Trading businesses will expand, and so will complexity. A simple and effective methodology using a small set of tools becomes fragile when faced with an influx of customers, with more pressure from regulations and speed becoming a key differentiator. In the modern world, success stops being based on platforms in isolation and more on how platforms integrate with each other.

EAERA and XValley are pleased to announce the formation of a strategic partnership to address current challenges in a more integrated manner. Rather than lining up a series of products, the strategic partnership aims to deliver a seamless trading environment, one in which all aspects of operations are aligned.

Thus, this approach helps trading companies scale easily and adapt to market demands.

Why Modern Trading Businesses Need an Ecosystem Approach

Today, trading firms engage with multiple layers simultaneously: execution engines, client relationships, compliance processes, analytics tools, reporting capabilities, and infrastructural support. While each layer works efficiently in isolation, a disorganized approach causes compounded inefficiency.

Fragmented systems typically result in:

- Data silos between trading, operations, and compliance

- Manual reconciliation and duplicated workflows

- Inability to make timely decisions due to incomplete visibility

- Higher operational and technical risk during scale

As client levels rise, these pain points don’t remain linear, so they accelerate. What starts as minor friction becomes a bottleneck that slows execution, increases costs, and limits growth.

An ecosystem strategy helps with this problem at its root. Rather than optimizing each separate instrument, it synchronizes architecture, data flows, and logic of operation on the whole business. Such an approach ensures more than just effective operation – it ensures robustness and predictability in the developing business.

From Standalone Systems to a Unified Trading Ecosystem

There are many trading operations trying to address the issue of complexity using the power of integration, such as integrating the CRM system with the trading platform or adding a compliance tool or building an analytics solution upon it. Though integration is the need of the hour but not the sole solution.

A unified ecosystem takes it a step further. It not only aligns systems at a certain level, but it also ensures that:

- Trading activity is channeled directly into operational and compliance process

- Client lifecycle data remains the same across platforms

- Performance measures and reporting reflect real-time system states

- Decisions are made based on common, accurate data

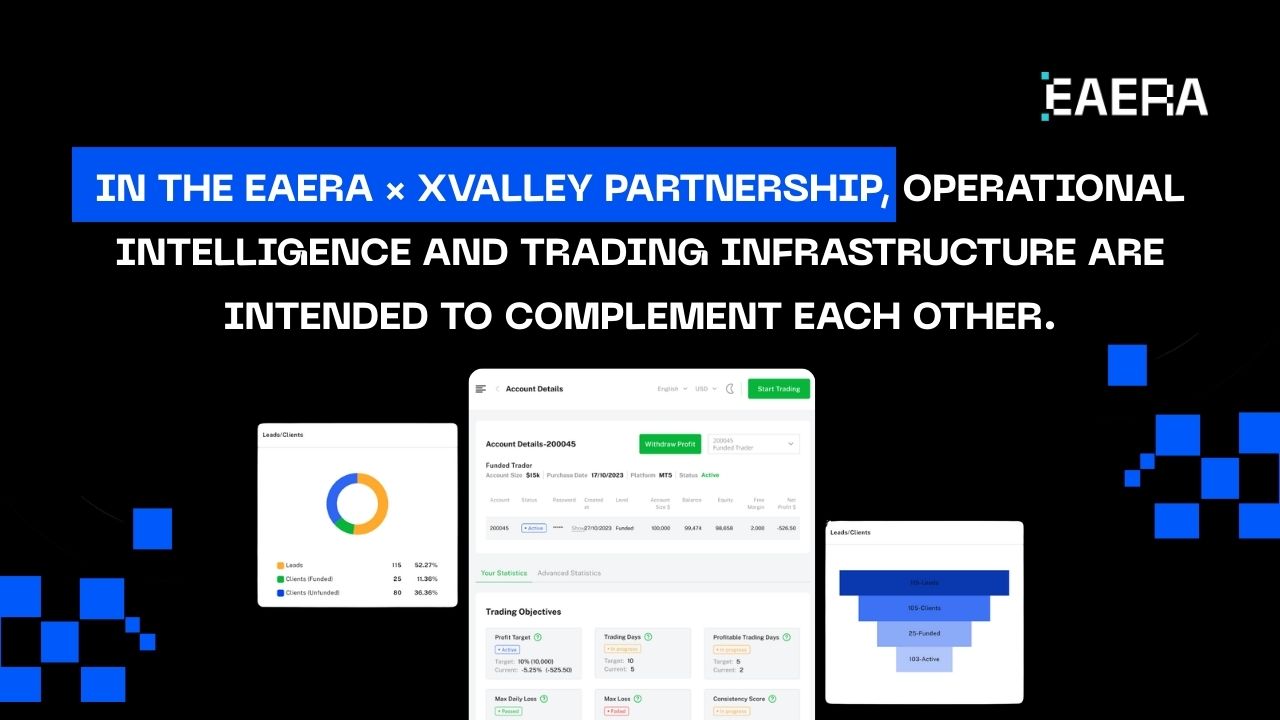

In the EAERA × XValley partnership, operational intelligence and trading infrastructure are intended to complement each other. Performance, client handling, and governance are considered as interlocked components in an integrated system.

This helps in eliminating frictions, reducing the time for project execution, and achieving better operational perspective for all concerned, including managers.

Core Values of the EAERA × XValley Partnership

The strength of the partnership is found not in overlap, but in clear separation of responsibilities with tight coordination. The overall system provides measurable benefits across multiple dimensions.

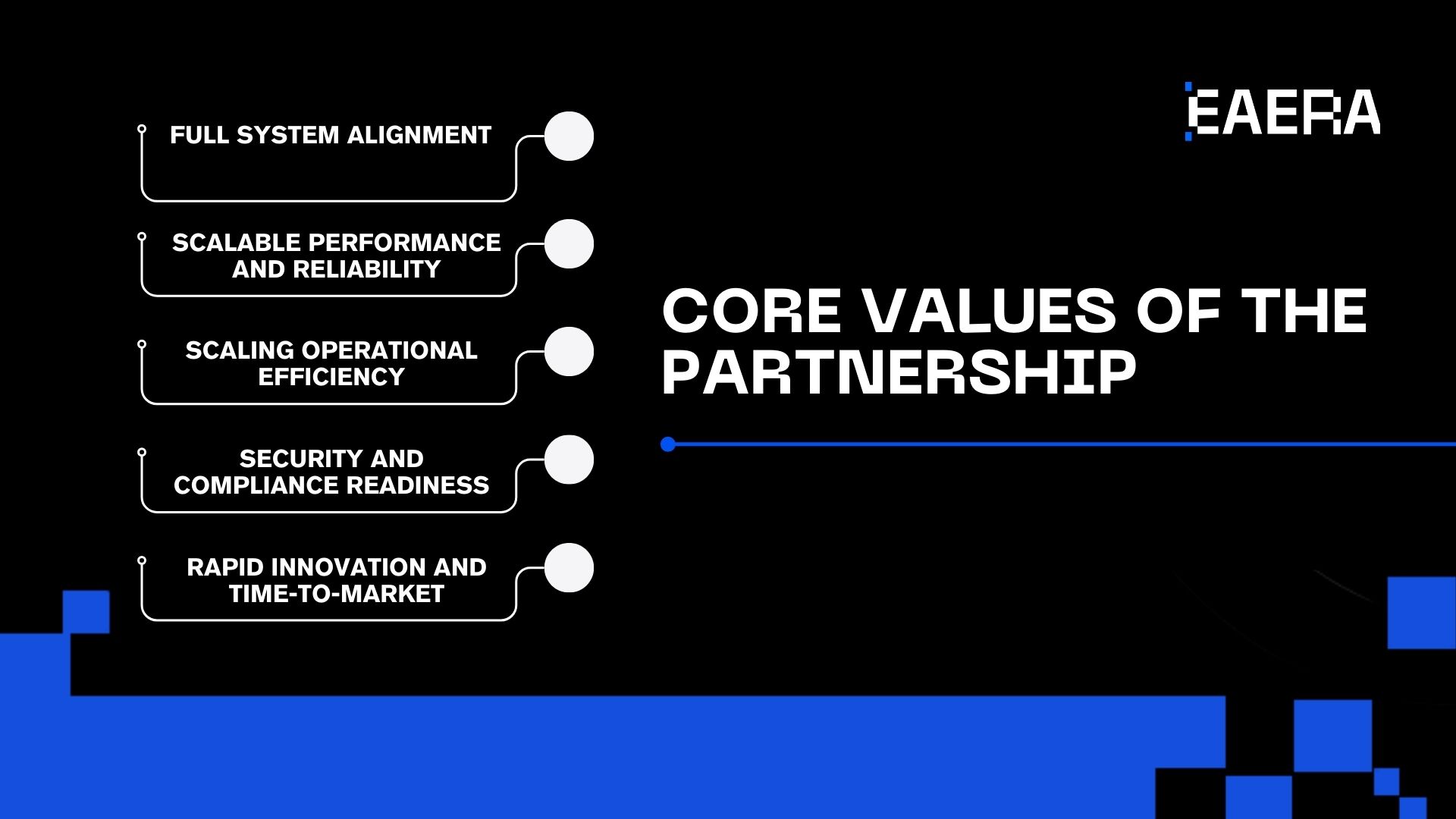

Full System Alignment

Trading, client business, and management activities are integrated in an orchestrated manner. In turn, there are no gaps between systems, and each step, whether technology-related or business-related, is a part of a unified flow.

Scalable Performance and Reliability

Infrastructure and operational systems are designed to scale together. As trading volume increases, trading performance remains stable with no need for process or tool reintegration.

Scaling Operational Efficiency

Automated systems eliminate manual handoffs, and having data in one central location eliminates duplicated efforts. Teams have less busy work and more time to spend on higher-value tasks like growth, optimization, and customer interaction.

Security and Compliance Readiness

An integrated environment facilitates the enforcement of standards and the surveillance of activity to the degree that the regulatory compliance becomes an integral part of the operations rather than an add-on feature.

Rapid Innovation and Time-to-Market

New products, asset classes, or business models can be added without rebuilding the foundational systems. The ecosystem enables evolutionary development without interfering with daily business.

Scaling with Confidence and Reduced Risk

Scaling is not merely an issue of expanding, but an issue of managing and expanding. Many trading businesses have encountered difficulties when volume of trade and systems of trade have grown at different rates when performance degradation, reporting, or regulatory issues have occurred when and as markets are their most active.

A unified ecosystem minimizes risks in the following ways:

- Coordinating data streams among different systems

- Reducing chokepoints between execution and operation

- Handling peak load requirements under volatile market rates

- Enabling clearer visibility of system health and performance

Because infrastructure and operations are entwined in scaling, they are not nay vulnerable from scaling. Instead, growth reinforces the system’s maturity.

Moreover, this reliability is even more important when trading firms are operating in a variety of geographic areas or trading complex products.

Enabling Modern Trading Business Models

The scene on the trading floor keeps changing very rapidly. All players are reaching out beyond the conventional forex space into multi-asset offerings, hybrid approaches and diversification of customers. All the above require flexibility without necessarily losing control.

The EAERA × XValley ecosystem provides for:

- Multi-asset and multi-region strategies

- High-frequency and performance-critical trading environments

- Prop trading and hybrid models of brokering

- Continuous growth without rewriting the architecture

The innovation ecosystem, rather than hindering innovation, helps create a firm base on which new approaches can be established. Such businesses easily adapt to business opportunities and, at the same time, display operational discipline.

A Long-Term Foundation for Sustainable Growth

Short-term solutions frequently produce long-term problems. Systems developed to meet only short-term needs are likely to fail when subjected to pressure and thus require costly migration or restructures.

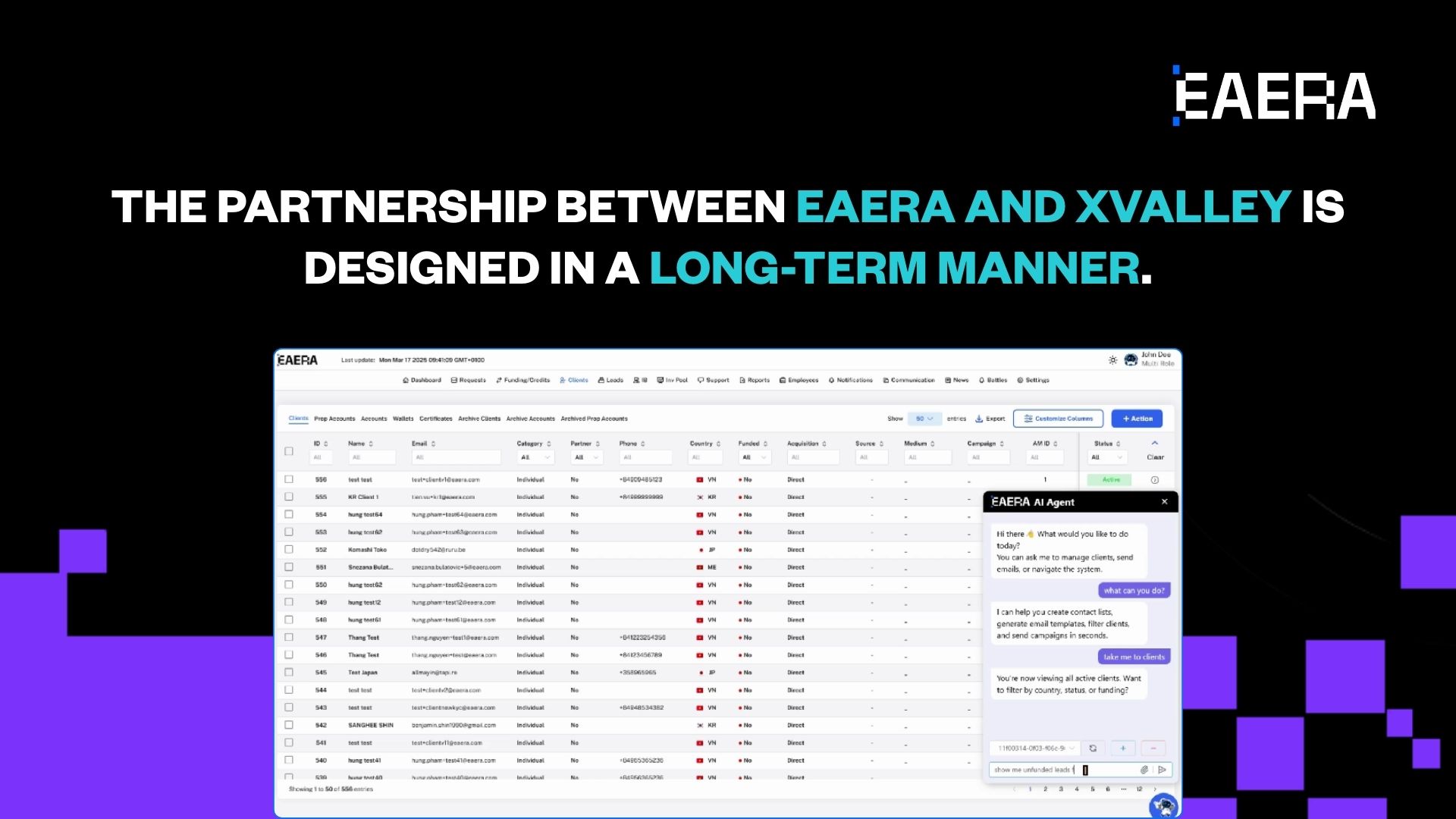

The partnership between EAERA and XValley is designed in a long-term manner. It focuses on:

- Consistent architectural

- Evolution rather than replacement

- Alignment of technology, operations, and strategy

This will allow trading operations to respond to change, market change, and technological change without compromising basic structure. Growth then becomes a managed process, rather than a constant fire fight.

In considering ecosystems, instead of tools, organizations shift the focus from reactive management to proactive and sustainable development.

In an industry where speed, reliability, and trust are the measures of success, fragmented infrastructure is not an option any longer. Trade businesses demand clarity, coordination, and scale as essential ingredients in the very foundation they are based upon.

The EAERA × XValley collaboration provides just that – a cohesive trading infrastructure environment where infrastructure and trading operations are geared towards the same goal: minimizing risk and promoting growth throughout all phases. By integrating the execution processes, management structures, and performance metrics of a trading infrastructure with a common architectural perspective, the collaboration enables trading companies to simplify complexity and push ahead.

In a market where fragmentation slows progress, ecosystem thinking creates momentum – and that momentum is what sustains long-term success.

About EAERA

EAERA is a fintech company with over 10 years of international experience, specializing in the development of financial core systems and Big Data analytics platforms for the modern financial industry.

About XValley

XValley is a Cyprus-based fintech company providing a flexible, scalable ecosystem of technology solutions for online trading and financial operations. Its offering includes a trading platform, risk management tools, liquidity bridge, mobile apps, client portal, and analytics, all integrated with trusted partners to support FX, CFDs, crypto, and multi-asset businesses worldwide.