Selecting the best forex CRM now involves more than just lead management in the fiercely competitive forex market. In addition to managing real-time trading data and raising customer expectations, modern brokerages operate across numerous platforms, geographical locations, and regulatory frameworks. If a CRM is unable to handle this complexity, it will soon become a bottleneck rather than a growth facilitator.

Related articles:

- Top 10 Forex CRM Features Every FX Broker Needs to Succeed

- Why Working with a Best Forex CRM Agency Helps in 2026?

By emphasizing operational control, scalability, risk management, and long-term efficiency over superficial features, this article explains what actually makes the best forex CRM for contemporary brokerage management.

What Defines the Best Forex CRM in Modern Brokerage Operations?

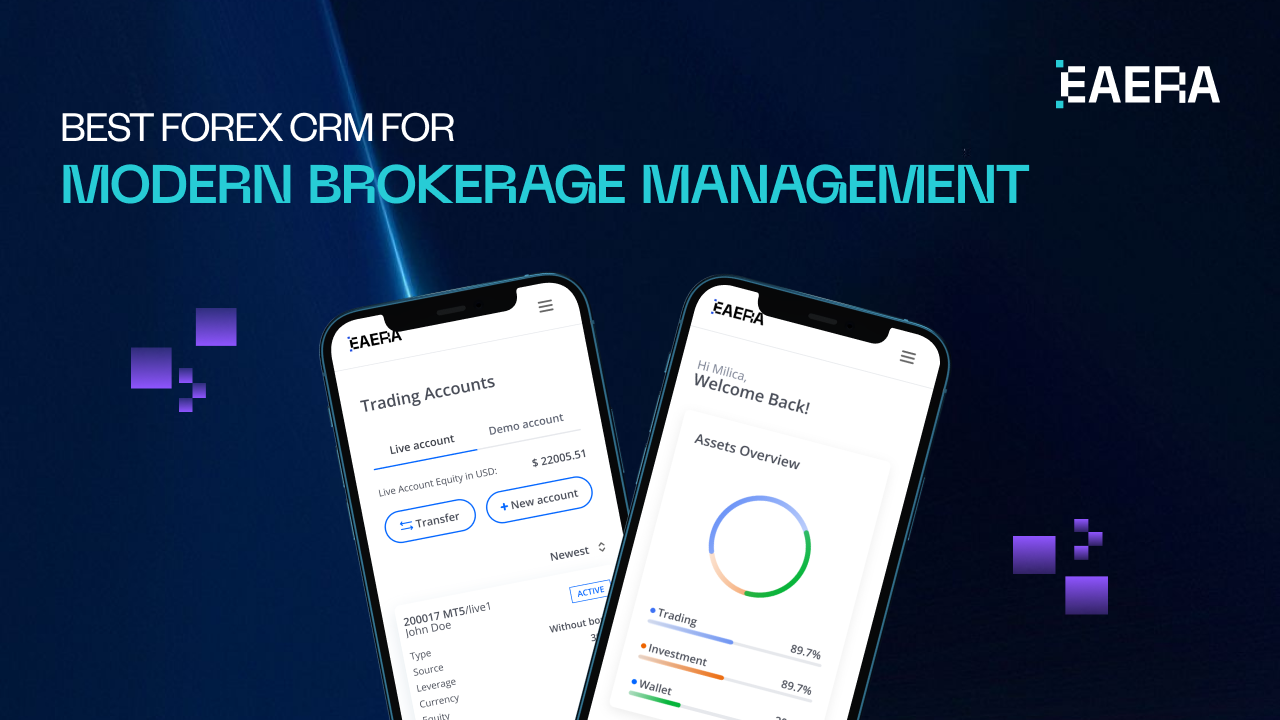

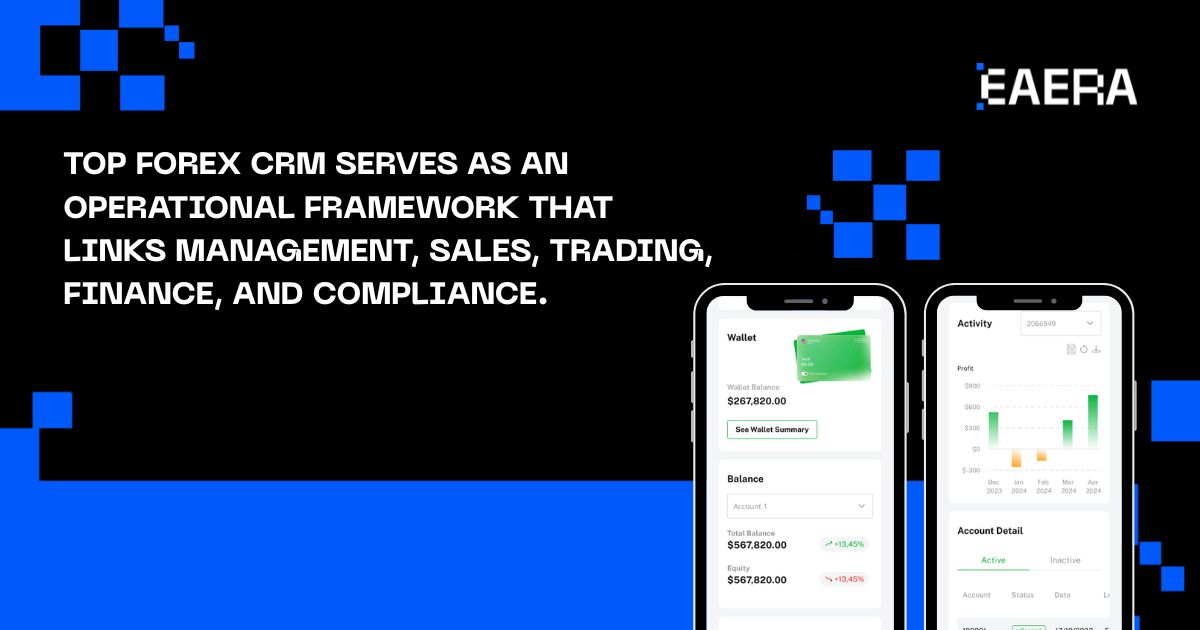

CRMs were primarily seen as sales tools in the forex industry for a long time. But as brokerage develops, this limited definition is no longer applicable. Today’s top forex CRM serves as an operational framework that links management, sales, trading, finance, and compliance.

Due to their lack of native support for trading accounts, margin logic, real-time exposure, and regulatory workflows, generic CRMs frequently fail in forex environments. For brokerages to handle complexity without depending on manual workarounds or disjointed tools, a modern forex CRM must be developed with domain-specific knowledge.

The best forex CRM is determined by how well it integrates with actual brokerage operations and changes as the company expands, not by how many features it has.

Core Capabilities Every Best Forex CRM Must Deliver

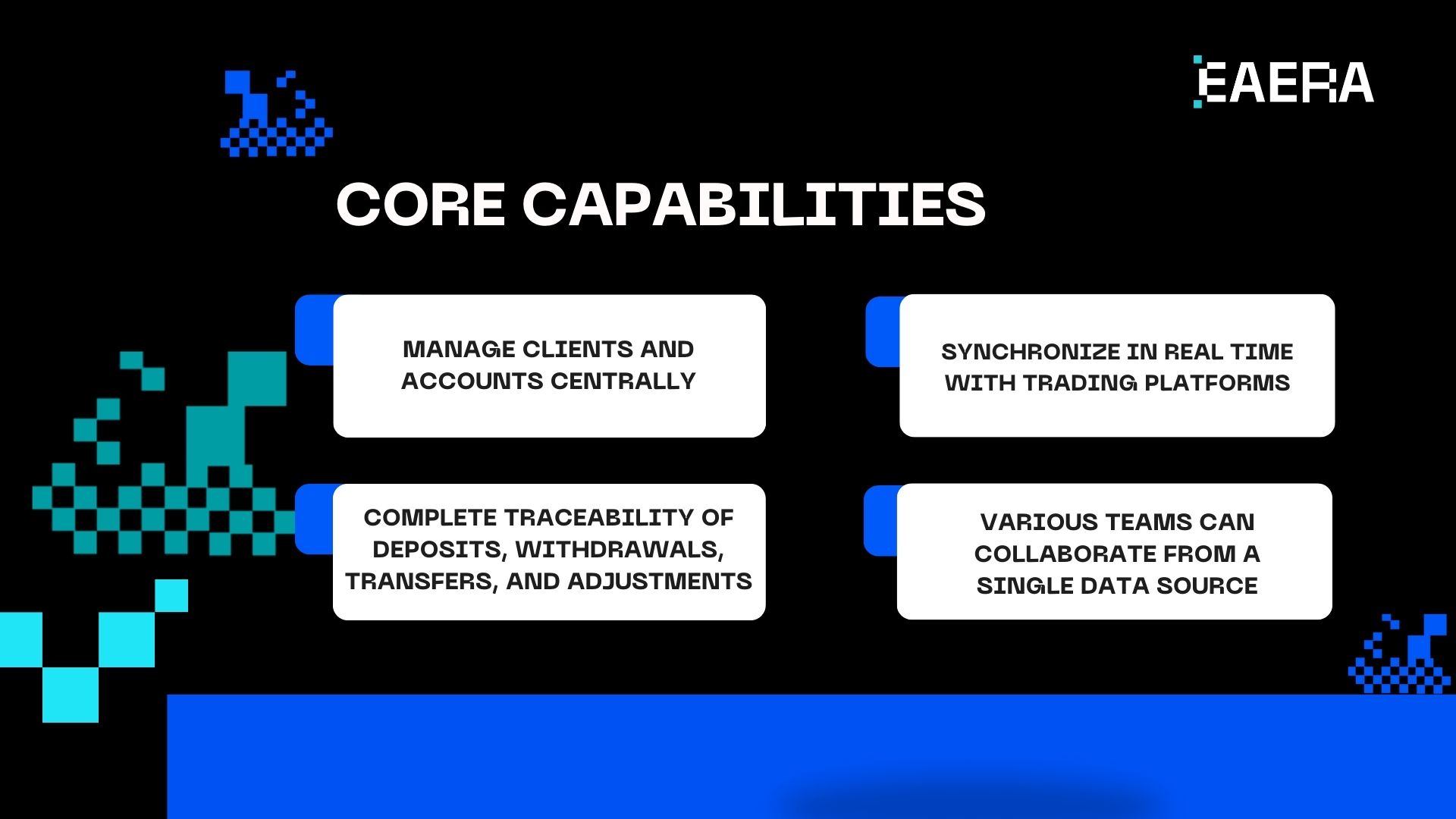

The best forex CRM must offer a number of fundamental features that complement each other in order to support contemporary brokerage management.

First, it’s crucial to manage clients and accounts centrally. For each client, a forex brokerage frequently oversees several accounts on various platforms and account types. All client profiles, account statuses, balances, and transactions must be combined into the CRM.

Second, it’s essential to synchronize in real time with trading platforms like MT4 and MT5. Decision-making and risk management are impacted by blind spots caused by incomplete or delayed data. Instead of reflecting trading activity minutes or hours later, the best forex CRM shows trading activity as it occurs.

Third, complete traceability of deposits, withdrawals, transfers, and adjustments is guaranteed by integrated funding and transaction tracking. For both internal teams and auditors, this lowers reconciliation errors and increases transparency.

Lastly, various teams—sales, operations, compliance, and management—can collaborate from a single data source thanks to unified dashboards. This alignment enhances accountability throughout the company and lessens internal conflict.

Risk Management and Compliance as a CRM Function

Compliance and risk are no longer independent systems that work in tandem with the CRM. They need to be integrated into everyday operations in contemporary brokerage settings. This is a defining characteristic of the best forex CRM.

Without this capability, risk management becomes reactive, responding only after problems have already escalated.

Compliance is just as important. Global regulatory expectations are still growing, and brokerages need to keep their KYC, AML, and audit procedures uniform. A forex CRM that incorporates compliance workflows guarantees that every action is recorded and traceable and lessens the need for manual checks.

Brokerages can grow without sacrificing regulatory readiness thanks to enterprise-grade platforms like EAERA, which show how risk and compliance logic can be integrated into CRM architecture from the ground up.

Operational Efficiency and Scalability for Growing Brokerages

One of the most obvious advantages of selecting the best forex CRM is efficiency. Manual procedures soon become unsustainable as trading volumes and client numbers rise.

Here, automation is crucial. CRM workflows can expedite tasks like account approvals, funding verification, reporting, and internal notifications. This lowers operational expenses, minimizes human error, and allows teams to concentrate on higher-value tasks.

Scalability is just as crucial. To grow, modern brokerages frequently introduce new products, expand into new markets, or launch new brands. The best forex CRM facilitates this expansion without necessitating significant customization or system redesigns. Support for multiple brands and regions guarantees that expansion does not compromise operational control.

In this context, scalability is a strategic necessity for long-term success rather than merely a technical feature.

Integration, Data Quality, and Decision-Making Power

Every facet of brokerage management is based on high-quality data. Even seasoned teams find it difficult to make confident decisions when data is inconsistent or fragmented.

The best forex CRM integrates information from trading platforms, payment systems, analytics tools, and support channels to function as a single source of truth. This integration minimizes system duplication and guarantees consistency.

Making decisions more quickly and accurately is made possible by high-quality, real-time data. With confidence, management teams are able to evaluate performance, spot bottlenecks, and react to changes in the market. This data-driven strategy eventually turns from a reporting exercise into a competitive advantage.

Strong data architecture solutions, like those created by EAERA, demonstrate how CRM design and analytics readiness are closely related, particularly for brokerages aiming for long-term expansion.

How to Choose the Best Forex CRM for Your Brokerage?

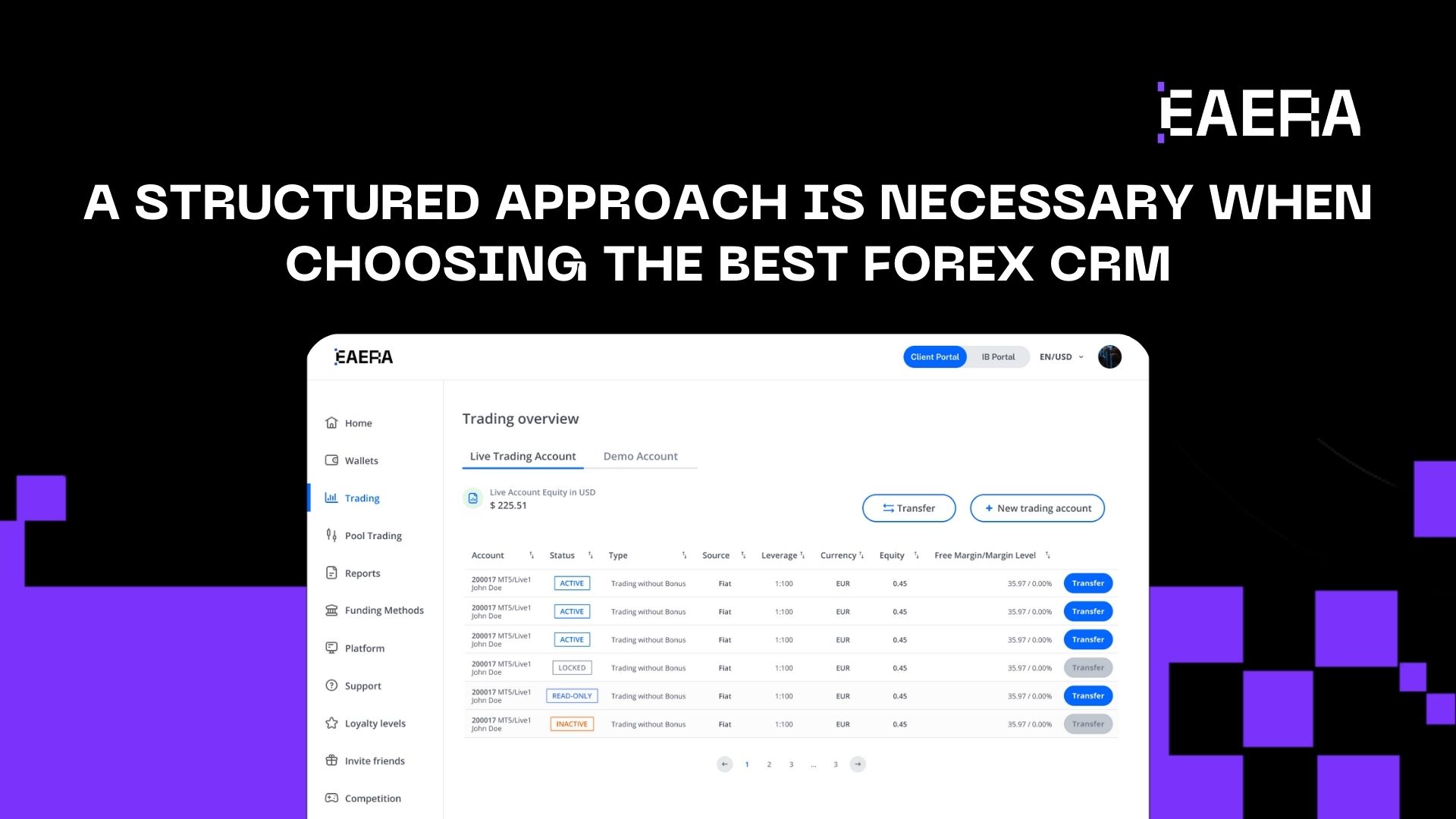

A structured approach is necessary when choosing the best forex CRM. Brokerages should assess systems based on long-term alignment rather than feature lists or immediate requirements.

Important factors include:

- Is the CRM designed with forex operations in mind?

- Real-time data synchronization’s precision and speed

- Workflows for risk and compliance is supported natively

- Scalability across brands, regions, and teams

- Balance between customization and maintainability

- Vendor expertise in the forex and fintech industries

By using these standards, brokerages can make sure that their CRM promotes growth rather than restricts it and avoid expensive reimplementation.

With increasing demands from clients, stock brokerages also require an effective forex CRM solution that can support fast response and personalized customer service. When a team gets instant access to customer data and history, problems get resolved automatically and customer relations also improve – a benefit not given due emphasis while choosing a good quality forex CRM.

But the quality, or superiority, of the best forex CRM is not measured against its features but against how it assists with today’s business model of broking. This model is achieved with real-time access, efficient systems, ingrained risk management, and scalability solutions.

As the forex market continues to advance, a CRM-based infrastructure in brokerages rewards companies with not only a sophisticated management tool but much more. They are provided with much-needed insights, control, and robustness in a highly complex digital environment that surrounding technological advancements have created.