Funding flows in prop trading are situated at the nexus of operational control, performance, and trust. While firms must uphold stringent risk limits, transparency, and audit readiness, traders anticipate timely capital allocation and predictable payouts. Manual funding procedures soon become a liability as prop firms manage increasing trader volumes and scale multi-phase programs.

For this reason, contemporary prop trading software is essential to facilitate smooth, regulated funding flows.

Related articles:

- Must-Have Automation in a Prop Trading Dashboard in 2026

- Prop Trading Solutions: Key Features and Top Provider

This article explains the importance of funding flows, the difficulties businesses encounter in the absence of specialized systems, and how prop trading software turns funding from a manual process into a controlled, scalable one.

Why Funding Flows Matter in Prop Trading Operations?

Financial transactions are only one aspect of funding flows. They serve as indicators of the company’s confidence in its traders. Dissatisfaction, disagreements, and reputational harm are frequently caused by funding delays, inconsistencies, or unclear regulations.

In a well-run prop firm, funding flows serve several critical purposes:

- Translating trader performance into capital allocation

- Enforcing risk limits through funding controls

- Supporting predictable payout cycles

- Providing transparency for operations and compliance teams

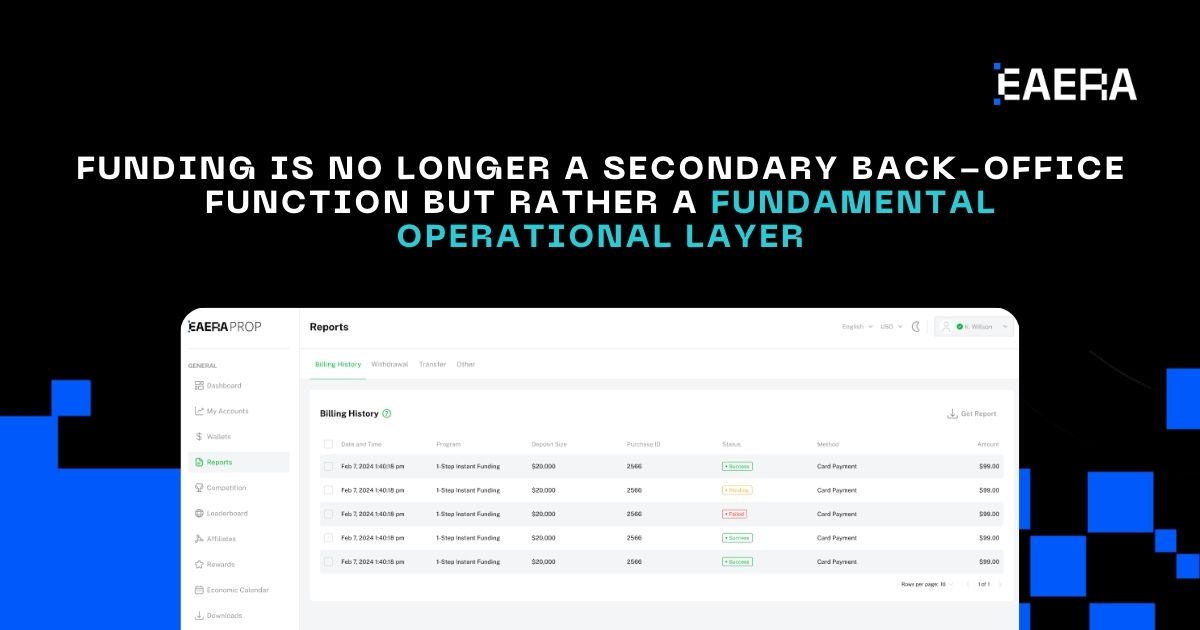

When funding flows are managed effectively, traders know what to anticipate and the rationale behind decisions. Even successful traders become unconfident when things are handled badly. As a result, funding is no longer a secondary back-office function but rather a fundamental operational layer.

Funding is handled as a component of system governance by contemporary prop trading software, guaranteeing its consistency, traceability, and scalability.

Common Funding Challenges Without Dedicated Prop Trading Software

To manage funding, many prop firms begin with spreadsheets, manual approvals, or loosely connected tools. This might be effective on a small scale, but as the company expands, it poses a serious risk.

Common challenges include:

- Manual approval bottlenecks, causing delays in capital allocation and payouts

- Inconsistent payout calculations, leading to disputes and support overhead

- Limited visibility into capital usage across traders and phases

- Difficulty auditing funding decisions, especially during compliance reviews

Human judgment plays a major role in funding decisions in the absence of centralized logic. Error and inconsistency are more likely as a result. These flaws worsen over time, making it more difficult to expand operations or launch new initiatives.

Instead of depending on ad hoc procedures, dedicated prop trading software incorporates funding logic directly into the system to address these issues.

Core Funding Automation Features in Prop Trading Software

Automation is essential to smooth funding flows. Funding automation throughout the trader lifecycle must be supported by a contemporary prop trading software platform.

Automated Capital Allocation

Capital allocation should follow predefined rules, not manual discretion. Key capabilities include:

- Rule-based funding thresholds tied to performance and risk

- Phase-aware capital scaling for evaluation, verification, and funded stages

- Allocation logic based on consistency rather than single outcomes

By eliminating uncertainty and partiality, automation guarantees that traders receive funding based on impartial standards.

Payout Automation

Payouts are one of the most sensitive parts of funding flows. Automation helps firms:

- Apply predefined payout rules consistently

- Check eligibility automatically based on account status and performance

- Schedule payouts on predictable cycles

- Maintain clear payout histories for traders and auditors

Payout automation lowers operational friction and delays by eliminating manual calculation and approval steps.

Funding State Management

Every trader account moves through different funding states. A strong prop trading software platform manages these states clearly:

- Pending funding

- Funded

- Restricted

- Payout-eligible

To guarantee that funding actions consistently correspond with current risk and performance conditions, state transitions ought to occur automatically based on regulations.

Risk and Compliance Controls Embedded in Funding Flows

Funding speed is insufficient on its own. Fast funding can put businesses at needless risk in the absence of appropriate controls. For this reason, risk and compliance are directly integrated into funding workflows by contemporary prop trading software.

Key control mechanisms include:

- Drawdown-linked funding limits

- Permission-based approval workflows

- Immutable funding logs

- Clear audit trails for every funding decision

These safeguards guarantee that funding flows continue to be transparent and compliant. Firms can readily show how and why funding decisions were made during audits or disputes.

Platforms like EAERA take a governance-first stance, designing funding automation in tandem with risk enforcement as opposed to adding it later.

Scaling Seamless Funding Across Multi-Phase Programs

Funding flows are made more complex by multi-phase trading programs. Rules, risk profiles, and funding logic vary by phase. The more traders there are, the harder it is to manage this manually.

A scalable prop trading software platform supports:

- Phase-specific funding rules

- Automatic capital increases when traders progress

- Multi-account and multi-currency handling

- Real-time funding visibility for operations teams

Without interfering with current workflows, automation enables businesses to introduce new initiatives or modify funding models. This adaptability is essential for expansion while preserving centralized control.

Additionally, smooth funding flows lessen reliance on specific employees, strengthening operations’ resilience.

Choosing the Right Prop Trading Software for Funding Operations

Choosing the appropriate prop trading software is a long-term strategic choice. Risk, finance, compliance, and trader experience are all impacted by funding flows, so these factors must be taken into consideration when designing the system.

Key evaluation criteria include:

- Funding logic built into the core architecture

- Automation-first design, not manual workarounds

- Clear risk and audit controls

- Integration with trading platforms and payment systems

- Scalability across regions, currencies, and programs

Explainability is particularly crucial. It should be clear to traders and regulators how funding rules operate.

Providers like EAERA support businesses at various stages of growth by concentrating on developing systems where funding flows are transparent, controlled, and flexible.

Funding Flows as a Strategic Advantage

Traders feel clarity instead of uncertainty when funding flows are smooth. Teams in charge of operations spend less time settling conflicts. Compliance teams become more assured about their preparedness for audits. Above all, businesses can grow without losing control.

A well-implemented prop trading software platform transforms funding into:

- A trust-building mechanism

- A risk control layer

- A scalability enabler

In contrast, firms that rely on manual processes often struggle to maintain consistency as they grow.

Modern prop trading operations depend on smooth funding flows. Prop trading software allows businesses to run effectively while upholding governance and trust by integrating automation, risk controls, and transparency into funding workflows.