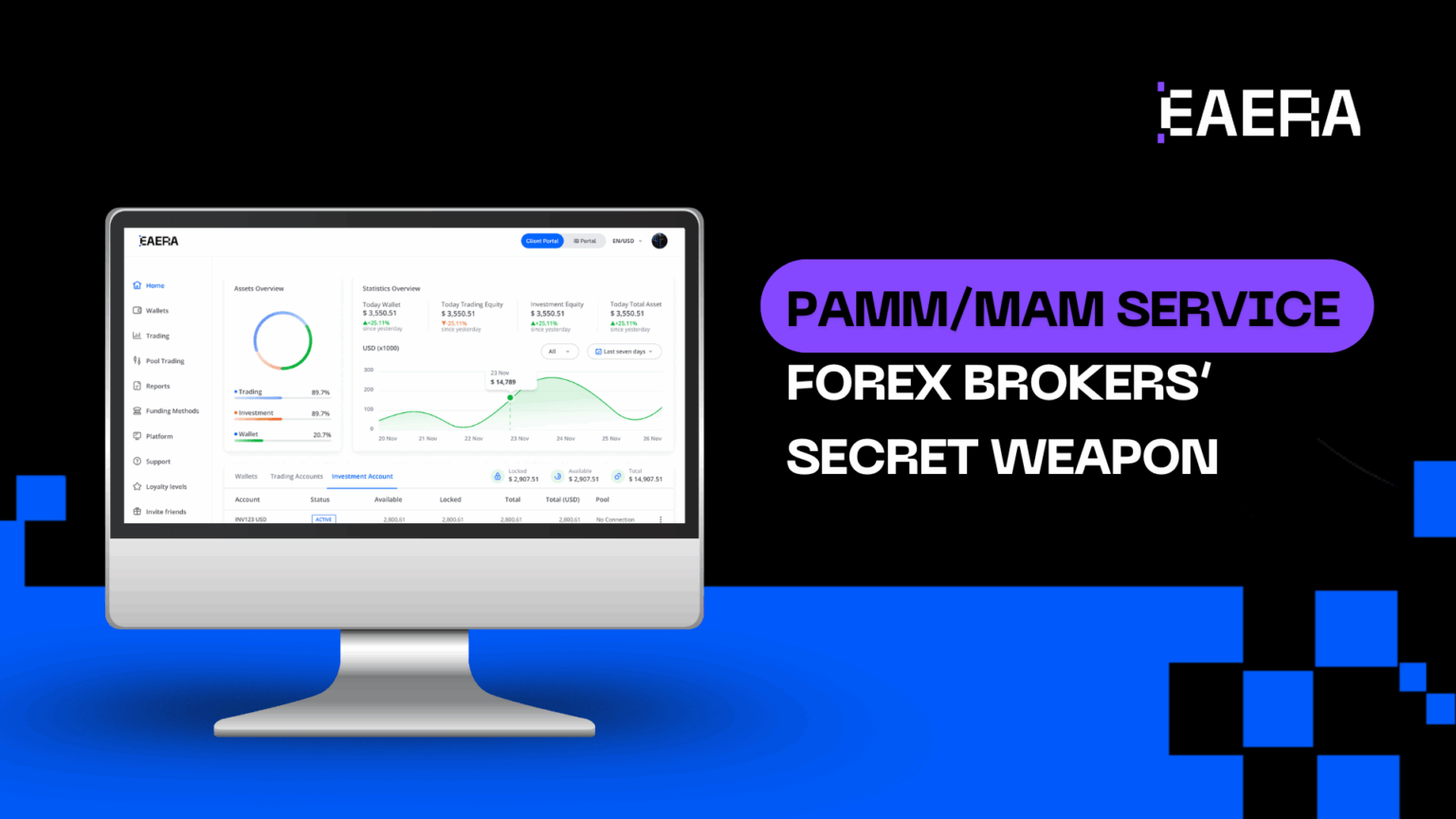

In the ever-evolving world of forex trading, efficiency and innovation are paramount. EAERA stands out as a trailblazer in financial technology, providing state-of-the-art solutions that cater to forex brokers and investors alike. Among its standout offerings are PAMM (Percentage Allocation Money Management) and MAM (Multi-Account Manager) services—tools that have redefined investment management for a global audience. These platforms enable FX brokers to attract and retain clients while allowing investors to enjoy professional fund management. In today’s competitive landscape, PAMM and MAM services are indispensable for optimizing returns and expanding portfolios.

Related articles:

- Forex CRM: The Key to Success in Forex Trading

- EAERA’s New Features: Streamlining User-to-User Payments with Cross-Transfer

Simplifying investment management with PAMM and MAM systems

1. Understanding PAMM and MAM

PAMM and MAM accounts are pivotal tools in the forex industry, providing innovative solutions for brokers, traders, and investors. These systems streamline the complexities of managing multiple accounts while ensuring a win-win for all stakeholders involved. Let’s explore these services in more depth.

1.1 What is PAMM?

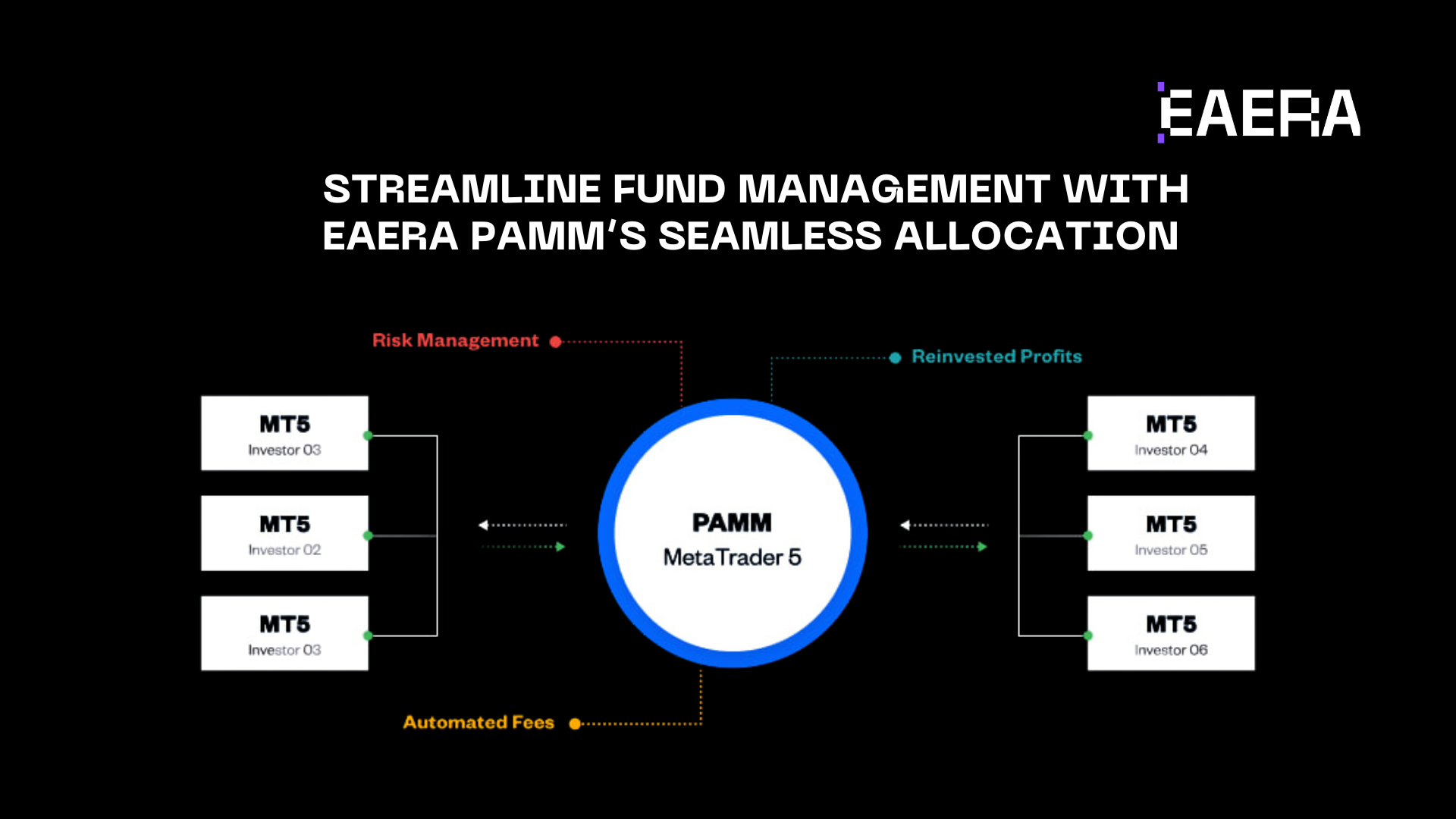

PAMM, or Percentage Allocation Money Management, is a system where investors allocate their capital to professional traders. These traders, also known as money managers, use the pooled funds to execute trades on behalf of investors. The profits or losses are distributed proportionally based on each investor’s contribution to the fund.

Key Features of PAMM Trading:

- Centralized Management: Traders manage multiple investors’ funds in a single account.

- Transparency: Investors can monitor trades and track performance in real-time.

- Profit Sharing: Revenue and losses are distributed according to each investor’s share.

- PAMM accounts are particularly appealing to passive investors who want to leverage the expertise of seasoned professionals without the need for active trading.

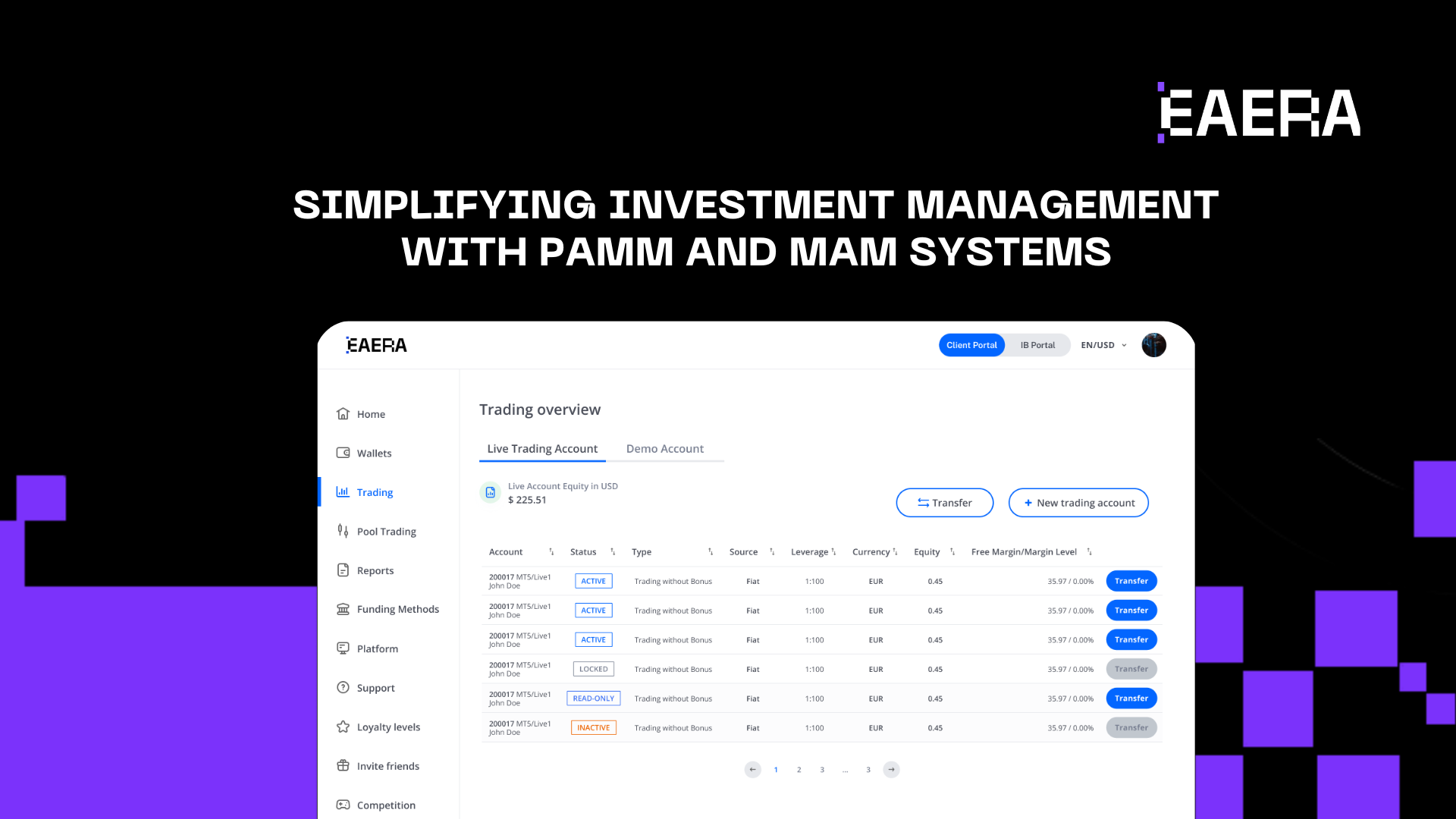

1.2 What is MAM?

MAM, or Multi-Account Manager, shares similarities with PAMM but offers additional flexibility. In a MAM setup, investors retain more control over their accounts, including the ability to customize risk parameters and trade sizes. This makes MAM an attractive choice for investors who prefer a more active role in their portfolio management.

Key Features of MAM Accounts:

- Customizable Allocations: Investors can set their preferred risk levels and trade sizes.

- Scalable Management: Money managers handle multiple accounts efficiently.

- Versatility: Supports diverse trading strategies, including those on MT4 and MT5 platforms.

- MAM accounts bridge the gap between professional fund management and individual control, making them ideal for investors with varying risk appetites.

1.3 Key Differences Between PAMM and MAM

While both PAMM and MAM systems enable professional traders to manage multiple client accounts, there are distinct features that set them apart. Understanding these differences is essential for brokers and investors to make informed decisions.

| Feature | PAMM | MAM |

| Fund Allocation | Fixed percentage allocation | Customized allocation per client |

| Investor Control | Limited | High |

| Risk Management | Standardized for all investors | Personalized to each account |

| Trade Visibility | Partial | Full |

| Ideal For | Passive investors | Active investors |

Understanding these nuances helps brokers and investors determine which system aligns best with their financial goals and trading styles.

Choosing the right account type for your trading goals

2. The Significance of PAMM Trading in Today’s Market

Advantages of PAMM Trading:

- Professional Fund Management: Investors benefit from the expertise of skilled traders.

- Portfolio Diversification: Reduces risks by spreading investments across strategies.

- Transparency: Clear reporting and profit-sharing mechanisms.

The global forex market has witnessed a surge in demand for PAMM services. As investors seek passive income opportunities, PAMM accounts have become a trusted avenue for consistent returns. Brokers offering these services are well-positioned to attract and retain clients.

3. EAERA’s PAMM/MAM Services

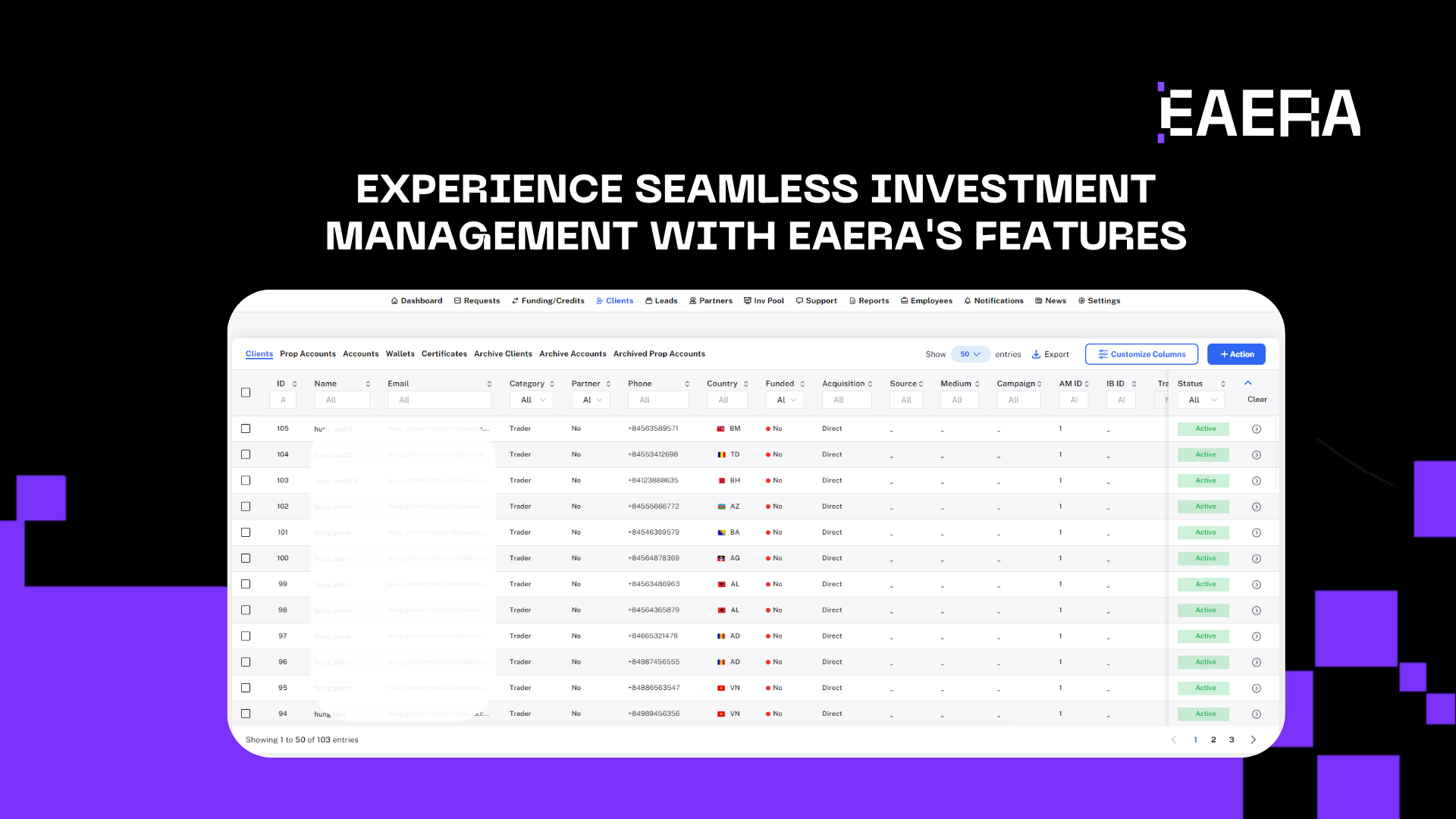

EAERA’s platform is designed to meet the diverse needs of brokers and investors. The cloud-based solution allows traders to manage unlimited accounts while integrating essential tools such as Client Portals, Forex CRM, Backoffice systems, and Affiliate Management. Shared investment accounts further enhance the platform’s appeal, driving trading volumes and client acquisition.

Here are the key features of EAERA’s PAMM/MAM service:

- Customizable User Interface: Provides a tailored experience for users

- Integrated Wallet System: Simplifies fund transfers and management

- Analytics and Reporting: Detailed insights for informed decision-making

- Automated Onboarding: eKYC support ensures seamless client integration

Experience seamless investment management with EAERA’s features

4. Why choose EAERA’s PAMM/MAM services?

Advanced Tools for Brokers

EAERA offers brokers a suite of advanced tools that simplify the complexities of managing multiple investments. With its cloud-based solutions, brokers can efficiently handle diverse client portfolios, ensuring smooth operations. The platform’s built-in compliance features and regulatory support further streamline processes, helping brokers stay ahead in a competitive market.

Flexible Commission Structures

One of the standout features of EAERA’s PAMM/MAM services is the ability to create flexible commission structures. Brokers and money managers can customize fee models to align with their trading strategies and clients’ expectations. This adaptability fosters trust and satisfaction among investors while offering competitive incentives for managers.

Enhanced Visibility Through Leaderboards

EAERA provides a unique leaderboard system that highlights top-performing money managers. This feature enhances visibility and credibility, making it easier for traders to attract new clients. Investors can make informed decisions by reviewing transparent performance metrics, which builds confidence in the system.

Seamless Integration with Forex Platforms

The platform supports popular trading platforms like MT4 and MT5, ensuring compatibility and ease of use. Whether brokers are managing beginner traders or seasoned investors, the seamless integration ensures an optimal trading experience.

Dedicated Support and Resources

EAERA’s commitment to excellence extends beyond its platform. Clients have access to dedicated customer support, ensuring their concerns are addressed promptly. In addition, the company offers educational resources and tutorials, enabling both brokers and investors to maximize the potential of PAMM/MAM services.

EAERA’s PAMM/ MAM services redefine forex investment by delivering comprehensive solutions, advanced tools, and unparalleled flexibility. For investors, these platforms offer professional fund management and diversification. For brokers, they streamline operations and boost client retention.

Ready to elevate your investment strategy? Visit EAERA’s website today to explore their PAMM/MAM services, request a demo, or contact their team for personalized consultations.