Operational complexity rises rapidly as forex brokerages expand beyond a single license or market. It takes more than just standard CRM software to manage various legal entities, regulatory regimes, brands, and client bases. Selecting the best forex CRM agency for multi-entity brokers becomes a strategic choice that has an immediate effect on long-term stability, scalability, and compliance.

Related articles:

- What Modern Software for Brokers Should Offer in 2026?

- How to Choose the Right Smart Prop Firm in 2026?

By emphasizing governance, entity-aware system design, and sustainable operational control over superficial features, this article explains what makes the best forex CRM agency for multi-entity brokers.

Why Multi-Entity Brokers Need a Specialized Forex CRM Agency?

Compared to single-entity firms, multi-entity brokers function under essentially different circumstances. Centralized oversight is still necessary even though each entity may have a different license, adhere to different regulations, and serve in different markets.

Common challenges include:

- Managing multiple licenses under different regulators

- Segregating client and transaction data by legal entity

- Applying entity-specific compliance rules

- Consolidating reporting for group-level visibility

This degree of complexity is beyond the scope of generic CRM solutions. Businesses frequently resort to manual workarounds, redundant systems, or fragmented data in the absence of an agency that is knowledgeable about multi-entity brokerage structures.

The best forex CRM agency tackles these issues from all angles, creating systems that strike a balance between entity-level autonomy and centralized control.

What Makes a Forex CRM Agency “Best” for Multi-Entity Operations?

Not all agencies can manage multi-entity broker groups, and not all CRM providers are agencies. A true best forex CRM agency goes beyond software delivery.

Key differentiators include:

- Deep understanding of regulated broker operations

- Experience designing CRM architectures for multiple entities

- Ability to translate regulatory requirements into system logic

- Long-term operational and technical support mindset

In contrast to off-the-shelf vendors, an agency collaborates closely with brokers to create workflows that accurately represent operational requirements. This covers risk controls that are manageable at the group level but differ by entity, onboarding logic, and approval of hierarchies and reporting structures.

This knowledge is crucial for multi-entity brokers to prevent expensive rework as the company expands.

Core Multi-Entity Capabilities the CRM Must Support

The CRM needs to be designed to identify and uphold entity boundaries at the system level. The best forex CRM agency guarantees that these features are essential and not added after the fact.

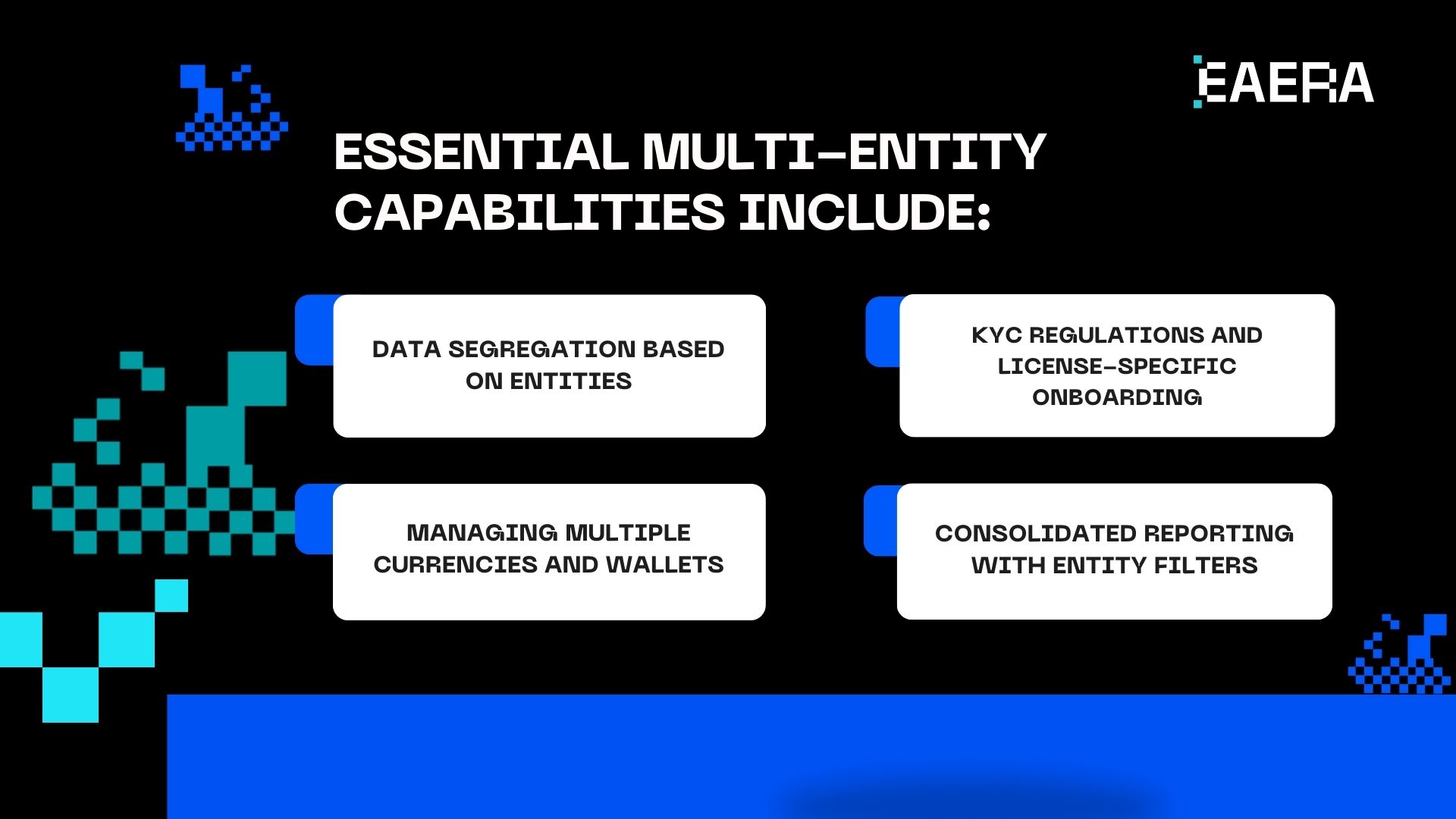

Essential multi-entity capabilities include:

- Data segregation based on entities

While still being available for approved group-level reporting, client data, transactions, and balances must be segregated by legal entity. - KYC regulations and license-specific onboarding

Requirements vary depending on the regulator. Depending on the entity and jurisdiction, the CRM must automatically apply the appropriate workflow. - Managing multiple currencies and wallets

Flexible wallet structures that complement each entity’s financial setup are necessary for brokers with global operations. - Consolidated reporting with entity filters

Without data leaks or misunderstandings, management must be able to view performance at the entity and group levels.

These capabilities are not optional. Brokers are exposed to operational inefficiencies, scalability constraints, and regulatory risk in their absence.

Compliance, Risk, and Governance Across Entities

One of the most difficult parts of multi-entity brokerage operations is compliance. Regulators want to know exactly how group oversight is maintained as well as at the entity level.

Instead of viewing compliance as a reporting task, the best forex CRM agency incorporates governance straight into system workflows.

Key governance features include:

- Entity-specific compliance workflows

- Audit-ready logs segmented by license

- Role-based access control by entity and department

- Clear approval, escalation, and override rules

Rather than being reactive, compliance becomes proactive when governance is integrated into the CRM. Regulatory confidence rises, internal accountability improves, and audits become simpler.

Platforms created by organizations such as EAERA show how entity-aware governance can be incorporated into day-to-day operations without causing business processes to lag.

Scalability and Operational Efficiency for Growing Broker Groups

For multi-entity brokers, expansion frequently entails acquiring new licenses, territories, or brands. Every addition raises complexity and expense if the CRM foundation isn’t sound.

Without necessitating structural adjustments, the best forex CRM agency creates systems that scale horizontally across entities.

Scalability features include:

- Adding new entities without rebuilding core logic

- Shared services (payments, reporting, risk) with controlled access

- Automation reducing cross-entity manual reconciliation

- Predictable performance as volume increases

When teams don’t have to handle different systems for every entity, operational efficiency increases. Reusing standardized procedures instead lowers operational risk and training time.

With this strategy, broker groups can expand with assurance and control.

The Role of Automation in Multi-Entity CRM Design

Multi-entity operations are greatly aided by automation. Manual procedures are not scalable across entities with varying requirements and regulations.

The best forex CRM agency prioritizes automation in areas such as:

- Entity-based rule enforcement

- Automated compliance checks

- Funding and withdrawal workflows per license

- Scheduled and on-demand reporting

Automation respects the differences between entities while ensuring consistency. Additionally, it lessens reliance on specific employees and the possibility of human error.

Automation in multi-entity settings is about repeatability and reliability, not speed.

Centralized Oversight Without Losing Local Control

Finding a balance between local autonomy and centralized oversight is one of the main issues facing multi-entity brokers. While entity teams require autonomy, group management requires visibility.

The best forex CRM agency solves this through:

- Configurable permission models

- Entity-scoped dashboards

- Group-level analytics with drill-down capability

With this structure, decision-makers can keep an eye on risk and performance throughout the broker group without needlessly getting involved in entity-level operations.

The result is a governance model that is both strong and flexible.

How to Choose the Best Forex CRM Agency for Your Broker Group?

It takes more than just assessing software features to choose the best forex CRM agency. The agency’s capacity to support long-term operational maturity must be evaluated by brokers.

A practical evaluation checklist includes:

- Proven experience with multi-entity broker groups

- CRM architecture designed for entity-aware logic

- Strong compliance and security practices

- Ongoing support and product evolution roadmap

Brokers ought to think about the agency’s customization strategy as well. While a lack of flexibility restricts scalability, excessive customization can increase maintenance risk. Finding the ideal balance is essential.

Configurable systems that adjust to broker needs without sacrificing system integrity are the focus of agencies like EAERA.

Why Multi-Entity Brokers Outgrow Generic CRM Solutions?

Many brokers start with generic CRM platforms and later attempt to adapt them for multi-entity use. This approach often leads to:

- Data fragmentation

- Manual compliance processes

- Increased operational cost

- Limited scalability

By addressing multi-entity complexity early on, a purpose-built CRM created by the best forex CRM agency steers clear of these pitfalls.

Early investment in the appropriate system and agency lowers long-term risk and speeds up growth.

Selecting the best forex CRM agency for multi-entity brokers is about finding a long-term operational partner, not software. Centralized governance, scalable automation, embedded compliance, and entity-aware design are all provided by the best agency. By investing in these capabilities, brokers can expand across markets and regulatory environments with greater clarity, control, and confidence.