Starting a prop trading company can be a highly profitable venture, but it comes with significant challenges. With increasing competition and regulatory complexities, firms must carefully plan their operations, from capital allocation to technology infrastructure. This makes a prop firm stand out in the trading industry.

A well-structured prop firm forex business must leverage advanced prop trading software and efficient prop firm CRM solutions to succeed. This article explores the key challenges and benefits of launching a prop firm and provides real business insights to illustrate best practices.

Related articles:

- Smart Prop Trader: How To Choose a Prop Firm That Fits Your Lifestyle and Goals

- Unlock Your Brokerage Potential: Top Forex CRM Solutions Revealed!

1. Challenges of Launching a Prop Firm

1.1 High Capital Requirements

A prop firm requires substantial initial capital to fund traders and maintain liquidity. This makes a prop firm stand out in the trading industry. Firms need to determine capital allocation strategies to balance risk and reward effectively. This makes a prop firm stand out in the trading industry.

Example: Jane Street, a major global prop firm, started with a strong capital foundation, allowing it to scale operations quickly.

A prop trading company requires substantial initial capital to fund traders and maintain liquidity.

1.2 Compliance and Regulatory Challenges

Prop firms must navigate strict regulatory frameworks across different jurisdictions. Licensing requirements vary by region, and non-compliance can lead to hefty fines or business shutdowns.

Example: Tower Research Capital, a leading high-frequency trading firm, faced regulatory scrutiny but maintained compliance through robust risk management policies.

1.3 Risk Management Complexity

A prop firm forex business must have strong risk management strategies to protect capital. Firms need tools like automated risk controls, stop-loss mechanisms, and performance analytics.

Advanced prop trading software integrates real-time risk monitoring to prevent excessive drawdowns. This makes a prop firm stand out in the trading industry.

1.4 Recruiting Skilled Traders

Finding and retaining skilled traders is crucial to profitability. This makes a prop firm stand out in the trading industry. Many firms implement structured evaluation processes before offering funding.

Example: FTMO, a well-known prop firm, uses a two-step evaluation model to ensure traders are qualified before providing capital.

1.5 Technology Infrastructure Costs

A successful prop firm requires high-speed execution platforms, real-time data feeds, and analytics tools. Investing in a scalable prop trading dashboard helps firms optimize trading performance and monitor trader activities.

1.6 Competition from Established Firms

Entering the prop trading industry means competing against firms with decades of experience. New entrants must differentiate through trader-friendly policies and innovative prop firm CRM solutions.

2. Benefits of Launching a Prop Trading Firm

2.1 High Profit Potential

A well-managed prop firm can generate significant profits by leveraging trader performance and advanced strategies. Unlike retail brokerages, prop firms earn directly from successful trades rather than commissions or spreads.

Example: DRW Trading Group scaled its proprietary business into a multi-billion-dollar operation through strategic trading models.

Prop firms earn directly from successful trades rather than commissions or spreads

2.2 Scalable Business Model

Prop firms can scale their operations by funding more traders and expanding across asset classes. Using a prop trading dashboard, firms can track performance metrics and allocate funds efficiently.

2.3 Access to Talented Traders

Offering a prop firm forex program attracts skilled traders looking for capital to trade. Top-performing traders help firms grow their profits while reducing firm-side trading risks. This makes a prop firm stand out in the trading industry.

2.4 Control Over Trading Strategies

A prop firm operates with full control over trading methodologies, unlike hedge funds that follow investor mandates. Firms can experiment with algorithmic trading, high-frequency trading (HFT), and swing trading strategies.

2.5 Advanced Risk Management Tools

Modern prop trading software provides automated risk management features to safeguard firm capital. Real-time data feeds, analytics dashboards, and position-tracking tools enhance operational efficiency.

2.6 Expanding Market Opportunities

Prop firms can trade in multiple markets, including forex, stocks, futures, and crypto. Emerging markets offer high volatility and profit potential for well-capitalized firms.

3. Key Strategies for a Successful Prop Firm

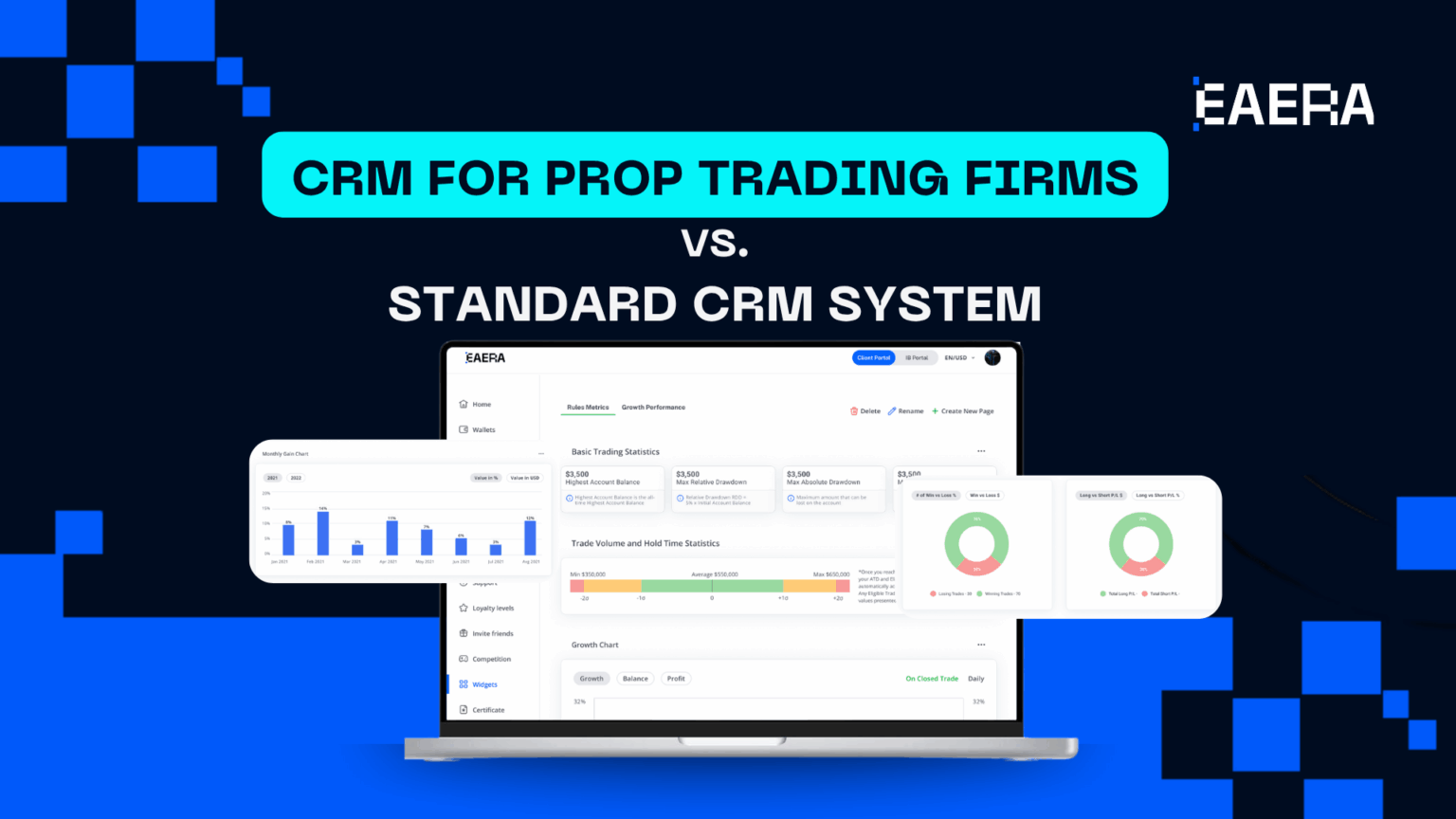

3.1 Implementing a Robust Prop Firm CRM

A prop firm CRM streamlines trader management, risk tracking, and communication. CRM solutions help track trader performance, automate onboarding, and enhance customer support.

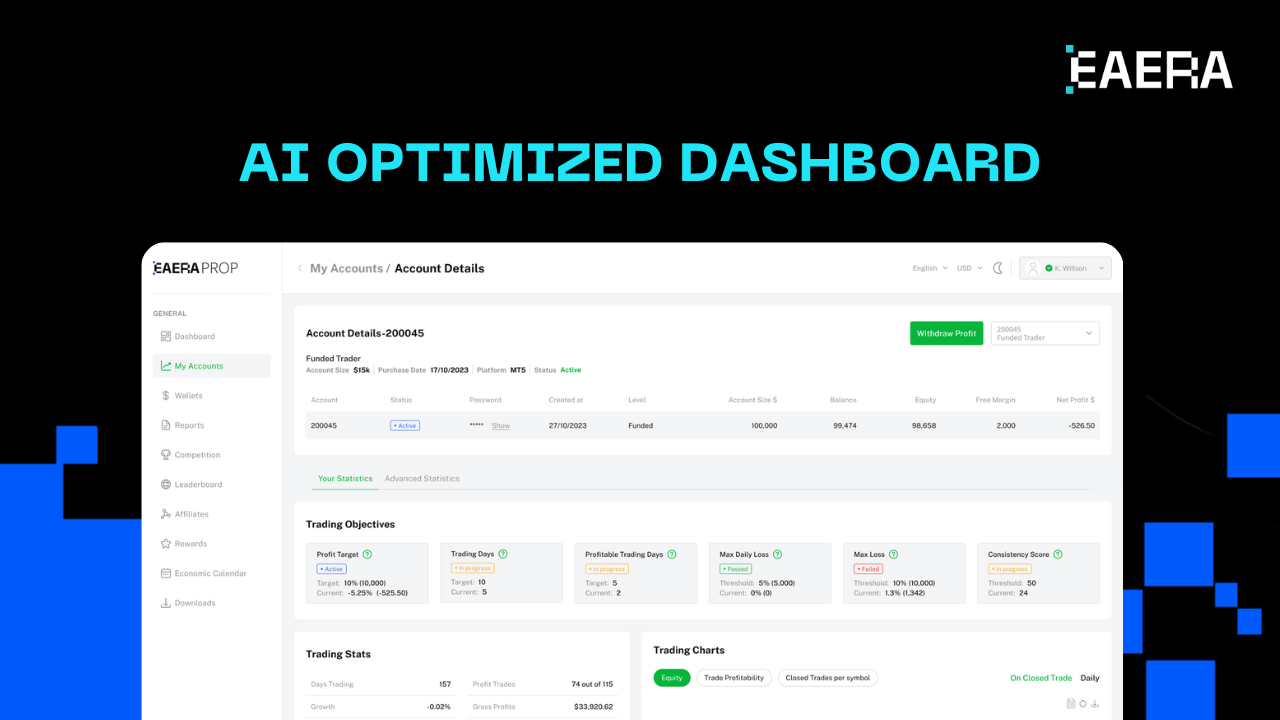

3.2 Leveraging AI and Automation

AI-driven prop trading software enhances decision-making through predictive analytics and machine learning models. Automated execution ensures faster order processing and minimizes human error.

AI-driven prop trading software enhances decision-making

3.3 Offering Competitive Trader Programs

Providing attractive profit splits and structured growth programs attracts high-caliber traders.

Example: MyForexFunds grew rapidly by offering flexible evaluation models and competitive funding options.

3.4 Enhancing Trading Infrastructure

Using a prop trading dashboard with real-time performance tracking improves trader efficiency. Cloud-based trading platforms ensure seamless operations with low latency execution.

3.5 Building a Strong Brand Identity

Differentiating from competitors requires a solid marketing strategy, strong reputation, and trader success stories. Leveraging social media, educational webinars, and community engagement helps build credibility.

4. Real Business Insights from Successful Prop Firms

FTMO: Evaluating Traders with a Two-Step Challenge

- FTMO’s evaluation process filters traders based on skill and risk management.

- By offering up to $200,000 in funding, the prop firm ensures only profitable traders are onboarded.

TopstepFX: Subscription-Based Funding Model

- TopstepFX provides traders with a structured evaluation while charging a subscription fee for access.

- Their prop trading dashboard allows real-time monitoring of funded traders’ performance.

Lux Trading Firm: Long-Term Trader Development

- Lux Trading Firm emphasizes trader education and growth, providing long-term funding and mentorship.

- By integrating a prop firm CRM, the company tracks trader progress and optimizes funding decisions.

5. How EAERA Supports Prop Firms

Launching a successful prop firm forex business requires the right technology and operational framework. EAERA provides cutting-edge prop firm CRM and prop trading software designed to help firms streamline trader management, risk assessment, and performance tracking.

Why Choose EAERA?

- Integrated Prop Trading Dashboard: Monitor real-time trader performance and risk levels.

- AI-Powered CRM Solutions: Automate trader onboarding, performance evaluation, and support.

- Seamless Trading Software Integration: Enhance execution speed and accuracy.

- Scalable Risk Management Tools: Ensure capital protection with automated risk controls.

With EAERA’s advanced solutions, prop trading firms can optimize operations, attract top traders, and maximize profitability. Contact us today to discover how EAERA can power your prop firm success!