The United Arab Emirates (UAE) has become a premier destination for launching a forex brokerage, thanks to its robust financial infrastructure and supportive regulatory framework. Securing a forex license in the UAE is a crucial first step for any firm looking to operate legally and gain client trust in this competitive market. Equally important is choosing the right brokerage software, which plays a key role in ensuring compliance, risk management, and seamless trading operations. From meeting regulatory requirements to integrating reliable brokerage software that supports KYC, AML, and real-time reporting, this guide will walk you through everything you need to establish a successful forex business in the UAE.

Related articles:

1. Introduction to Forex Licensing in the UAE

A Forex license is the foundation of legal operations for any company aiming to offer trading services in the UAE. This regulatory approval ensures full compliance with local laws, protects investors, and enhances credibility in a market known for its dynamic trading activity. Navigating the UAE’s federal structure requires understanding multiple regulatory bodies and how they interact. Equally critical is choosing reliable brokerage software to support licensing compliance, KYC procedures, and client onboarding. The right brokerage software also helps streamline operational workflows and ensures your brokerage remains audit-ready at all times.

In this environment, using advanced brokerage software is not optional — it’s essential. From automation to real-time reporting, the right tools streamline operations and maintain compliance with UAE regulations. Whether you’re applying for a license through a mainland or free zone authority, your success depends on selecting brokerage software that adapts to jurisdictional requirements and regulatory updates. A strong brokerage software system also plays a pivotal role in risk management and client data protection.

A Forex broker CRM — often integrated into brokerage software — enables firms to manage client relationships, compliance checks, and communication workflows effectively. Leveraging the right brokerage software positions you for long-term success in the UAE’s fast-moving forex industry.

Before applying, businesses must define their operational model and license type:

- Forex Broker License: Suited for entities acting as agents executing client trades or principals trading on their own account. This license demands robust brokerage software to manage transactions and compliance.

- Forex Trading Company License: Ideal for companies trading their own capital, often requiring exchange memberships rather than a full broker license.

The choice hinges on whether the business serves clients or trades independently, with brokers facing stricter scrutiny. A brokerage software can enhance client management for brokers, while trading companies benefit from streamlined software for brokers tailored to proprietary trading.

2. Step-by-Step Guide to Obtain a Forex License in the UAE

Step 1: Choose the Right UAE Jurisdiction for Your Forex Brokerage Software

Selecting the right jurisdiction in the UAE is a critical first step, as it determines your regulatory authority, ownership structure, and operational flexibility. The choice you make will also influence how your brokerage software integrates with local compliance and reporting requirements.

- Mainland UAE: is regulated by the SCA or the Central Bank (CBUAE). While it typically requires 51% local ownership, it grants access to the broader UAE market. Firms operating here benefit from brokerage software designed to handle complex regulatory compliance and localization.

- Dubai International Financial Centre (DIFC): governed by the DFSA, offers 100% foreign ownership, 0% tax, and a global business environment. DIFC-based firms often rely on robust brokerage software to manage cross-border transactions, KYC, and client communications efficiently.

- Abu Dhabi Global Market (ADGM): regulated by the FSRA, mirrors DIFC’s benefits with top-tier infrastructure and international regulatory standards. Both DIFC and ADGM are ideal for firms aiming to scale globally with the help of adaptable brokerage software solutions.

Free zones like DIFC and ADGM provide flexibility for international investors, making them attractive for those leveraging software for brokers to scale globally.

Step 2: Ensure You Meet the Eligibility Criteria

Each regulator sets specific requirements, including:

- Minimum Capital: Varies by jurisdiction, ensuring financial stability.

- Experienced Team: Key personnel need proven financial services expertise.

- Business Plan: A detailed strategy outlining operations and market approach.

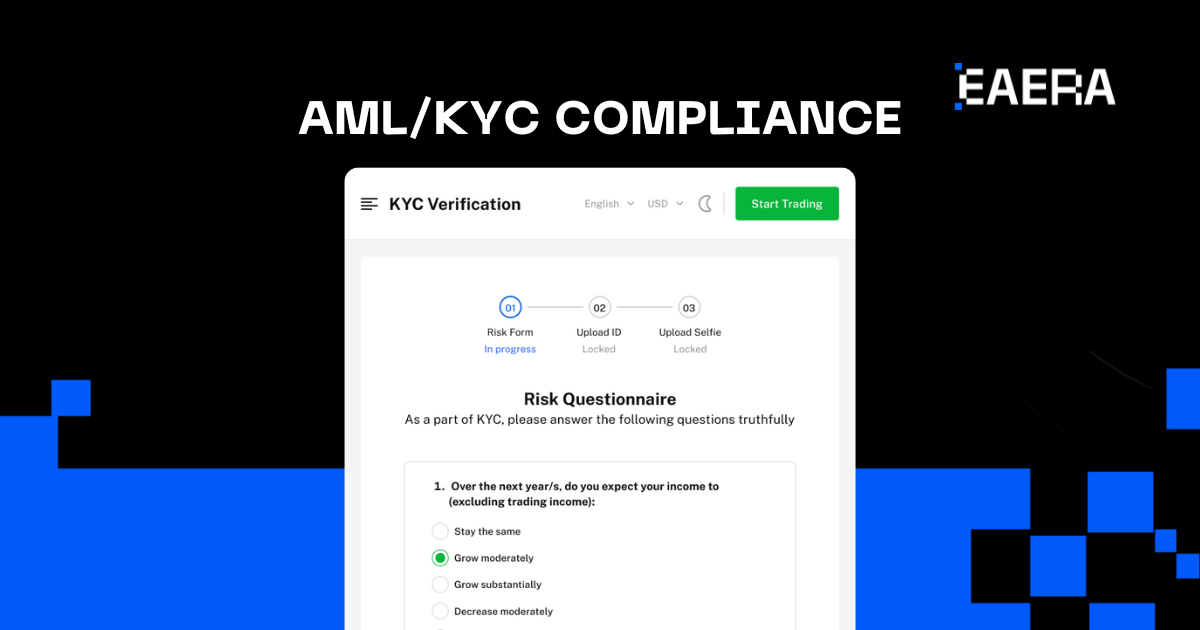

- AML/KYC Compliance: Policies to prevent money laundering and verify clients.

Meeting these standards demonstrates your firm’s credibility and readiness to operate in a regulated environment. Modern brokerage software can help streamline the process by offering built-in tools for regulatory reporting, document management, and client verification. Choosing the right brokerage software also ensures your firm remains compliant as regulations evolve, while minimizing manual processes and human error.

Step 3: Prepare the Required Documents for Your Forex Brokerage Software

Essential documents include:

- Company incorporation papers.

- A comprehensive business plan.

- Three-year financial projections.

- Key personnel details.

- Proof of capital availability.

- AML/KYC and risk management policies.

Ensuring accuracy and consistency across all documents is essential. Many firms use brokerage software to centralize data, automate reporting, and maintain version control throughout the application process. The right brokerage software can also help align your documentation with evolving compliance expectations, reducing the risk of delays or rejections.

Step 4: Apply to the Relevant Regulatory Authority (DFSA, FSRA, etc.)

Submit your application to the appropriate regulator—SCA/CBUAE for mainland operations, DFSA for DIFC, or FSRA for ADGM—through their official portals or submission processes. This step may include interviews or meetings to assess your preparedness, where demonstrating your operational setup, including the use of compliant brokerage software, can strengthen your case for approval.

Step 5: Pay the Application and Licensing Fees

Fees vary by regulator and include application processing, annual licensing costs, and potential additional charges. Budgeting for these is essential, with brokerage software aiding in financial tracking.

Step 6: Undergo Regulatory Review and Licensing Approval

Regulators conduct thorough reviews, verifying submitted documents, performing due diligence, and potentially inspecting your operations. This process can take several months and often requires patience and responsiveness. Utilizing brokerage software during this phase can help you efficiently manage documentation, track requests, and respond to regulatory queries in a timely manner.

Step 7: Comply with Ongoing Regulations and Maintain Forex Brokerage Software Standards

Post-approval, brokers must:

- Submit regular financial and compliance reports.

- Maintain minimum capital levels.

- Segregate client funds.

- Update AML/KYC protocols.

Non-compliance can result in severe penalties, making brokerage software essential for automating reporting, monitoring capital requirements, and managing client data securely. Advanced brokerage software helps ensure that ongoing obligations are met with accuracy and efficiency, reducing the risk of regulatory breaches.

Obtaining a Forex license in the UAE is a multifaceted journey, involving careful jurisdiction selection, strict eligibility requirements, and comprehensive documentation. Free zones like DIFC and ADGM provide unique advantages—full ownership, modern infrastructure, and tax benefits—while the mainland offers broader access to the local market. With the right strategy and reliable brokerage software, firms can unlock the full potential of one of the world’s most vibrant financial ecosystems.

For seamless execution, businesses should invest in advanced tools like brokerage software, brokerage systems, and Forex brokerage software solutions. At EAERA, we provide an all-in-one suite—EAERA CBS—designed as the operating system for financial institutions. Our cutting-edge software for brokers empowers you to meet regulatory demands, manage clients, and thrive in the UAE’s competitive Forex landscape. Begin your journey today by exploring our brokerage software solutions and consulting with experts to ensure a smooth licensing process.