The decision between cloud-based and on-premise forex back office solutions is more than a technical choice—it is a strategic milestone for new brokerages. Much like choosing between renting a fully serviced apartment or building your own house, this decision shapes your operational agility, costs, and long-term scalability. Let’s explore the differences in depth and find out which model best fits modern forex businesses.

Related articles:

- CRM for Forex in KYC and Compliance Processes

- Forex Broker Software: The Essential Tool for Clear Business Insights

Understanding Forex Back Office Solutions

What Is a Forex Back Office?

A forex back office is the operational hub of a brokerage. It manages client accounts, processes deposits and withdrawals, tracks trading activity, and ensures compliance with regulations. In essence, it is the “engine room” that keeps every trade, payment, and report running smoothly.

Key Functions in a Forex Back Office

Core tasks typically include:

- Client management: KYC verification, account setup, and profile updates.

- Transaction processing: Deposits, withdrawals, internal transfers, and reconciliations.

- Reporting and analytics: Trade volume, commission payouts, and financial statements.

- Risk management and compliance: Monitoring suspicious activities and meeting regulatory requirements.

These functions must operate seamlessly to maintain trader trust and regulatory standing.

Cloud-based Forex Back Office

Definition and Core Characteristics

A cloud-based forex back office is hosted on remote servers maintained by a third-party provider. Access is delivered via the internet, allowing brokers and staff to log in securely from any location.

Advantages of Cloud-based Systems

- Lower upfront costs: No heavy investment in physical servers or in-house IT infrastructure.

- Rapid deployment: Go live in weeks, not months, enabling quick market entry.

- Scalability: Easily add new accounts, instruments, or regions as your brokerage grows.

- Automatic updates: Security patches and feature enhancements are handled by the provider.

- Global accessibility: Ideal for remote teams and brokers targeting multiple time zones.

Potential Challenges of Cloud Deployment

While the cloud is convenient, it requires:

- Robust internet connectivity to avoid downtime.

- Careful vendor selection, ensuring compliance with financial regulations like GDPR or local data residency rules.

- Clear service-level agreements (SLAs) to guarantee uptime and performance.

On-premises Forex Back Office

Definition and Core Characteristics

An on-premises forex back office is installed on physical servers owned and maintained by the brokerage. All data, applications, and security protocols remain under direct company control.

Advantages of On-premises Systems

- Full data sovereignty: Complete control over where and how sensitive data is stored.

- Customization freedom: Tailor modules and workflows to unique trading strategies.

- Offline resilience: Internal operations can continue even during internet disruptions.

Potential Challenges of On-premises Deployment

However, this model demands:

- Significant upfront investment in hardware and software licenses.

- Dedicated IT staff for maintenance, updates, and cybersecurity.

- Longer deployment timelines, which can slow market entry for start-ups.

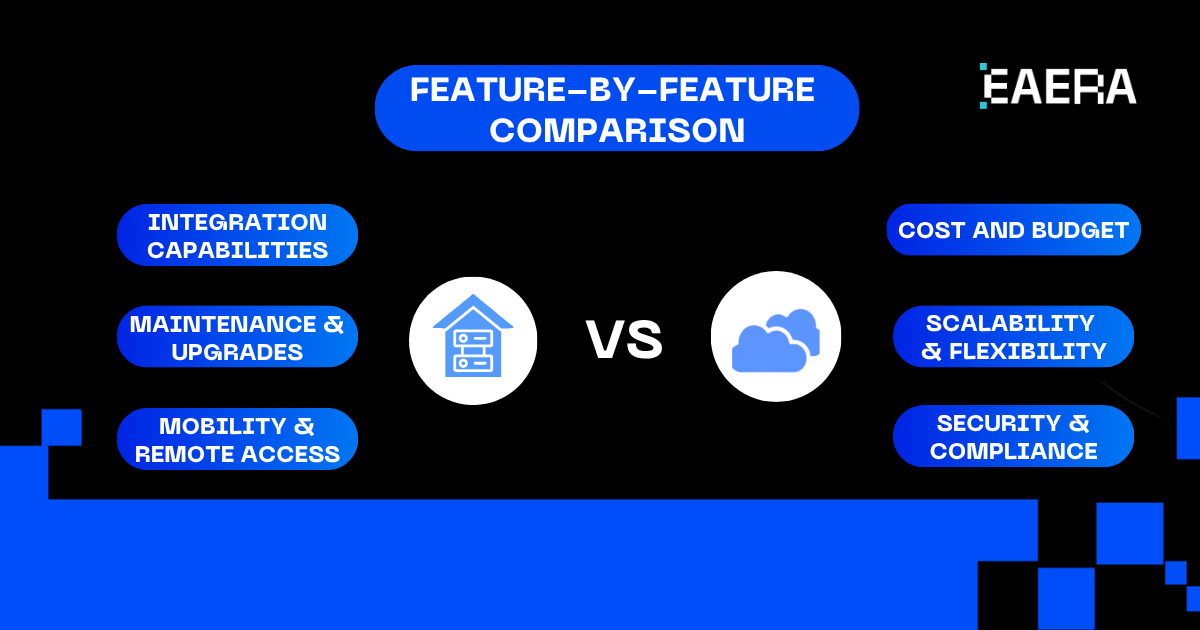

Cloud vs On-premises: A Feature-by-Feature Comparison

Selecting a forex back office is not just about architecture; it is about aligning technology with business strategy. The following feature-by-feature analysis highlights where cloud-based and on-premises models converge and diverge, helping new brokerages make an informed choice.

| Feature | Cloud-based Forex Back Office | On-premises Forex Back Office |

| Cost & Budget | Subscription/pay-as-you-go; low upfront cost; predictable monthly expenses | High initial investment; long-term ownership, and ongoing hardware & IT costs |

| Scalability & Flexibility | Instantly scalable; ideal for rapid growth and multi-region expansion | Limited by hardware; slower to scale; capital-intensive |

| Security & Compliance | Enterprise-grade security; certifications (ISO, SOC, GDPR); disaster recovery | Full control over security; suitable for strict data sovereignty requirements |

| Performance & Reliability | Distributed data centers; high uptime via redundancy and load balancing | Local infrastructure robust if well-designed; vulnerable to local outages |

| Integration Capabilities | Standardized APIs; plug-and-play modules; fast updates | Custom-built integrations; tailored workflows; requires in-house expertise |

| Regulatory Adaptability | Multi-jurisdiction hosting; easier compliance across regions | Full control over data location; simplifies audits in specific markets |

| Maintenance & Upgrades | Automatic updates; minimal disruption | Manual updates; scheduled downtimes; IT staff required |

| Data Ownership & Control | Strong encryption; legal agreements define ownership | Complete data custody; no third-party access |

| Mobility & Remote Access | 24/7 global access; ideal for remote teams | Remote access possible but complex (VPN, firewall setup) |

| Vendor Ecosystem & Support | Rich fintech partnerships; fast innovation; integrated tools | Slower innovation; tailored vendor contracts; internal development |

Key Considerations for New Brokerages

Choosing between a cloud-based and on-premise forex back office is a strategic decision that directly impacts your brokerage’s agility, compliance posture, and operational efficiency. Here are the most important factors to weigh:

1. Business Size and Growth Trajectory

Start-up brokerages with limited capital and ambitious expansion plans often find cloud solutions more suitable. The ability to scale instantly—whether adding new instruments or entering new markets—makes cloud deployment ideal for fast-paced growth. On the other hand, boutique firms with a stable client base and localized operations may prefer the control and customization offered by on-premise systems.

2. Regulatory Environment

Regulatory compliance is non-negotiable in forex trading. Jurisdictions with strict data localization laws may require on-premise solutions to ensure data remains within national borders. Cloud providers with multi-region hosting and compliance certifications (e.g., GDPR, ISO 27001) can still meet many regulatory requirements, but brokers must verify that their chosen vendor aligns with local laws.

3. Technical Expertise and IT Resources

Cloud-based systems are ideal for teams lacking deep technical expertise. Managed services, automatic updates, and vendor support reduce the burden on internal staff. Conversely, brokerages with strong IT departments may benefit from the customization and autonomy of on-premise setups, especially when integrating proprietary trading tools or workflows.

4. Operational Agility and Time-to-Market

Cloud deployments can be launched in weeks, enabling brokers to enter the market quickly. On-premise systems, while offering more control, often require months of setup, hardware procurement, and testing. For brokers aiming to capitalize on market trends or seasonal demand, cloud solutions offer a clear advantage.

5. Budget and Long-Term Investment

Cloud models convert capital expenditure into predictable operational costs, making budgeting easier for new firms. On-premise systems demand significant upfront investment but may become cost-effective over time for high-volume brokers with stable infrastructure.

Try EAERA’s Cloud-Based Forex Back Office

For brokerages seeking a powerful, scalable, and secure cloud solution, EAERA’s cloud-based forex back office offers a compelling option tailored to modern trading environments.

Key Features of EAERA’s Forex back office

- Centralized Dashboard: Get a real-time overview of client activity, transaction status, and operational requests—all in one place.

- Request Management: Streamline KYC verification, account setup, wallet management, and more with efficient tracking tools.

- Transaction Handling: Manage deposits, withdrawals, transfers, and credits across multiple currencies, including FIAT and crypto.

- Client and Lead Management: Track leads, monitor conversion rates, and manage client profiles with precision.

- Advanced Reporting: Generate detailed reports on financial performance, client behavior, and transaction history.

- Role-Based Access Control: Define user roles and permissions to ensure secure access and operational integrity.

Benefits for Brokerages

- Efficiency: Automates core banking processes, reducing manual workload and operational bottlenecks.

- Real-Time Monitoring: Make informed decisions with live updates on key metrics and client activity.

- Enhanced Client Experience: Accelerate onboarding and transaction approvals for a smoother client journey.

- Security and Compliance: Built-in safeguards ensure data protection and adherence to global regulatory standards.

For new forex brokerages, the choice between cloud-based and on-premise back office systems is strategic, not merely technical. Cloud solutions excel in speed, scalability, and cost-efficiency, while on-premise setups provide unmatched control and customization.

EAERA’s forex back office solution is designed to empower brokerages with the tools they need to grow, adapt, and thrive in a competitive forex landscape—without the overhead of traditional infrastructure. Experience how it transforms your trading experiences today with eaera.com!