The multi-level Introducing Broker (IB) model is now the main means of expansion forex brokers. But as the IB model expands through multiple levels, multiple geographies, and multiple payouts, the complexity of the operation rises exponaentially. Managing these types of operations manually or through standard software tools creates risk, inefficiency, and trust problems. A specialized forex CRM solution is no longer a luxury, but a requirement for IB-based expansion.

Related articles:

- Top Features Every CRM for Forex Brokers Needs in 2026

- How Do Forex Broker Solutions Support Faster KYC?

Why Multi-Level IB Structures Increase Operational Pressure?

The multi-level IB model creates multiple layers of relationships that are significantly more complex than the single-tier model. Forex brokers must now deal with not only their IBs but also sub-IBs, agents, and end-clients with different commission structures.

Common operational challenges include:

- Tracking nested IB hierarchies accurately

- Mapping clients to the correct IB level

- Applying different commission rates by tier

- Managing payouts across currencies and regions

- Resolving disputes caused by unclear calculations

Without a structured forex CRM solution in place, these activities are typically handled through manual spreadsheet systems. But as the operation grows in size, these systems are no longer viable, leading to delayed payouts and partner dissatisfaction.

How a Forex CRM Solution Structures IB Networks?

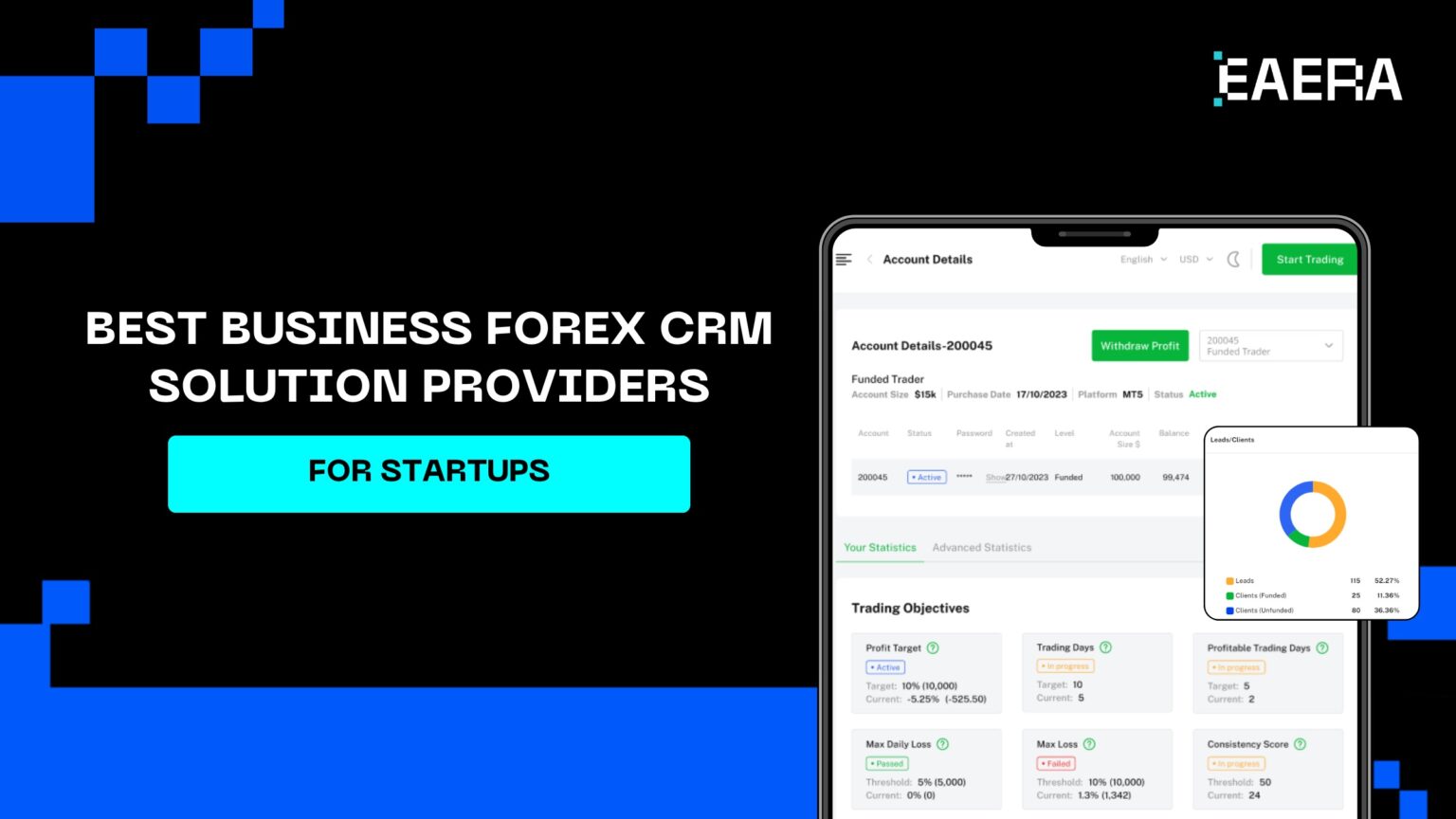

A purpose-built forex CRM solution acts as a control layer for a complex IB infrastructure. Unlike a traditional CRM system, it accurately represents the true operation of a brokerage partner program.

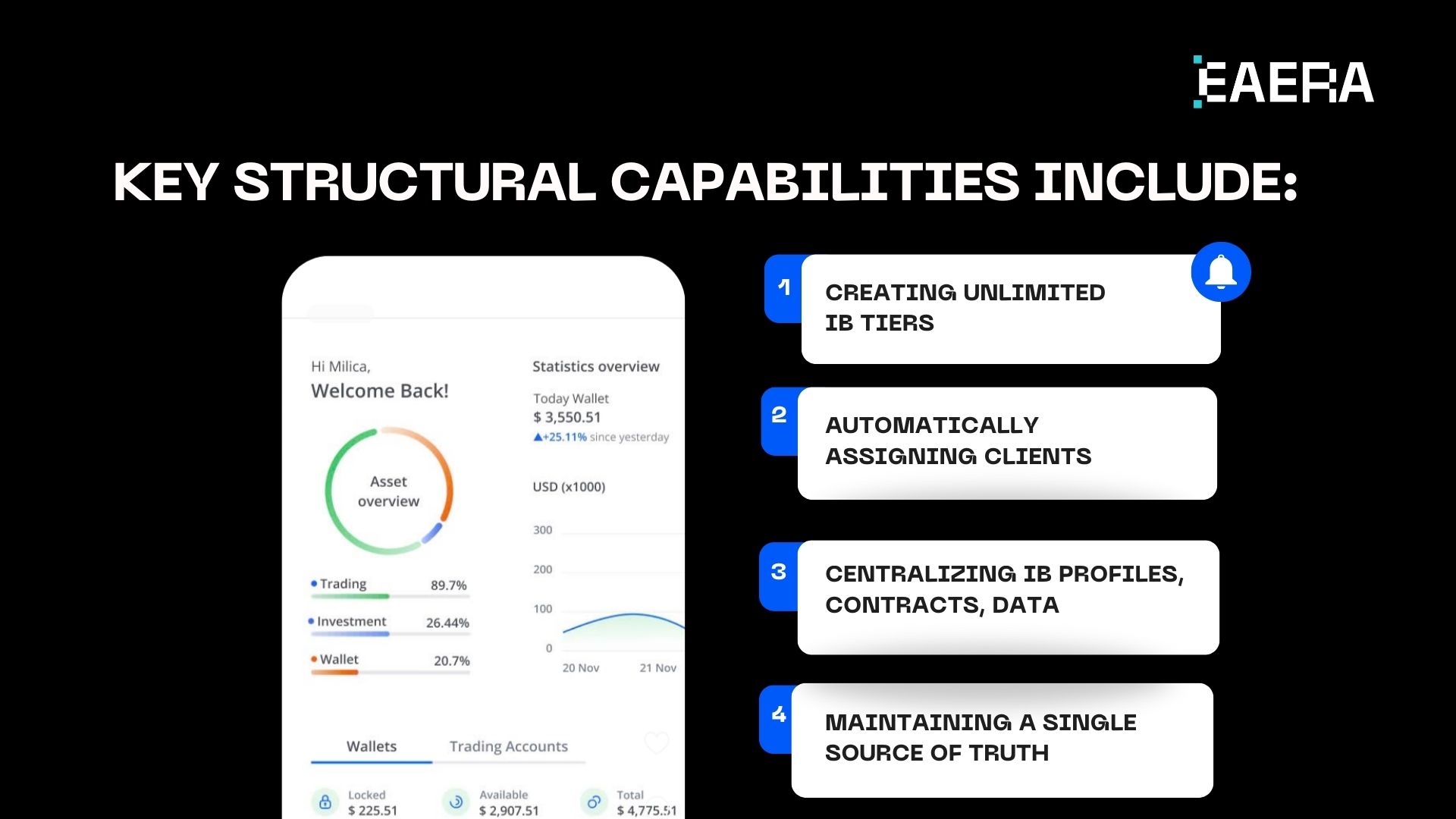

Key structural capabilities include:

- Creating unlimited IB tiers with clear parent–child relationships

- Automatically assigning clients to the correct IB node

- Centralizing IB profiles, contracts, and performance data

- Maintaining a single source of truth across the network

This model ensures that every transaction, client interaction, or payout is associated with a particular IB level. Brokers can effectively eliminate confusion and dependency on manual checks by using a reliable forex CRM solution.

Core Commission Management Features Multi-Level IBs Require

Commission management is probably the most critical part of an IB program. Even minor mistakes can cause distrust between partners. A reliable forex CRM solution should include a sophisticated commission management system that accurately represents a real-world IB program.

Essential features include:

- Hierarchical commission rules by IB level

- Custom calculation models (lot-based, spread-based, hybrid)

- Volume and performance thresholds

- Automated allocation across multiple IB tiers

- Real-time commission visibility for brokers and IBs

These features ensure commission management is transparent and consistent. By providing a reliable commission management system, a forex CRM solution can effectively eliminate commission-related mistakes.

Payout Automation as a Trust and Retention Mechanism

For IBs, the precision and speed of their payouts directly affect their loyalty. If payments are delayed or disputed, their loyalty will be short-lived, irrespective of the commission rates offered.

A scalable forex CRM solution automates payouts by:

- Applying predefined rules without manual intervention

- Synchronizing payout data with live trading activity

- Generating clear, itemized statements for each IB

- Supporting scheduled or on-demand payout cycles

Automation, apart from speed, also provides fairness and consistency in the system. This is because, with the ability to independently verify their earnings, disputes will be minimized, thus increasing loyalty. Eventually, a reliable forex CRM solution will become a competitive advantage in recruiting top-performing partners.

Scaling IB Programs Across Regions Without Losing Control

As brokers expand their business globally, their IB programs may operate in different jurisdictions, each with different regulatory, currency, and operational challenges.

A strong forex CRM solution supports regional expansion by offering:

- Multi-currency commission and payout handling

- Region-specific commission rules and tax logic

- Configurable payout methods based on local preferences

- Centralized oversight across all entities and markets

This flexibility allows brokers to expand their IB network without compromising their operations. There are forex CRM systems, such as EAERA, that are developed with such scalability in mind, allowing brokers to manage their global IB network with consistent control and visibility.

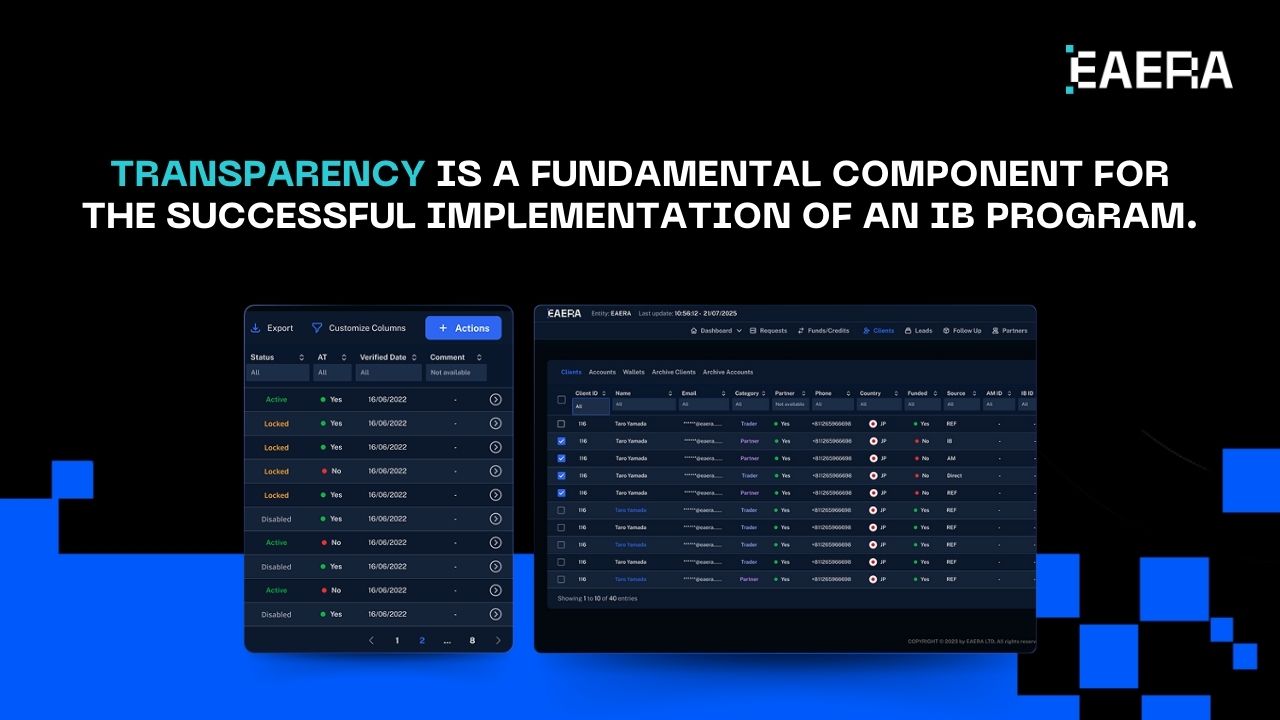

Reporting Transparency for Brokers and IBs

Transparency is a fundamental component for the successful implementation of an IB program. Brokers and partners need to be aware of the performance and earnings.

An effective forex CRM solution provides:

- Real-time dashboards for IB performance tracking

- Detailed commission breakdowns by client and tier

- Historical reporting for reconciliation and audits

- Exportable reports for accounting and compliance teams

These reporting features can help eliminate confusion and increase trust within the system. When IBs know exactly how their commissions are made, they are more likely to be more engaged and motivated.

Choosing the Right Forex CRM Solution for IB-Led Growth

Not all systems are created equally when it comes to the complexity of multi-level IBs. Choosing the right forex CRM solution involves not only the present needs but also the future scalability.

Key selection criteria include:

- Flexibility of IB hierarchy and commission logic

- Depth and clarity of reporting tools

- Automation coverage across onboarding, commissions, and payouts

- Security, access control, and audit readiness

- Seamless integration with trading platforms and payment systems

Companies like EAERA specialize in the design and implementation of IB-specific solutions that allow brokers to grow their partner programs without any issues.

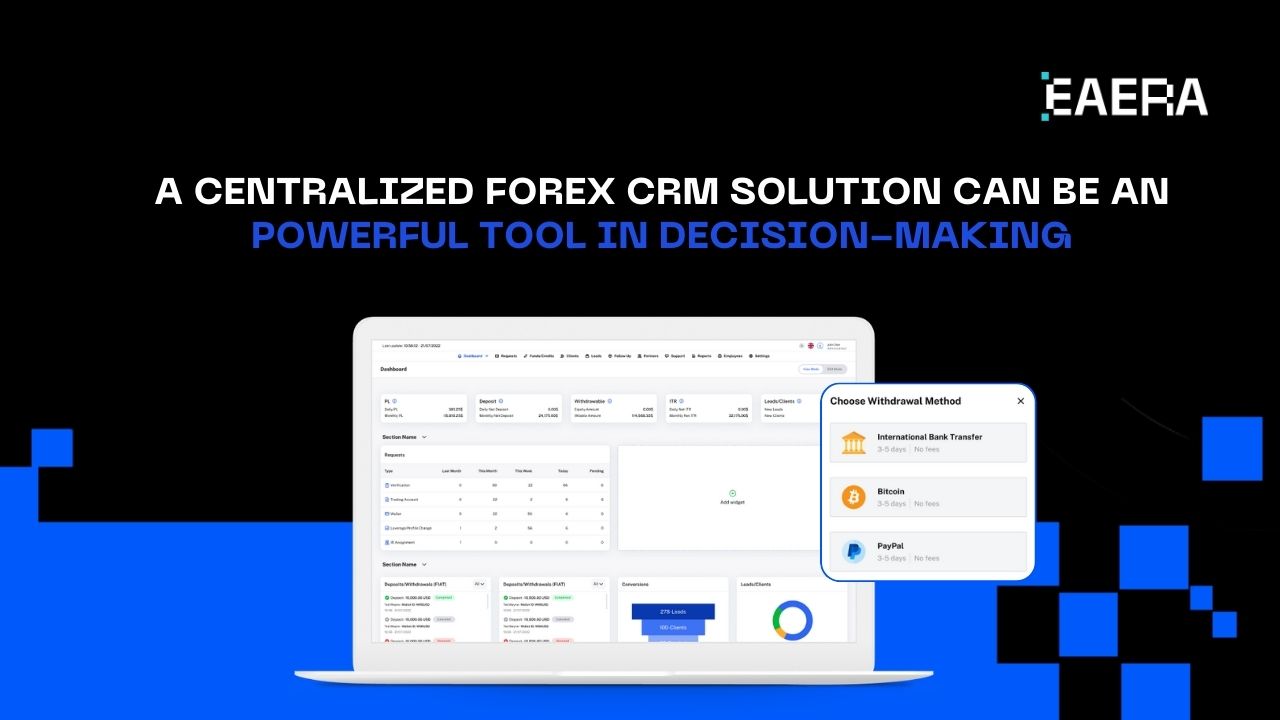

Long-Term Strategic Advantages of a Centralized IB Management System

Outside of operational benefits, a properly built forex CRM solution can provide a broker with long-term strategic benefits that are not always considered during the initial system selection process. As IB networks grow in sophistication, a broker will eventually have access to ever more valuable performance data not only at the client level but across an entire IB network.

With centralized IB data, brokers can:

- Identify top-performing IB tiers and regions

- Optimize commission models based on actual conversion and volume metrics

- Detect underperforming segments early and adjust strategy

- Design incentive programs grounded in real performance insights

A centralized forex CRM solution can also be an incredibly powerful tool in decision-making during periods of market volatility. Should a broker’s trading volumes fluctuate, or a regulatory change occur, a broker can easily determine the impact across an IB network and react accordingly with minimal disruption.

From a governance standpoint, a centralized system helps a broker break free from dependency upon a particular group or knowledge base. By doing so, a broker can establish a level of operational maturity that demonstrates reliability not only to IBs but also to regulatory bodies, liquidity providers, and strategic partners.

The value of a quality forex CRM solution will be compounded over time. What was initially a tool for managing commission payments will eventually become a powerful tool in driving a broker’s growth strategy, IB network optimization, and overall competitiveness in IB-based brokerage models.

While multi-level IB programs promise explosive growth potential, this is only possible if the appropriate infrastructure is in place. A robust forex CRM solution can turn the management of IBs into an automated process that promotes growth while maintaining transparency. This helps brokers maintain trust and minimize risk while encouraging growth in a competitive environment.