In the fast-paced and highly competitive world of forex trading, a robust Customer Relationship Management (CRM) system is no longer a luxury but a necessity for FX brokers. A well-designed Forex CRM streamlines operations, enhances client relationships, and drives business growth by addressing the unique challenges of the forex industry.

Unlike generic CRM systems, a Forex CRM is tailored to meet the specific needs of FX brokers, integrating seamlessly with trading platforms, compliance requirements, and client management processes. This blog explores the 10 key characteristics that every Forex CRM should have to deliver tangible results for an FX broker, ensuring they remain competitive in a dynamic market.

Related articles:

- MetaTrader 5 Ultimate Tutorial: Mastering MT5 for Smart Trading

- How a Forex CRM Helps CFD Brokers Handle Growing Trader Requests

Why a Forex CRM Is a Must-Have for Any FX Broker?

The forex market, with its high trading volumes and global reach, demands efficiency and precision in managing client interactions and brokerage operations. For an FX broker, a specialized Forex CRM acts as the backbone of the business, centralizing client data, automating repetitive tasks, and ensuring compliance with stringent regulations.

Without a purpose-built CRM, brokers risk fragmented workflows, missed opportunities, and inefficiencies that can erode client trust and profitability. A high-quality Forex CRM empowers brokers to nurture leads, retain clients, and optimize operations, ultimately boosting conversions and long-term success.

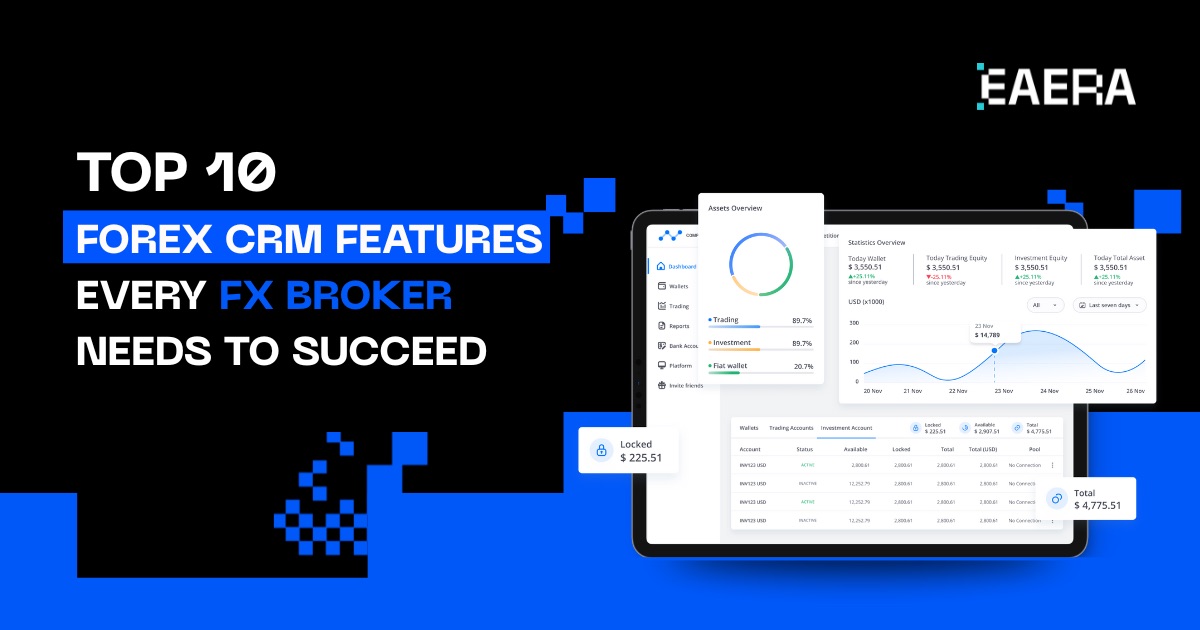

10 Essential Forex CRM Features for FX Brokers

1. Seamless Integration with Trading Platforms for FX Broker Operations

A top-tier Forex CRM must integrate seamlessly with popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and others for an FX broker. This ensures real-time synchronization of client trading activities, account details, and transaction data. By eliminating manual data entry, integration reduces errors and saves time, allowing an FX broker to focus on strategic tasks. For example, a CRM that syncs with MT5 can provide real-time insights into client trading behavior, enabling an FX broker to offer personalized support and tailored promotions.

2. Comprehensive Client Management to Boost FX Broker Performance

Effective client management is at the heart of any successful FX broker. A Forex CRM should offer a centralized repository for client data, including demographics, trading history, preferences, and communication logs. This holistic view enables brokers to understand client needs, segment audiences, and deliver personalized experiences. Features like lead tracking, automated follow-ups, and client activity monitoring ensure that potential conversions are not missed, fostering stronger relationships and improving retention rates.

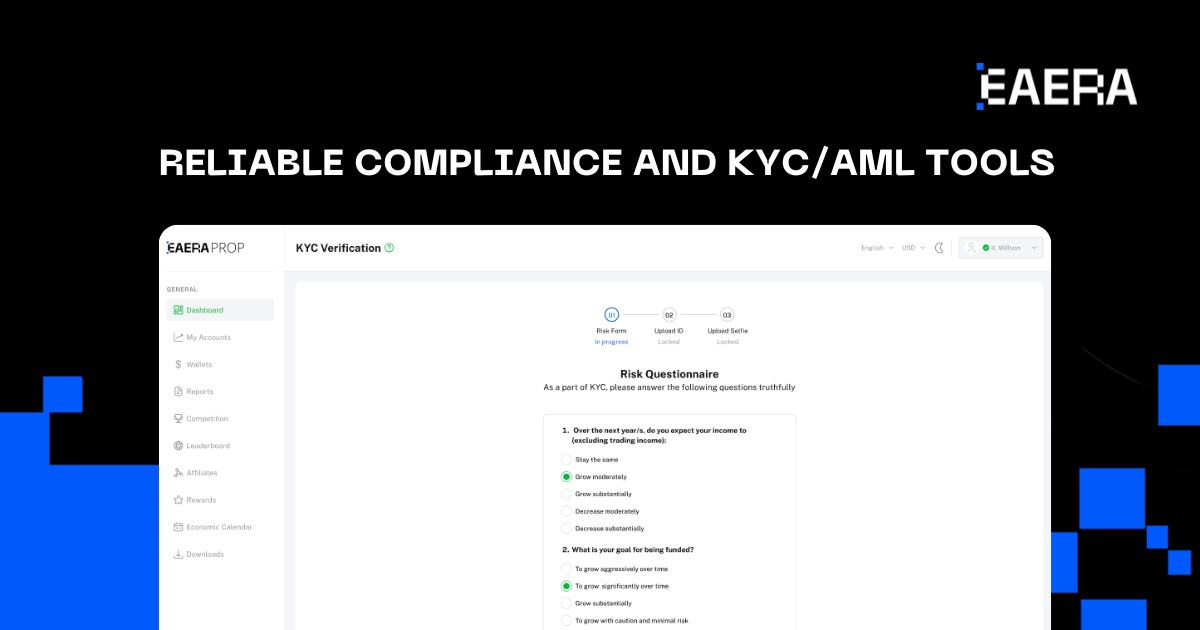

3. Compliance and KYC/AML Tools for FX Broker Regulation

Regulatory compliance is non-negotiable in the forex industry. A reliable Forex CRM must include automated Know Your Customer (KYC) and Anti-Money Laundering (AML) processes to ensure adherence to global standards.

These tools streamline client onboarding by verifying documents, checking for fraudulent activities, and maintaining accurate records. By automating compliance tasks, the CRM reduces the risk of regulatory penalties and frees up resources for business growth.

4. Advanced Data Analytics and Reporting for Smarter FX Broker Decisions

Data-driven decision-making is critical for FX brokers to stay ahead of the competition. A Forex CRM should provide comprehensive reporting and analytics tools to track client behavior, trading patterns, and marketing campaign performance.

Real-time dashboards and customizable reports allow brokers to gain actionable insights, refine strategies, and optimize operations. For instance, analyzing trading volumes can help identify high-value clients, enabling targeted marketing efforts to maximize profitability.

5. Automation for Operational Efficiency

Manual processes are time-consuming and prone to errors, which can hinder an FX broker’s scalability. A robust Forex CRM automates repetitive tasks such as client onboarding, email campaigns, and payment processing. Automated workflows streamline operations, reduce human error, and allow brokers to focus on high-value activities like client engagement and business expansion. Automation also enhances client satisfaction by ensuring timely communication and support.

6. Scalability for Growing Brokerages

As FX brokers expand their client base and operations, their CRM must scale accordingly. A scalable Forex CRM accommodates growing networks of clients, introducing brokers (IBs), and affiliates without compromising performance. Cloud-based solutions are particularly effective, offering flexibility and cost-efficiency for startups and established brokerages alike. Scalability ensures that the CRM remains a valuable asset as the business evolves.

7. Customizability to Fit Unique Needs

Every FX broker has unique branding, operational requirements, and market strategies. A flexible Forex CRM allows customization of its interface, workflows, and features to align with a broker’s needs. From tailoring the client portal to match brand aesthetics to configuring internal systems for specific processes, customizability enhances user experience and operational efficiency. A CRM that adapts to an FX broker’s vision fosters a seamless and professional client journey.

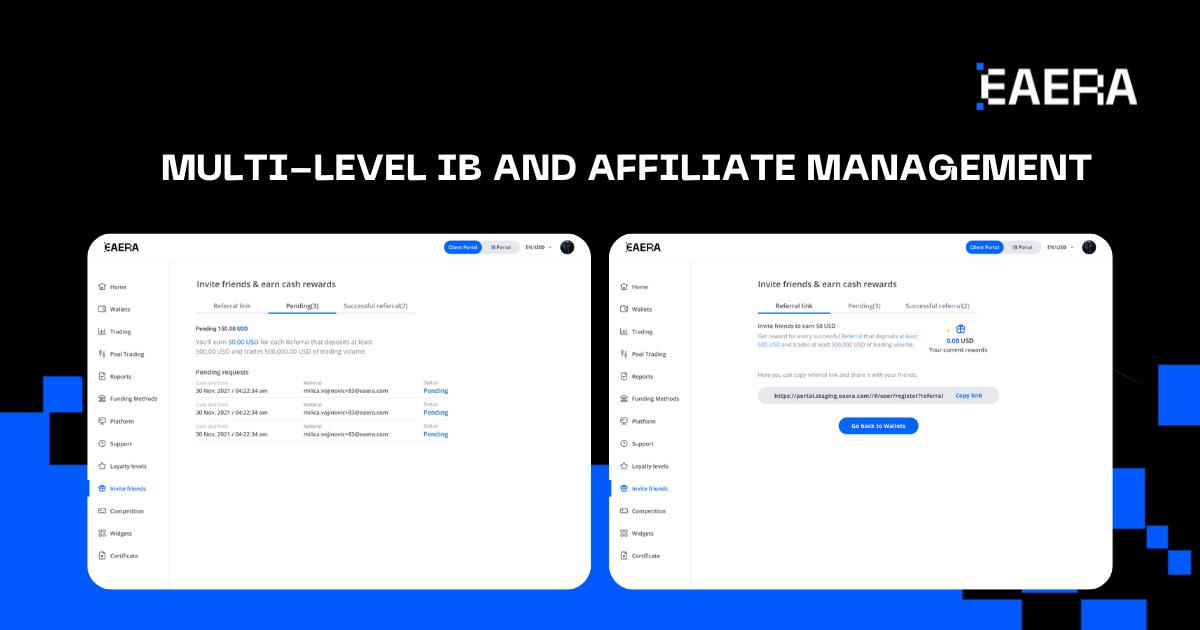

8. Multi-Level IB and Affiliate Management

Introducing brokers and affiliates are vital for expanding market reach. A Forex CRM should include multi-level IB and affiliate management tools to track commissions, monitor performance, and manage partnerships effectively for an FX broker.

These features enable an FX broker to incentivize partners, streamline commission payouts, and grow their network. For example, a CRM with automated commission calculations ensures transparency and builds trust with IBs and affiliates for an FX broker.

9. Secure Payment Gateway Integration

Efficient and secure payment processing is critical for client satisfaction and operational success for an FX broker. A Forex CRM should integrate with multiple payment service providers (PSPs) to offer clients a variety of deposit and withdrawal options. Support for regional PSPs ensures that an FX broker can cater to diverse markets, enhancing accessibility. Additionally, high-security standards, such as PCI DSS compliance, protect client data and build trust in an FX broker’s operations.

10. Exceptional Customer Support and Training

Implementing a Forex CRM is only the beginning; ongoing support and training are essential for maximizing its potential for an FX broker. A reliable CRM provider should offer comprehensive onboarding, 24/7 customer support, and user training to ensure an FX broker can leverage all features effectively. Responsive support minimizes downtime and resolves issues quickly, while training empowers an FX broker’s team to use the CRM to its fullest, driving long-term success.

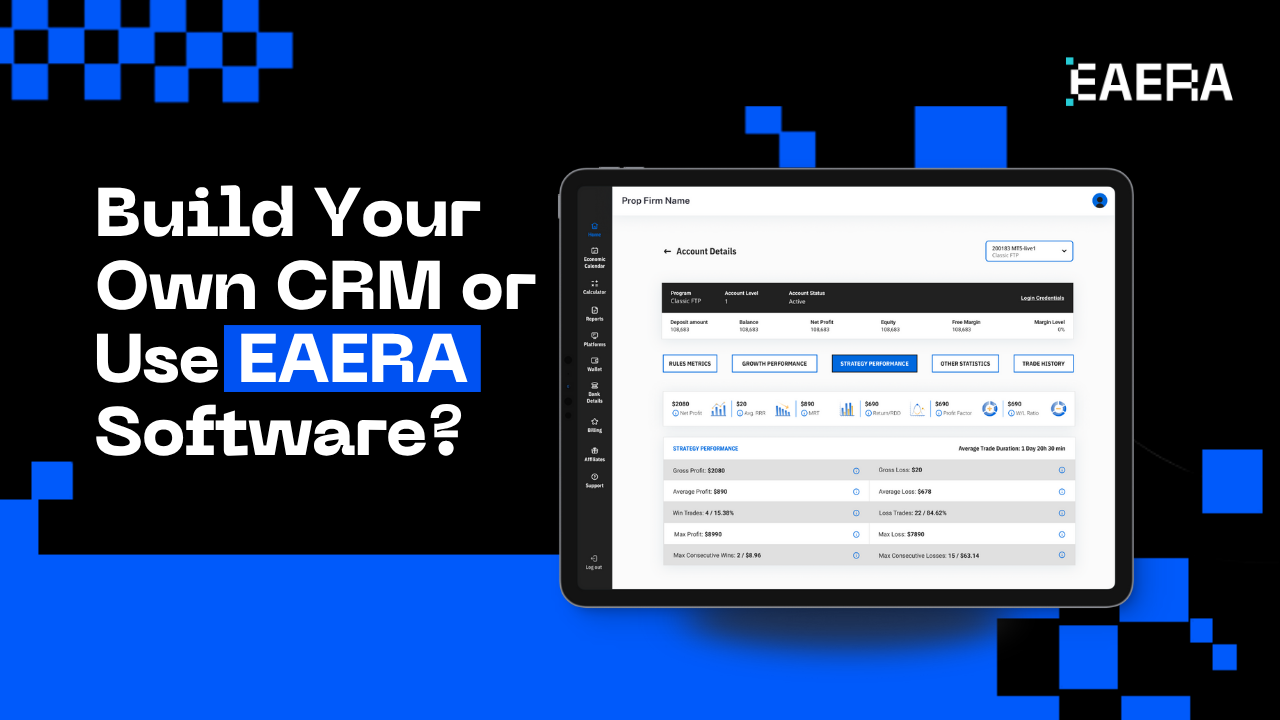

Choosing the Best Forex CRM for Your FX Broker

Selecting the right Forex CRM requires careful consideration of your brokerage’s needs, budget, and growth plans. Start by evaluating the CRM’s integration capabilities, ensuring it works seamlessly with your trading platforms. Prioritize scalability and customizability to accommodate future expansion and align with your brand.

Compliance tools, analytics, and customer support are also critical factors. By choosing a CRM that aligns with these characteristics, FX brokers can build a foundation for sustained growth and client satisfaction.

EAERA: Your Partner for Forex CRM Success

For FX brokers seeking a transformative CRM solution, EAERA offers a revolutionary cloud-based Forex CRM designed to meet the needs of both startups and established firms. With cutting-edge technology, seamless integration with platforms like MT4 and MT5, and advanced features like AI-powered client segmentation, real-time reporting, and automated KYC/AML processes, EAERA empowers brokers to streamline operations and enhance client relationships.

From customizable interfaces to robust analytics and multi-level IB management, EAERA delivers the tools needed to drive profitability and growth. Contact EAERA today at eaera.com/contact-us/ to schedule a demo and discover how their Forex CRM can elevate your brokerage to new heights.