The rise of proprietary trading has opened new doors for forex traders and investment firms. At the heart of every successful prop trading company is a well-structured system powered by smart prop trading solutions. Today, having the right prop firm CRM, prop trading software, and a streamlined prop firm dashboard are critical to scaling operations, improving risk control, and maximizing trader performance.

This article explores the essential features to look for in a prop trading solution and highlights top providers helping prop firms lead the next wave of financial innovation.

What Are Prop Trading Solutions?

Prop trading solutions encompass the platforms, tools, and technologies that a prop firm uses to manage its traders, risk exposure, account funding, evaluations, and payouts. Instead of manually overseeing hundreds of traders, prop firms rely on sophisticated CRM systems, dashboards, and software integrations to automate processes and make smarter decisions.

In today’s competitive market, a prop firm forex business must operate efficiently and transparently. Whether it’s a global prop trading company or a boutique firm, the right prop trading solutions provides a strong backbone for operational success.

Key Features of a Prop Trading Solution

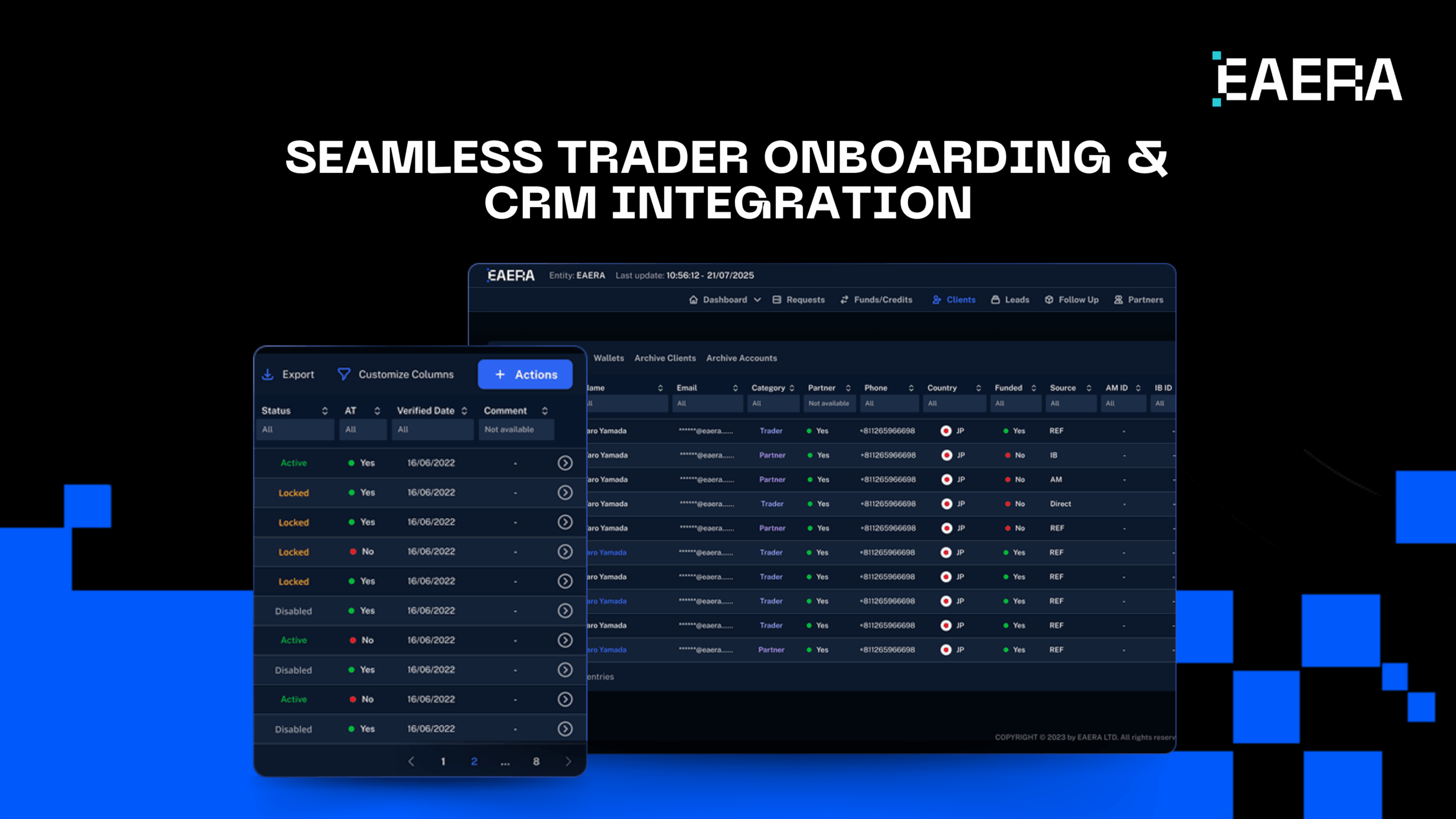

1. Seamless Trader Onboarding and CRM Integration

One of the most vital components of a successful prop trading company is a well-structured prop firm CRM. This system acts as the operational backbone, managing trader onboarding, documentation, evaluation tracking, and overall performance monitoring.

An efficient CRM streamlines the onboarding process by automating KYC and AML verifications and tracking each trader’s journey from signup to funding. For instance, a prop trading company in Singapore reported a 40% reduction in onboarding times after implementing an AI-powered CRM. Faster onboarding allows firms to deploy capital more quickly and attract top trading talent.

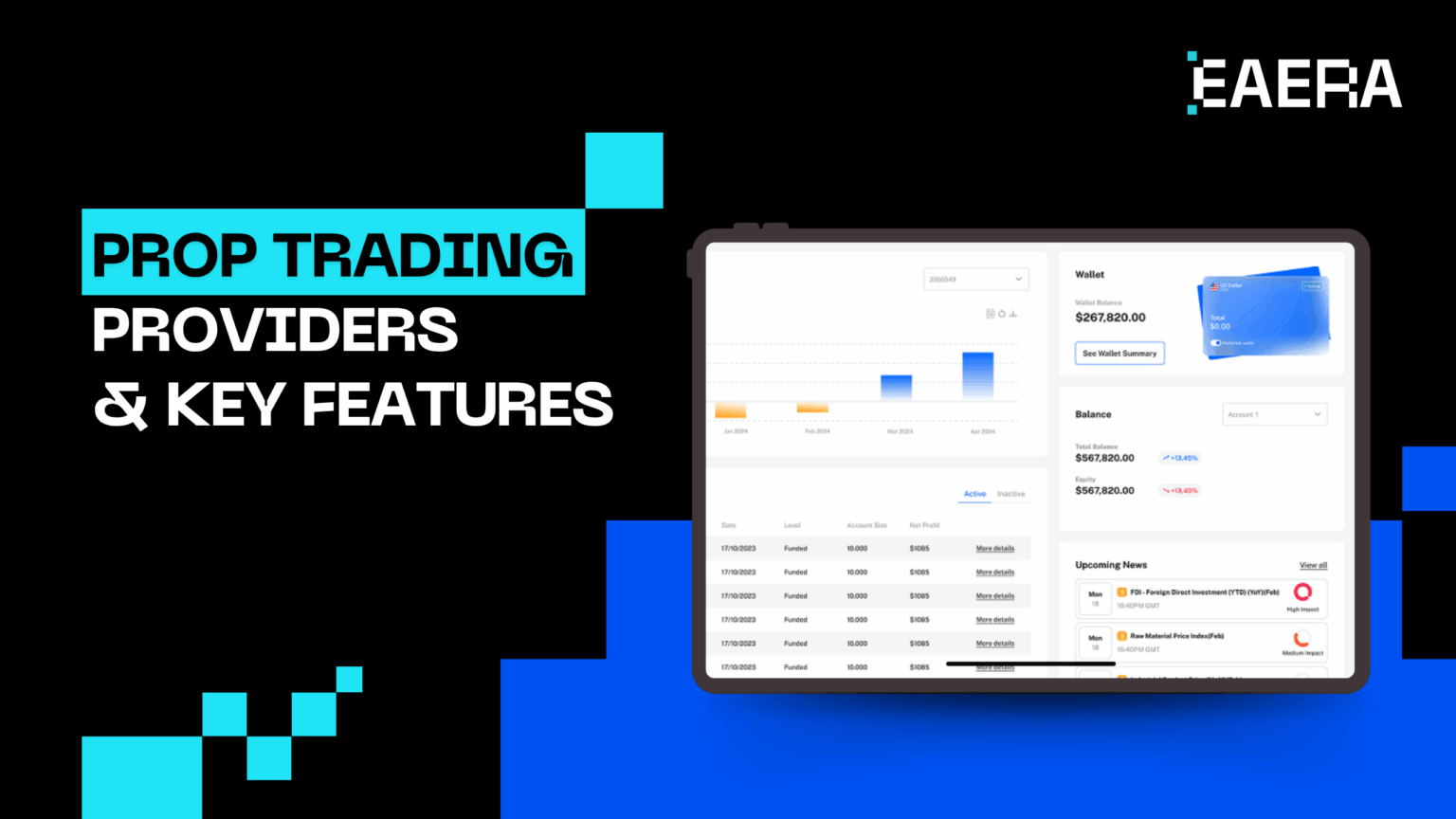

2. Real-Time Visibility Through a Customizable Dashboard

A prop firm dashboard provides real-time visibility into trader activities and risk metrics. A well-designed dashboard presents live updates on profit and loss, open positions, equity, margin use, and compliance with firm-set risk parameters.

When a Dubai-based prop firm launched a personalized trading dashboard, trader engagement rose by 25%. Traders appreciated having full transparency into their risk exposure, growth milestones, and profit splits, creating a more motivated and disciplined trading environment.

3. Automated Risk Management to Protect Capital

Risk management is non-negotiable in proprietary trading. Prop trading software must offer real-time trade monitoring, automatic enforcement of daily loss limits, dynamic leverage adjustments, and instant account suspension if traders violate preset risk parameters.

An Australian prop trading company reduced monthly losses by 30% after automating these risk controls through their CRM and dashboard. By removing manual oversight, firms ensure faster reactions to risk breaches and create a safety net that protects their capital from unnecessary exposure.

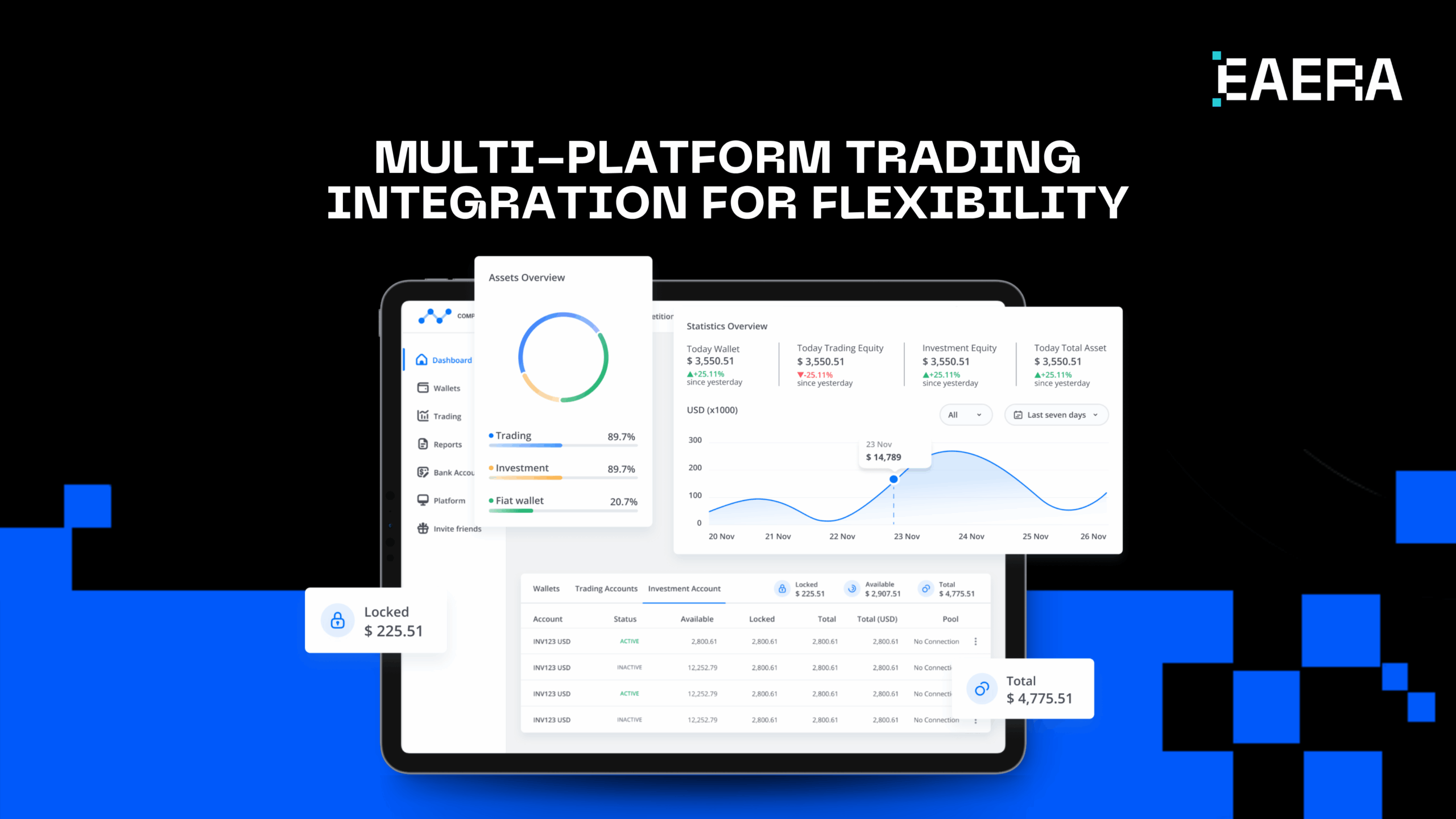

4. Multi-Platform Trading Integration for Flexibility

A top-tier prop trading solution must integrate seamlessly with multiple trading platforms like MT4, MT5, and cTrader. This integration ensures real-time trade data is pulled into the CRM and dashboard without manual intervention, offering operational efficiency and accurate oversight.

A London-based prop trading company expanded its trader base by 18% after introducing multi-platform support, allowing traders to work with their preferred trading terminals while the firm maintained centralized monitoring and risk control.

5. Evaluation and Scaling Program Automation

Evaluation programs are at the heart of any prop firm’s funding model. Prop trading software must support the automatic setup and tracking of trader challenges, ensuring evaluation rules like profit targets, drawdown limits, and trading objectives are enforced consistently.

Prop firms such as FTMO and MyForexFunds have scaled globally by automating these processes, allowing thousands of traders to move from trial phases to full funding without manual bottlenecks, boosting trader success rates and firm profitability.

6. Streamlined Payouts and Profit Sharing

Automated payout systems are crucial for trader satisfaction and operational efficiency. Prop firm CRMs must allow traders to view earnings, request withdrawals, and track profit splits directly through the dashboard.

A New York-based prop trading company saw a 20% increase in trader satisfaction after implementing a real-time payout feature, which minimized administrative delays and gave traders more control over their earnings.

7. Compliance and Reporting for Regulatory Assurance

With tightening global regulations, compliance features in a prop firm CRM are more critical than ever. These modules must automate identity verification, tax reporting, AML tracking, and record keeping to ensure the firm operates within legal frameworks.

Not only do these measures protect the firm from legal risks, but they also build trust among traders who prefer firms that operate transparently and in compliance with international standards.

Top Providers of Prop Trading Solutions

EAERA

EAERA is a leading provider of prop trading software and CRM solutions tailored for the unique needs of modern prop firms. EAERA’s platform integrates onboarding, risk management, evaluation programs, trader dashboards, and payout management into a seamless, scalable system.

Features include:

- Fully customizable prop trading dashboard

- AI-driven trader analytics and insights

- Multi-platform trading integration (MT4, MT5, cTrader)

- Automated trader evaluation and scaling systems

- Advanced compliance and security modules

EAERA’s solutions have helped prop firms reduce operational costs by up to 35% while improving trader satisfaction and retention rates.

FTMO Technology Stack

FTMO, a top prop firm forex brand, has developed an in-house dashboard and evaluation system that has set the standard for the industry. Their platform monitors trader behavior in real-time, automatically flags violations, and scales successful traders quickly.

FundedNext

FundedNext focuses on psychological coaching through its CRM by offering webinars, workshops, and personalized feedback loops. Their prop trading dashboard is built to keep traders informed about not only technical stats but also mindset metrics.

MyForexFunds

Known for offering a variety of evaluation programs, MyForexFunds uses integrated CRM and dashboard systems that let traders easily monitor their objectives, payouts, and rule compliance.

Why Choosing the Right Solution Matters

Selecting the right prop trading solutions is crucial for prop trading companies because it directly impacts:

- Operational efficiency

- Risk exposure control

- Trader satisfaction and loyalty

- Growth scalability

Firms that invest in a full-service prop firm CRM and advanced dashboards can offer traders a more transparent, efficient, and supportive environment, boosting profitability in the long term.

How EAERA Powers the Future of Prop Trading

EAERA delivers end-to-end prop trading solutions that empower firms to scale faster, operate smarter, and create a winning environment for traders. Our system combines CRM functionalities, risk control modules, real-time prop firm dashboards, and payout automation into one unified platform.

Whether you’re a new prop trading company or an established name in the prop firm forex sector, EAERA’s technology is designed to optimize your operations and ensure your traders succeed.

If you’re ready to elevate your prop trading operations and stay ahead of the competition, contact EAERA today and discover how our customized CRM and trading solutions can drive your growth.