By 2026, automation will be a fundamental necessity in prop trading rather than a differentiator. Manual oversight becomes a structural risk as prop firms operate under stricter governance requirements, scale multi-phase programs, and onboard thousands of traders. This is where a contemporary prop trading dashboard is essential—not as a visual layer, but as an automated control system that upholds regulations, lowers mistakes, and fosters confidence.

Related articles:

- How an FX Trading Platform Boosts Client Trust?

- Prop Trading Solutions: Key Features and Top Provider

With an emphasis on risk control, fairness, scalability, and operational clarity, this article describes the fundamental automation features that any future-ready prop trading dashboard must support in 2026.

Why Automation Is Critical in Prop Trading Dashboards?

Prop trading firms operate in an environment that is defined by risk sensitivity, volume, and speed. Human-led processes cannot reliably manage these conditions at scale. When automation is used properly, it ensures that judgment is applied within a controlled, repeatable framework rather than eliminating human judgment.

A well-designed prop trading dashboard uses automation to:

- Enforce trading rules consistently

- Eliminate delays in risk response

- Reduce operational overhead

- Improve audit readiness

Without automation, businesses deal with common problems like inconsistent rule enforcement, delayed breach of handling, and disagreements brought on by ambiguous decisions. Instead of being a reporting tool, automation turns the dashboard into a governance layer.

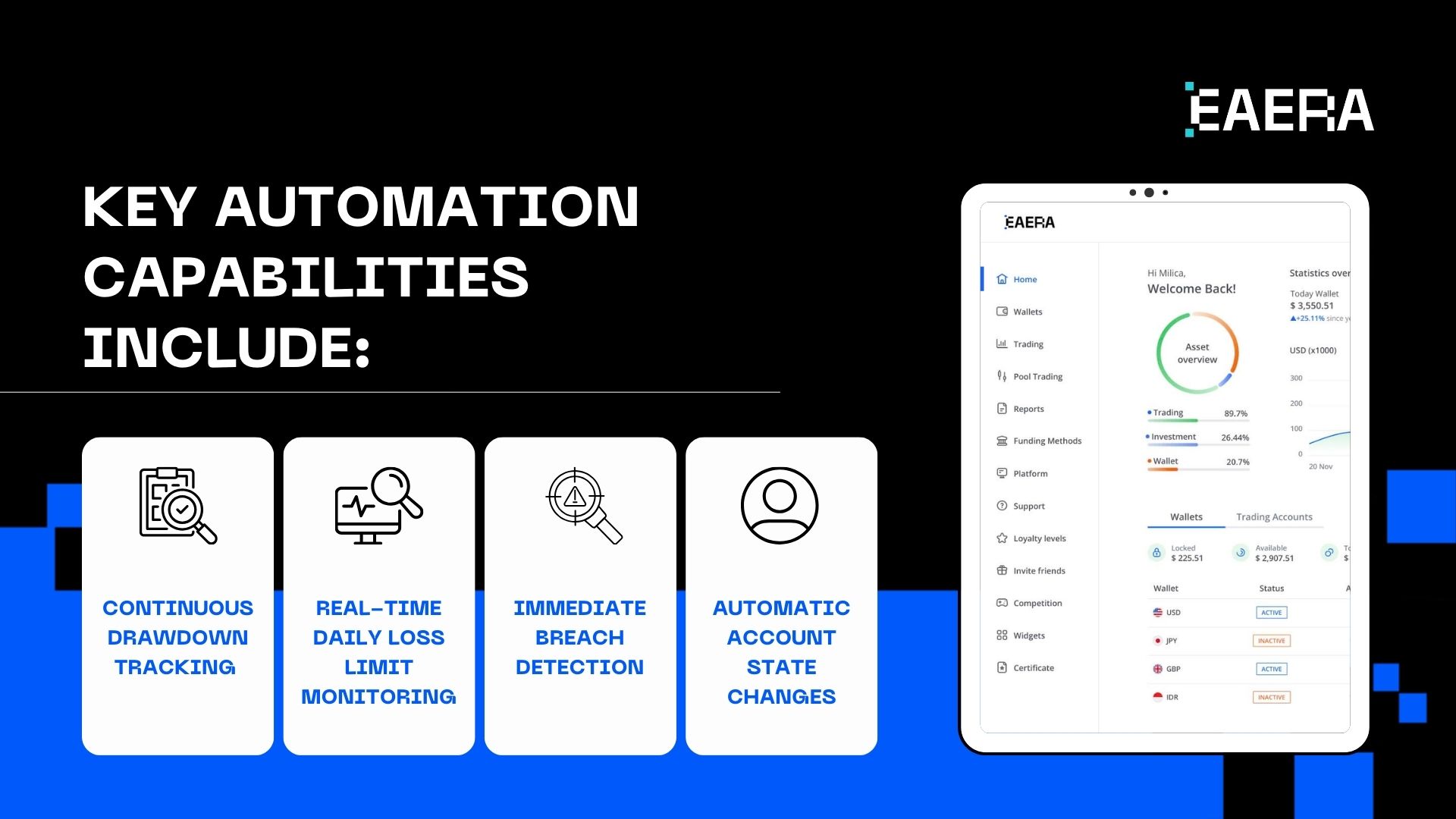

Automated Risk Monitoring and Rule Enforcement

Risk automation is the core function of any serious prop trading dashboard. In 2026, real-time enforcement is non-negotiable.

Key automation capabilities include:

- Continuous drawdown tracking

- Real-time daily loss limit monitoring

- Immediate breach detection

- Automatic account state changes

The system must react immediately when thresholds are exceeded, flagging violations without waiting for manual review, closing positions if necessary, or changing accounts to read-only. This eliminates uncertainty and stops the escalation of risk.

Automation ensures that:

- Rules are applied equally to all traders

- No account benefits from delayed intervention

- Risk teams focus on oversight, not firefighting

Without automated risk enforcement, a prop trading dashboard puts the company at needless risk to its finances and reputation.

Additionally, automation standardizes the handling of exceptions. Every edge case adheres to predetermined logic rather than making ad hoc decisions, guaranteeing consistent results across traders and minimizing internal escalation, confusion, and reliance on individual judgment in high-pressure scenario

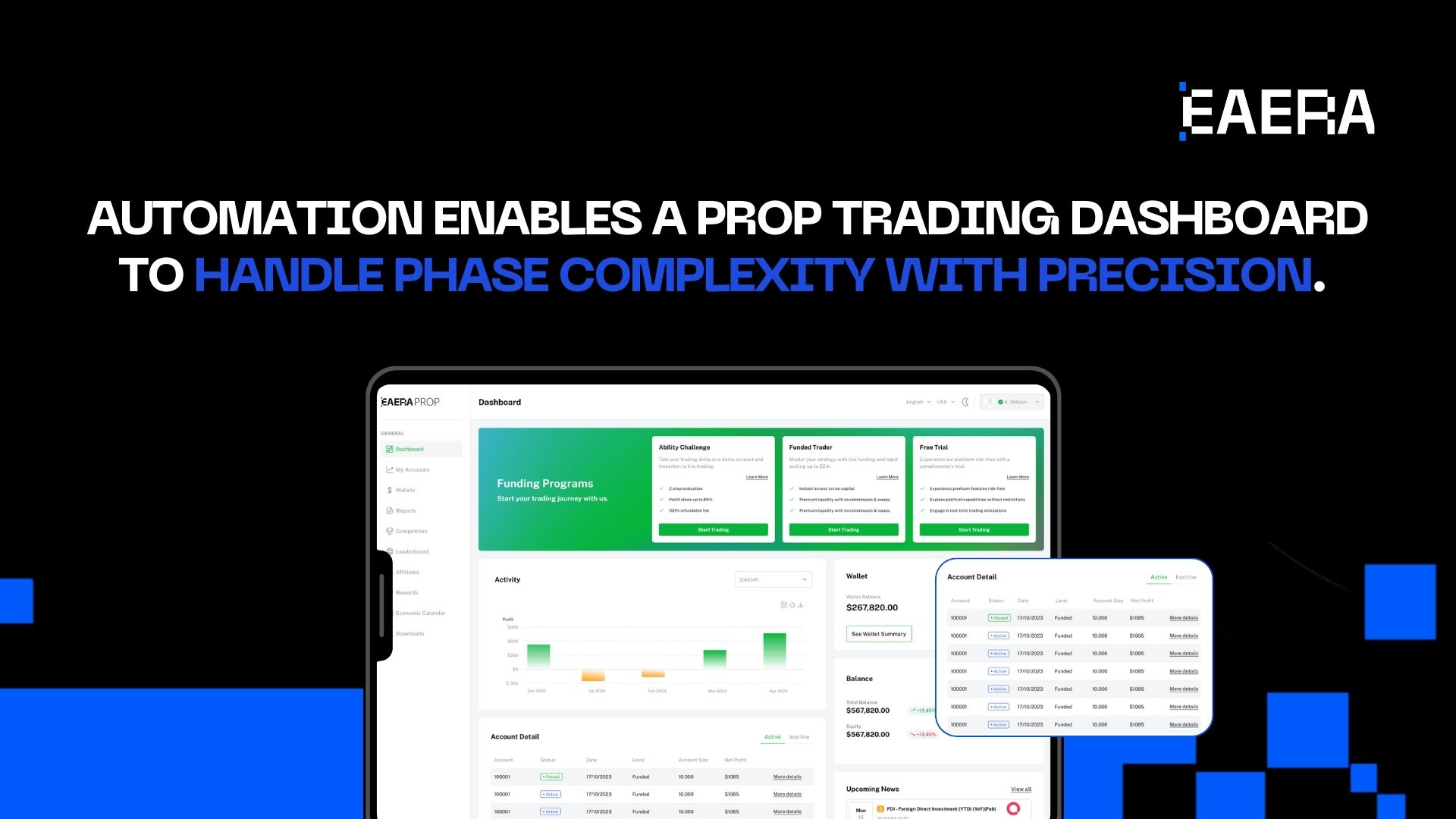

Automation for Multi-Phase Program Management

These days, the majority of prop firms run multi-phase trading programs, which usually consist of funded, evaluation, and verification stages. Every stage has its own set of guidelines, financial goals, and risk constraints. Manually handling this is ineffective and prone to mistakes.

Automation enables a prop trading dashboard to handle phase complexity with precision.

Essential features include:

- Phase-specific rule templates

- Automatic pass and fail determination

- Programmatic phase transitions

- Historical phase tracking per trader

The system automatically advances the account when a trader satisfies predetermined requirements. Failure is consistently and openly documented when regulations are broken. This lessens the workload for support and does away with subjective decision-making.

Automation also allows firms to:

- Launch new program variants quickly

- Adjust rules without disrupting existing traders

- Maintain clear progression records for compliance

Without this level of automation, multi-phase programs become operational bottlenecks rather than scalable growth engines.

Trader Performance and Behavior Automation

A contemporary prop trading dashboard needs to automate performance and behavior analysis in addition to rule enforcement. Unstructured, contextual, and actionable insights are necessary; raw metrics alone are not enough.

Key automated insights include:

- Performance summaries by phase

- Risk-adjusted metrics

- Rule proximity alerts

- Behavior pattern detection

For instance, traders who are overtrading or getting close to daily loss limits may be flagged by the system. These insights enable risk teams to step in early if necessary while also assisting traders in self-correcting.

Automation in this area supports:

- Disciplined decision-making

- Reduced emotional trading

- Clear feedback loops for trader development

The dashboard helps traders trade more carefully rather than pressuring them to trade more.

Operational and Compliance Automation

Internal operations frequently become a hidden source of risk as prop firms expand. Accurate, unchangeable records are necessary for compliance requirements, audits, and dispute resolution. Without requiring manual labor, automation guarantees that these requirements are satisfied.

A future-ready prop trading dashboard should automate:

- Audit log generation

- Rule change versioning

- Permission-based access control

- Incident and dispute traceability

All system decisions—pass, fail, breach, or transition—need to be recorded and accessible. By doing this, a transparent audit trail is produced, safeguarding the trader and the company.

This governance-first approach is used in the design of platforms like EAERA, which incorporate compliance automation into operational workflows instead of treating it as an afterthought.

Choosing a Future-Ready Prop Trading Dashboard

Not every dashboard sold to prop firms is designed with long-term scalability in mind. Businesses will need to assess platforms in 2026 on the basis of automation depth and architecture rather than superficial features.

A future-ready prop trading dashboard should meet the following criteria:

- Automation-first system design

- Real-time data processing

- Explainable system decisions

- Modular, configurable rule engines

- Scalable infrastructure

Explainability is particularly crucial. Both traders and regulators need to comprehend the rationale behind decisions. Clarity should be improved by automation rather than obscured.

Providers like EAERA concentrate on creating dashboards where automation promotes long-term operational stability, fairness, and transparency.

The Strategic Role of Automation in 2026

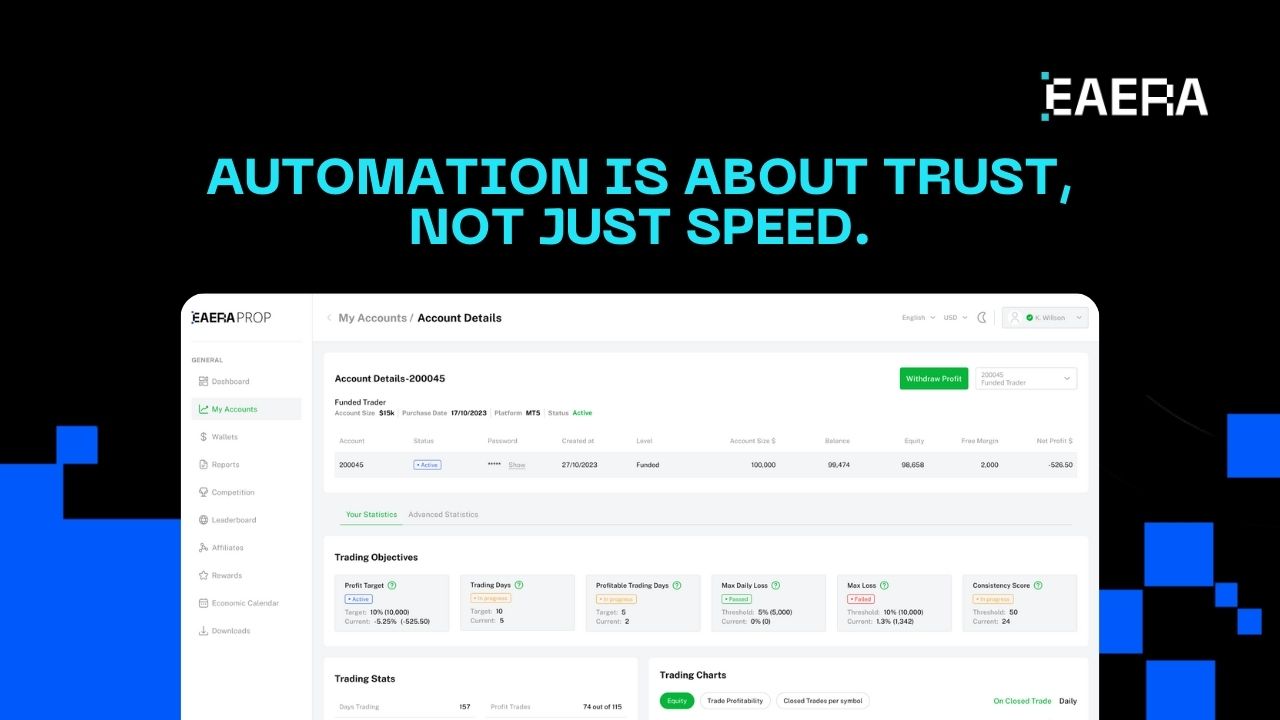

Automation is about trust, not just speed. Confidence rises when traders are aware that regulations are applied consistently and openly. Efficiency increases when operations teams use systems rather than manual inspections. Risk is reduced when compliance data is easily accessible.

A well-automated prop trading dashboard becomes:

- A risk control system

- A trader guidance tool

- A governance platform

- A foundation for scalable growth

In 2026, automation will determine a prop trading dashboard’s efficacy. Automation allows prop firms to scale with confidence while upholding fairness and control, from multi-phase program management and compliance governance to real-time risk enforcement. Businesses that make investments in automation-first dashboards set themselves up for long-term success in a setting that is becoming increasingly demanding.

Automation becomes the key differentiator between reactive operations and resilient systems as trader expectations and regulatory scrutiny rise. Prop firms that embed automation deeply into their prop trading dashboard will not only reduce risk, but also create a calmer, more transparent trading environment that supports disciplined decision-making over the long term.