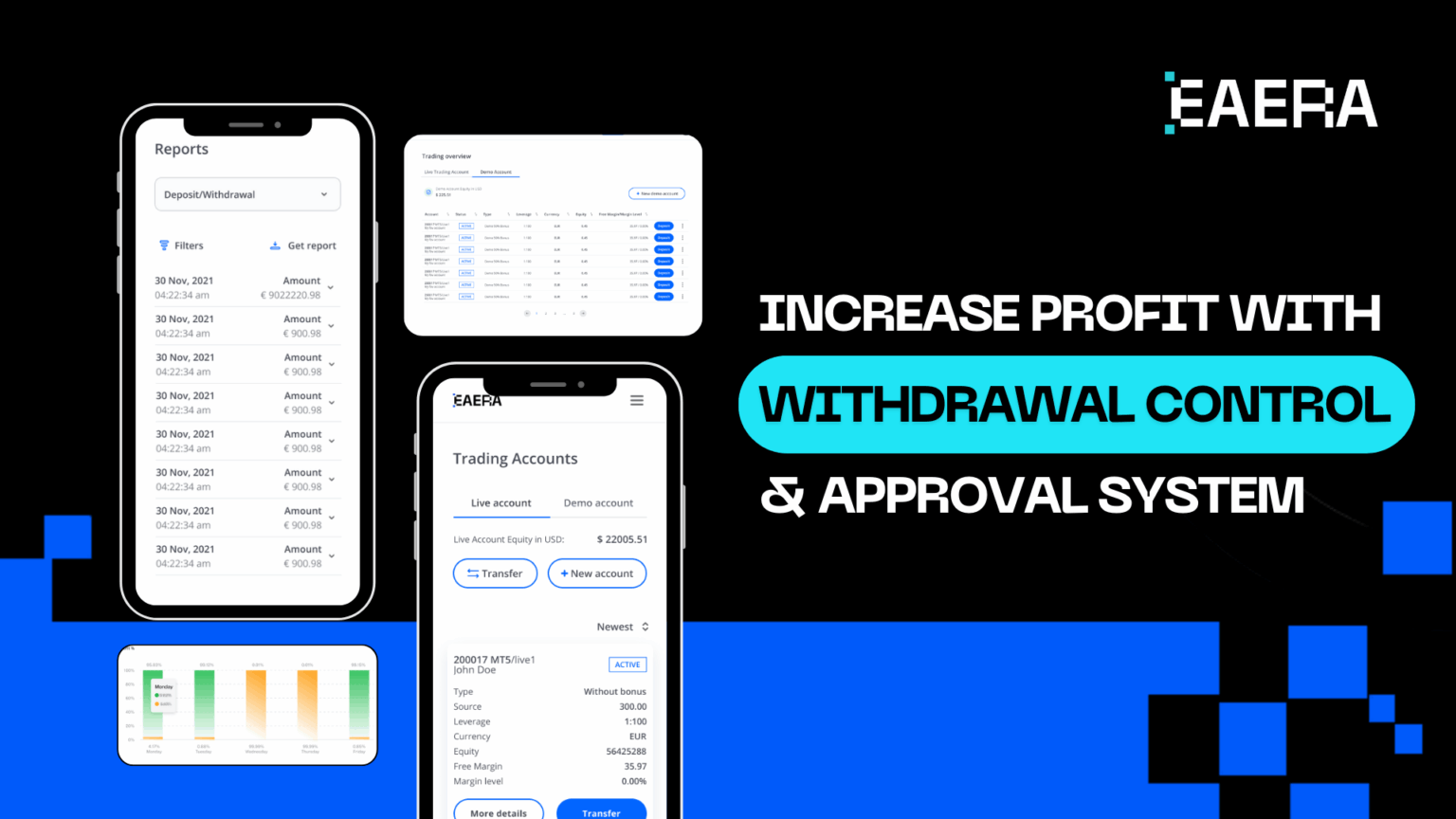

The Forex trading world moves fast, and staying ahead means using every tool at your disposal. For FX brokers, a robust Forex CRM (Customer Relationship Management) system is the backbone of efficient operations. One often-overlooked feature? Withdrawal control and approval systems. These tools can transform brokerage profitability by streamlining processes, reducing risks, and building client trust. In this guide, we’ll explore how Forex CRM systems, like those offered by EAERA, can help brokers maximize profits through smart withdrawal management.

Related article:

- Forex Broker Solutions: Top 8 Features You Need in 2025

- 10 Crucial Aspects for Selecting a Forex CRM Provider in 2025

1. Why Withdrawal Control is Critical for FX Brokers

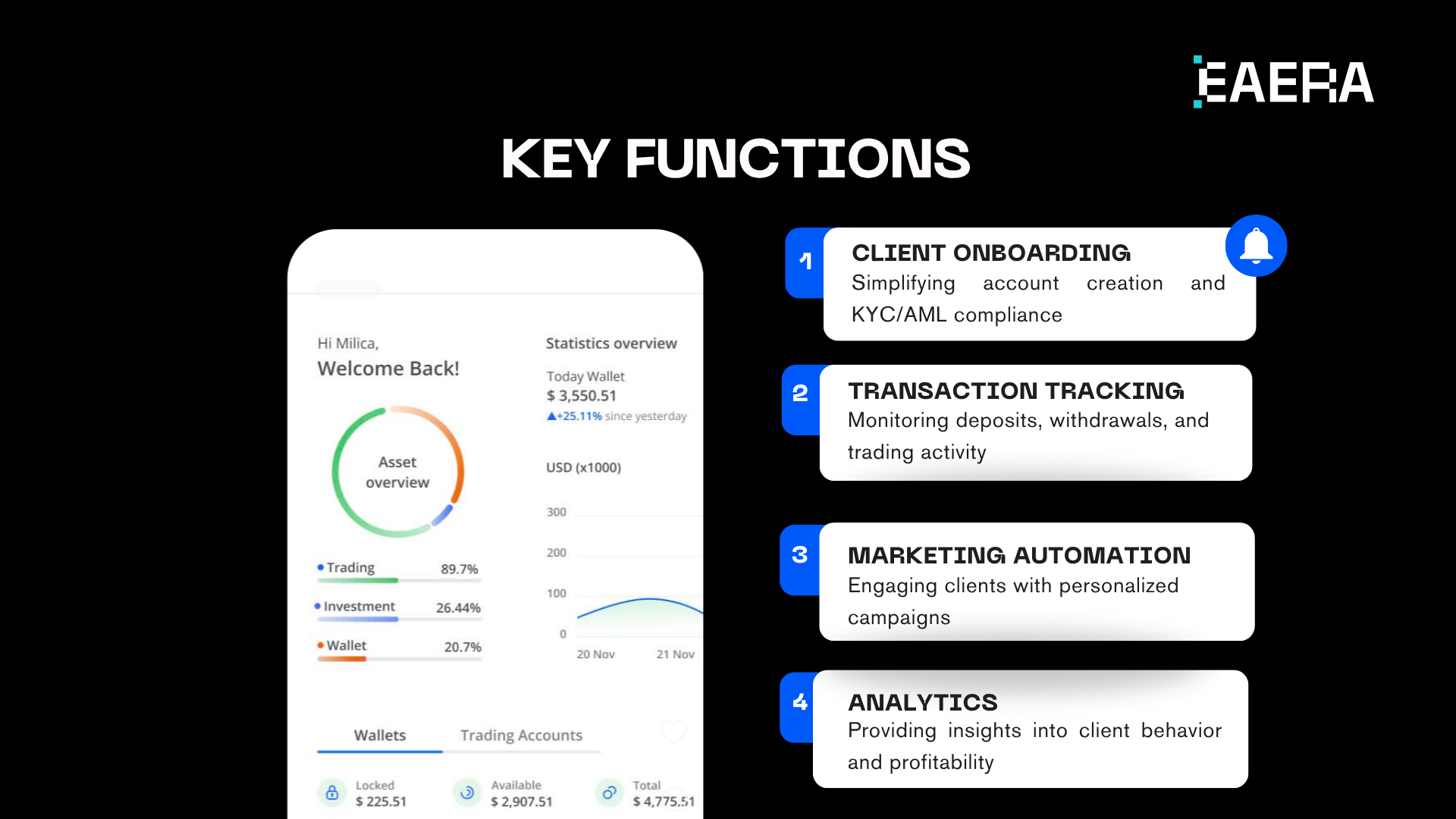

A Forex CRM is more than just a database—it’s the operating system of a brokerage. It manages client interactions, automates workflows, and ensures compliance with regulations. For FX brokers, the right CRM can mean the difference between a thriving business and one struggling with inefficiencies. Key functions include:

- Client onboarding: Simplifying account creation and KYC/AML compliance

- Transaction tracking: Monitoring deposits, withdrawals, and trading activity

- Marketing automation: Engaging clients with personalized campaigns

- Analytics: Providing insights into client behavior and profitability

Among these, withdrawal control and approval systems stand out as critical for protecting profits and maintaining client satisfaction. Let’s dive into how these features work and why they’re game-changers.

2. The Power of Withdrawal Control in Forex CRM

Withdrawing funds is a sensitive part of any brokerage’s operations. Mishandling withdrawals can lead to reputational damage, financial losses, and client churn. A Forex CRM with a robust withdrawal control system helps FX brokers avoid these pitfalls by introducing structure and oversight. Here’s how:

Preventing Fraud and Errors

Fraudulent withdrawal requests, mismatched payment details, or requests exceeding available equity can cost brokers dearly. A withdrawal control system, like the one integrated into EAERA’s cloud-based CRM, flags suspicious activity. For example, it can detect:

- Requests from unverified accounts

- Withdrawals exceeding account balances

- Mismatched payment details, such as bank account names

By catching these issues early, FX brokers protect their funds and maintain operational integrity.

Streamlining Compliance

Regulatory compliance is non-negotiable in Forex trading. KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations require thorough checks on withdrawal requests. EAERA’s Forex CRM automates these processes, routing requests to compliance teams for review. This ensures FX brokers meet legal requirements without slowing down operations.

Enhancing Client Trust

Clients expect fast, hassle-free withdrawals. A well-configured withdrawal control system balances security with speed. For instance, EAERA allows FX brokers to set rules for automatic approvals on smaller withdrawals (e.g., under $100) while flagging larger ones for manual review. This keeps clients satisfied and avoids unnecessary delays in processing.

3. How Approval Systems Boost Brokerage Profitability

An approval system within a Forex CRM adds another layer of control, ensuring withdrawals are processed only after proper authorization. This feature is a profit-protection powerhouse for FX brokers. Here’s why:

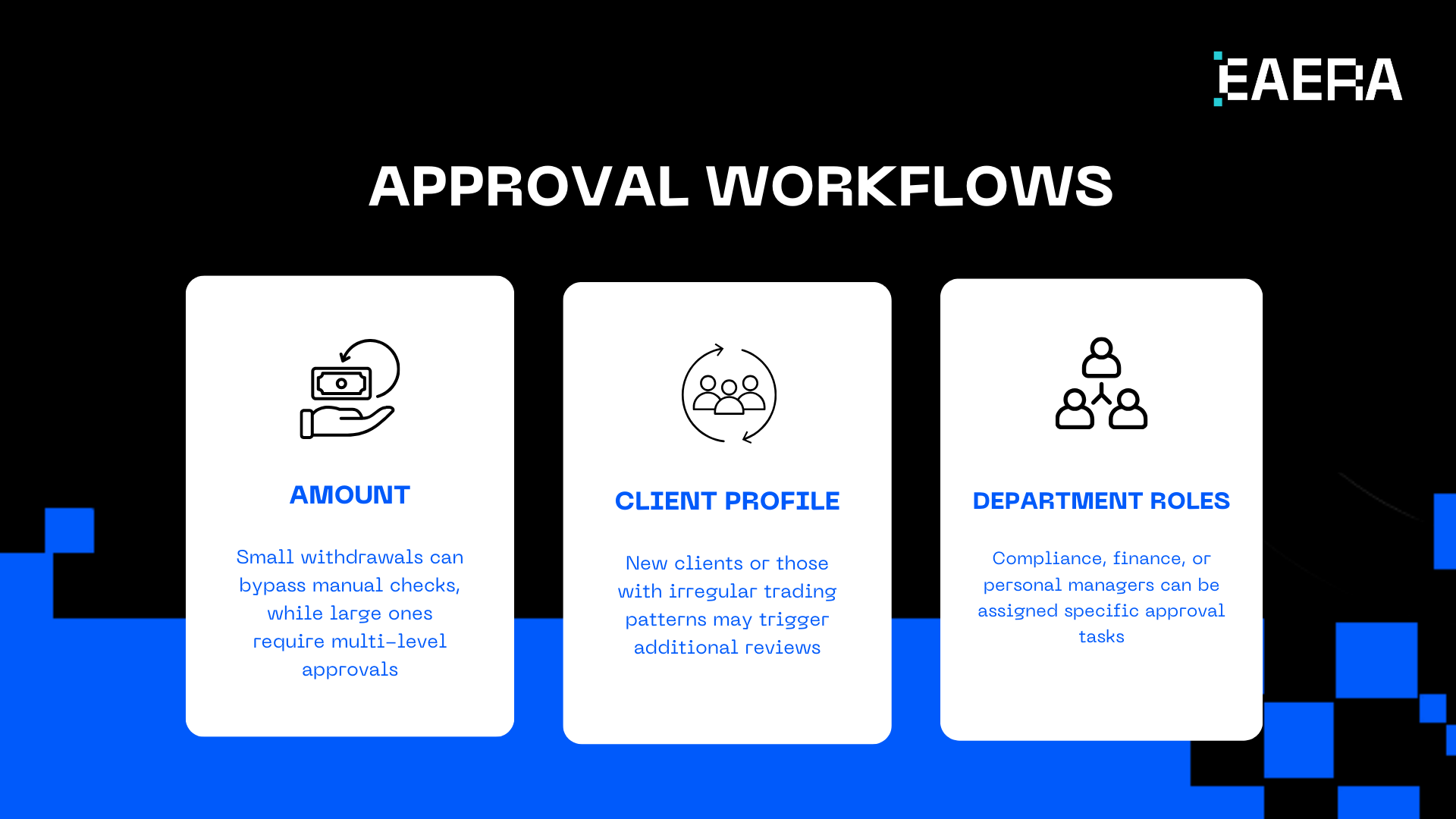

Flexible Approval Workflows

Not all withdrawals are equal. A $50 request from a verified client is low-risk, but a $10,000 request from a new trader might need extra scrutiny. EAERA’s approval system lets brokers customize workflows based on:

- Amount: Small withdrawals can bypass manual checks, while large ones require multi-level approvals

- Client profile: New clients or those with irregular trading patterns may trigger additional reviews

- Department roles: Compliance, finance, or personal managers can be assigned specific approval tasks

This flexibility minimizes financial risks while keeping operations efficient and responsive.

Reducing Financial Risks

Market volatility can expose brokers to financial risks, especially during major news events. An approval system allows Forex brokers to monitor trading activity before approving withdrawals. For example, if a client requests a large withdrawal during a volatile period, the system can pause the request until the market stabilizes. EAERA’s real-time analytics make this process seamless, helping brokers hedge risks effectively.

4. EAERA: Revolutionizing Forex CRM for Profitability

EAERA stands out as a leader in Forex CRM solutions, offering a cloud-based platform tailored for both startup and established Forex brokers. Its withdrawal control and approval system features are designed to maximize brokerage profitability while ensuring a seamless client experience. Key benefits of EAERA include:

- Cloud-based flexibility: Access data and manage withdrawals from anywhere, ensuring global scalability

- Real-time reporting: Monitor transactions and client activity to make informed decisions

- Automation: Streamline KYC/AML checks and low-risk withdrawals to save time

- Customization: Tailor approval workflows to fit your brokerage’s unique needs

By integrating these tools, EAERA helps FX brokers reduce operational costs, mitigate risks, and retain clients more effectively.

5. Best Practices for Implementing Withdrawal Control and Approval Systems

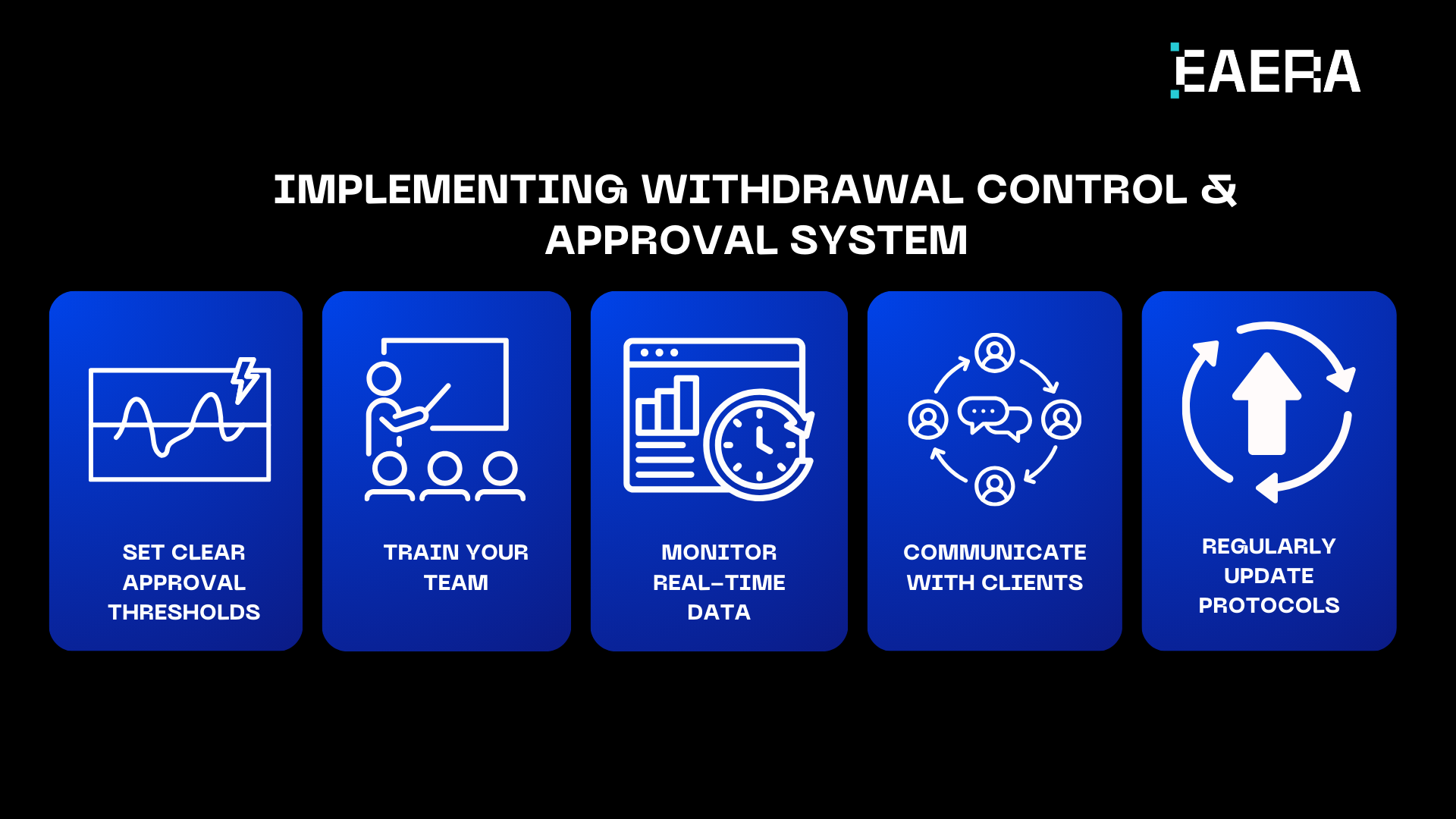

To get the most out of your Forex CRM’s withdrawal control and approval system, follow these best practices:

- Set clear approval thresholds: Define rules for automatic and manual approvals based on withdrawal amounts. Example: allow instant approvals for requests under $100, but require checks for anything higher.

- Train your team: Ensure your compliance, finance, and client management teams understand the approval system. EAERA offers user-friendly dashboards, but ongoing training ensures maximum efficiency.

- Monitor real-time data: Use your CRM’s analytics to track withdrawal patterns. If a low-activity client suddenly requests a large amount, the system should flag it.

- Communicate with clients: Transparency builds trust. Inform clients about the withdrawal process and expected timelines. EAERA’s client portal lets traders track their requests, reducing support queries.

- Regularly update protocols: Cyber threats evolve, so your withdrawal control system must stay ahead. EAERA includes SSL encryption and two-factor authentication, but regular security audits are crucial.

6. The Impact on Brokerage Profitability

Implementing a Forex CRM with withdrawal control and approval systems directly impacts brokerage profitability in several ways:

- Cost savings: Automation reduces manual processing, lowering operational costs

- Risk reduction: Preventing fraud and compliance violations saves money and protects reputation

- Client retention: Fast, secure withdrawals keep clients satisfied, reducing churn

- Scalability: A system like EAERA grows with your brokerage, supporting more clients without added complexity

Industry research shows the global Forex CRM market is projected to grow from $70.1 billion in 2023 to $139.74 billion by 2031, driven by demand for efficient client management tools.

Brokers who invest in advanced CRMs now will be well-positioned to capitalize on this growth.

7. The future landscape of Forex CRM and withdrawal management

Reflecting the dynamic nature of the Forex market, Forex CRM systems are also advancing. Notable emerging trends are:

- Predictive analytics: Using AI to forecast withdrawal patterns and flag risks. EAERA is already integrating these tools to stay ahead

- Blockchain for payments: Crypto withdrawals are gaining traction, and EAERA supports multi-currency wallets for seamless processing

- Mobile access: Brokers and clients expect on-the-go management. EAERA’s mobile-compatible platform meets this demand

By staying ahead of these trends, EAERA positions FX to thrive in a competitive market.

For FX brokers, a Forex CRM with withdrawal control and approval systems is a must-have for boosting brokerage profitability. These tools prevent fraud, ensure compliance, and enhance client trust—all while streamlining operations. EAERA’s cloud-based solution takes this to the next level with automation, real-time analytics, and customizable workflows. By adopting EAERA, brokers can protect their bottom line and build a loyal client base.

Ready to transform your brokerage? Explore EAERA’s Forex CRM today and see how withdrawal control can drive your profits to new heights.