The true cost of antiquated or underpowered systems is often underestimated by forex brokers. Weak forex CRM software may seem “good enough” on the surface to manage day-to-day tasks. However, there are hidden operational, compliance, and revenue risks that accumulate over time beneath that surface. Scalability, trust, and long-term profitability are all directly impacted by the quality of your CRM infrastructure in today’s fiercely competitive and regulated market.

Related articles:

- Why a Forex CRM Provider Matters for Compliance?

- Forex CRM: How to Choose the Best Provider for Your Brokerage

Understanding What Makes Forex CRM Software Inadequate

One lacking feature does not characterize weak forex CRM software. Rather, it represents structural constraints that limit a broker’s capacity to function effectively and legally.

Common characteristics include:

- Heavy reliance on manual workflows

- Limited automation across onboarding, payouts, and reporting

- Fragmented data spread across multiple tools

- Poor support for compliance and audit requirements

During the early stages of growth, these limitations are frequently overlooked. However, weak systems start to exhibit fractures that are expensive to repair as client volume rises, partner structures grow, and regulatory scrutiny increases.

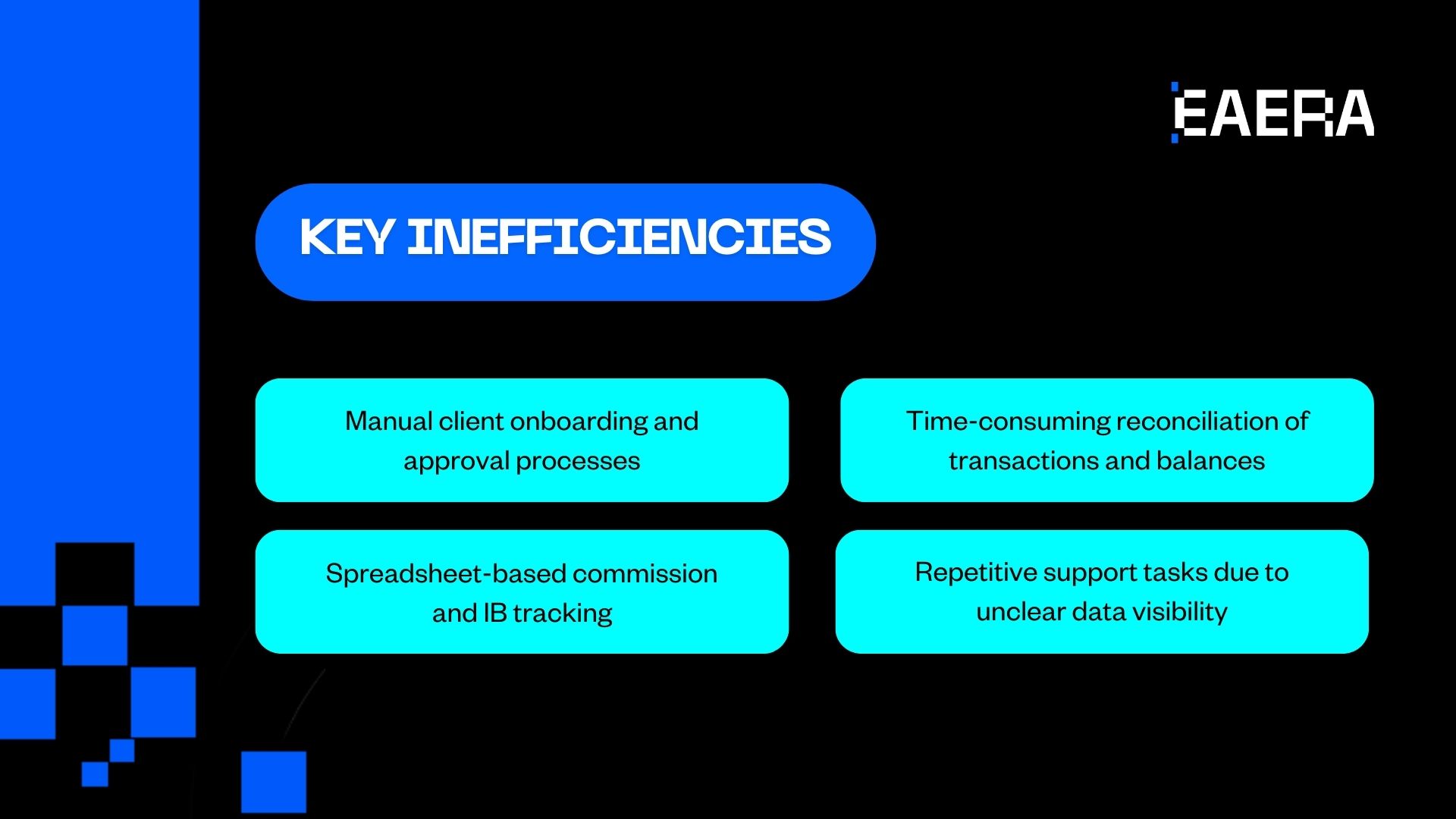

The Operational Inefficiencies Brokers Often Overlook

Operational inefficiency is one of the main hidden costs of poor forex CRM software. Although they may initially appear manageable, manual processes are inefficient and require a lot of internal resources.

Key inefficiencies include:

- Manual client onboarding and approval processes

- Time-consuming reconciliation of transactions and balances

- Spreadsheet-based commission and IB tracking

- Repetitive support tasks due to unclear data visibility

These inefficiencies result in:

- Increased staffing costs

- Slower response times to clients and partners

- Higher error rates across operations

- Reduced capacity to focus on growth initiatives

Instead of investing in infrastructure that removes the need for manual intervention, brokers eventually wind up hiring more employees to make up for system gaps.

Regulatory Exposure Hidden in Weak CRM Systems

The biggest long-term risk associated with inadequate forex CRM software is compliance. Brokers must exhibit control, consistency, and traceability in all of their operations, according to regulators.

Inadequate systems often lead to:

- Incomplete or inconsistent audit trails

- Weak access controls over sensitive data

- Delayed or inaccurate regulatory reporting

- Inconsistent KYC and AML enforcement

These problems greatly increase exposure during audits, even though they might not result in immediate penalties. Regulators evaluate whether controls are in place as well as whether they are applied consistently. Brokers must reconstruct compliance evidence retroactively in the absence of robust forex CRM software, which is an ineffective method.

Revenue Loss and Partner Trust Breakdown

Another hidden expense that brokers seldom link to inadequate forex CRM software is revenue leakage. Trust with partners and clients can be damaged by minor commission errors, late payouts, or ambiguous reporting.

Typical revenue-related issues include:

- Incorrect IB commission calculations

- Delayed or disputed payouts

- Limited transparency for partners

- High volume of payment-related support tickets

When trust declines:

- IBs become less motivated to promote the broker

- High-performing partners leave for competitors

- Client retention rates drop

It costs a lot more to restore trust than to keep it. Strong forex CRM software protects revenue streams and long-term partnerships by guaranteeing precise payouts, transparent reporting, and constant communication.

Growth Limitations That Appear Too Late

Many brokers don’t realize their forex CRM software limitations until they try to scale. Weaknesses that were previously concealed are revealed by growth.

Scalability challenges often include:

- Inability to support multi-region operations

- Lack of flexibility for different regulatory frameworks

- Performance issues during high trade volumes

- Difficulty managing multi-tier IB structures

Brokers must decide whether to slow down growth or undergo disruptive system migrations when systems are unable to scale. Because of the scalability of contemporary platforms like EAERA, brokers can grow their businesses without having to rebuild their core infrastructure.

How Strong Forex CRM Software Eliminates Hidden Costs?

Investing in capable forex CRM software is not about adding features—it is about removing friction, risk, and inefficiency across the business.

Strong systems provide:

- Centralized client, transaction, and partner data

- Automated onboarding and compliance workflows

- Built-in audit trails and reporting tools

- Real-time visibility into operational performance

With the right forex CRM software, brokers gain:

- Lower operational costs through automation

- Reduced regulatory risk

- Faster partner onboarding and payout cycles

- Better decision-making through unified data

Platforms like EAERA demonstrate how compliance-first architecture and automation can turn CRM systems into strategic assets rather than operational burdens.

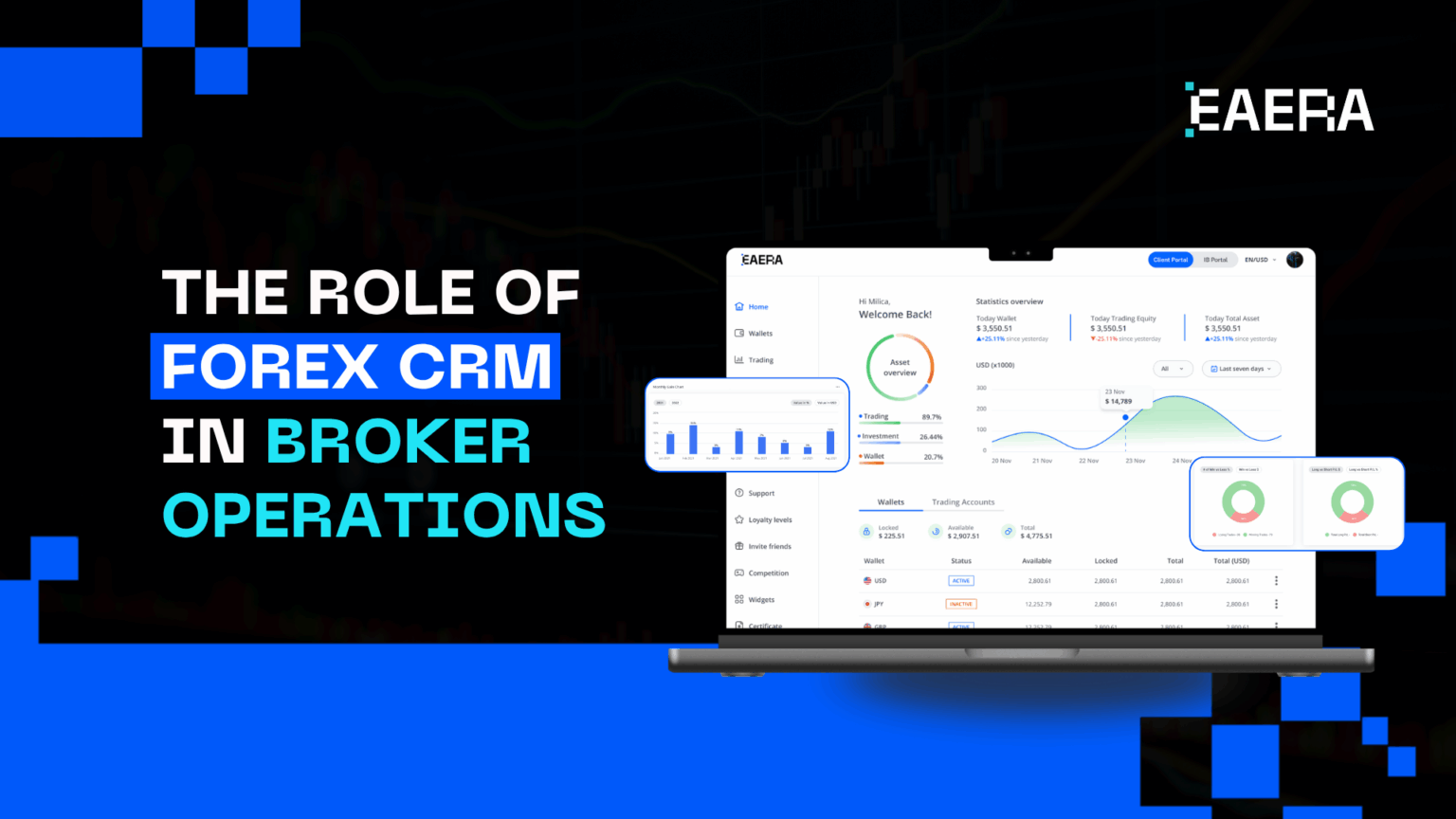

The Long-Term Strategic Cost of Delaying CRM Upgrades

Delaying CRM modernization is one of the most underappreciated risks in brokerage operations. Due to short-term budget priorities, internal disruption concerns, or perceived switching costs, brokers frequently put off updating subpar forex CRM software. However, the strategic cost of delay is often greater than the actual cost of transition.

Outdated systems eventually cause organizational drag. Teams modify their processes to accommodate system constraints, creating manual workarounds that become ingrained in day-to-day activities. These workarounds make compliance enforcement uneven, decrease visibility, and increase reliance on particular people. Brokers are exposed to operational and regulatory risk when key personnel depart because they take institutional knowledge with them.

Additionally, delaying upgrades makes it more difficult for a broker to react to changes in the market. Quick system adjustments are frequently required due to new partnership models, payment methods, or regulatory requirements. Brokers are forced to make reactive rather than proactive decisions because weak forex CRM software is unable to quickly adapt.

Infrastructure stagnation has an impact on brand perception from a competitive perspective. A broker’s technical maturity is increasingly evaluated by regulators, liquidity providers, and payment partners prior to engagement. While outdated systems raise concerns, even if performance metrics seem strong on the surface, modern CRMs indicate operational discipline and long-term viability.

Ultimately, delaying is a strategic decision that subtly increases risk. Early modernization gives brokers optionality, which allows them to scale, change course, and comply without encountering structural obstacles. On the other hand, people who use subpar forex CRM software frequently discover that waiting is far more expensive than upgrading.

Seldom is the true cost of subpar forex CRM software immediately apparent. It manifests itself gradually through lost revenue, stalled growth, compliance risk, and inefficiencies. Early investments in scalable, compliance-ready systems help brokers avoid these hidden expenses and set themselves up for long-term success. Strong infrastructure is essential in an industry where long-term viability is determined by trust, transparency, and control.