In the Forex market, success hinges on a combination of factors: sharp trading strategies, risk management, and efficient operational processes. While traders may focus on market movements and technical analysis, the backbone of any successful Forex brokerage firm lies in its technological infrastructure. This is where brokerage software plays a pivotal role.

Forex brokerages can significantly enhance their operational efficiency and gain valuable insights into their business performance by leveraging robust brokerage software solutions. These integrated brokerage systems encompass a wide range of functionalities, including order management, risk management, and client relationship management (brokerage CRM).

By utilizing sophisticated software for brokers, firms can automate repetitive tasks, streamline workflows, and gain real-time access to critical data. A comprehensive forex broker CRM provides invaluable insights into client behavior, trading patterns, and overall market trends. This data-driven approach empowers brokerages to make informed decisions, optimize their trading strategies, and ultimately achieve sustainable growth and profitability.

Related articles:

- Forex CRM Explained: What It Is and How It Benefits Your Brokerage

- Choosing the Best CRM for FX Brokers: A Step-by-Step Guide

1. What is Forex Broker Software?

At its core, brokerage software encompasses a suite of integrated brokerage systems designed to streamline and automate various aspects of a Forex brokerage firm’s operations. This includes everything from client onboarding and account management to order execution, risk management, and back-office functions. Essentially, it provides the technological foundation upon which the entire business operates.

By employing top-notch brokerage software, firms can ensure seamless operations while offering superior services to their clients. These systems combine advanced features, such as algorithmic trading and real-time monitoring, to deliver unparalleled performance and reliability.

2. Why Forex Broker Solutions are Critical for Business Success

The advantages of implementing brokerage software solutions are numerous:

2.1. Enhanced Operational Efficiency

By leveraging advanced brokerage software, firms can significantly enhance operational efficiency. Automation streamlines repetitive tasks such as order entry, trade confirmations, and client account updates, freeing up valuable time for staff to focus on more strategic initiatives.

Furthermore, these sophisticated brokerage systems optimize business processes, minimizing manual intervention and reducing the risk of human error. This streamlined workflow directly translates to increased productivity, enabling faster order execution and improved trade processing speeds, ultimately contributing to overall business growth.

2.2. Improved Risk Management

Brokerage software solutions prioritize risk management. Real-time Monitoring provides crucial insights into market fluctuations and client positions, enabling proactive risk mitigation measures.

Additionally, brokerage systems often incorporate Automated Risk Checks that implement automated rules and alerts to identify and manage potential risks, such as excessive leverage or margin calls. This proactive approach not only safeguards client accounts but also ensures brokerage software providers maintain Enhanced Compliance with regulatory requirements and industry best practices.

2.3. Enhanced Client Experience

Brokerage software empowers firms to enhance client relationships significantly. By leveraging a robust brokerage CRM, brokers can offer Personalized Service tailored to individual client needs and preferences.

These systems provide clients with Improved Customer Support, such as 24/7 access to account information and trading platforms, enhancing customer satisfaction. Enhanced Communication is facilitated through seamless integration between client portals and broker interfaces, fostering stronger relationships and building trust within the client base.

2.4. Valuable Business Insights

Brokerage software empowers data-driven decision-making, providing a significant competitive advantage. These sophisticated brokerage systems generate comprehensive reports and analytics on trading activity, client behavior, and market trends.

This valuable data enables Data-Driven Decision Making to optimize trading strategies, identify new revenue streams, and ultimately Improve Profitability. By leveraging these insights, firms can gain a Competitive Advantage by operating more efficiently, offering superior client service, and adapting quickly to changing market dynamics.

3. Key Features to Look for in Forex Broker Solutions

Selecting the optimal brokerage software solution is crucial for the success of any Forex brokerage firm. A technological foundation is essential for efficient operations, enhanced risk management, and improved client satisfaction. When evaluating brokerage software options, several key features must be considered.

3.1. Order Management System (OMS)

A strong Order Management System (OMS) is paramount. This system should enable efficient order routing to multiple liquidity providers, ensuring the best possible execution prices. Moreover, it should facilitate order matching and execution across various trading instruments and support the implementation of automated trading strategies.

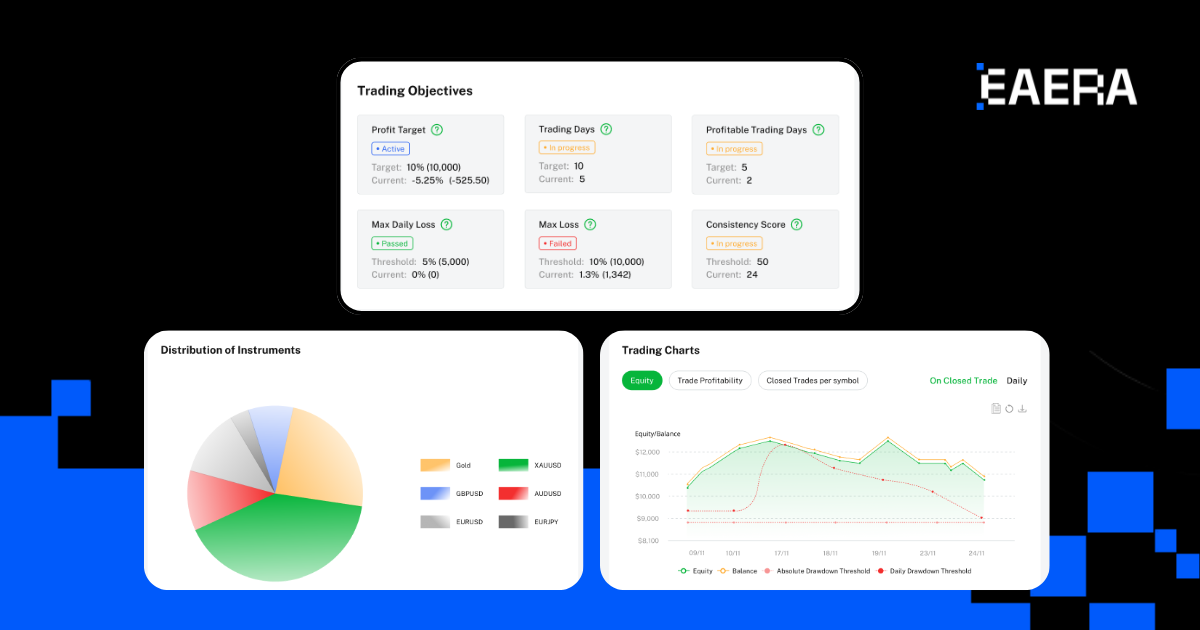

3.2. Risk Management System (RMS)

A sophisticated Risk Management System (RMS) is indispensable. This system should accurately calculate margin requirements and monitor client positions in real-time. It should also support the implementation of stop-loss and take-profit orders to limit potential losses and enforce position limits to mitigate risk and ensure client and firm stability.

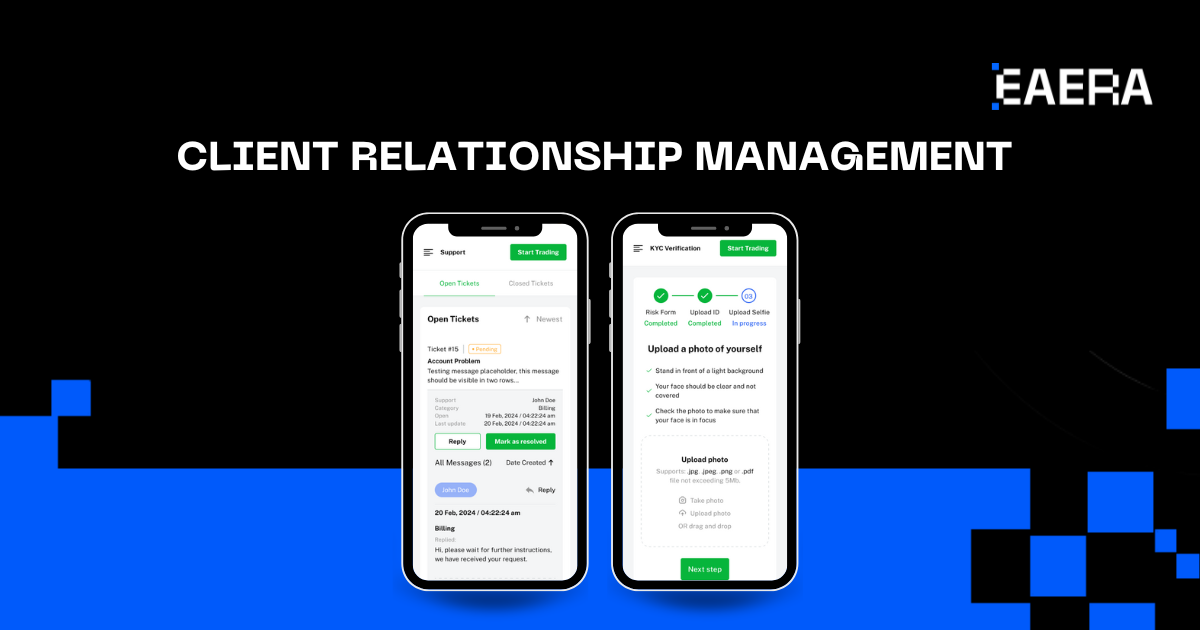

3.3. Client Relationship Management (CRM)

A comprehensive Client Relationship Management (CRM) system should streamline the client onboarding process, including KYC/AML checks and account opening. It should also facilitate seamless communication with clients through various channels, such as email, chat, and phone. Moreover, it should enable client segmentation based on trading activity, risk profile, and other criteria, allowing for personalized service offerings.

3.4. Trading Platform Integration

The brokerage software should integrate seamlessly with popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, ensuring real-time data synchronization between the trading platform and the back-office system.

3.5. Reporting and Analytics

The system should provide real-time dashboards with key performance indicators (KPIs), such as trading volume, client activity, and profitability. It should also generate customizable reports to meet specific business needs and regulatory requirements. Last but not least, business intelligence tools could leverage business intelligence tools to gain deeper insights into market trends and client behavior.

3.6. Compliance and Security

The brokerage software must ensure compliance with relevant regulations, such as those issued by the Financial Conduct Authority (FCA), the Securities and Exchange Commission (SEC), and other regulatory bodies. Robust security measures must be implemented to protect sensitive client data and prevent unauthorized access.

By carefully evaluating these key features, Forex brokerage firms can select the most suitable brokerage software solution to support their business growth, enhance operational efficiency in the Forex market.

4. Trends Shaping Forex Broker Software in 2025 and Beyond

Building upon these essential features, the Forex broker software landscape is constantly evolving, driven by several key trends that are reshaping the industry. There are several key trends that forex brokers should always keep their eyes on:

4.1. Artificial Intelligence (AI) and Machine Learning

The integration of AI and machine learning technologies is transforming the trading landscape by automating decisions and optimizing portfolio management. These advanced algorithms not only streamline trading processes but also enhance predictive capabilities, enabling the accurate forecasting of market trends and identification of potential trading opportunities. The implementation of AI-powered chatbots ensures seamless 24/7 customer support, addressing client inquiries promptly and elevating the overall user experience. Together, these innovations are redefining efficiency and customer engagement in the trading industry.

4.2. Blockchain Technology

The integration of Decentralized Finance (DeFi) technologies is revolutionizing Forex trading by enhancing transparency, security, and operational efficiency. By leveraging blockchain-based solutions, traders benefit from increased trust and streamlined processes. Additionally, the platform supports cryptocurrency trading, offering access to digital assets such as Bitcoin, Ethereum, and a wide range of other cryptocurrencies. This dual focus on DeFi and crypto trading positions the platform at the forefront of modern financial markets, catering to both traditional and digital asset traders.

4.3. Cloud Computing

The increasing adoption of cloud-based brokerage software solutions is driving significant advancements in scalability, flexibility, and cost-effectiveness for trading platforms. These solutions enable seamless operations and rapid adaptation to market demands while optimizing resource allocation. Additionally, leveraging cloud-based security measures ensures the protection of sensitive data, safeguarding it against potential cyber threats. This strategic use of cloud technology not only enhances operational efficiency but also reinforces trust through improved data security.

5. What Should You Know Before Choosing Forex Broker Software?

Selecting the right brokerage systems is a critical decision that can significantly impact a firm’s success. Key considerations include:

5.1. Business Requirements

To effectively implement a robust trading solution, it is essential to clearly define specific business requirements, including projected trading volume, target client base, and adherence to regulatory compliance standards. This clarity ensures that the solution aligns with operational goals and industry regulations. A thorough evaluation of the existing IT infrastructure is critical to identify potential integration challenges, enabling proactive planning and seamless deployment of the new system. This approach minimizes disruptions and ensures the infrastructure can support future growth and evolving business needs.

5.2. Vendor Evaluation

The right vendor for trading solutions involves a structured approach. Begin by conducting thorough research on potential vendors, assessing their reputation, industry experience, and client testimonials to gauge reliability and expertise. Follow this with requesting demos and trials to evaluate the software’s functionality, ease of use, and compatibility with your business requirements. Finally, compare pricing and licensing models offered by different vendors to identify the most cost-effective solution that delivers optimal value without compromising on quality or performance. This systematic process ensures an informed decision that aligns with both operational needs and budget constraints.

5.3. Scalability and Flexibility

Select a solution that is flexible and adaptable to dynamic market conditions and evolving business requirements. Ensure that the chosen platform is designed to scale seamlessly, accommodating future growth in trading volume and an expanding client base. By prioritizing scalability and adaptability, the solution will support long-term business objectives while maintaining efficiency and performance in an ever-changing trading environment.

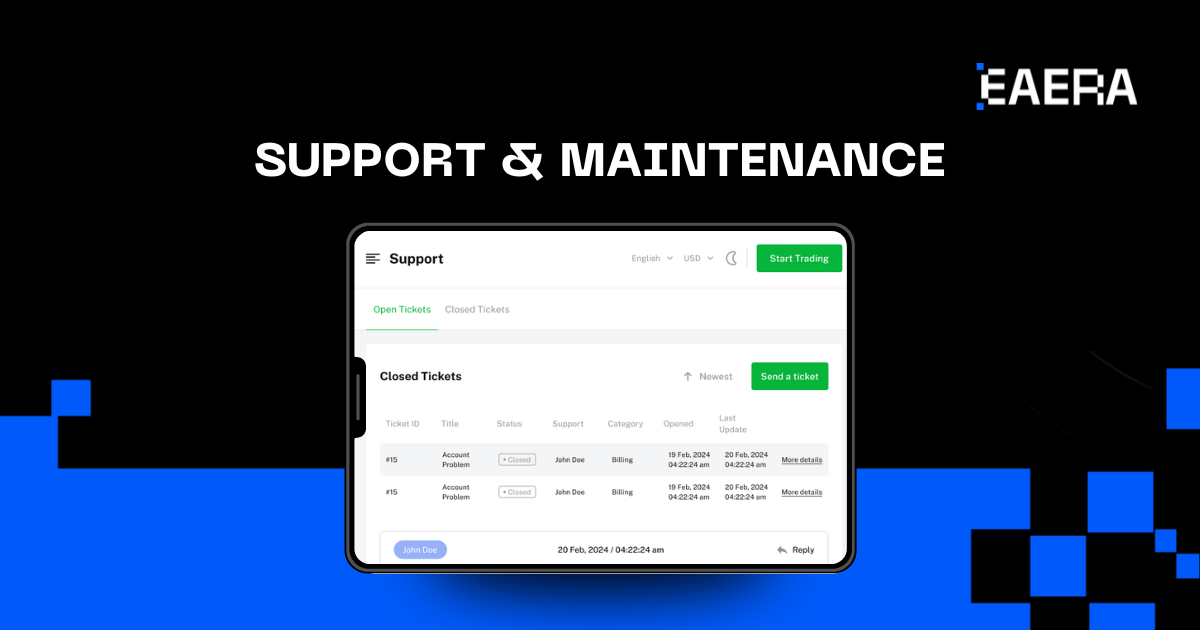

5.4. Support and Maintenance

When choosing a trading solution, carefully evaluate the level of vendor support offered. Assess their availability, responsiveness, and technical expertise to ensure they can promptly address issues and provide reliable assistance. Additionally, inquire about maintenance and upgrade options, including associated costs, the frequency of updates, and expected downtime. Understanding these factors will help brokerage choose a vendor that not only meets current operational needs but also provides ongoing support for long-term success.

5.5. Compliance

Ensuring that it complies fully with all relevant regulatory requirements to maintain legal and operational integrity. Additionally, verify that the vendor has robust security measures in place to protect sensitive client data, such as encryption, multi-factor authentication, and regular security audits. These precautions are essential to safeguarding client trust and ensuring compliance with industry standards.

By investing in the right brokerage CRM and systems, firms can enhance operational efficiency, improve risk management, and deliver a superior client experience.

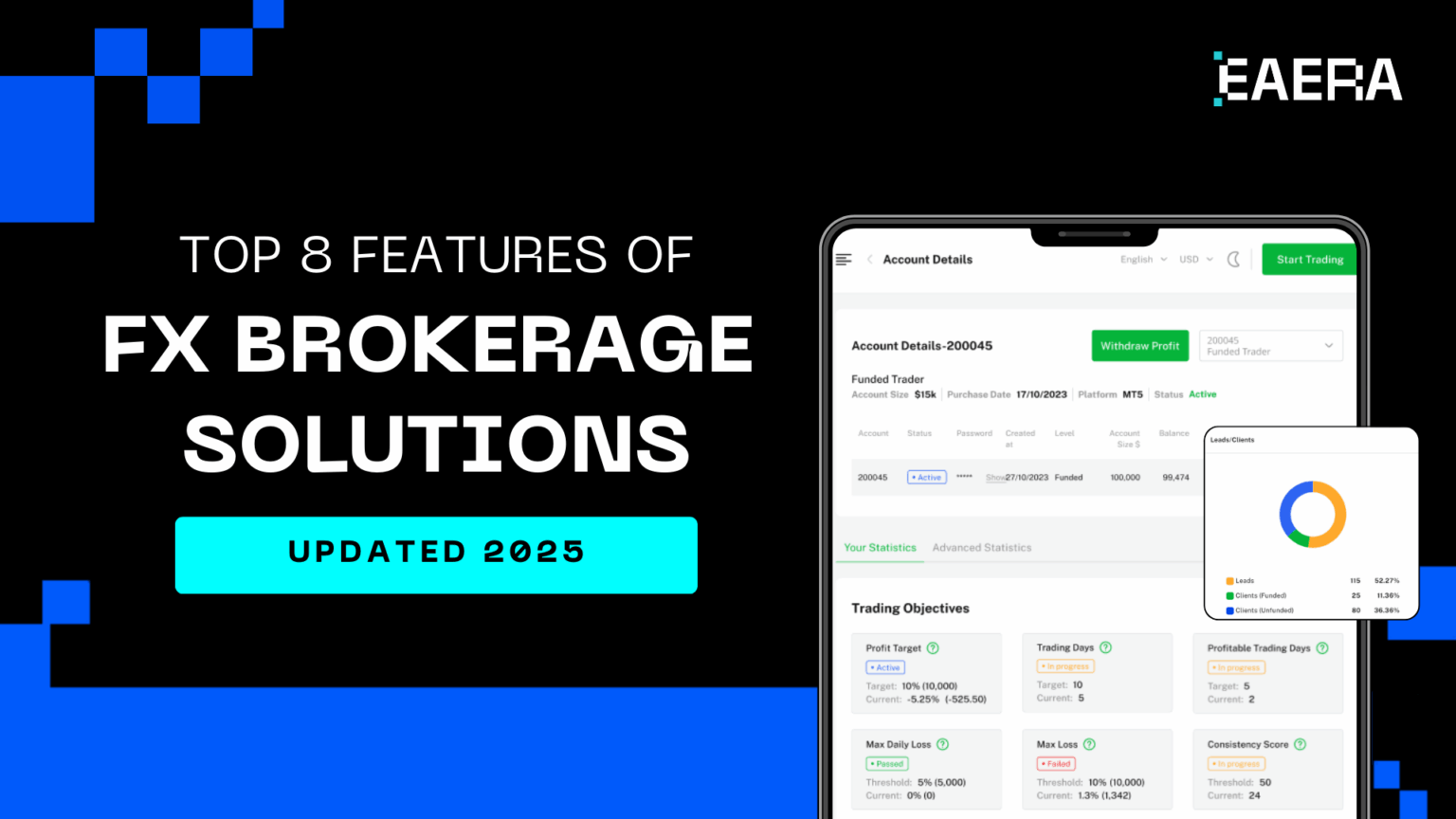

6. Why Choose EAERA for Your Forex Brokerage

EAERA stands out as a must-have Forex broker software due to its comprehensive features that cater to the complex needs of modern brokerage companies. As one of the advanced brokerage systems on the market, EAERA streamlines operations with robust tools for order management, real-time risk monitoring, and seamless integration with leading trading platforms.

Key Features of EAERA’s Forex CRM Software:

- Seamless integration with trading platforms to provide a unified experience.

- Advanced analytics for customer segmentation, trader behavior analysis, and actionable insights.

- Built-in compliance features for streamlined regulatory adherence and risk management.

With EAERA, you can confidently overcome the challenges of the FX market while unlocking new growth opportunities, making it the essential tool for clear business insights.