In contemporary trading environments, strategy design itself frequently has less effect on performance than execution quality. Orders that are rejected, delayed, or carried out irregularly can undermine even the most carefully thought-out tactics. These problems are more frequently the result of the system’s processing and management of execution than they are of market behavior alone.

Related articles:

A trading platform is the core system responsible for converting trading decisions into market actions. It controls routing, execution, confirmation, validation, and risk assessments.

What Fast and Reliable Execution Really Means?

Speed is frequently used to reduce execution quality, but speed is insufficient on its own. Accuracy, consistency, and speed are all components of true execution quality.

Because markets move quickly, speed is important. Exposure to price movement and slippage increases when decisions are delayed. However, there can be serious risk if orders are executed as quickly as possible without adequate validation. Unintentional exposure, rule infractions, and incorrect position sizing can cause more harm than a few milliseconds of latency.

What guarantees that execution acts consistently under all circumstances is reliability. Both during regular trading hours and during times of high volatility, a dependable system consistently completes orders. Instead of continuously keeping an eye out for malfunctions, this consistency enables traders and operators to trust the system’s behavior.

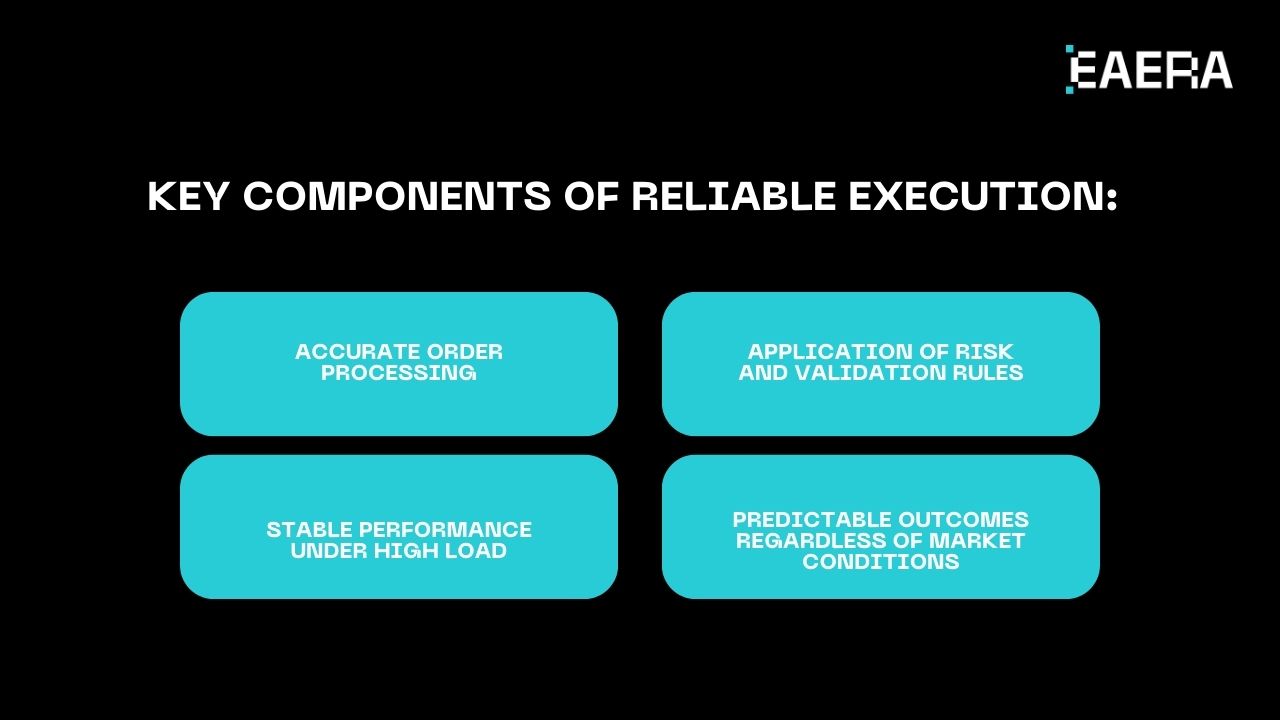

Key components of reliable execution are:

- Accurate order processing

- Application of risk and validation rules

- Stable performance under high load

- Predictable outcomes regardless of market conditions

This implies that the execution quality becomes a system-level result. A good trading platform indeed considers execution as a controlled process, unlike the current best-effort process.

The Execution Lifecycle Inside a Trading Platform

Every trade has a specific lifecycle. Knowing this lifecycle makes it easier to understand where execution quality improves or deteriorates.

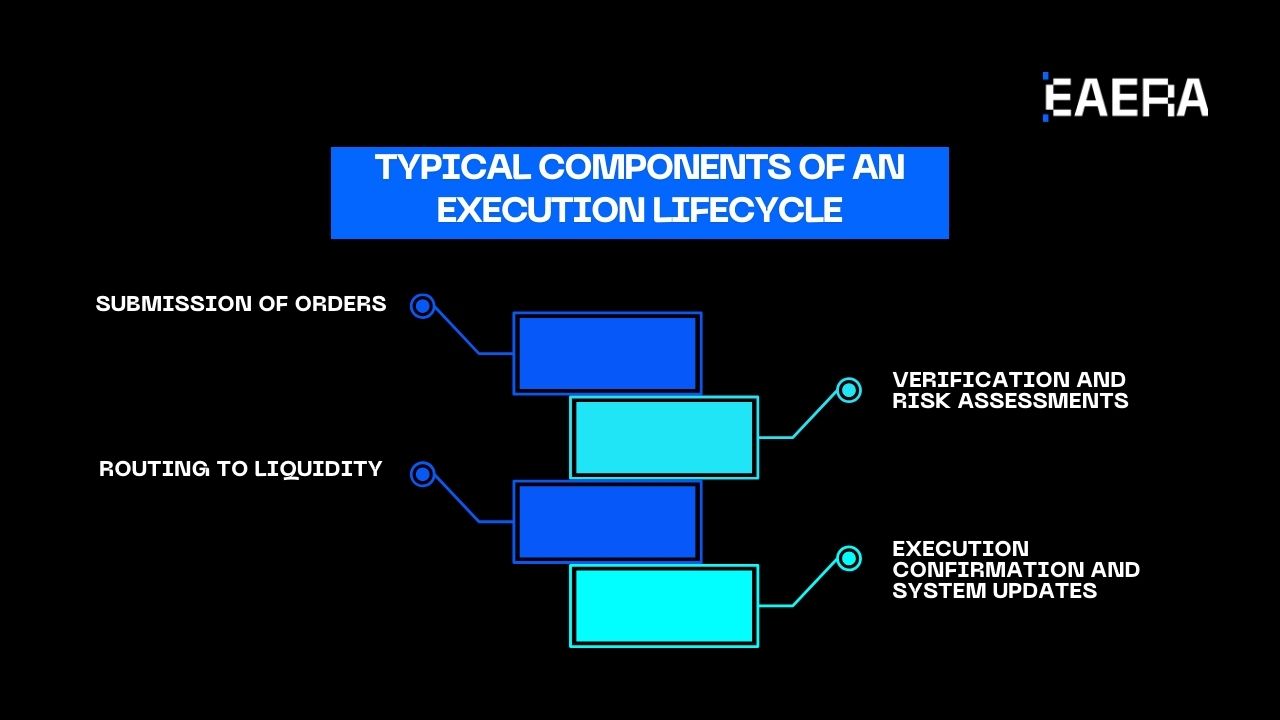

Typical components of an execution lifecycle include:

- Submission of orders

- Verification and risk assessments

- Routing to liquidity

- Execution confirmation and system updates

The trading platform needs to confirm order format, account status, and fundamental limitations at the submission stage. To prevent needless delays, this step needs to be quick and deterministic.

The next step is risk validation. Checks on margin, exposure limits, or compliance regulations are a few examples of this. Risk checks safeguard execution quality when they are integrated directly into the execution workflow. Latency and inconsistency are introduced by manual or external risk checks.

Routing is where the speed of execution will be noticed the most. When the routing logic is inefficient, it results in a partially filled order, which takes time or results in the rejection of the order. A good trading platform relies on specific routing rules.

Finally, both confirmation and post-trade updates need to happen instantly. This is because the delay in updates regarding balance or exposure affects trust and appropriate risk management.

An organized trading interface can encompass all stages of trading in one single workflow process.

Platform Architecture and Processing Logic

Execution performance is heavily influenced by architecture. It establishes the system’s response to events and its ability to scale under stress.

Event-driven processing is preferred over sequential workflows in modern execution systems. Market or order events immediately initiate actions in an event-driven design. As a result, the trading platform can react more quickly and reliably.

Among the key architectural features are:

- Real-time processing instead of batch updates

- Tight coupling between validation, routing, and confirmation

- Resilient components that recover quickly from failure

It’s crucial to be stable under load. Order volume can rise sharply during times of high volatility or news releases. Execution reliability is directly impacted by systems that are not built for scale, which slow down or malfunction.

The architecture affects risk controls as well. Validation occurs quickly and reliably when risk logic is integrated into execution workflows. Execution becomes unpredictable when risk is managed externally.

Instead of just implementing details, a well-designed trading platform views architecture as the basis for execution quality.

Automation and Control in Modern Execution

Maintaining quick, dependable execution at scale requires automation. Delays, irregularities, and operational risk are introduced by manual intervention.

Automation facilitates execution through:

- Eliminating human latency in routine steps

- Enforcing execution rules uniformly

- Reducing error rates as volume increases

Validation, routing, and confirmation are automated procedures in a contemporary trading platform. Regardless of timing or volume, all orders follow the same reasoning. Performance can be evaluated and enhanced over time thanks to this predictability.

Automation without governance, however, can magnify errors. Monitoring, auditability, and explicit rules must be combined with automated execution.

Among the efficient control mechanisms are:

- Clearly defined execution rules

- Real-time monitoring and alerts

- Complete audit trails for execution decisions

This balance enables traders to concentrate on strategy while the platform guarantees consistent, disciplined execution.

Reliability During Volatility and High Load

Stress in the market frequently leads to execution issues. Weaknesses that are concealed during calm times are revealed by volatility.

Typical stressful situations consist of:

- Signature economic announcements

- Sudden liquidity shifts

- Sharp price movements across instruments

A trading platform must uphold order integrity, apply regulations consistently, and avoid system overload during these times. The risk of an unsuccessful or inaccurate execution is increased by raw speed without stability.

Predictability is a top priority for trustworthy platforms. Extreme circumstances may cause orders to be processed a little more slowly, but they are handled appropriately. Even in erratic markets, traders and operators can successfully manage risk thanks to this predictability.

An ideal execution system is characterized by reliability under pressure.

Common Execution Failures and How Platforms Prevent Them

Instead of being isolated occurrences, execution failures are frequently signs of structural flaws.

Typical issues consist of:

- Order rejections due to inconsistent validation

- Partial fills caused by inefficient routing

- Delayed confirmations that obscure real exposure

By incorporating execution discipline into system design, a trustworthy trading platform avoids these problems. The process of validation is deterministic. The routing logic is predetermined. Updates on confirmation happen instantly.

Platforms lessen the need for manual correction and ongoing supervision by preventing failures at the system level.

Execution Quality as a Long-Term Competitive Advantage

Over time, execution quality compounds. Even though minor inefficiencies might not seem like much on their own, they add up as volume increases.

Human-intervention-based platforms find it difficult to grow. With reduced operational risk and increased trust, platforms built for predictable execution scale more easily.

In the long run, platforms that prioritize execution allow:

- Easier scaling of trading operations

- More accurate performance analysis

- Greater confidence from traders and stakeholders

As automation and data-driven trading develop further, execution dependability will become more important than slight speed increases.

Reliability and speed of execution are not coincidental. Through automation, disciplined workflows, and architecture, it is built into the system. A trading platform that facilitates execution efficiently integrates control, accuracy, and speed into a single operational procedure.

Rather than focusing only on features, organizations should evaluate how their trading platform behaves under real conditions. When execution is treated as a system, responsibility, performance, risk management, and trust improve together.