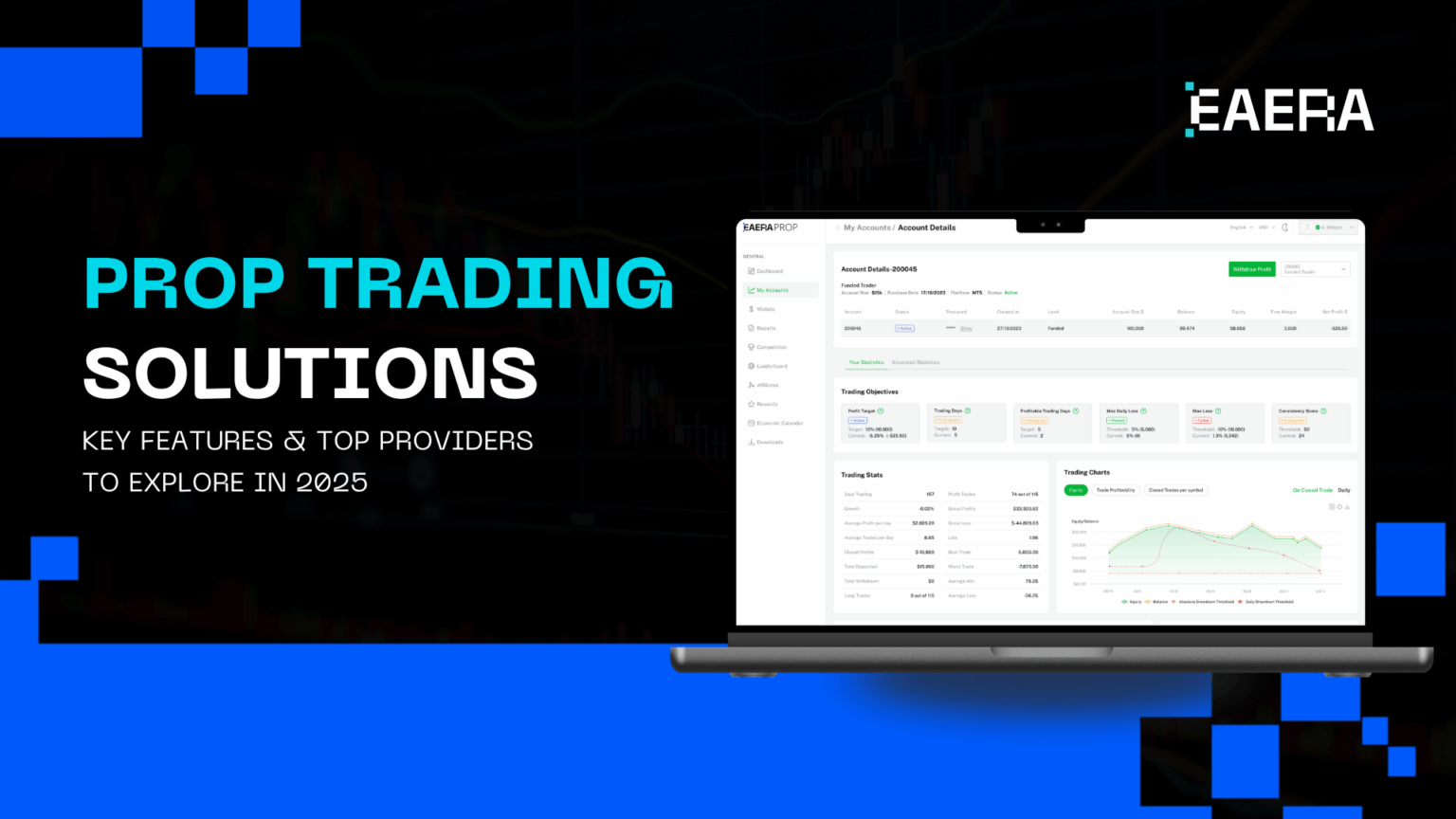

In the fast-paced world of forex trading, the need for prop trading solutions is growing rapidly. Prop trading allows skilled traders to access larger capital pools, enabling them to maximize their trading potential without putting up personal funds. For forex brokers looking to expand their operations and reduce risk, partnering with a prop firm can provide numerous benefits. Among the leaders in this space is EAERA, a trusted name that offers cutting-edge prop trading solutions designed to meet the needs of brokers worldwide. This article explores the key features of prop trading solutions and how brokers can benefit from working with the right prop firm.

Related articles:

1. What is Prop Trading?

Prop trading refers to when a firm trades financial instruments using its own capital rather than client funds. Unlike retail traders who use their personal capital, traders at a prop firm have access to significantly larger funds to trade on behalf of the firm. This model provides substantial leverage for traders, allowing them to amplify their potential profits.

For forex brokers, partnering with a prop firm offers multiple advantages, including reduced risk, greater capital access, and higher profit potential. Brokers can tap into the expertise of prop trading firms and increase their trading volume without having to risk their personal capital. By leveraging the resources of a prop firm, brokers can enhance their market participation, optimize their trading strategies, and ultimately grow their businesses.

2. Key Features of Prop Trading Solutions

When considering prop trading solutions, forex brokers should focus on several core features that can improve their operations and help them succeed in the competitive forex market. Here are some of the most important aspects of prop trading solutions:

Risk Management Tools:

One of the greatest advantages of working with a prop firm is the robust risk management tools that come with their platforms. With real-time monitoring, stop-loss mechanisms, and custom risk settings, brokers can manage their exposure while maximizing their profits. These tools are particularly crucial in forex markets, where volatility can be high.

Capital Allocation:

A key benefit of partnering with a prop firm is the access to larger capital for trading. Prop firms allocate significant funds to their traders, allowing them to take larger positions with less personal risk. This level of capital allocation can significantly increase the potential for higher returns in forex trading.

Advanced Technology and Trading Platforms:

Top prop trading firms, like EAERA, offer brokers access to state-of-the-art trading platforms. These platforms come equipped with powerful features such as automated trading systems, real-time data feeds, and advanced analytics tools. Brokers using such technology can trade more efficiently and gain an edge over competitors.

Profit Sharing Models:

The profit-sharing model is central to any prop trading relationship. In a typical setup, the prop firm shares a percentage of the profits generated by the traders. These models are designed to ensure that both the broker and the prop firm have aligned incentives, encouraging success for both parties.

Educational Support and Mentorship:

Another key feature of prop trading solutions is the educational and mentorship opportunities provided. EAERA is known for offering comprehensive training programs, webinars, and one-on-one mentoring to help brokers enhance their trading skills. These resources are invaluable for forex brokers looking to grow and develop their businesses.

3. Advantages of Using Prop Trading Solutions for Forex Brokers

Working with a prop firm offers forex brokers several advantages. These include access to larger capital, enhanced risk management, and the ability to scale operations without bearing excessive personal risk. Let’s explore the key benefits in more detail:

- Access to Global Markets: Through prop trading, brokers can access a wide range of global markets, enabling them to diversify their portfolios and take advantage of trading opportunities across different currencies. A prop firm can provide access to liquidity and capital that might not be available to retail traders.

- Scalability: As a forex broker grows, scalability becomes essential. With a prop firm, brokers can easily scale their operations, accessing more capital and increasing their trading volumes. This scalability is a huge advantage, allowing brokers to quickly expand their reach and grow their business.

- Risk Reduction: A major benefit of prop trading is the reduced risk for brokers. Since brokers are trading with the firm’s capital, they don’t have to risk their own funds. This allows for more aggressive strategies and higher leverage, all while keeping personal risk to a minimum.

- Diversification of Income Streams: By partnering with a prop firm, brokers can diversify their income streams. They can generate revenue from both trading profits and performance-based fees, which can significantly enhance their overall earnings.

- Enhanced Flexibility and Autonomy: Prop trading solutions allow brokers to maintain flexibility in their operations. They can select their trading strategies, work with different trading platforms, and collaborate with a prop firm that supports their specific business goals.

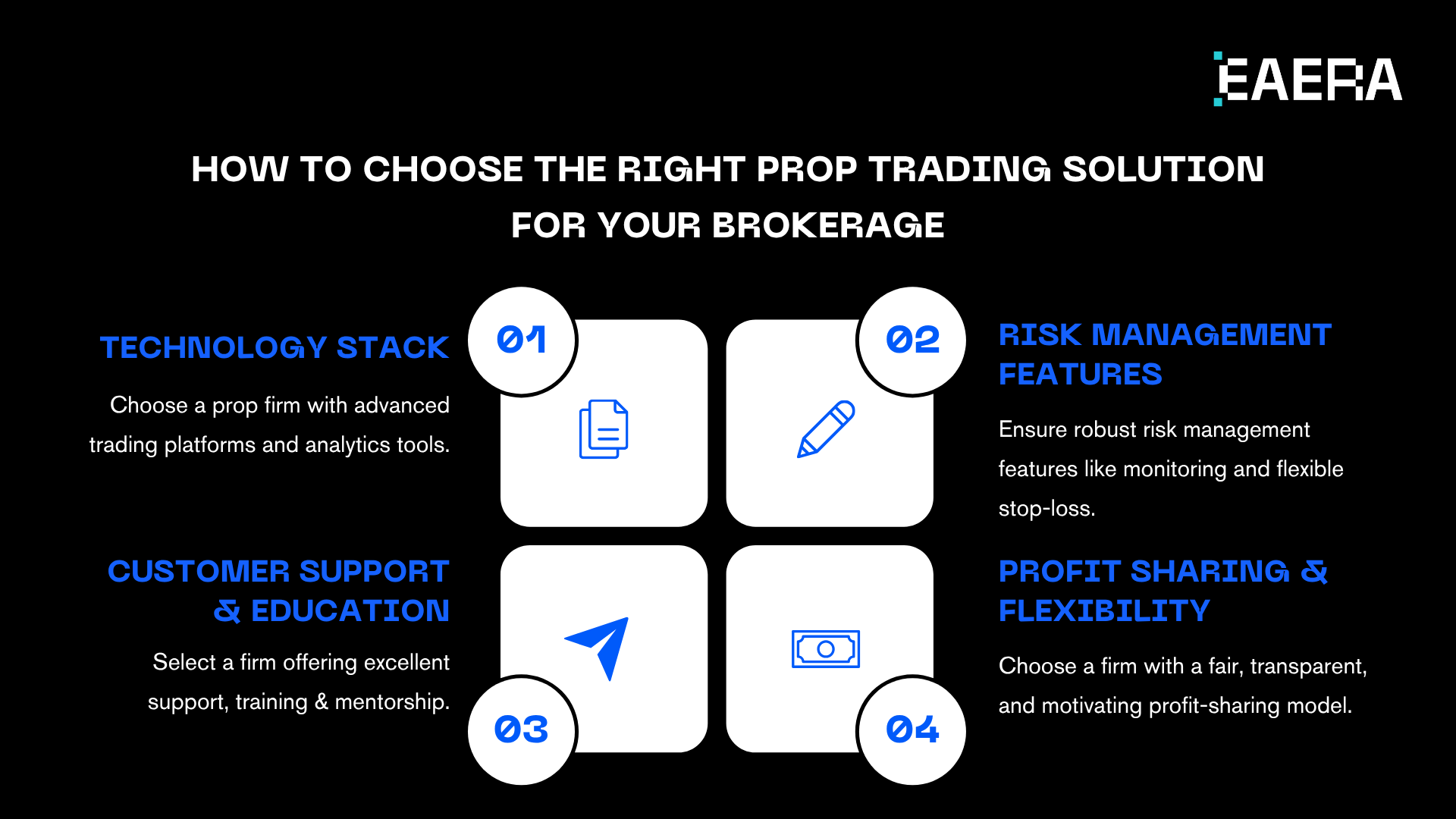

4. How to Choose the Right Prop Trading Solution for Your Brokerage

When selecting a prop firm or prop trading solution, forex brokers should consider a variety of factors. These factors will help ensure they choose a partner that aligns with their goals and provides the necessary tools to succeed:

- Technology Stack: Look for a prop firm that offers advanced trading platforms with features like automated trading, real-time data, and powerful analytics tools. EAERA is a leader in this space, offering brokers cutting-edge technology designed to enhance their trading efficiency.

- Risk Management Features: Ensure that the prop firm provides robust risk management tools. Real-time monitoring, flexible stop-loss settings, and other risk controls are crucial to safeguarding capital in volatile markets.

- Customer Support and Education: Choose a prop trading solution that provides excellent customer service and educational resources. Firms like EAERA offer comprehensive training, mentorship, and ongoing support to help brokers succeed in their trading endeavors.

- Profit Sharing and Flexibility: Make sure the prop firm offers a fair and transparent profit-sharing model. The right model will provide brokers with incentives to grow and perform, while also ensuring that the prop firm is adequately compensated for its support.

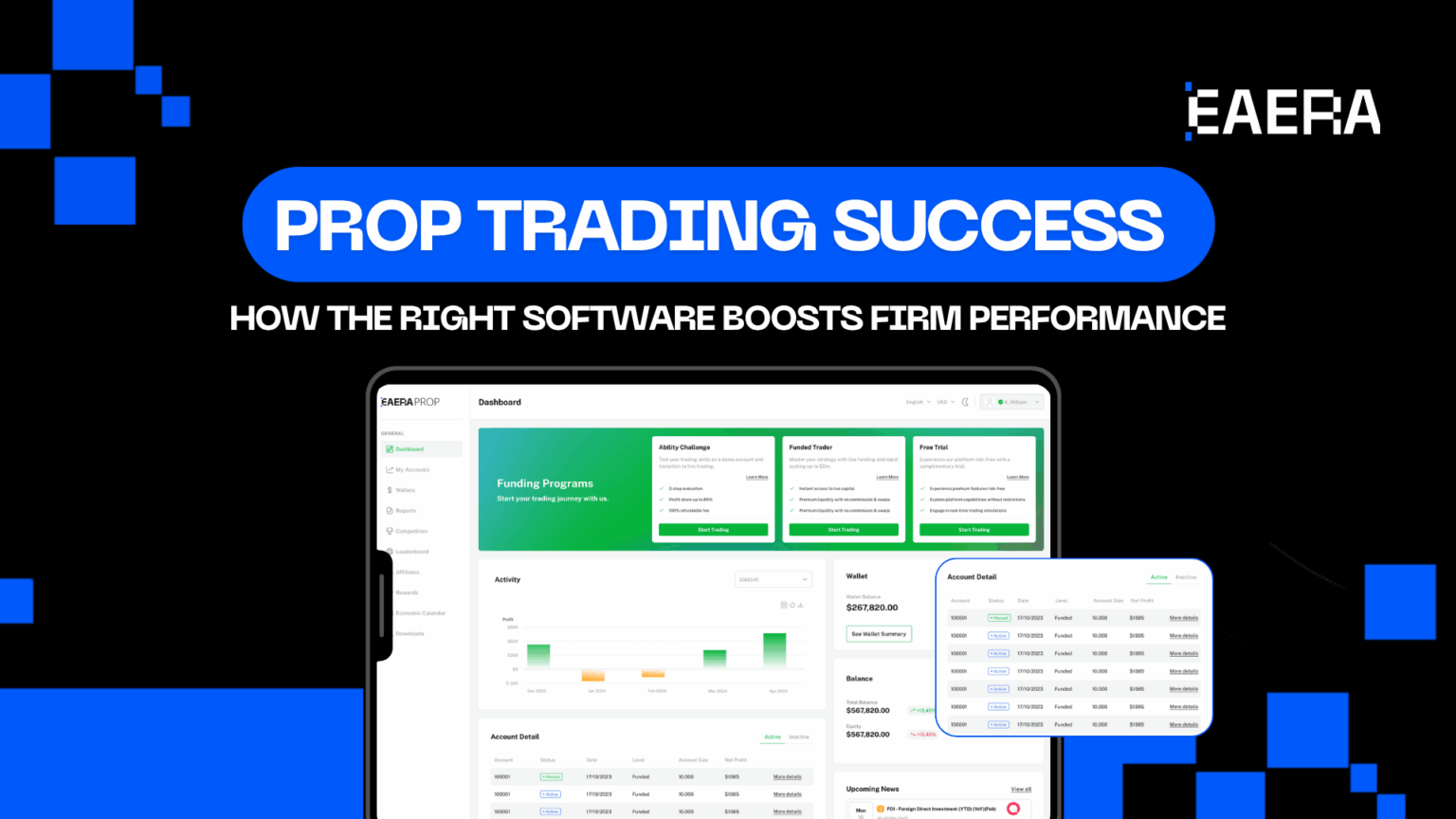

5. EAERA’s Prop Trading Solution: A Game Changer for Forex Brokers

EAERA stands out as a premier prop firm offering innovative prop trading solutions for forex brokers across the globe. Here’s why EAERA’s solutions are a game changer for brokers:

Comprehensive Technology Stack: EAERA provides brokers with access to advanced trading platforms that support automated trading, real-time analytics, and seamless integration with global forex markets. These platforms help brokers execute strategies more efficiently and stay ahead of market trends.

- Risk Management Expertise: EAERA’s prop trading solutions come with built-in risk management features, such as real-time monitoring and custom risk settings. These tools ensure that brokers can protect their capital while maximizing their trading opportunities.

- Capital and Leverage Solutions: EAERA offers scalable capital allocation to brokers, allowing them to take on larger positions without risking personal funds. With flexible leverage options, brokers can increase their profit potential while managing risk effectively.

- Profit Sharing and Incentives: EAERA’s transparent profit-sharing model ensures that brokers are fairly rewarded for their trading success. The structure encourages collaboration and long-term growth for both the broker and EAERA.

- Training and Support: EAERA is committed to the success of its partners, providing comprehensive training programs, mentorship, and ongoing support. Brokers can access a wealth of educational resources, helping them sharpen their skills and maximize their trading results.

In conclusion, prop trading solutions offer forex brokers the opportunity to enhance their operations by leveraging larger capital, reducing personal risk, and accessing advanced trading tools. Partnering with a reputable prop firm like EAERA can significantly boost a broker’s potential for success, providing them with the necessary resources and expertise to thrive in global forex markets. Brokers looking to scale their operations, reduce risk, and increase profitability should consider integrating prop trading solutions into their business model.