The Forex market is one of the most dynamic and fast-paced industries in the world. For brokers, staying competitive requires not just great trading platforms but also tools to manage relationships and operations effectively. This is where a Forex CRM system becomes indispensable. In this article, we’ll delve into what Forex CRM is, its core features, and how it can transform your brokerage. We’ll also explore why EAERA’s Forex CRM stands out as a game-changer in this space.

Related articles:

- Gamification and Forex CRM: A Game-Changer for Brokers

- The Importance of Forex CRM: Why Every Forex Broker Needs One

1. Understanding Forex CRM

Definition and Overview

A Customer Relationship Management system is a specialized software solution designed to cater to the unique needs of Forex brokerages. Unlike generic CRMs, Forex CRM integrates with trading platforms and helps brokers manage leads, clients, operations, and compliance seamlessly.

Forex brokers deal with a high volume of transactions, client interactions, and regulatory requirements. A robust Forex CRM simplifies these processes by centralizing data and automating repetitive tasks, allowing brokers to focus on scaling their businesses.

Why Forex CRM Matters

Without a Forex CRM, brokers often face fragmented workflows, missed opportunities, and inefficient client management. Forex CRMs address these challenges by offering tools tailored to the industry, enabling brokers to maintain a competitive edge in a crowded market.

2. Core Features of a Forex CRM

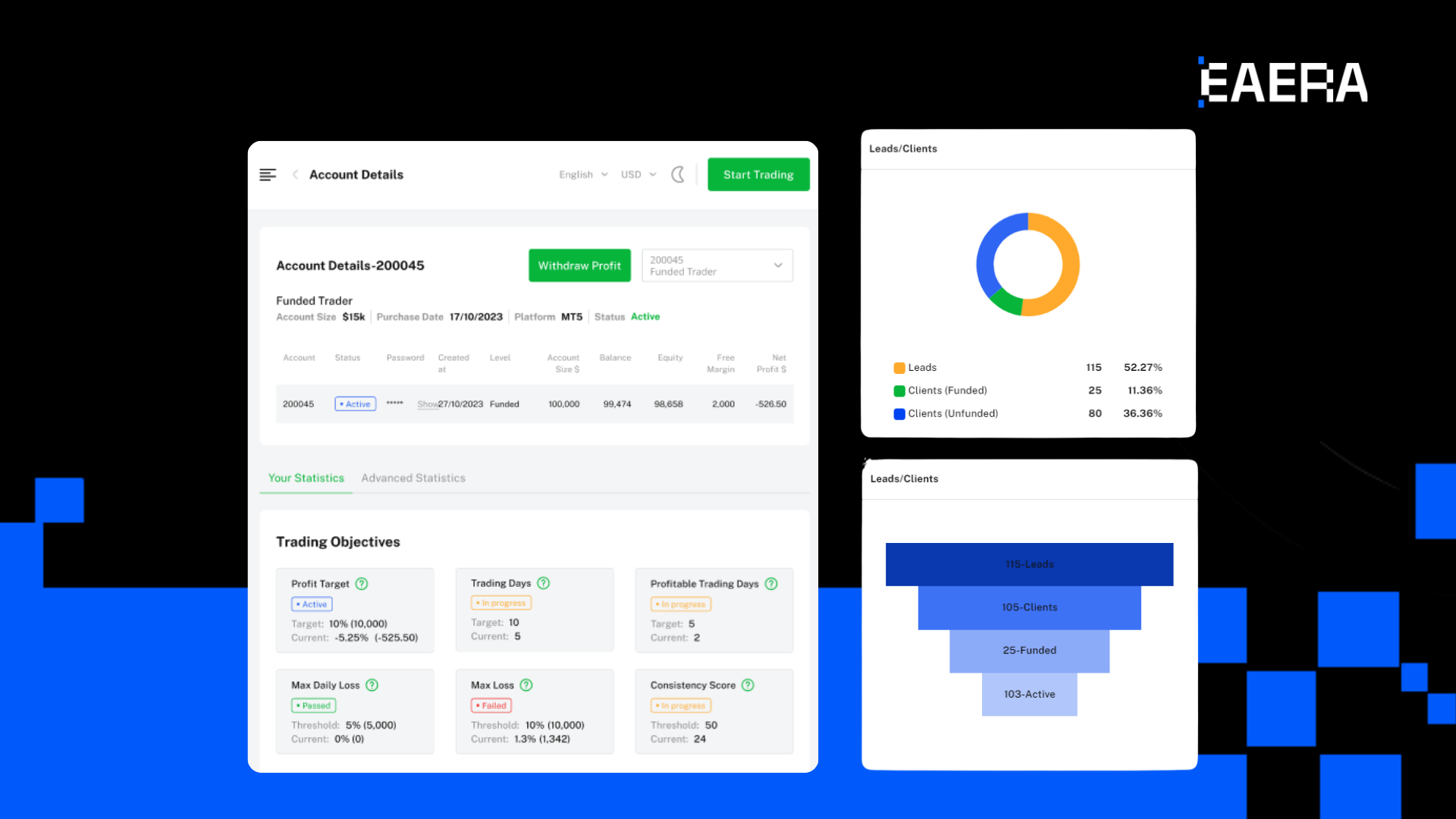

Lead and Client Management

Forex CRM systems streamline the process of tracking leads and nurturing potential clients. They provide a centralized client database where brokers can view client histories, preferences, and activities. This ensures better decision-making and fosters stronger relationships.

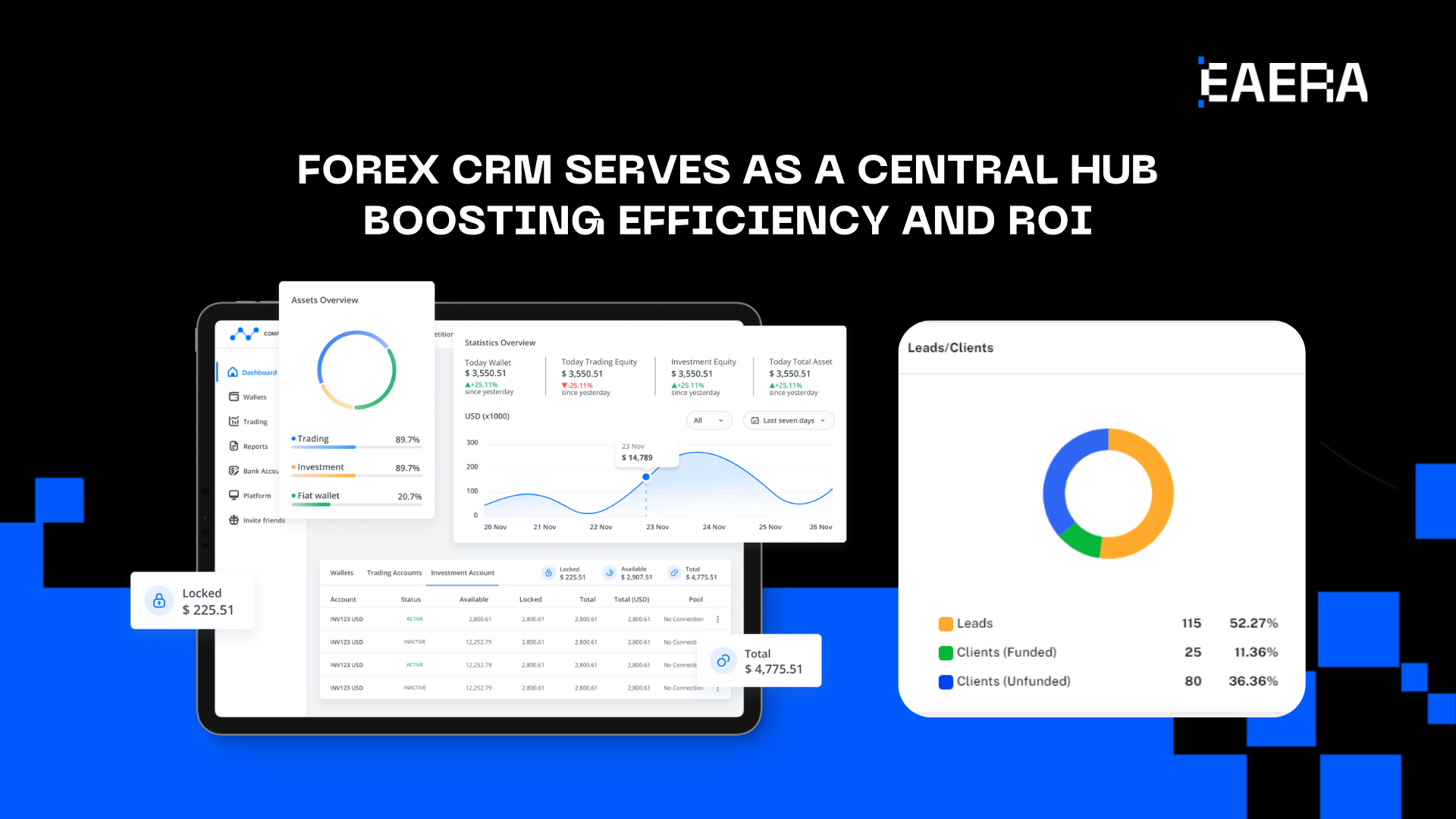

Trading Platform Integration

Integration with trading platforms like MT4 and MT5 is a cornerstone of Forex CRMs. This feature allows brokers to sync client activities, transactions, and account details in real time, eliminating the need for manual data entry and reducing errors.

Advanced Reporting and Analytics

Forex brokers rely on data to make informed decisions. Forex CRMs offer built-in analytics and reporting tools that track key metrics such as lead conversion rates, trading volumes, and client retention. These insights empower brokers to optimize their strategies and achieve better results.

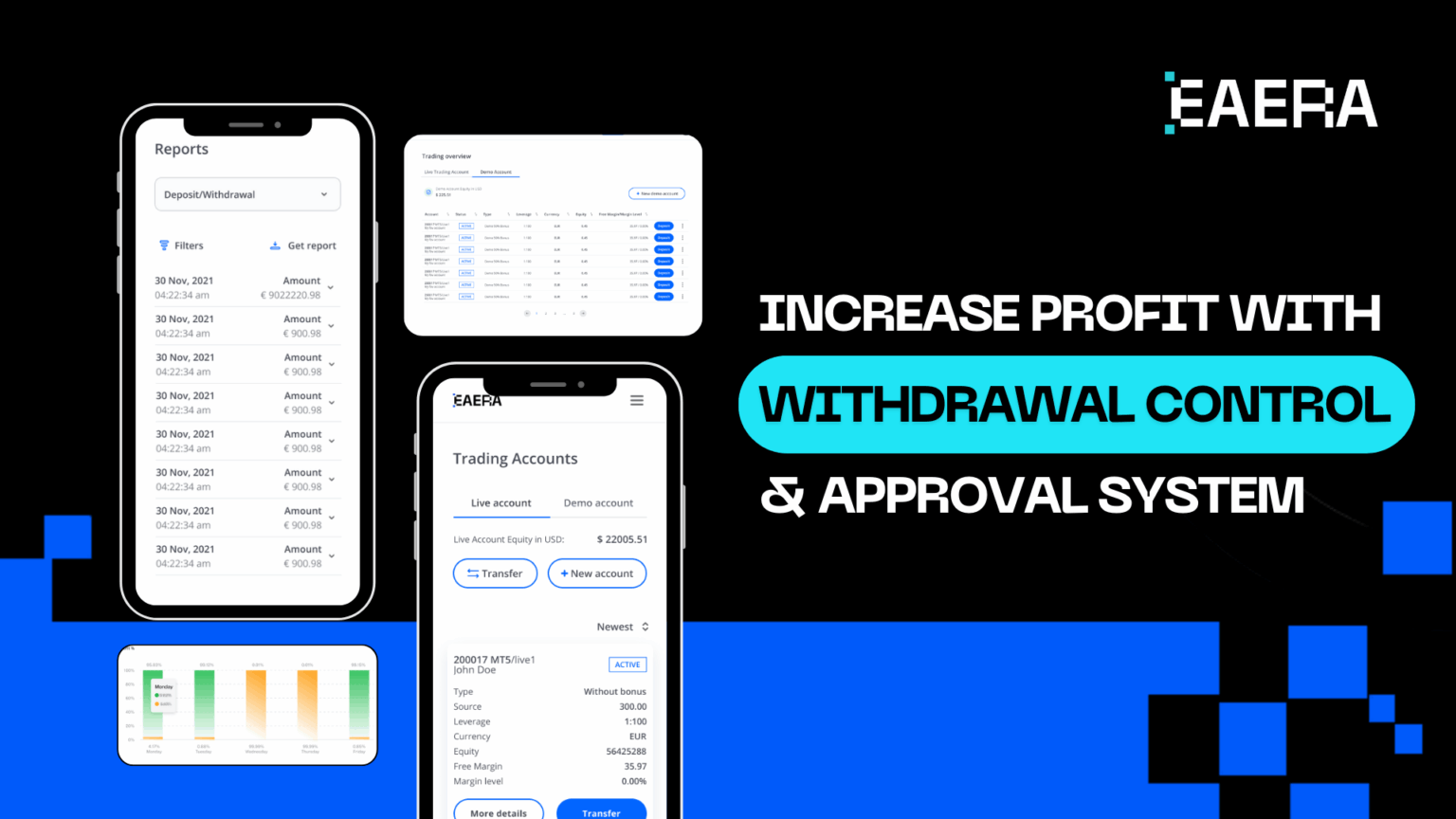

Automated Processes

From onboarding clients to conducting KYC (Know Your Customer) checks, automation in Forex CRMs saves time and ensures compliance with international regulations. Automated workflows also reduce the risk of human error, boosting overall efficiency.

Communication Tools

Forex CRMs come with built-in communication features like email marketing, SMS notifications, and chat integrations. These tools help brokers stay connected with clients, share updates, and foster engagement, ultimately improving client retention.

3. Benefits of Using a Forex CRM for Your Brokerage

Enhanced Client Experience

Forex CRMs enable brokers to offer personalized services by analyzing client behavior and preferences. A tailored approach builds trust and loyalty, which are essential for long-term success in the competitive Forex market.

Increased Operational Efficiency

Manual processes can slow down operations and lead to errors. Forex CRMs automate routine tasks, allowing brokers to focus on critical activities like strategy development and client acquisition. Faster response times and streamlined workflows also improve overall productivity.

Compliance and Risk Management

Compliance is a top priority for Forex brokers operating in different jurisdictions. Forex CRMs come with compliance tools that ensure adherence to international regulations. Automated KYC checks and reporting features help brokers mitigate risks and avoid penalties.

Scalability

As your brokerage grows, so do your operational demands. Forex CRMs are designed to scale with your business, offering modular features and flexible integrations. Whether you’re a small brokerage or an established firm, a Forex CRM can support your growth trajectory.

Profitability Boost

With better lead management, higher client retention, and optimized operations, Forex brokers can see a significant boost in profitability. A Forex CRM acts as a central hub that drives efficiency and maximizes return on investment (ROI).

4. Choosing the Right Forex CRM for Your Brokerage

Key Considerations

Selecting the right Forex CRM requires careful evaluation of your brokerage’s needs. Consider factors like the size of your operation, the volume of clients, and the specific features you require. A good Forex CRM should align with your goals and enhance your workflow.

Customization and Flexibility

Every brokerage is unique, which is why customization is critical. A flexible Forex CRM allows you to tailor the platform to match your branding and operational requirements. EAERA’s Forex CRM, for example, offers extensive customization options to meet the diverse needs of brokers worldwide.

Support and Training

Implementing a Forex CRM is only the first step. Ongoing support and training are crucial for leveraging its full potential. Look for providers that offer comprehensive onboarding, user training, and 24/7 support to ensure a seamless experience.

5. Why EAERA’s Forex CRM Is the Ultimate Solution for Forex Brokers

EAERA has established itself as a leader in the Forex CRM space, thanks to its innovative approach and client-centric solutions. Here are some of the standout features of EAERA’s Forex CRM:

- Cutting-Edge Technology: Built with the latest technologies, EAERA’s CRM ensures high performance, security, and reliability.

- Tailored for Forex Brokers: Every feature is designed with Forex brokerages in mind, from lead management to compliance tools.

- Global Reach: EAERA’s CRM supports brokers operating in multiple regions, with multilingual and multi-currency functionalities.

EAERA’s Forex CRM has transformed the operations of numerous brokerages. For instance, one mid-sized brokerage increased its lead conversion rate by 40% within six months of implementing EAERA’s solution. Such success stories demonstrate the tangible benefits of choosing the right CRM.

In the highly competitive Forex industry, staying ahead requires more than just exceptional trading platforms. A Forex CRM is a vital tool that helps brokers manage operations, nurture client relationships, and achieve compliance. By integrating automation, analytics, and communication features, Forex CRMs empower brokers to scale efficiently and maximize profitability.

EAERA’s Forex CRM stands out as a top choice for brokers looking to streamline their operations and gain a competitive edge. With its advanced features, customization options, and commitment to client success, EAERA is your partner in growth.

Take the next step toward revolutionizing your brokerage. Contact EAERA today to schedule a demo and discover how our Forex CRM can transform your business! https://eaera.com/contact-us/