In the robust world of online trading, startups in the Forex and financial brokerage industry are under pressure when participating in intense competition. It is significantly challenging to attract clients, offer perfect trading experiences, manage operations, and ensure regulatory compliance. Therefore, it demands advanced technological solutions from providers.

Related articles:

In this situation, a Forex CRM (Customer Relationship Management) system becomes indispensable. A Forex CRM is more than a client database; it is the backbone of a future brokerage, which enables seamless onboarding, solid engagement with clients, security, and efficient operational workflows.

Partnership with a suitable Forex CRM solution provider may help startups, who are planning to scale fast with limited resources, to enter the trading world. This article explains the working procedure of the solution and suggests choosing the best provider.

Key Benefits of Forex CRM solution for Startups

Centralized Client Ecosystem

A modern Forex CRM solution unifies every client touchpoint into a single integrated system, including account creation, trading actions, and supporting interactions. This all-in-one solution offers real-time visibility into customer insights, enhances customized service, and effective communication.

Faster Onboarding & Compliance Automation

Automated AML checks and identity verification speed up and improve the accuracy of approvals. Startups reduce manual labor and operational delays while maintaining compliance.

Intelligent IB & Partner Management

Programs for affiliates and IBs are crucial for the early growth of brokerages. A sophisticated CRM facilitates expansion by:

- Transparent multi-level commission monitoring

- Insightful performance dashboards for partners

- Automated and timely reward distribution

This guarantees a partner-driven acquisition model that is scalable.

Integrated Payment Processing

CRMs give traders a smooth deposit and withdrawal experience by supporting a variety of payment gateways, e-wallets, and instant funding options, which increase trust, liquidity, and long-term engagement.

Enhanced Client Support Operations

Live chat, ticket management, and complete communication logs are examples of built-in support tools that assist teams in resolving problems more quickly while upholding accountability and service quality.

Insightful Analytics & Performance Reporting

Proactive decision-making and accurate strategy execution are made possible by leadership’s access to comprehensive business intelligence on revenues, user conversions, trading activity, and retention trends.

How does Forex CRM enhance startups’ operation?

As startups frequently have lean teams, automation and efficient procedures are essential. A strong Forex CRM solution provider can upgrade operations of businesses in multiple ways:

- Smooth Coordination Between Departments: Workflow bottlenecks are eliminated because teams from different departments all have access to the same centralized data.

- Reduced Operational Costs: Automation minimizes the need for manual handling of tasks such as account approvals, risk monitoring, deposit confirmations, etc.

- Faster Market Entry: Pre-integrated trading platforms (such as MT4/MT5 and cTrader) and PSP networks are commonly provided by forex CRM providers. Instead of months, startups can launch in a matter of weeks.

- Regulatory Readiness: License requirements and audits are supported by integrated logs, identity verification, and security standards.

- Enhanced Client Experience: With bonus and loyalty programs, tailored marketing, and immediate support channels, a CRM keeps traders engaged for longer.

How to choose the right Forex CRM provider?

Early-stage brokerages are not a good fit for every Forex CRM. When weighing your options, consider:

- Scalability: The solution needs to grow along with your clientele and market expansion.

- Full brokerage ecosystem: Include back office, trader room, IB portal, PSPs, and trading platform integrations.

- Tech Support & Deployment: For teams with limited tech capacity, 24/5 support, onboarding services, and product training are essential.

- Data Security & Compliance: Examine secure infrastructure, end-to-end encryption, and market standing.

- Customization Capabilities: Branding, languages, workflows, and modules must be tailored to your business model.

- Transparent Pricing: No hidden technology costs that eat up startup budgets.

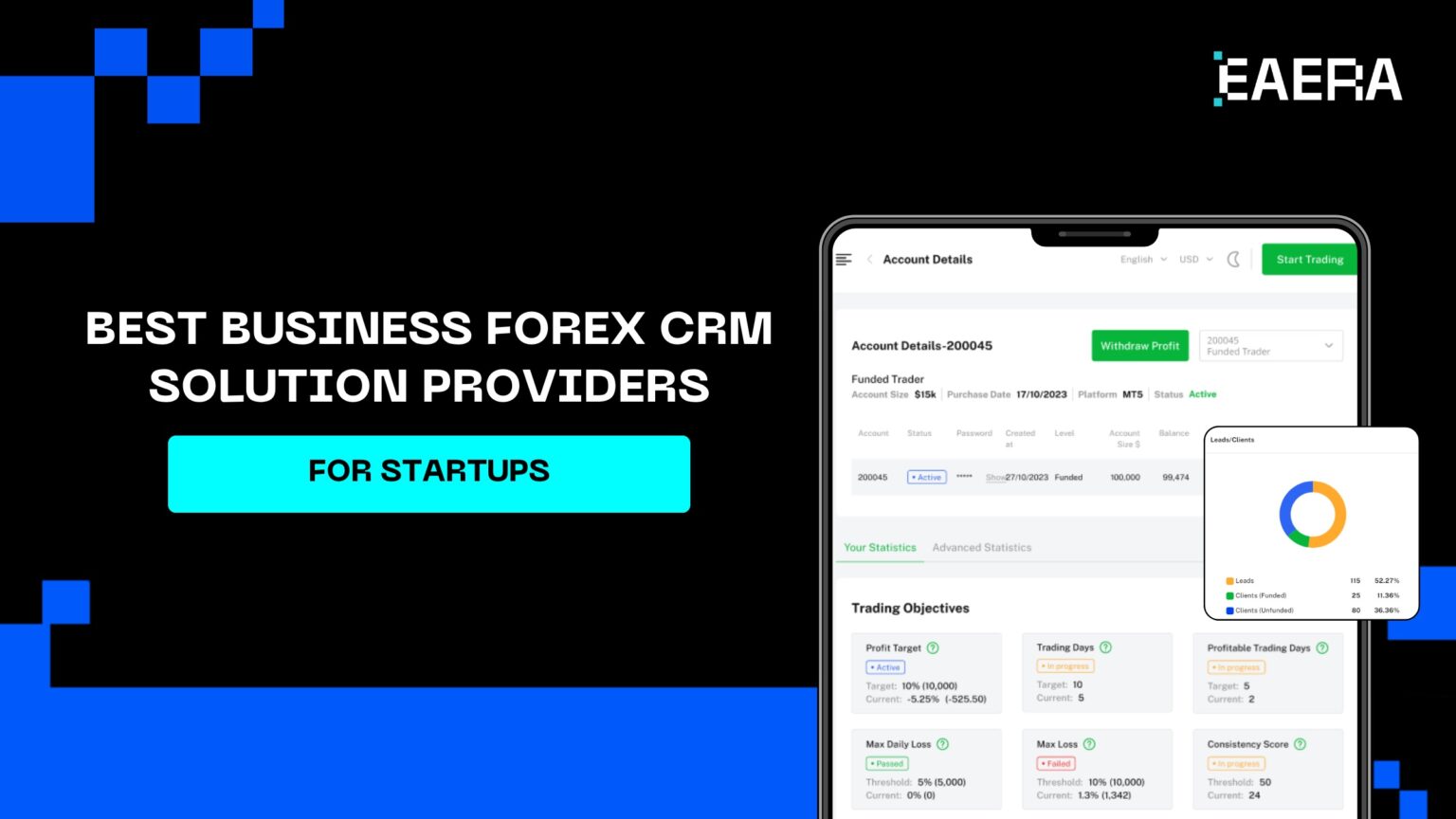

Why is EAERA the best option for startups?

EAERA (Enterprises Architecture ERA) has positioned as a next-generation Forex CRM provider that supports brokerages of all scales, particularly startups striving to upend the market.

What makes EAERA the best option is as follows:

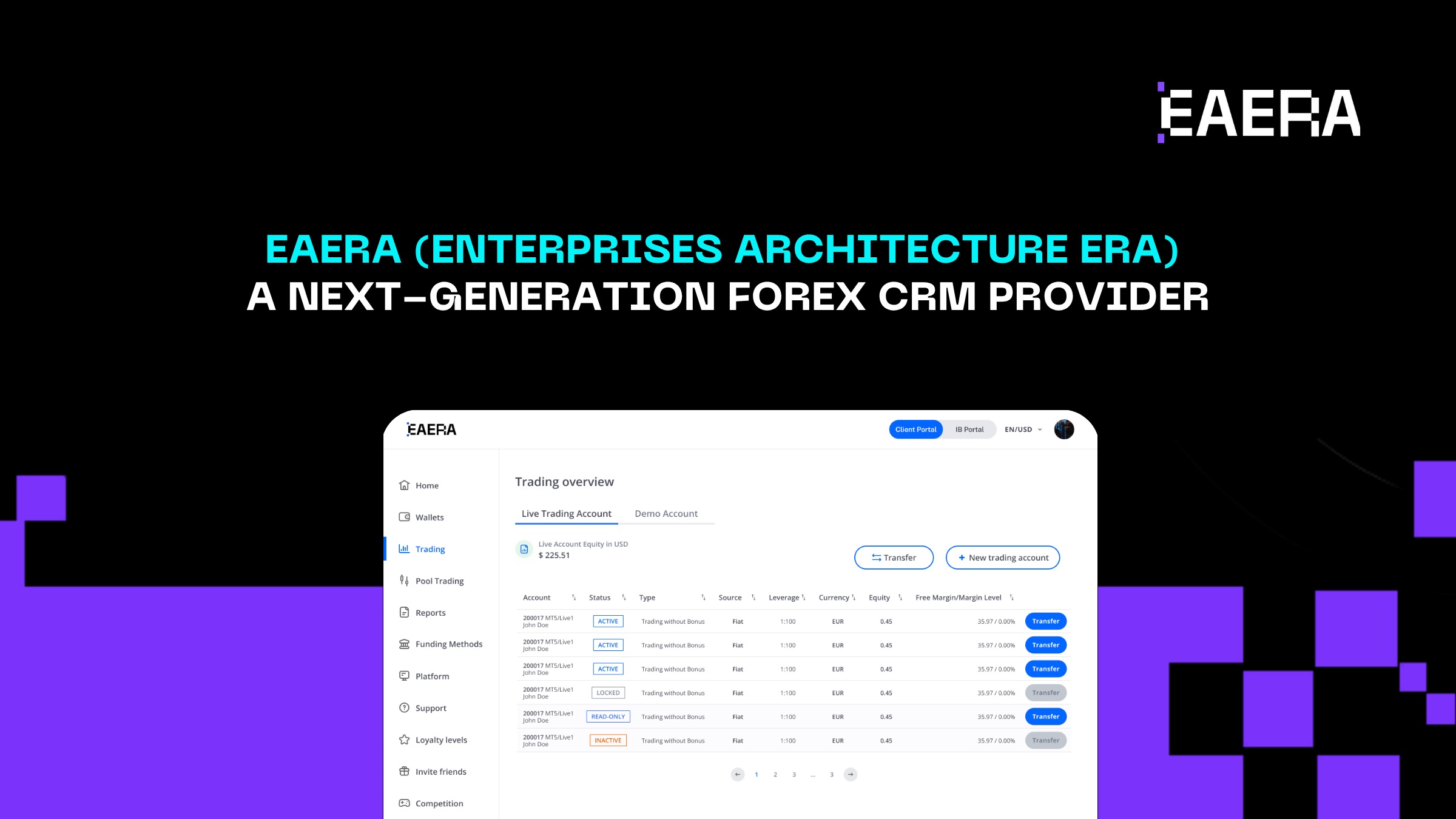

Comprehensive All-in-One Trading Ecosystem

EAERA offers every service a startup brokerage need; hence, rather than multiple vendors, there is only one source of truth:

- CRM & Back Office System

- Advanced Trader’s Room

- Multi-tier IB Management

- Liquidity & Bridge integrations

- Secure payment gateway ecosystem

Highly Scalable & Modular Architecture

Start with just the most basic features and add more as your company expands. Ideal for new businesses looking to control expenses while getting ready for large-scale success.

Speed to Market

EAERA’s ready-to-integrate infrastructure enables brokers to launch fast: Not months, but weeks.

Deep Customization

Brand identity matters. EAERA customizes modules, workflows, compliance regulations, and user interfaces to meet your unique needs and regional specifications.

Unmatched Cost-Effectiveness

Enterprise-level functionality without enterprise-level costs, allowing startups to focus their investments on customer acquisition.

Proven Expertise in Brokerage Technology

EAERA is run by seasoned professionals who have firsthand knowledge of broker challenges and are committed to providing dependable technology and continuous innovation.

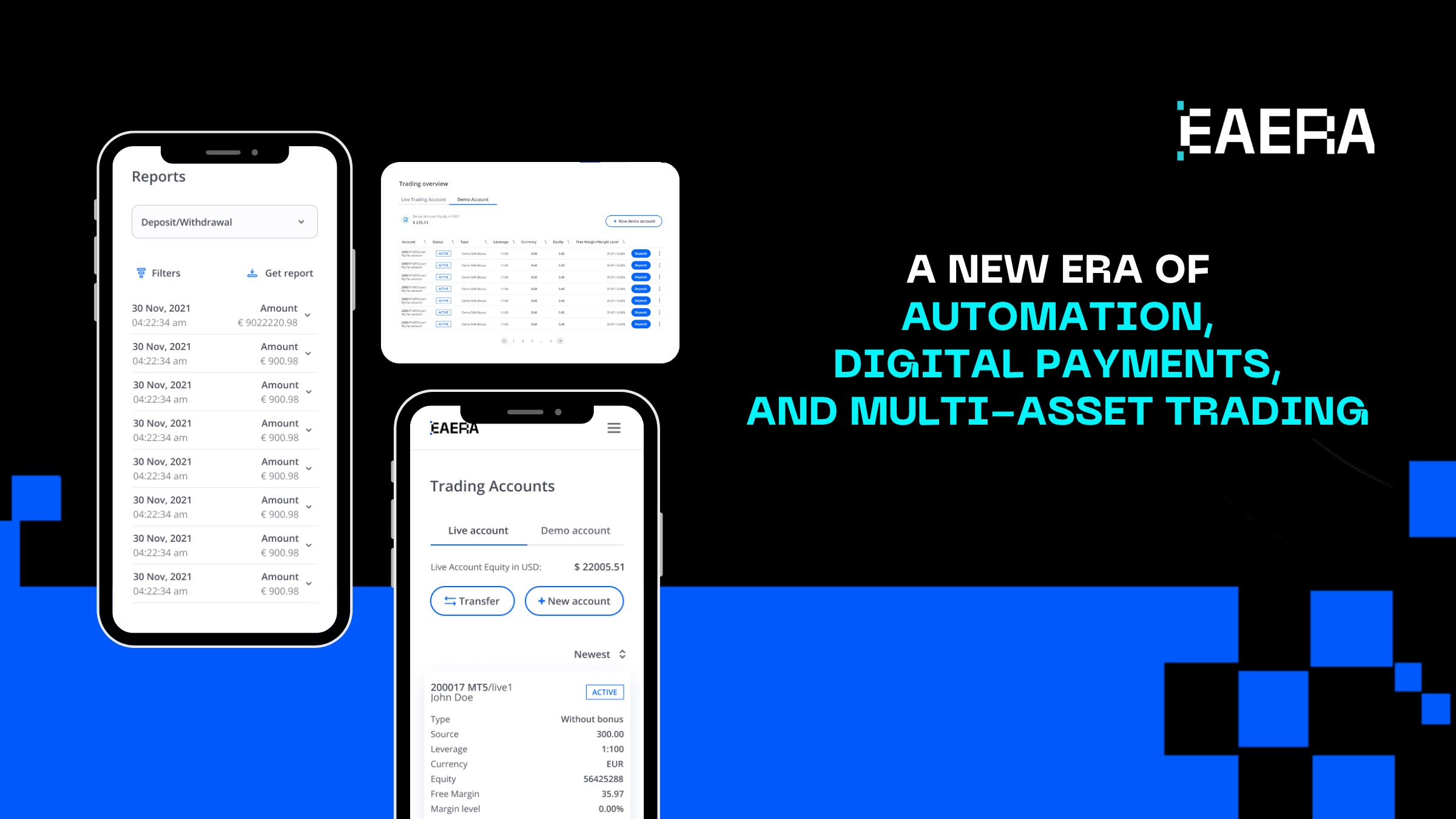

Future-Ready Technology for Modern Brokers

Automation, digital-first transactions, and multi-asset experiences are becoming the norm in the trading industry as it enters a new phase. Digital wallets are facilitating instantaneous international payments; alternative assets like cryptocurrency and tokenized goods are gaining popularity quickly; and artificial intelligence is driving personalized analytics.

Brokerages must transition from static legacy systems to scalable, future-ready architecture that can adjust to innovation, shifting regulations, and changing trader expectations if they want to stay competitive in this market.

EAERA delivers a roadmap aligned with the Next Trading Era:

AI-driven Client Growth

Machine learning facilitates:

- Onboarding based on risk

- Fraud and compliance detection

- Automated behavioral insights and segmentation

- Smart recommendations to boost trader engagement

Every client interaction is transformed by AI into an opportunity for optimized performance and more robust outcomes.

Crypto & digital wallet integrations

Brokerages can diversify beyond conventional currencies by providing

- Cryptocurrency deposits and swaps

- Tokenized assets

- Secure e-wallet management

This makes it possible to reach younger and international trading audiences.

Smart bonus & loyalty automation

With engagement automation, brokers can:

- Reward client activity automatically

- Introduce bonuses that increase deposits

- Customize incentives according to behavior

- Strengthen brand loyalty that is emotionally connected

Modular expansion to new asset classes

Brokers can enter markets without having to invest in expensive redevelopment thanks to EAERA’s system’s rapid scalability, which applies to stocks, indices, commodities, futures, and decentralized products.

Real-time risk and sentiment analytics

For startup brokers, risk monitoring is essential. Dashboards integrated by EAERA analyze:

- Exposure of position

- Utilization of margins

- Variations in volatility

- Patterns and sentiment of traders

Those who build smart, scale quickly, and innovate constantly will rule the brokerage industry in the future. EAERA is here to make that a reality.