The forex market is about to enter a pivotal stage. Expectations for competition, regulations, and technology will be significantly higher by 2026 than they were in the past. The largest risks for any forex will now come from internal choices that restrict scalability, visibility, and control rather than just market volatility.

Related articles:

- Unlock Your Brokerage Potential: Top Forex CRM Solutions Revealed!

- Best Forex CRM for Modern Brokerage Management

The most important mistakes a forex broker should avoid in 2026 are highlighted in this article, which focuses on operational and structural problems that have a direct impact on long-term resilience, growth, and compliance.

Underestimating Technology as a Core Business Driver

Treating technology as a supporting function rather than a primary business driver is one of the most frequent mistakes a forex broker still makes. Many brokers continue to use disjointed systems that were developed over time—separate tools for payments, reporting, risk monitoring, CRM, and back-office operations.

Data silos are produced by this disjointed approach. Management decisions are based on incomplete or delayed information when systems do not communicate well. These gaps result in slower reactions, higher operating costs, and greater risk of exposure as trading volumes rise, and client behavior becomes more complex.

A forex broker that only considers technology as an IT expense will find it difficult to compete in 2026. Integrated platforms with smooth departmental data flow are necessary for modern brokerage management. Instead of slowing down decision-making, technology should facilitate better oversight, quicker decisions, and more predictable results.

Organizational misalignment is another under appreciated effect of fragmented technology. Teams create distinct versions of the same reality when departments rely on different systems. While compliance teams respond to problems after they arise, sales may push campaigns without knowing the risk of exposure.

This lack of shared visibility causes internal conflict and slower execution for a forex broker. In addition to increasing productivity, integrated technology fosters a common operational language among teams, facilitating quicker and more confident decision-making. Departmental alignment will be just as crucial in 2026 as technology.

Poor Risk Management and Lack of Real-Time Visibility

One of the aspects of brokerage operations that is still undervalued is risk management. To keep an eye on exposure, margin usage, and customer behavior, many forex brokers rely on manual checks or delayed reports. This approach may have worked at smaller scales, but it becomes dangerous as activity grows.

Risk teams are unable to respond quickly to abnormal trading patterns or market volatility without real-time visibility. Small problems have the potential to grow rapidly, resulting in financial losses, harm to one’s reputation, or regulatory attention. A lack of automation also increases dependence on human intervention, which introduces inconsistency and error.

By directly integrating risk controls into day-to-day operations, modern platforms are built to address these issues. Solutions like EAERA show how automated alerts, centralized dashboards, and real-time exposure tracking enable a forex broker to keep control even in the face of rapidly shifting market conditions. Delayed risk visibility is a competitive liability in 2026, in addition to being inefficient.

Ignoring Scalability and Future Growth Requirements

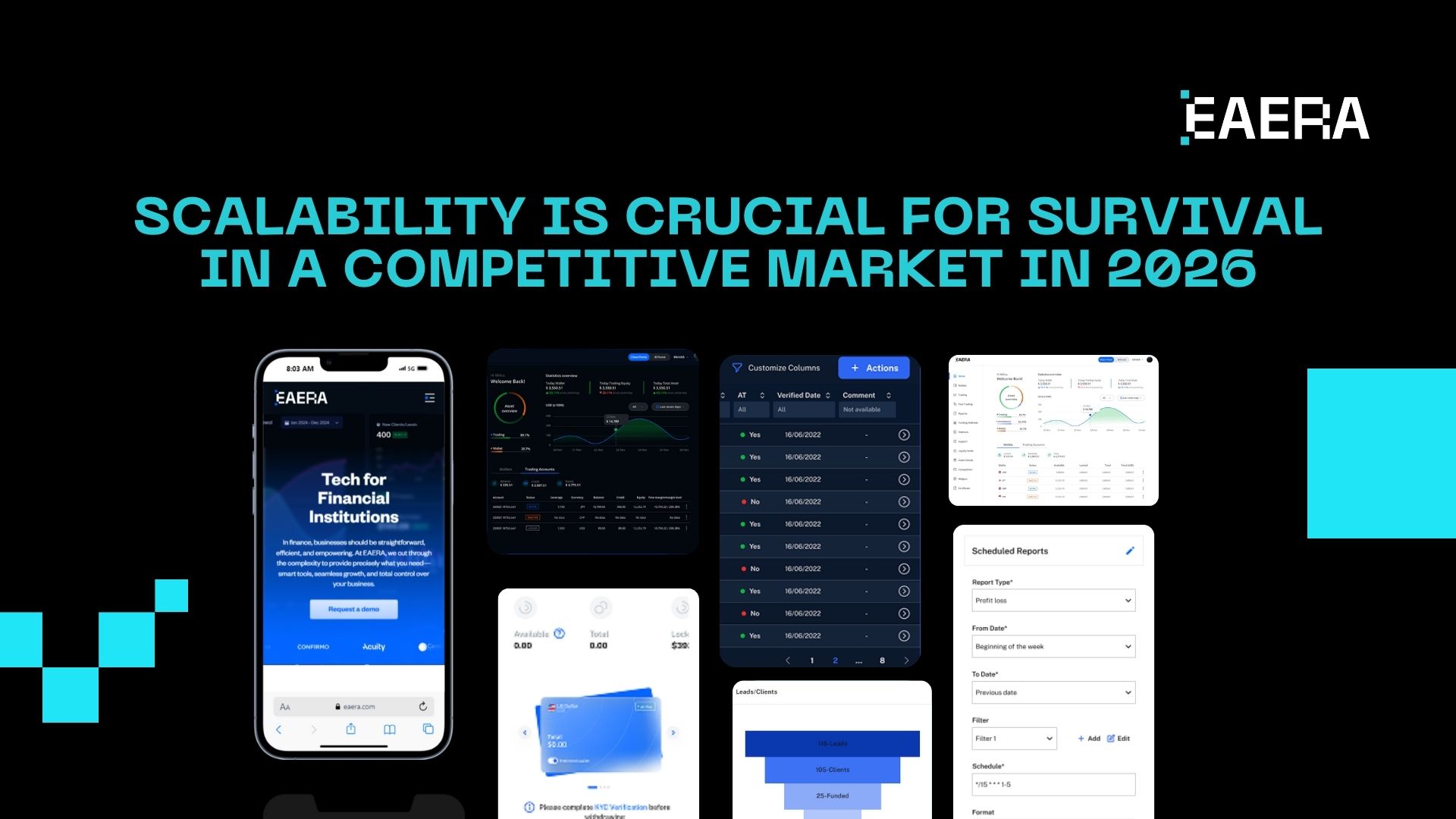

Building systems solely to meet present needs is another grave error. Without taking future growth into account, many forex brokers build workflows and infrastructure around current client volumes, product offerings, or geographical areas.

Brokers frequently encounter difficulties as they expand, such as introducing new brands, expanding into new jurisdictions, or providing support for several trading platforms. Bottlenecks result from systems that were not built with scalability in mind. Teams spend more time managing complexity than focusing on strategy and growth.

A forex broker can grow without having to reengineer its core systems thanks to scalable architecture. This includes the capacity to onboard new services without interfering with current ones, support for multi-brand operations, and adaptable configuration for various regulatory environments. Scalability is crucial for survival in a competitive market in 2026.

Weak Client Experience and Inefficient Onboarding

The expectations of clients are changing quickly. Traders anticipate quick onboarding, clear procedures, and constant channel communication. A forex broker runs the risk of losing customers before they start trading if they provide a slow or confusing user experience.

Ineffective onboarding procedures continue to be a big problem, particularly regarding KYC and account approval. Clients are irritated, and support of workloads is increased by manual document handling, ambiguous status updates, and frequent information requests.

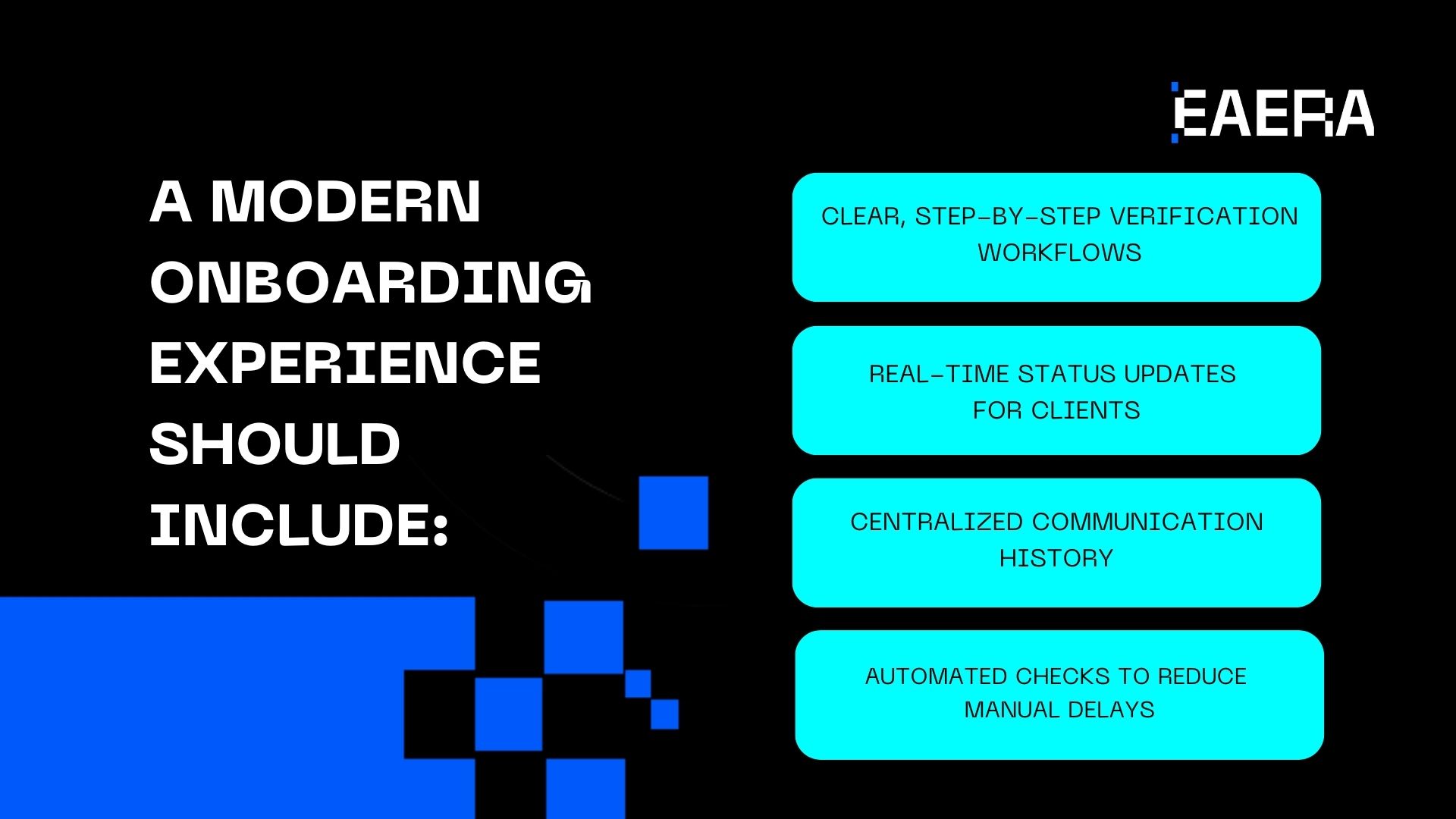

A modern onboarding experience should include:

- Clear, step-by-step verification workflows

- Real-time status updates for clients

- Centralized communication history

- Automated checks to reduce manual delays

Enhancing customer satisfaction is only one aspect of improving client experience. Conversion rates, lifetime value, and brand trust are all directly impacted. A forex broker will incur greater acquisition costs and lower retention in 2026 if they do not prioritize onboarding efficiency.

Ongoing client experience is just as important as onboarding. Traders anticipate prompt, clear access to account data, transaction history, and assistance. Even basic requests require manual investigation when systems are disconnected, which lengthens response times and causes frustration. Investing in unified client management lowers support costs and builds trust for a forex broker. Long-term customer loyalty in competitive markets is frequently determined by operational transparency.

Treating Compliance as a Reaction Instead of a System

Compliance is traditionally considered a reactive process—for instance, something to be done only as changes to regulations occur. This represents huge risks for an organization because manual auditing, inadequate logs, and inconsistent practices make it hard to act fast enough to answer any given regulator requests for information during an inquiry process.

Compliance needs to be incorporated as an integral aspect of the daily operations of the forex broker. Every activity, from the beginning of the account opening to the processing of transactions, must be traceable and auditable.

Computing platforms with integrated compliance logic can facilitate brokers to have better consistency and transparency within their computing processes. For instance, EAERA provides support for compliance-ready system design with such functionality as data centralization, structured workflow enforcement, and comprehensive audit capability. The role of compliance is not optional for 2026 computing platforms.

The biggest mistakes a forex broker makes in 2026 are not tactical errors, but fundamental ones. Underestimating technology, neglecting real-time risk management, ignoring scalability, delivering poor client experiences, and treating compliance reactively all limit long-term growth.

To avoid these pitfalls, it’s necessary to have a shift of mindset. For this, brokers need to invest more with integrated technology, maximize the inherent benefits of increased visibility and automation, and lay the foundation for long-term growth. The approach will allow them to reap the advantages of robustness, operationality, and the global market’s growing challenges to the competition.