The Forex market remains one of the most dynamic and fast-paced financial sectors worldwide. As we move into 2025, major transformations are reshaping how brokerages operate, compete, and grow. From regulatory compliance to digital innovation, Forex broker solutions are becoming more advanced, integrated, and essential than ever. To stay ahead in a competitive landscape, brokers must adopt Forex broker solutions that are scalable, secure, and built to meet the evolving expectations of today’s tech-savvy traders.

1. Which New Trends Are Defining the Top Forex Broker Solutions in 2025?

The landscape of Forex broker solutions is rapidly evolving in 2025, driven by technological innovation, heightened regulatory demands, and rising client expectations. To stay ahead, brokers must adopt scalable, intelligent, and future-proof strategies. The most successful brokerages are those that fully integrate Forex broker solutions into every aspect of their business.

Below are the top 5 trends shaping the next generation of Forex broker solutions in today’s competitive market:

1.1. Regulatory Developments and Adaptation

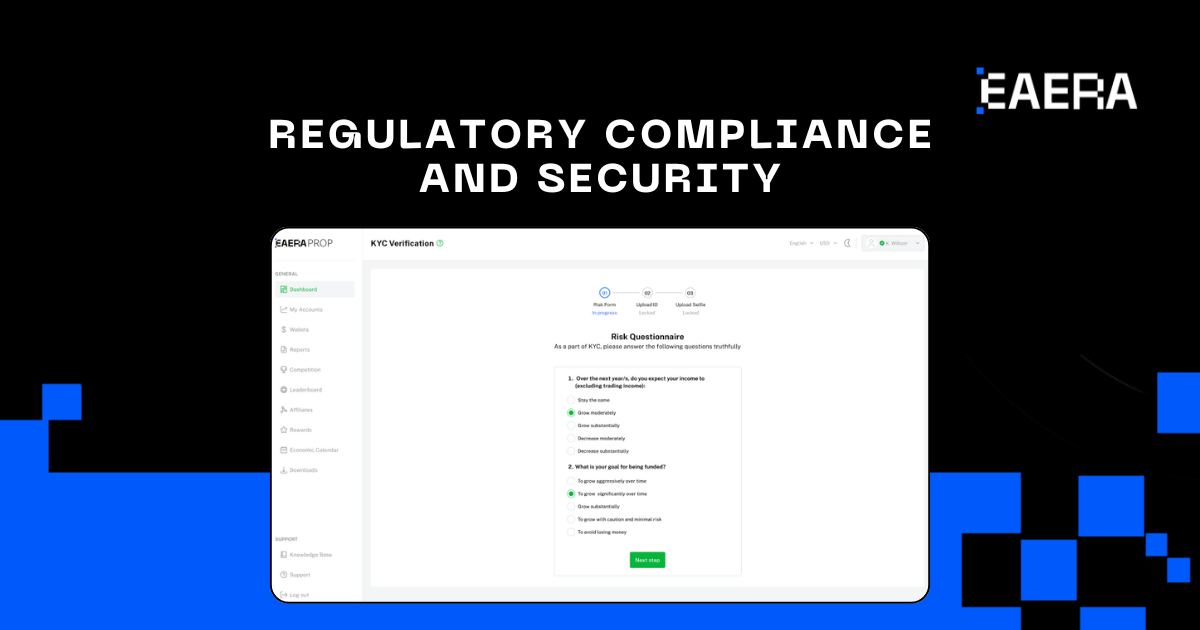

As global regulatory frameworks grow stricter, compliance is no longer optional—it’s a strategic advantage. Modern Forex broker solutions come equipped with built-in compliance tools, streamlining processes like KYC, AML, and regulatory reporting. These systems ensure real-time data transparency and secure handling of sensitive client information.

1.2. Blockchain and Cryptocurrencies: Beyond Speculation

Blockchain is now a core component of innovative Forex broker solutions, powering faster settlements, tamper-proof records, and secure transaction flows. With more traders seeking exposure to digital assets, brokers are expanding their offerings through tokenized assets and blockchain-backed operations.

1.3. Strategic Expansion into Emerging Markets

Top-tier Forex broker solutions are designed with localization in mind, helping brokers penetrate fast-growing markets in Asia, Africa, and Latin America. These solutions provide multilingual interfaces, mobile-friendly tools, regional payment integrations, and support for local regulations.

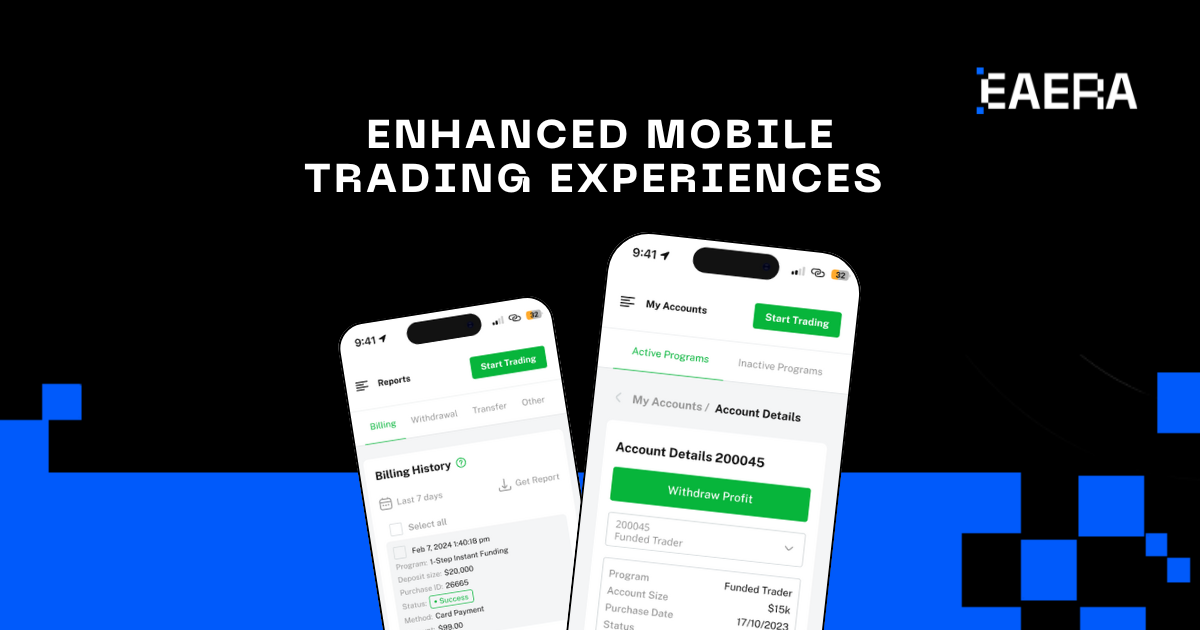

1.4. Enhanced Mobile Trading Experiences

Mobile platforms are essential to modern traders. Advanced Forex broker solutions now include mobile-first interfaces with full desktop-level functionality. Features like real-time charting, AI-based alerts, and biometric security ensure a seamless and secure mobile trading experience.

1.5. Prioritizing Trader Education and Support

Leading Forex broker solutions embed educational resources directly into the platform. From live webinars to AI-curated market insights, these tools empower traders to improve continuously. Combined with multilingual support and 24/7 service, education and customer care now play a critical role in broker success.

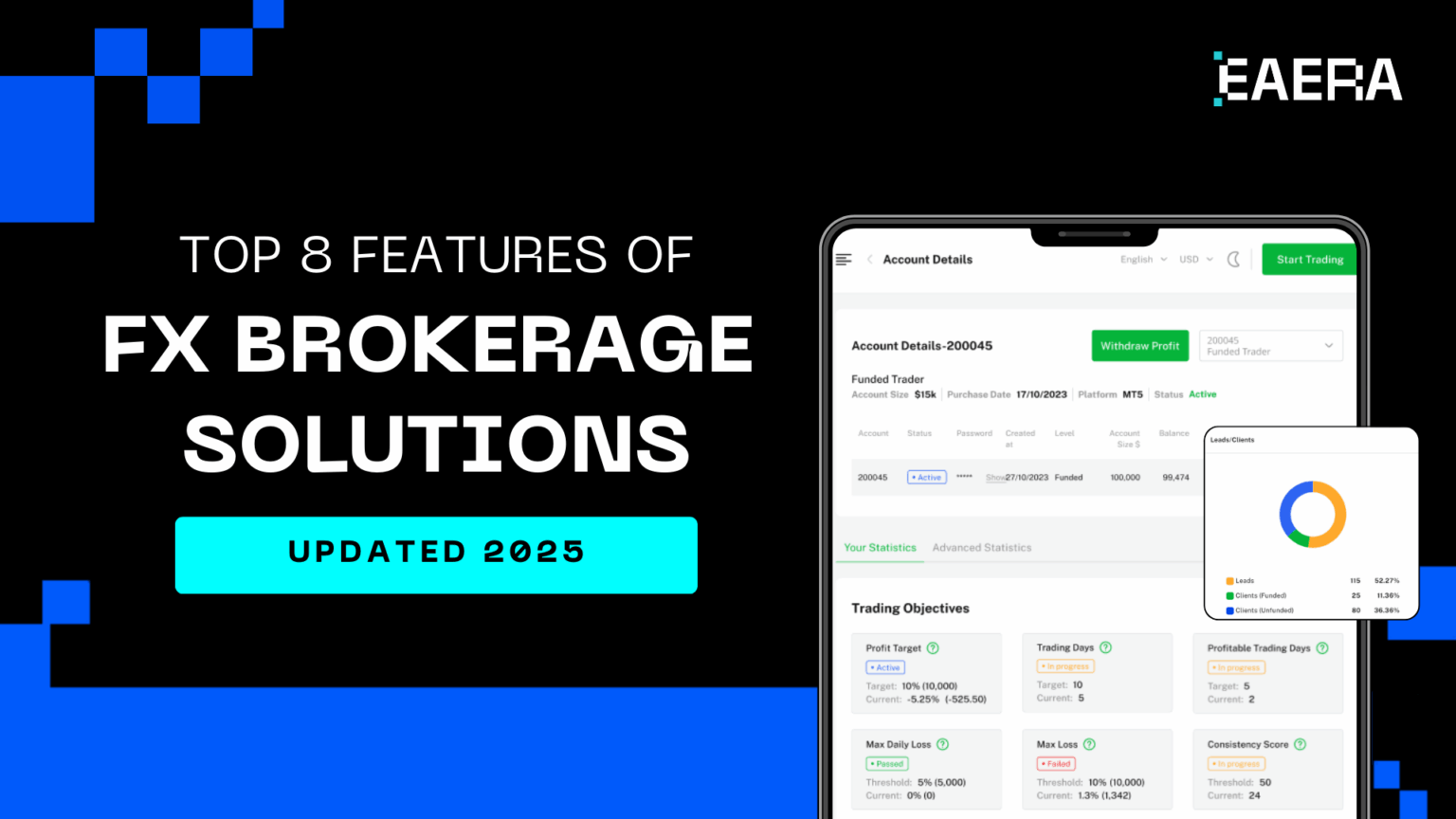

2. Main Forex Broker Solutions Features Every Broker Needs in 2025

In 2025, successful brokerages rely on more than just CRM software—they depend on robust Forex broker solutions that serve as the central hub for daily operations, client management, and growth. These solutions go beyond contact databases to deliver advanced features that drive performance and competitiveness. Here are the key capabilities your Forex broker solutions must include:

2.1. Multi-Asset Compatibility

Today’s traders demand access to various asset classes beyond just Forex. The best Forex broker solutions offer comprehensive support for a wide range of instruments, including Forex, indices, stocks, commodities, and cryptocurrencies. This level of flexibility in Forex broker solutions helps brokers attract a diverse client base and provide a complete trading experience that meets modern demands.

2.2. AI-Powered Automation and Analytics

Advanced Forex broker solutions now leverage artificial intelligence to automate repetitive tasks, enhance client personalization, and deliver predictive insights. From automated KYC/AML processes to intelligent marketing automation, AI helps brokerages save time and make more informed business decisions.

2.3. Real-Time Data Integration

In today’s fast-paced trading environment, real-time data is essential. Leading Forex broker solutions integrate with reliable data providers to ensure brokers and traders get instant updates on market movements, news, and trends. These real-time capabilities are crucial for brokers relying on Forex broker solutions to react quickly to market shifts and make timely decisions.

2.4. Low-Latency Execution Integration

Trade execution speed is a key differentiator. Effective Forex broker solutions are designed to work hand-in-hand with low-latency platforms, minimizing slippage and delays to ensure a fast, smooth trading experience for clients.

2.5. Scalable Architecture and Cloud Flexibility

As your brokerage grows, so must your technology infrastructure. Cloud-based Forex broker solutions offer scalability, allowing brokers to efficiently manage increasing trade volumes and data demands. These Forex broker solutions enable secure, remote access and the flexibility to scale without compromising performance or security.

2.6. Advanced Security and Regulatory Compliance

Security and compliance are at the core of reliable Forex broker solutions. With built-in KYC/AML features, GDPR compliance, and advanced encryption, these systems protect client data and meet evolving regulatory demands. Trusted Forex broker solutions also ensure data transparency and secure user access.

3. Choosing the Right Software: A Forex Broker Solutions Checklist

Selecting the right technology is vital for any brokerage looking to compete in today’s fast-moving market. The right Forex broker solutions provide the tools and flexibility needed to support growth, enhance security, and improve client satisfaction. Use this checklist to evaluate the software that powers your brokerage:

- Integration: Ensure the Forex broker solutions integrate smoothly with your trading platforms, CRM, back office, and other core systems

- Customization: Look for solutions that adapt to your unique workflows and business model

- Scalability: Choose Forex broker solutions that scale with your brokerage as client numbers and transaction volumes grow

- Security: Robust security features are essential to protect client data and prevent breaches

- Compliance: The best Forex broker solutions support automated regulatory compliance, including KYC, AML, and reporting

- Support: Check that your provider offers dependable support, onboarding assistance, and training

- Cost and Features: Consider total cost of ownership. Leading Forex broker solutions offer multi-asset support, AI analytics, mobile access, and performance monitoring as standard

By evaluating your needs and carefully researching available options, you can select Forex broker solutions that empower your brokerage to grow and compete in the evolving 2025 market. Choosing the right CRM or trading software isn’t just a tech decision—it’s a strategic move toward long-term success. The best Forex broker solutions help streamline operations, ensure compliance, and deliver better client experiences.

Why Choose EAERA?

- Seamless integration with MT4, MT5, cTrader & more

- Built-in compliance and data security (GDPR, KYC/AML)

- AI-powered automation for smarter decision-making

- Scalable Forex broker solutions for all brokerage sizes

- 24/7 expert support for uninterrupted service

With EAERA’s advanced Forex broker solutions, your brokerage can maximize efficiency, automate workflows, and scale faster than ever. Contact us today and experience the power of EAERA’s all-in-one CRM solution!