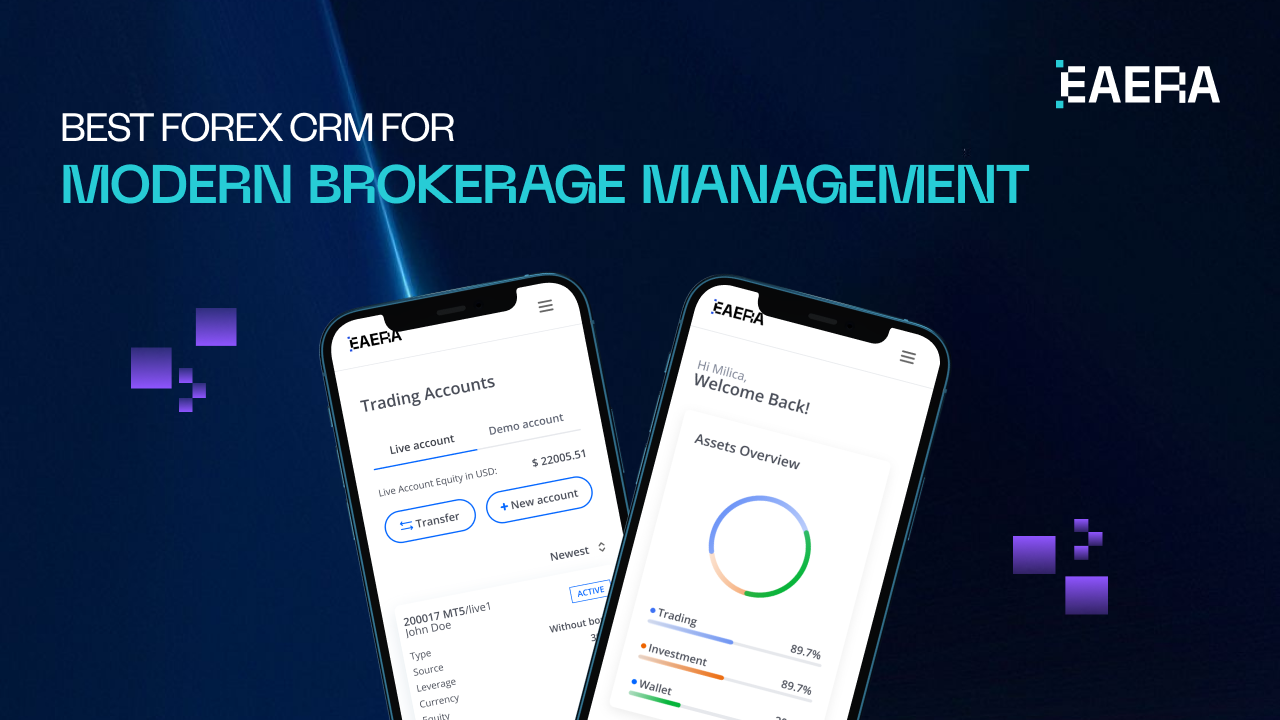

The Forex brokerage landscape in 2026 is defined by global competition, growing regulatory pressure, and rising trader expectations. Even though brokers are quickly entering new markets, many still face challenges like manual onboarding, dispersed data, sluggish sales cycles, and ineffective back-office operations.

Therefore, picking the best Forex CRM is a strategic choice that affects how well a broker can draw in, onboard, manage, and keep traders at scale. In addition to providing tools, a robust CRM offers operational leverage that directly boosts profitability, performance, and brand trust.

Related articles:

- Unlock Your Brokerage Potential: Top Forex CRM Solutions Revealed!

- Forex Broker Solutions: Top 8 Features You Need in 2025

The seven most important features are examined in this article along with the reasons they provide actual, quantifiable value.

The Problems Brokers Struggle With

Before looking at features, it’s important to understand what the best Forex CRM is designed to fix:

- Manual onboarding slows revenue and frustrates clients

- Compliance reviews consume staff hours and lead to inconsistency

- Trading data lives across multiple platforms, making it hard to see the full picture

- Poor lead management wastes marketing budgets

- IB commissions become chaotic without proper automation

- Poor reporting hinders decision-making

- Fragmented systems force teams to work reactively, not strategically

A high-quality CRM unifies these processes into a single cohesive system, reducing costs, improving accuracy, and allowing brokers to scale without multiplying staff.

7 Features That Truly Define the Best Forex CRM

While many CRM platforms boast long feature lists, few actually deliver real value. It’s all about how each feature contributes to better performance operationally, less workload on your staff, and an improved trader experience. Here are the seven features that really count – and why they have become essential for every successful brokerage.

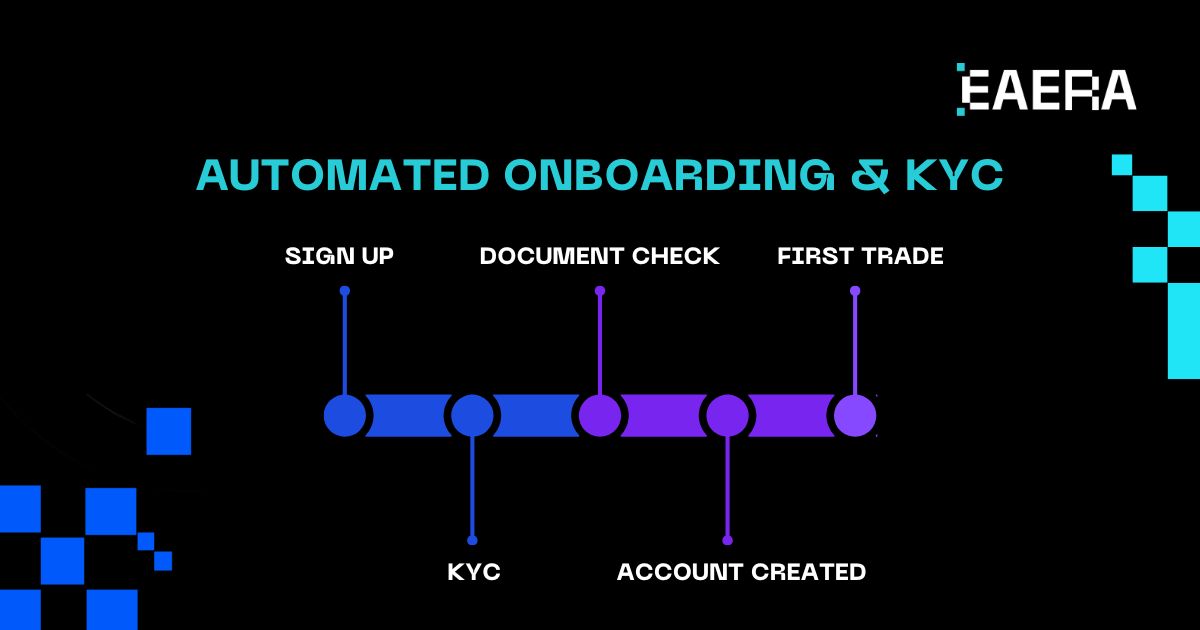

1. Automated Onboarding & KYC That Reduces Drop-Off and Boosts Revenue

The best Forex CRM turns the laborious, manual onboarding procedure into a smooth, online journey. Traders may go from registration to trading in a matter of minutes thanks to automated KYC checks, quick document verification, and direct account creation.

This automation’s true worth can be quantified. Faster and more user-friendly onboarding results in fewer traders abandoning the process mid-way. The time from lead acquisition to first deposit is significantly reduced, and compliance staff no longer must deal with manual document inspection. Automation directly increases revenue in a field where competition is determined by speed.

2. Intelligent Lead & Sales Automation That Improves Conversion Rates

The real function of a CRM is to convert leads, not only store them. The best Forex CRM finds high-potential leads and directs them toward making a deposit using behavioral insights, scoring models, and automatic follow-up sequences.

With this strategy, the CRM becomes an income generator. Sale representatives spend less time estimating which leads are ready to convert or manually reviewing spreadsheets. Rather, the algorithm automatically prioritizes chances so that traders with the best intentions receive attention. Marketing budgets stretch further because fewer leads fall through the cracks, and the brokerage enjoys more predictable and efficient growth.

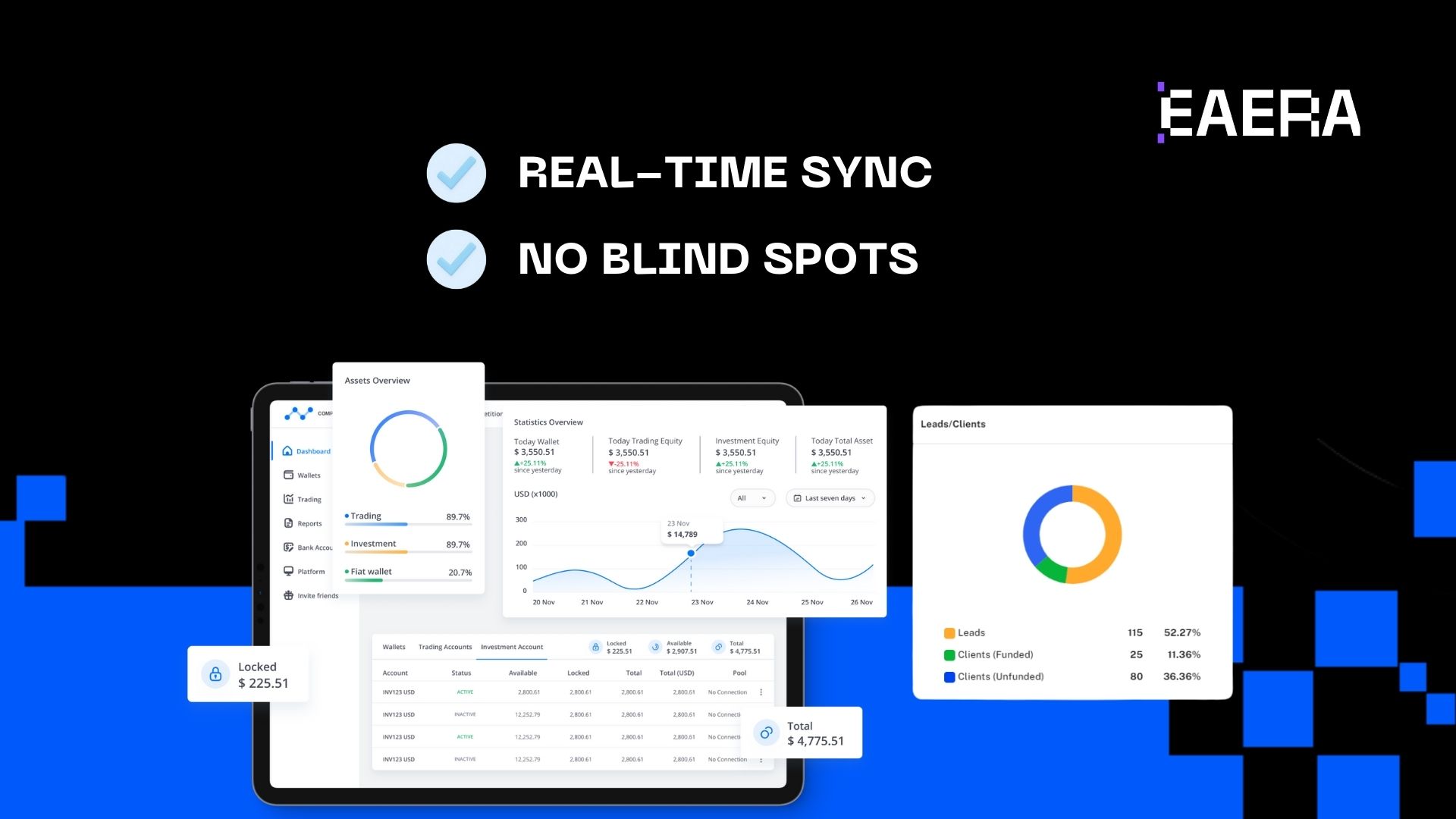

3. Deep Trading Platform Integrations That Eliminate Operational Blind Spots

Any brokerage must have real-time visibility into trader activities. The best Forex CRM synchronizes positions, balances, trading history, and exposure into a single dashboard by integrating seamlessly with MT4, MT5, cTrader, and other platforms.

This degree of integration offers benefits that go well beyond practicality. It gives management total control over brokerage performance, helps risk teams find weaknesses early, and helps sales teams comprehend client behavior. Staff may rely on precise data that is updated every second rather than navigating disjointed systems. This not only enhances decision-making but also significantly reduces the risk of operational errors.

4. Transparent IB & Affiliate Management That Strengthens Broker Partnerships

For the majority of brokers, establishing and sustaining robust IB and affiliate networks is a fundamental development strategy. A sophisticated CRM guarantees that partners are always aware of their earnings and the reasons behind them by offering total transparency into commissions, performance metrics, and downline structures.

One of the most important resources in partner-driven acquisition is trust, which is fostered by this openness. IBs feel more comfortable endorsing the brokerage more vigorously when they observe prompt, accurate reporting. Long-term partner loyalty rises; payout cycles become more seamless, and disputes sharply decline. The CRM transforms a straightforward tracking system into an effective instrument for growing and supporting the broker’s international acquisition of ecology.

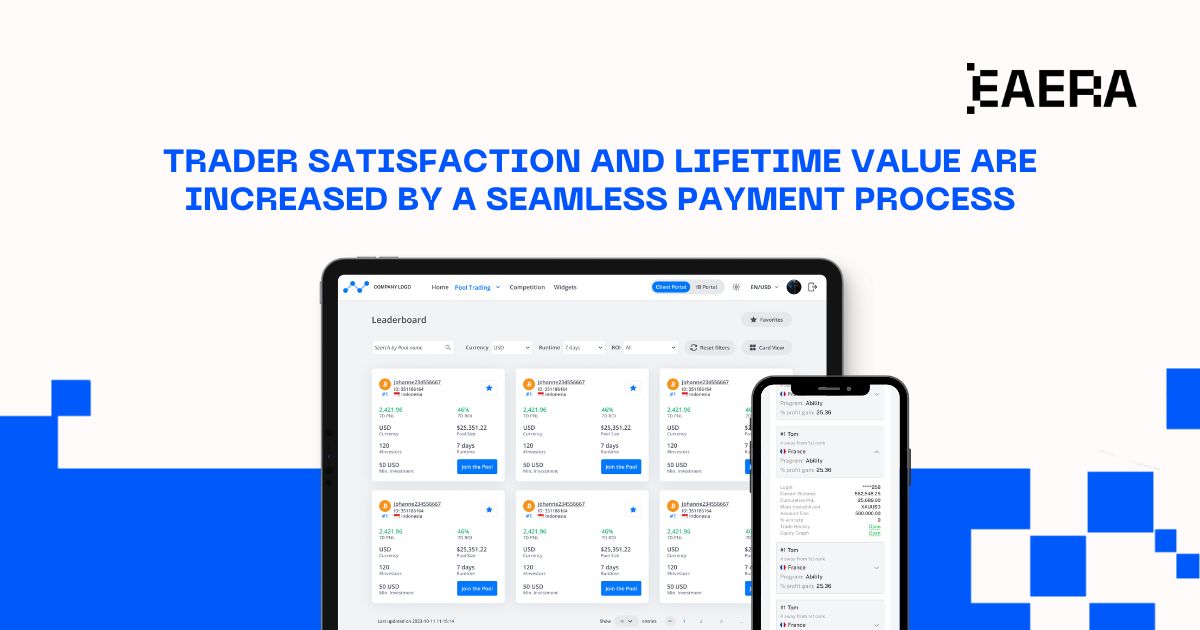

5. Integrated Payment Processes to Improve Withdrawals and Deposits

A trader’s decision to remain with a brokerage is frequently influenced by their funding experience. Fast deposits and predictable withdrawals are made possible by the best Forex CRM, which centralizes all payment methods, including local banking choices, crypto gateways, and international PSPs.

Making finance a retention advantage instead of a point of friction is where the true value is found. To enter the market right away, traders anticipate quick deposits as well as precise withdrawal deadlines. Automated reconciliation lessens the workload for payment teams, increases reporting accuracy, and decreases financial errors for brokers. Trader satisfaction and lifetime value are directly increased by a seamless, cohesive payment process.

6. Real-Time Reporting That Enables Strategic, Data-Driven Decisions

Enormous volumes of data are produced by modern brokerages, but only the best Forex CRM can transform that data into actionable intelligence. Real-time dashboards reveal trends in onboarding, deposit flows, trading performance, churn behavior, and risk exposure.

One of the CRM’s most significant achievements is the transition from reactive to proactive management. Leaders may swiftly and confidently modify tactics when they are able to recognize problems as soon as they arise, as opposed to learning about them weeks later. Whether it’s optimizing a new market expansion or identifying underperforming acquisition channels, real-time reporting gives brokers the clarity needed to make smarter decisions faster.

7. Scalable Infrastructure That Grows with the Brokerage

Ultimately, the best Forex CRM is designed to facilitate sustained growth. Brokers may scale without changing their technological stack because of cloud-native design, multilingual interfaces, security protocols, role-based access restrictions, and adaptable workflows.

Stability is the true advantage. The CRM adjusts without slowing down operations when the brokerage expands into new areas, adds more traders, or diversifies its platforms. Additionally, a scalable system boosts brand confidence because partners and clients are reassured when the broker’s operations continue to be dependable in the face of significant expansion.

A CRM that excels in these areas becomes more than a back-office tool. It becomes the core foundation that supports sustainable growth, operational efficiency, and long-term competitiveness in the global Forex market.