Prop firms have rapidly expanded across regions in recent years, onboarding thousands of traders from the Americas, Europe, and Asia. Sufficient prop trading software is necessary to manage risk in real time, process payouts efficiently, and keep up-to-date performance and compliance dashboards across time zones.

Related articles:

- Prop Trading Solutions: Key Features and Top Provider

- Top Prop trading system to Ignite Your Business Growth

Prop trading software has emerged as an all-in-one automation platform created to streamline the complexity of contemporary prop firm operations. Businesses can no longer rely on manual spreadsheets or disjointed tools due to increased competition and changing trader expectations for speed and transparency.

What Is Prop Trading Software?

A comprehensive management system designed especially for proprietary trading companies is known as prop trading software. Prop trading software oversees the full lifecycle of trader engagement and operational workflow, in contrast to standard trading platforms like MT5 or cTrader, which concentrate on order execution.

Its core components typically include:

- Account management: evaluation phase management, funded accounts, rule enforcement

- Risk engine: real-time exposure, leverage, and drawdown monitoring

- Dashboards: performance analytics for traders, managers, and administrators

- Automation workflows: onboarding, account resets, alerts, payouts

Prop trading software establishes a single operating environment by automating procedures and centralizing data from trading platforms. As a result, thousands of accounts are managed effectively, consistently, and transparently—all critical components of a contemporary prop firm.

Key Operational Challenges Faced by Prop Firms

As prop firms scale internationally, they encounter several operational bottlenecks:

- Multiple time zones: Traders execute around the clock, requiring real-time monitoring and prompt problem solving.

- Massive data loads: High-frequency trading generates enormous streams of real-time data that need to be processed and displayed instantly.

- Complex risk tracking: It is impossible to manually track drawdowns, leverage, equity, and P&L for hundreds of accounts.

- KYC/AML verification: Automated document checks are necessary to ensure compliance when onboarding international traders.

- Human limitations: Manual procedures may result in mistakes, irregularities, and sluggish reaction times.

- Scalability issues: Without automation, firms struggle to expand beyond a few hundred traders.

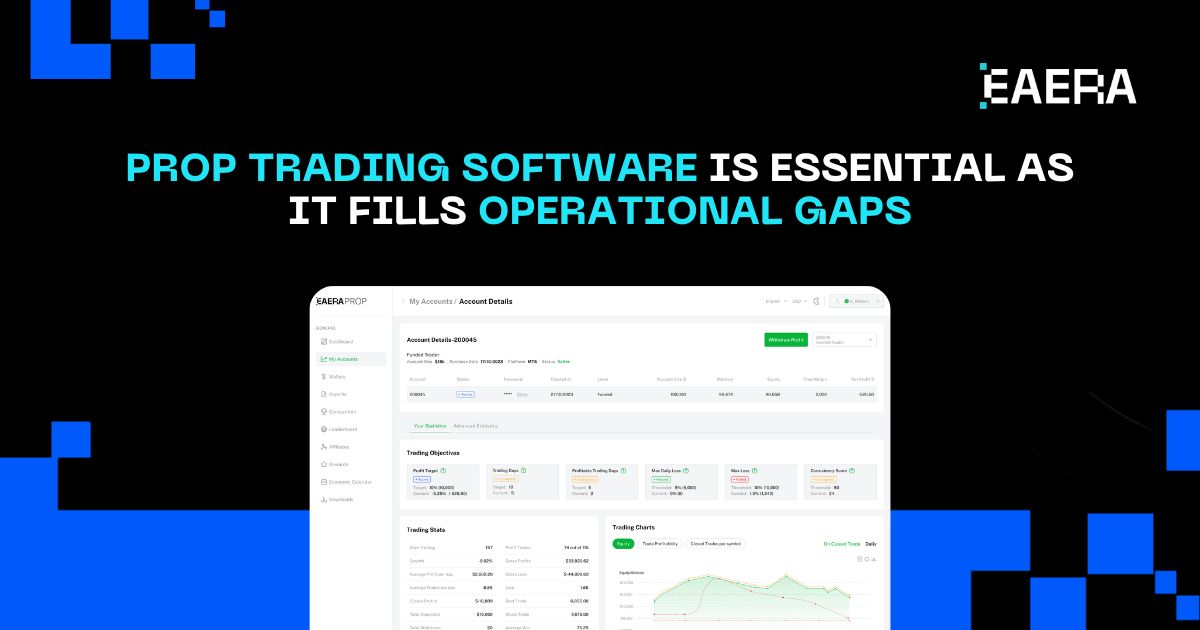

These difficulties demonstrate why prop trading software is now essential—it fills the operational gaps that keep businesses from growing.

Prop trading software is essential as it fills operational gaps

How Prop Trading Software Streamlines Operations?

Automation of Evaluation & Funding Processes

The ability of prop trading software to automate the full evaluation lifecycle is one of its greatest benefits. Instead of manually creating challenge accounts, sending verification emails, or tracking progress in spreadsheets, the system executes these steps automatically:

- Challenge accounts are created automatically

- Verification procedures adhere to established trading guidelines

- Funded accounts activate when criteria are met

- Balance resets, notifications, and rule enforcement happen without human intervention

Automation lowers errors and expedites the trader’s journey from registration to active trading by eliminating time-consuming and repetitive tasks.

Real-Time Risk Monitoring & Alerts

Any prop firm’s sustainability is determined by its risk management. Intelligent engines that continuously track trader behavior are a feature of prop trading software:

- Maximum daily loss

- Overall drawdown

- Leverage usage

- Exposure limits

- P&L trends

When a threshold is crossed, the system sends immediate alerts via email, dashboard pop-ups, etc. Before capital is compromised, managers can intervene or automatically pause accounts. Proactive risk management, as opposed to reactive, is made possible by this degree of automation.

Centralized Data & Multi-Asset Analytics

All trading data is combined into a single, cohesive dashboard by prop trading software. The system gathers and synchronizes data in real time, regardless of whether the company uses MT5, cTrader, or a custom API.

This provides managers with a thorough understanding of multi-asset performance, profitability trends, equity curves, trader consistency, and behavior patterns. Decision-makers can view all pertinent insights in one location rather than juggling spreadsheets or navigating between platforms.

Confusion is decreased, management decisions are made more quickly, and businesses are better able to recognize performance trends thanks to centralized data.

Built-In Compliance & Reporting

Compliance is becoming more important. Modern prop trading software consists of:

- Integrated KYC/AML checks

- Automated document review

- Audit trails for every action

- Auto-generated trading and performance reports

These features reduce administrative workload while ensuring regulatory alignment.

Performance Dashboards & Leaderboards

The capacity of sophisticated systems to offer motivation and transparency via leaderboards and dashboards is a crucial differentiator. Managers and traders can see:

- Individual KPIs

- Risk-to-reward ratios

- P&L summaries

- Trading frequency and behavior

- Consistency scores

Leaderboards promote a healthy competitive environment and create recognition for top performers, which enhances trader engagement and brand credibility.

Automation of Payouts & Profit Sharing

One of the main complaints raised by traders is payout delays. The entire payout process is automated by prop trading software:

- Calculates profit splits based on firm rules

- Processes requests with automated checks

- Integrates with global payment gateways

- Logs all payout activity for compliance

Automation increases accuracy, boosts trader trust, and drastically cuts turnaround time.

Benefits of Using Prop Trading Software

The impact of adopting prop trading software extends across the organization:

- Scalability: Handle rapid growth of traders without expanding staff.

- Consistency: Automated procedures lower operational risk and apply regulations consistently.

- Speed: Decision-making is accelerated by real-time updates and immediate alerts.

- Transparency: Managers and traders alike gain confidence from transparent dashboards.

- Cost reduction: Automation reduces the need for large operational teams.

- Enhanced trader experience: Traders enjoy faster evaluations, quicker payouts, and more reliable reporting.

Traders enjoy faster evaluations, quicker payouts, and more reliable payouts, more reliable reporting

Overall, prop trading software enables firms to run smoother operations while maintaining institutional-grade execution. All things considered, prop trading software helps businesses operate more efficiently while preserving institutional-caliber performance.

What to Look for When Choosing Prop Trading Software?

For long-term performance, choosing the appropriate system is essential. Important characteristics to consider are:

- Cloud-native architecture for stability and uptime

- Open API for easy integrations

- Multi-asset support across forex, commodities, indices, and crypto

- Customizable trading rules (drawdown, profit targets, leverage)

- Flexible automation workflows

- Security standards like encryption and access control

- Localization features for languages and time zones

- Reliable onboarding and support

A secure, adaptable, and scalable solution guarantees that the business can grow without having to redo its fundamental operations.

The Future of Prop Trading Software

Deeper connectivity, sophisticated automation, and artificial intelligence are driving the next evolution of prop trading software. Important trends consist of:

- AI-driven risk analytics to forecast potential violations

- Adaptive evaluation models that adjust difficulty based on performance

- Automated regulatory compliance tailored to regional laws

- Integration with liquidity providers for better transparency

- Behavior prediction engines to identify consistency and psychological patterns

Prop trading software will develop into a complete operating system that powers all divisions of a prop firm, including onboarding, risk management, and payouts, as these innovations mature.

Prop trading software is now more than just a tool; it is the technological underpinning that makes it possible for prop firms to function effectively, openly, and on a large scale. Businesses that implement cutting-edge, integrated prop trading software will be in a better position to thrive in a global trading environment and expand sustainably.