In the fast-paced world of financial services, a robust brokerage CRM is essential for managing client relationships, streamlining operations, and ensuring compliance. One critical component that often determines the success of a brokerage CRM is Know Your Customer (KYC). By integrating KYC processes into your CRM strategy, brokerages can enhance trust, reduce risk, and deliver more personalized experiences that meet both regulatory and client expectations.

Related articles:

- Forex CRM: How to Choose the Best Provider for Your Brokerage

- 10 Reasons Why You Should Get a Forex Broker CRM

1. Introduction to KYC and Its Role in Brokerage CRM

KYC, or Know Your Customer, refers to a set of essential procedures used to verify client identities and evaluate risk profiles. This process is fundamental to maintaining financial security, helping to prevent money laundering, fraud, and other illicit activities. While KYC is crucial across the financial industry, it plays an especially vital role within a brokerage CRM, where firms must manage sensitive client data and high-volume transactions. Integrating KYC into a brokerage CRM not only strengthens compliance efforts but also boosts operational efficiency. By using advanced broker software and specialized brokerage CRM solutions for Forex and investment firms, companies can protect their platforms and build trust with clients.

2. Why KYC Is Crucial for Brokerage Companies Using CRM Systems

Brokerage companies operate under intense regulatory scrutiny, making KYC a foundational aspect of sustainable operations. Integrating KYC into a brokerage CRM is no longer optional—it’s a necessity for compliance, security, and client trust.

- Compliance with Regulatory Requirements: Global regulators enforce stringent KYC obligations to ensure brokerages remain within legal frameworks. A brokerage CRM with built-in compliance features helps firms meet these demands efficiently, minimizing the risk of fines and reputational damage.

- Prevention of Fraud and Identity Theft: With financial fraud on the rise, brokerages must safeguard against identity theft and unauthorized activity. KYC, paired with a secure brokerage CRM, offers powerful protection by verifying client identities during onboarding and monitoring for suspicious behavior.

- Risk Management: Understanding a client’s financial background is essential for assessing risk. A data-driven brokerage CRM allows firms to analyze trading behaviors and funding sources in real time, helping them categorize clients by risk levels and respond proactively.

- Building Trust and Reputation: In an industry built on confidence, brokerages that prioritize compliance and security stand out. A comprehensive brokerage CRM ensures KYC data is up-to-date and easily accessible, reinforcing a firm’s credibility and strengthening client relationships.

In short, a strong KYC strategy supported by a capable brokerage CRM not only meets regulatory demands but also protects your business and fosters long-term growth.

3. Managing Risk: How KYC Strengthens Brokerage CRM Compliance

Effective risk management is a core requirement for brokerage firms, and integrating KYC into a brokerage CRM is a powerful way to meet that challenge. A well-structured brokerage CRM equipped with KYC functionality helps detect and prevent a wide range of financial threats:

- Money Laundering: KYC procedures like source-of-funds verification and transaction monitoring are essential to complying with AML regulations. When embedded within a brokerage CRM, these tools provide automated oversight that minimizes exposure to illicit activities.

- Terrorist Financing: Robust identity checks and red-flag alerts help prevent brokerages from being misused for terrorist financing. A dynamic brokerage CRM can monitor patterns and highlight anomalies in real time.

- Insider Trading: Although KYC isn’t primarily aimed at insider trading, its data contributes to monitoring trading activity. A compliant brokerage CRM uses this data to detect suspicious behavior that could signal unethical trading.

- Fraudulent Accounts: With remote onboarding becoming the norm, verifying the authenticity of each client is crucial. KYC integrated within a brokerage CRM ensures only verified individuals gain access, reducing the likelihood of fraudulent accounts.

- Regulatory Penalties: Non-compliance can lead to significant fines and reputational damage. A smart brokerage CRM with automated KYC workflows helps brokerages stay ahead of regulations and avoid costly oversights.

4. Continuous Compliance: The Ongoing Nature of KYC in CRM Workflows

KYC isn’t a one-time requirement—it’s a continuous process that must evolve alongside changes in a client’s financial behavior, legal status, or risk profile. This ongoing approach, often called “Continuous KYC,” is essential for maintaining compliance and security in a fast-changing regulatory environment. A well-integrated brokerage CRM supports this by automating periodic reviews and flagging critical updates. By embedding continuous monitoring into the brokerage CRM workflow, firms can stay compliant without overwhelming their teams.

5. Customer Benefits of KYC-Driven Brokerage CRM

While KYC is essential for regulatory compliance and risk management, it also provides clear advantages for clients when integrated into a well-designed brokerage CRM:

- Security: Clients feel more secure knowing that their identities and funds are protected by stringent KYC protocols embedded within the brokerage CRM, reducing exposure to fraud and data breaches.

- Trust: A firm that follows KYC procedures using a transparent and compliant brokerage CRM builds credibility, which strengthens client trust and encourages long-term relationships.

- Efficient Services: With accurate client data maintained in the brokerage CRM, services become more streamlined—transactions are quicker, errors are minimized, and customer support is more responsive.

- Personalization: KYC-driven insights within the brokerage CRM allow firms to tailor offerings based on client preferences and behaviors, delivering a more personalized and satisfying experience.

6. KYC Implementation Challenges in Brokerage CRMs and How to Overcome Them

Implementing KYC within a brokerage CRM comes with hurdles, but the right strategies can help overcome them:

- Cost: Setting up and maintaining KYC systems can be expensive, especially for smaller firms. Automation features in a brokerage CRM help reduce long-term costs by minimizing manual work.

- Complexity: Verifying clients across different countries and document types adds complexity. Digital verification tools simplify this process and improve accuracy.

- Customer Experience: Lengthy KYC procedures can frustrate clients, especially in online settings where speed is expected. A balanced approach, supported by Forex broker CRM, maintains security while preserving usability.

Solutions include AI-based verification, intuitive onboarding flows, and outsourcing KYC tasks to specialized providers when in-house resources are limited.

7. Best Practices for Integrating KYC into Your Brokerage CRM

To optimize KYC effectiveness, brokerage companies should adopt these best practices:

- Stay Informed: Regularly track regulatory updates to ensure compliance with evolving KYC mandates across jurisdictions.

- Use Technology Wisely: Deploy brokerage systems with AI-powered risk scoring, real-time monitoring, and digital identity checks to enhance efficiency and precision.

- Train Staff: Equip teams with comprehensive KYC training to execute processes flawlessly, reducing errors and ensuring adherence.

- Conduct Regular Reviews: Periodically reassess and update KYC policies to address emerging risks and maintain up-to-date client profiles.

- Integrate Seamlessly: Ensure KYC processes integrate smoothly with existing brokerage CRM, creating a cohesive operational framework.

8. Global Compliance: KYC Considerations for International Brokerage CRMs

KYC becomes more complex for global firms due to varying regulations. A flexible brokerage CRM must adapt to local compliance rules while supporting a consistent global standard. Non-compliance in one region can damage a firm’s reputation worldwide, making KYC essential for legal and brand protection.

Real-World Impact: Case Studies of KYC in Brokerage CRM Success

In practice, neglecting KYC can lead to massive fines and reputational harm. On the flip side, firms using advanced brokerage CRM solutions often see reduced fraud, improved efficiency, and greater client trust—proving KYC’s value as both protection and competitive edge.

Enhancing KYC Processes Through CRM and Technology Integration

Modern tools like AI and digital verification accelerate onboarding and improve accuracy. A smart brokerage CRM integrates these technologies, helping firms scale KYC processes while maintaining client convenience.

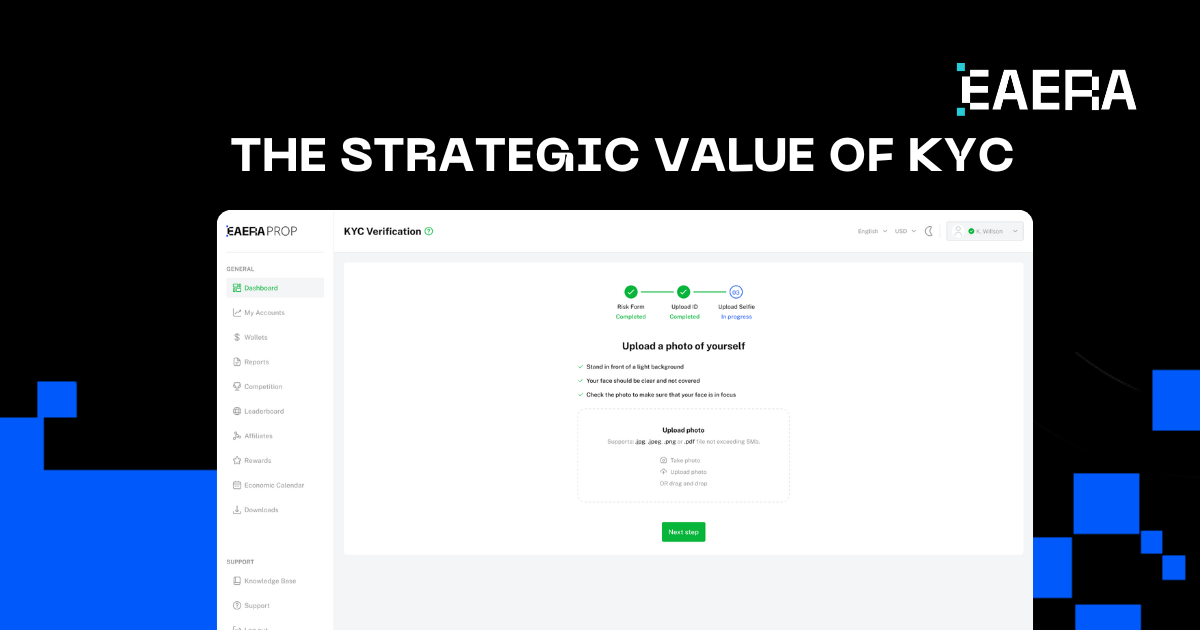

Strategic Value: How KYC Elevates Your Brokerage CRM Advantage

KYC is more than compliance – it enhances a firm’s credibility. By embedding KYC into a robust brokerage CRM, companies can attract quality clients and stand out in a crowded market.

KYC is essential for staying compliant, preventing fraud, and building client trust. When integrated into a smart brokerage CRM, it becomes a strategic advantage – not just a regulatory task. At EAERA, our all-in-one platform, EAERA CBS, helps brokerages simplify KYC and boost operational efficiency. Book a demo today to see how we can support your success.