In the competitive Forex trading industry, brokerages rely on advanced tools to boost efficiency and build lasting client relationships. One of the most vital tools is a Forex CRM—a solution designed specifically for brokerages to manage customer interactions, automate processes, and drive growth. Choosing the right Forex CRM provider can define how well a brokerage scales, complies with regulations, and delivers a smooth trading experience.

Related articles:

- Forex CRM and FX Market Outlook: Key Trends for 2025

- 10 Reasons Why You Should Get a Forex Broker CRM

I. What Is a Forex CRM? Why It’s Essential for Brokerages

A Forex CRM is a specialized customer relationship management system tailored to the needs of Forex brokerages. It manages leads, automates onboarding, monitors trades, and supports marketing activities. More than a simple contact database, a Forex CRM provides deep client insights and helps retain traders through personalized service.

The best systems also include real-time analytics, allowing brokers to make informed decisions quickly. With a growing need for efficiency and client personalization, adopting a high-quality brokerage CRM has become essential.

II. Why Choosing the Right Forex CRM Matters

A top-tier Forex CRM enhances every aspect of brokerage operations. From lead generation to client retention, the right CRM offers tools to improve conversion rates, reduce manual workloads, and deliver tailored communication. Analytics and automation help brokers adapt strategies based on client behavior.

However, choosing the wrong Forex CRM can lead to disorganized workflows, poor customer experiences, and compliance issues. A secure, scalable, and feature-rich system is key to building a future-ready brokerage.

III. Top Forex CRM Features Every Brokerage Should Look For

To run a successful brokerage, choosing a feature-rich Forex CRM is essential. Below are the top capabilities your Forex CRM must include to streamline operations, improve client experience, and support growth.

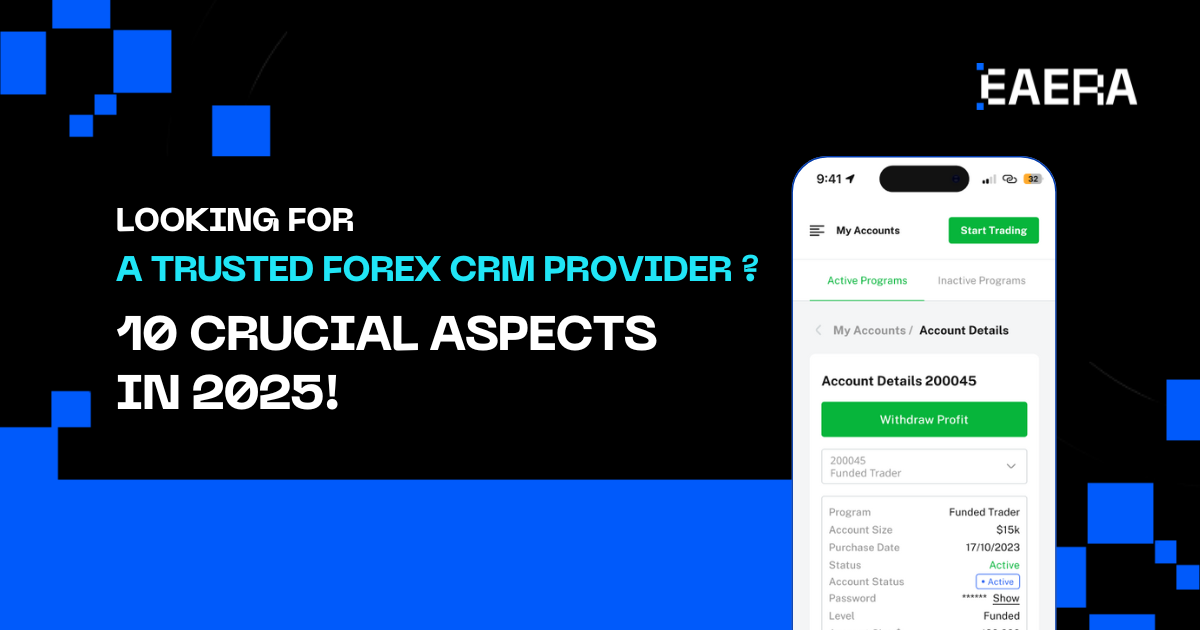

- Seamless Integration: A high-performing Forex CRM must integrate effortlessly with trading platforms, payment gateways, and back-office systems. This helps sync client data and trading activities, minimizing manual tasks and errors.

- Lead Management: An advanced Forex CRM provides automated lead scoring, smart segmentation, and real-time tracking to convert prospects into active clients. Effective lead management is one of the core functions of any high-quality Forex CRM.

- Automated Client Onboarding: A good Forex CRM should support identity verification, KYC/AML compliance, and document handling. Smooth onboarding helps reduce drop-off rates and ensures regulatory alignment.

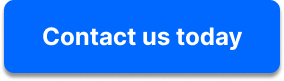

- Reporting & Analytics: Real-time dashboards and customizable analytics are must-haves in a Forex CRM. They help track trading behavior, revenue trends, and campaign performance for better decision-making.

- Marketing Automation: With a capable Forex CRM, brokerages can run multi-channel marketing campaigns using email, SMS, and push notifications. AI-driven personalization further increases conversion rates.

- Security & Compliance: Your Forex CRM should offer enterprise-grade security with data encryption, MFA, and compliance with standards like GDPR and MiFID II.

- Scalability: Whether you’re a new brokerage or scaling fast, a cloud-based Forex CRM should support growing client bases and trading volumes without system lag or instability.

- Customer Support: A reliable Forex CRM vendor offers 24/7 support, onboarding assistance, and ongoing training to help teams get the most out of the software.

When selecting a provider, always prioritize these features. A well-equipped Forex CRM will enhance operational efficiency, deepen client relationships, and provide a competitive edge in the Forex market.

IV. Steps to Choosing the Best Forex CRM Provider

Selecting the best Forex CRM provider is a strategic decision that directly affects your brokerage’s efficiency, scalability, and client satisfaction. To ensure success, it’s essential to follow a clear, structured approach when evaluating your Forex CRM options. Here are the key steps:

- Define Business Needs: Start by identifying your brokerage’s pain points, growth plans, and essential features needed in a Forex CRM—such as onboarding automation, lead tracking, and compliance tools.

- Research Providers: Explore multiple Forex CRM vendors to compare pricing, core functionalities, integration capabilities, and industry reputation. Look for platforms with a proven track record in the Forex space.

- Request Demos & Trials: Don’t rely on sales brochures—test drive the CRM. Evaluate ease of use, dashboard clarity, API integrations, and customization flexibility.

- Assess Security & Compliance: Your chosen Forex CRM must ensure client data protection, GDPR and MiFID II compliance, and offer enterprise-grade security features like encryption and MFA.

- Evaluate Customer Support: A responsive support team and available onboarding training can make or break your Forex CRM experience. Check for 24/7 support, multilingual resources, and dedicated account managers.

- Consider Total Cost of Ownership: Beyond the subscription fee, factor in setup costs, license tiers, custom development, and long-term scalability.

By thoroughly evaluating these areas, brokers can confidently select a Forex CRM that aligns with their operational needs today and grows with them into the future.

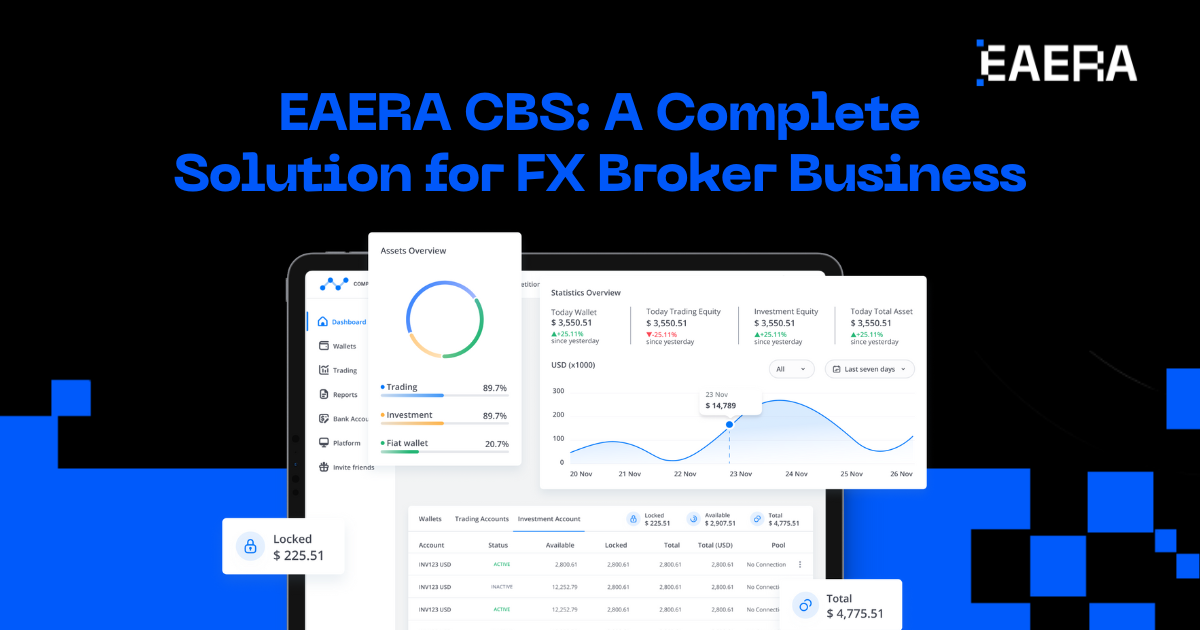

EAERA CBS: A Leading Forex CRM Solution for Brokerages in 2025

As the demand for high-performance Forex CRM systems grows, brokers need solutions that offer more than basic client management. Among the top providers in 2025, EAERA CBS stands out for its feature-rich platform tailored specifically for the needs of Forex brokerages.

When comparing Forex CRM options, it’s crucial to choose a provider that understands the complexities of the industry—offering seamless integrations, real-time analytics, and robust security. EAERA CBS delivers on all fronts with a powerful, centralized Forex CRM solution designed to improve operational efficiency and elevate the client experience.

EAERA CBS offers a full suite of brokerage tools, including:

- An intuitive client portal for trade execution and account monitoring

- A centralized CRM system for managing client data and communication

- A comprehensive back office for financial, compliance, and operational control

- Partner portals for commission tracking and client oversight

- Flexible extensions like PAMM and social trading to customize services

- For brokerages seeking a complete Forex CRM package that scales with business growth, EAERA CBS is a top-tier choice in 2025.

Selecting the best Forex CRM is a pivotal move for any brokerage looking to scale and compete effectively. The ideal system should automate key operations, enhance client engagement, ensure compliance, and support long-term growth. By focusing on features, usability, and support, you can choose a Forex CRM that not only meets your business needs today but evolves with you into the future.