Staying ahead of tightening global regulations while scaling rapidly is a major challenge for Forex brokers. With Know Your Customer (KYC) and Anti-Money Laundering (AML) rules becoming more stringent, manual compliance processes are no longer sufficient. This is where a purpose-built CRM for Forex becomes essential. In this real-world case study, we will explore how a mid-sized brokerage successfully streamlined its compliance and client onboarding using EAERA’s advanced CRM solution.

Related articles:

Why Forex Brokers Can’t Ignore KYC and Compliance?

KYC acts as a broker’s first line of defense, ensuring client identities are verified and protecting against fraud and money laundering. Neglecting or delaying these checks can lead to severe consequences, including fines, frozen accounts, or even license revocation. A specialized CRM for Forex trading is like a control tower—maintaining real-time synchronization of client records, trades, and compliance documents across jurisdictions and time zones. For brokers aiming to grow without compromising regulatory integrity, investing in the right CRM for forex is strategic.

The Strategic Role of CRM for Forex

A Forex CRM centralizes client data, connects with trading platforms like MetaTrader or cTrader, and streamlines everything from lead management to withdrawals.

Core features include:

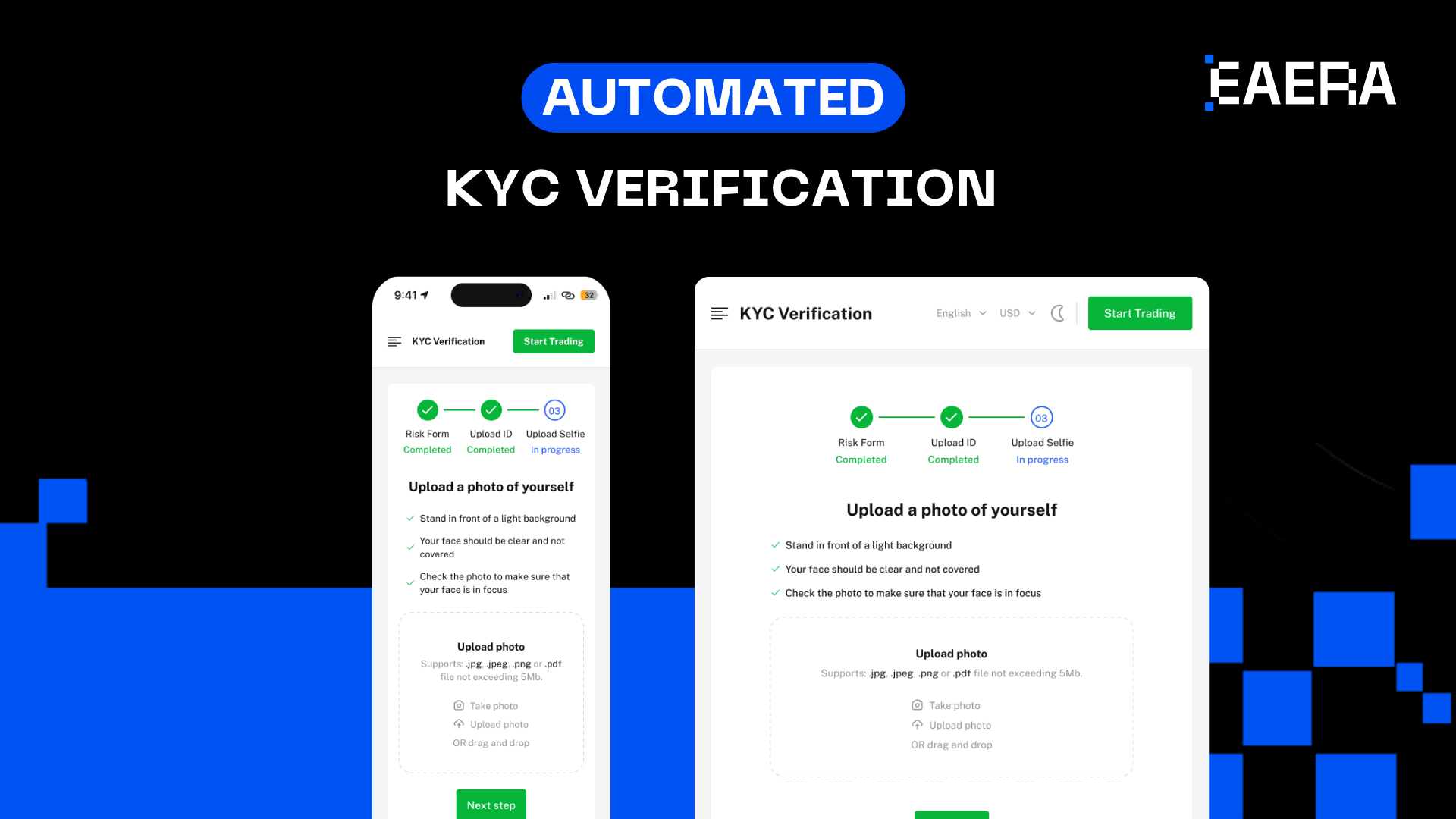

- Client Onboarding and Account Management: Seamless sign-ups, electronic document uploads, and live status tracking make onboarding effortless for clients and administrators.

- Integrated Trading Platform Connections: Real-time connections ensure accurate account balances, trade history, and risk exposure for each verified trader.

- Risk and Compliance Automation: Built-in rule engines automate KYC checks and flag suspicious activity, ensuring every client meets legal standards.

Real-World Case Study: Applying CRM for Forex in KYC and Compliance Process

The Client Background

The client is a mid-sized Forex brokerage serving the fast-growing Asia market, they are looking to scale operations while staying fully compliant with financial regulations. With years of experience managing manual KYC and compliance processes, the firm has outgrown spreadsheets and fragmented tools. As trading volumes and client registrations rise rapidly, they face mounting challenges in centralized customer management, operational efficiency, and regulatory reporting.

From a business perspective, the broker needs a dedicated CRM for Forex to unify client data, transaction histories, leads, and IB/agent networks. Marketing and sales teams seek to launch email marketing, automation, and customer-tracking campaigns to lift conversion rates. On the operations side, they want to connect their CRM seamlessly with MT4/MT5 trading platforms, payment gateways, and KYC/AML modules to cut manual work and reduce error risks.

Strategically, the firm is actively comparing CRM for Forex—evaluating features, pricing, and customization options—to find a flexible, future-proof solution. Compliance remains a top priority: they require built-in tools for regulatory tracking, activity logging, and performance reporting to satisfy diverse financial authorities across Asia. This combination of growth ambitions and strict compliance needs makes the company an ideal candidate for EAERA’s CRM for Forex, which delivers automation, scalability, and peace of mind.

The Challenges and Problems

Operating as a mid-sized broker in the Asian Forex market offers huge growth potential, but it also creates a perfect storm of operational and compliance pressures. Without a specialized CRM for Forex, these challenges multiply, threatening efficiency and profitability.

1/ Fragmented Customer Management

Managing thousands of client records across spreadsheets, emails, and disconnected tools leads to data silos and duplication. The absence of a centralized CRM for Forex makes it difficult to track trading history, leads, or IB/agent performance in real time. As a result, sales and support teams waste hours searching for information and risk missing important follow-ups.

2/ Slow and Error-Prone KYC & Compliance

Manual KYC checks and AML procedures are time-consuming and prone to human error. For a broker expanding across multiple Asian jurisdictions, every country adds unique verification rules. Without automated compliance inside a CRM for Forex, staff spend excessive time verifying IDs, cross-checking databases, and preparing regulatory reports—delays that frustrate clients and invite regulatory penalties.

3/ Inefficient Marketing and Sales Processes

Email marketing, lead nurturing, and conversion tracking are vital for growth, yet manual marketing workflows can’t keep up with. Without built-in automation and analytics from a CRM for Forex, campaigns remain inconsistent, and valuable prospects often drop off before opening an account.

4/ Lack of Integration with Trading and Payment Platforms

Disconnected systems create operational bottlenecks. Separate platforms for MT4/MT5, payment gateways, and client records force staff to enter data multiple times, increasing the risk of mistakes. A modern CRM for Forex provides seamless integration, ensuring that every trade and transaction is tied to a verified client profile in real time.

EAERA Solution for Client

With this case study, EAERA partnered with our clients to deliver a customized CRM for Forex that directly addressed their KYC, compliance, and operational challenges. The deployment followed a structured, results-driven process:

Needs Assessment

EAERA worked closely with the broker’s management and compliance teams to map every customer touchpoint and regulatory requirement. Together, they defined key needs: centralized client management, automated KYC/AML checks, seamless MT4/MT5 integration, and powerful marketing automation.

Platform Integration

The EAERA CRM for Forex is related to MT4/MT5 trading platforms, payment gateways, and identity verification services. This ensured real-time data syncing for deposits, withdrawals, trades, and compliance updates—all accessible from one centralized dashboard.

Custom Feature Configuration

EAERA configured key features and benefits specifically for the client’s operations:

- Centralized dashboard for live oversight of requests, transactions, and trading activity.

- Request management to automate KYC verification, account setup, wallet management, and compliance checks.

- Transaction handling to support multi-currency deposits, withdrawals, and transfers in both fiat and crypto.

- Client and lead management to track every lead, IB/agent, and conversion path in detail.

- Advanced reporting to generate regulator-ready reports on transactions and client behavior.

- Role-Based Access Control to keep sensitive data secure while defining clear permissions for staff.

Training and Onboarding

EAERA provided hands-on training sessions for sales, compliance, and operations teams, ensuring staff could fully leverage the CRM’s automation and analytics features. Support materials and responsive help channels encouraged smooth adoption.

Results: A New Standard in Forex Operations

The EAERA CRM for Forex delivered measurable, transformative outcomes:

- 70% Faster Onboarding: Automated KYC and centralized data cut approval times from days to under an hour.

- 90% Reduction in Manual Compliance Work: Built-in checks and one-click reporting eliminated most manual document handling.

- Error-Free Transactions and Reporting: Integrated MT4/MT5 and payment data ensured complete accuracy across all systems.

- Improved Client Trust and Conversion: Real-time status updates and responsive marketing automation increased customer satisfaction and conversion rates.

- Scalability and Future-Readiness: The broker is now equipped to expand into new Asian markets without adding administrative overhead.

Lessons Learned and Best Practices

1. Early Mapping of Compliance Needs Is Critical

Defining KYC/AML requirements at the very start allowed EAERA and the broker to configure custom rules accurately. This avoided rework and ensured that every regulatory obligation—across multiple Asian markets—was met from day one.

2. Centralized Data Enables Speed and Accuracy

Migrating all client, transaction, and trading data into one secure CRM reduced errors and eliminated duplicate records. The team quickly saw how a single source of truth drives faster onboarding and cleaner audits.

3. Integration Pays Off Long-Term

Connecting the CRM for Forex with MT4/MT5 platforms, payment gateways, and verification tools eliminated manual data entry. Although integration required careful planning, the payoff in efficiency and reliability was immediate and lasting.

4. Training Boosts Adoption and ROI

Hands-on training sessions and user-friendly design meant staff adopted new workflows quickly. The faster the team embraced the system, the faster the broker realized cost savings and compliance improvements.

5. Continuous Optimization Ensures Scalability

Regulatory requirements and trading volumes change. Building a habit of regular audits and feature reviews ensures the CRM remains aligned with market growth and new regulations.

Conclusion

The Forex market never sleeps, and neither should compliance. This real-world case proves that a well-implemented CRM for Forex can cut onboarding times, reduce risk, and strengthen client relationships.

Contact EAERA today at eaera.com to schedule a personalized demo and see how our powerful CRM for Forex can automate KYC, strengthen compliance, and scale your brokerage with confidence.

FAQs

What is the role of CRM in Forex KYC?

- It automates identity verification, document management, and reporting to meet global regulations quickly and accurately.

Can CRM reduce compliance costs?

- Yes. By replacing manual reviews with automation, brokers save on labor and avoid fines.

How does automation prevent fraud?

- Automated risk scoring flags suspicious activities instantly, protecting brokers from fraud and money laundering.

Is a Forex CRM suitable for small brokers?

- Absolutely. Scalable solutions let even small brokers benefit from enterprise-grade compliance features.

What trends will shape Forex compliance in the next five years?

- Expect stronger AI-based fraud detection, blockchain-secured identity, and tighter global AML standards.