Choosing the right forex CRM software is critical for any FX broker looking to boost client satisfaction, streamline operations, and drive business growth. With so many options on the market, it’s essential to focus on CRM solutions that truly deliver results. In this article, we’ll explore the seven key characteristics that set exceptional forex CRM software apart—so you can make an informed decision for your brokerage and stay ahead in the competitive forex industry.

Related articles:

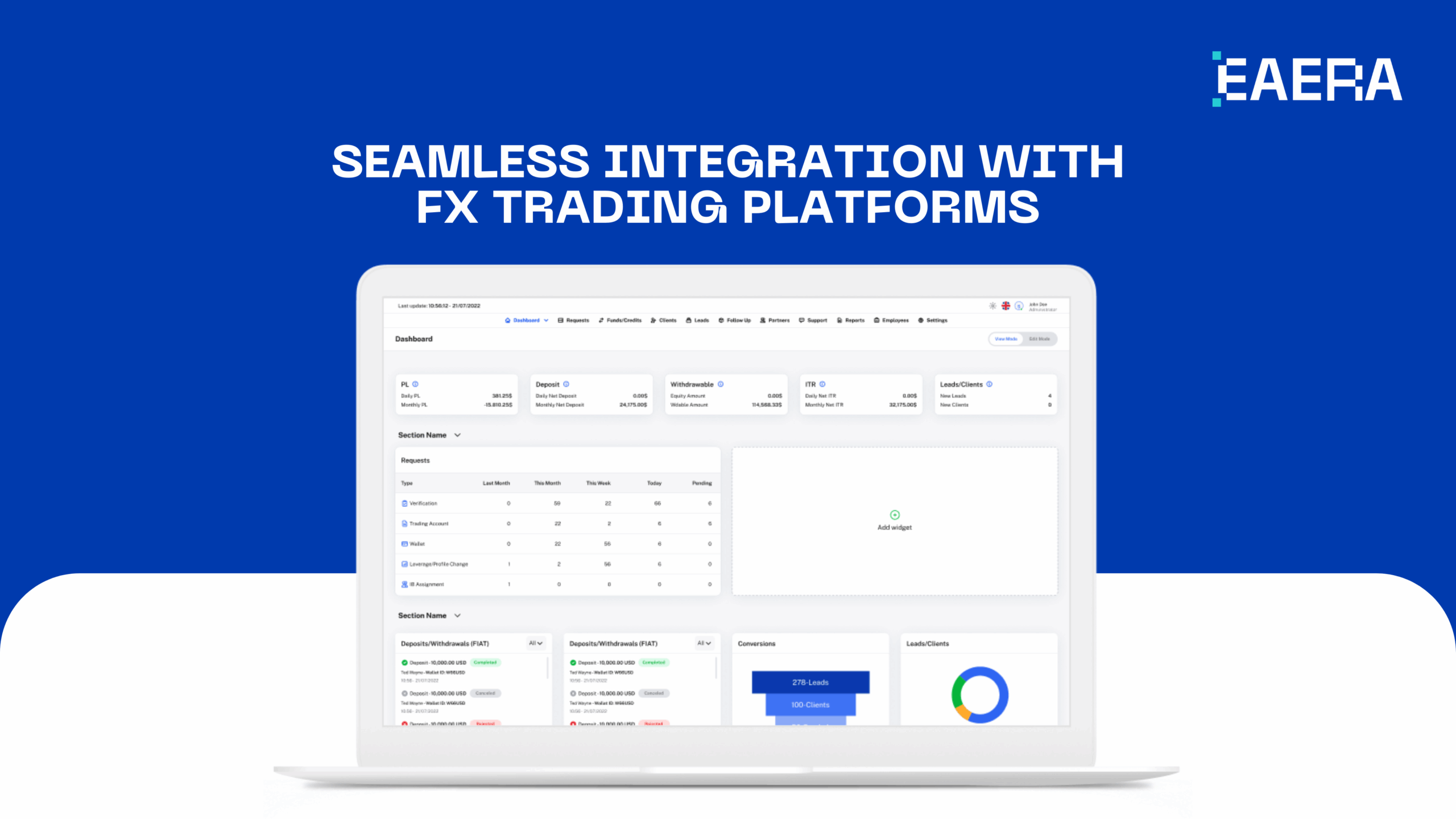

1. Seamless Integration with FX Trading Platforms

A reliable forex CRM software must integrate smoothly with leading FX trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. This seamless connection ensures brokers can:

- Access real-time trading data and monitor client activity.

- Automate account creation, deposits, and withdrawals to enhance user experience.

- Provide clients with up-to-date reports on their trading performance.

For example, a European FX broker saw a 30% reduction in customer service inquiries after integrating its forex CRM software with MT5, allowing traders to access account details directly through the trading platform. Without proper integration between your FX trading platform and forex CRM software, brokers risk fragmented operations, leading to inefficiencies that negatively impact both clients and internal teams.

2. Advanced Lead Management and Automated Marketing in Forex CRM Software

A strong forex CRM software must offer an efficient lead management system that automates the process of capturing and nurturing potential clients. Key features include:

- Lead segmentation based on client trading history, location, and risk tolerance.

- Automated email and SMS follow-ups for engagement.

- AI-driven scoring to prioritize high-value prospects.

One leading brokerage firm in Asia implemented AI-driven lead scoring within their forex CRM software, allowing their sales team to focus on the most promising traders. This led to a 20% increase in conversion rates within three months. Automation in forex CRM software ensures brokers maximize efficiency while maintaining a high level of client engagement.

Additionally, AI-powered chatbots are now playing a significant role in lead engagement. An FX trade broker in the UK integrated chatbots with their CRM to handle preliminary inquiries, resulting in 40% faster response times and higher lead retention. This highlights how automation within forex CRM software enhances customer experience while freeing up human resources for high-priority tasks.

3. Multi-Level IB and Affiliate Management for Forex CRM Software

Brokers rely heavily on Introducing Brokers (IBs) and affiliates to expand their client base. The best forex CRM software provides tools for:

- Tracking multi-tier IB commissions in real-time.

- Automating revenue-sharing calculations for accuracy.

- Generating performance reports to assess partner effectiveness.

A growing FX broker in the Middle East switched to forex CRM software with a robust IB tracking system and saw a 35% increase in referrals due to improved transparency and automated commission payouts. Forex CRM software that offers effective IB and affiliate management helps brokers streamline partner operations and eliminate manual errors.

Without a well-structured IB management system within forex CRM software, brokers risk losing valuable partners due to inefficiencies. For example, a large-scale FX trade broker in Australia improved its IB retention rate by 20% after implementing forex CRM software that allowed IBs to track commissions in real-time. This level of transparency fostered stronger partnerships and encouraged more referrals.

4. Compliance and Regulatory Management in Forex CRM Software

Regulatory requirements are becoming stricter, making compliance a critical factor for all FX trade brokers. The right forex CRM software should include:

- Built-in KYC and AML verification processes.

- Automated document submission and approval workflows.

- Real-time tracking of suspicious activities to prevent fraud.

For example, an Australian brokerage using AI-powered forex CRM software for compliance reduced the time required for KYC verification by 40%, allowing them to onboard clients faster without compromising security. Non-compliance can lead to heavy fines and reputational damage, making forex CRM software with robust regulatory management features absolutely essential for brokers.

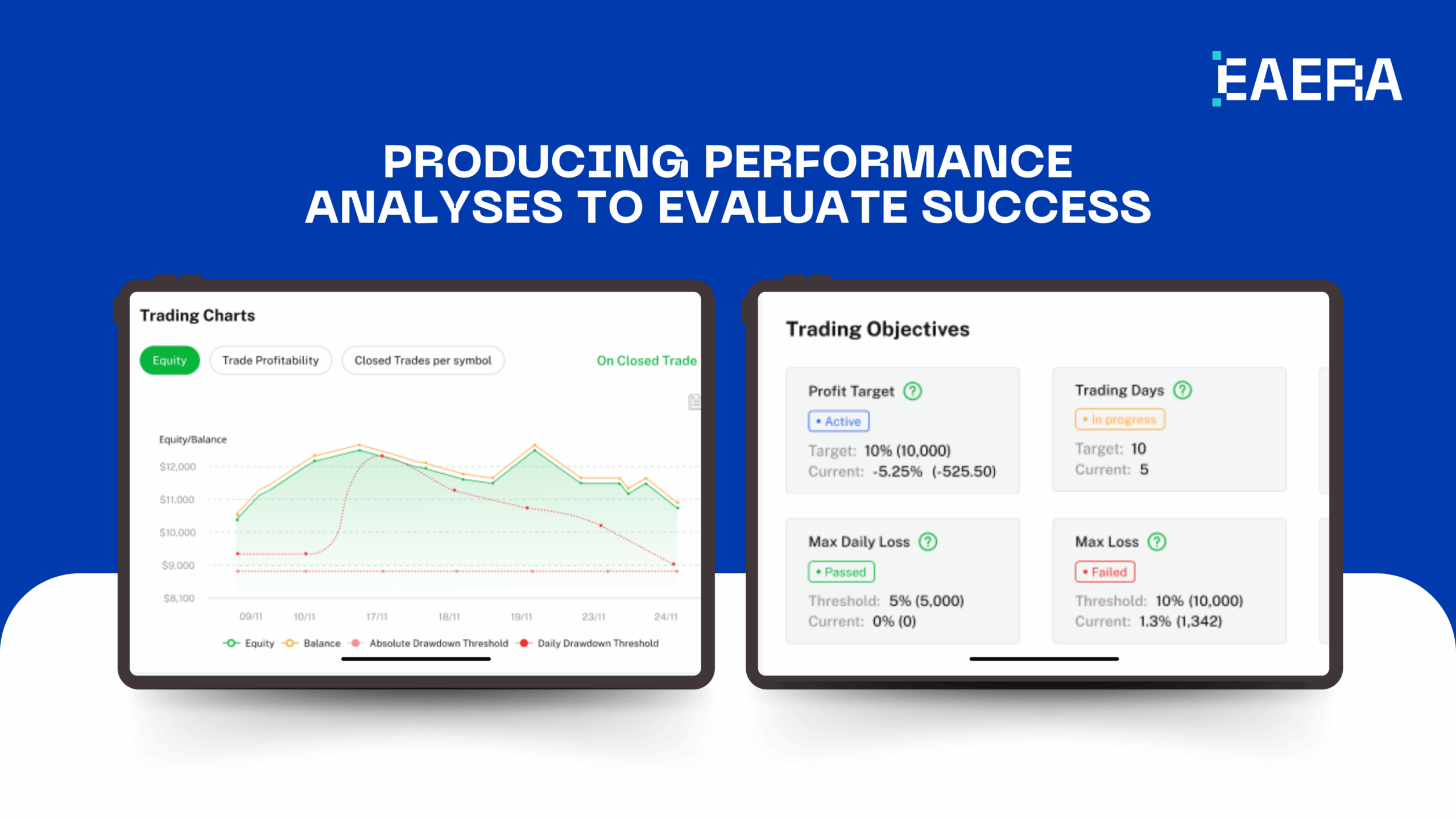

5. AI-Powered Analytics and Reporting for Better Results

Data-driven decision-making is vital for modern brokers, and high-quality forex CRM software must provide real-time analytics and predictive insights to optimize brokerage operations. With forex CRM software, brokers can:

- Identifying inactive traders and re-engaging them with personalized offers.

- Monitoring deposit and withdrawal trends to detect anomalies.

- Enhancing risk management through AI-driven fraud detection.

A North American FX broker integrated AI analytics into its forex CRM software, identifying clients at risk of churn. By launching a targeted retention campaign, they reduced churn by 15% within six months. Predictive analytics in forex CRM software enable brokers to anticipate challenges and take proactive measures.

Furthermore, FX trading platform integrations with forex CRM software analytics allow brokers to generate customized reports on profitability trends, enabling better strategic planning. One European firm successfully increased its monthly revenue by 12% after implementing AI-driven CRM insights.

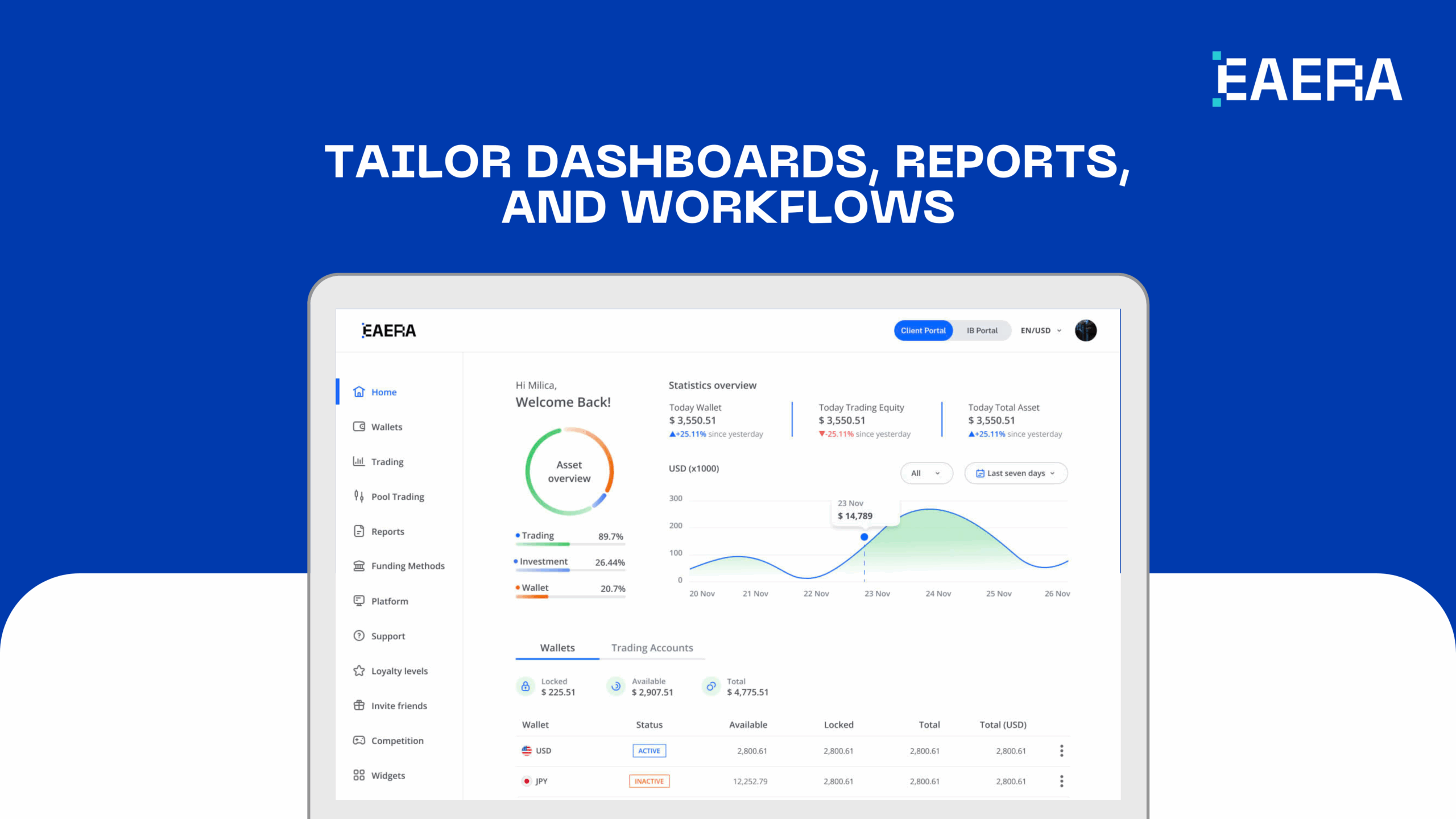

6. Customization and Scalability of Forex CRM Software

Every brokerage has unique needs, and a one-size-fits-all solution may not be effective. The best forex CRM software should be flexible and scalable, allowing brokers to:

- Customize dashboards, reports, and workflows to fit business objectives.

- White-label forex CRM software features to align with branding.

- Scale operations efficiently without system limitations.

A startup FX trade broker that initially operated in a single region successfully expanded into three new markets by adopting a highly customizable forex CRM software. The ability to tailor CRM features is crucial for growing brokerages looking to expand into new markets.

A mid-sized broker in South America needed a CRM that could integrate seamlessly with multiple regional payment providers. By implementing a scalable forex CRM software, they reduced transaction processing times by 25% and expanded their client base without operational roadblocks.

7. Strong Security and Data Protection in Forex CRM Software

Given the sensitive nature of client financial data, a forex CRM software must prioritize security. Essential security features include:

- End-to-end encryption to protect transactions and communications.

- Multi-factor authentication (MFA) for account security.

- Compliance with GDPR, AML, and other regulatory requirements.

A well-established FX broker in Europe upgraded to a more secure forex CRM software, which led to a 70% reduction in cyber threats due to enhanced encryption and automated security audits. A secure CRM ensures that client data remains protected and builds trust between the broker and its traders.

Why EAERA is the Best Forex CRM Software for FX Brokers?

Choosing the right forex CRM software can define the success of a brokerage. EAERA offers a feature-rich solution designed to optimize client management, enhance compliance, and maximize operational efficiency. With seamless integration into major FX trading platforms, AI-driven analytics, multi-level IB tracking, and high-level security, EAERA provides the ultimate CRM system for brokers looking to scale and improve profitability.

If you’re ready to elevate your brokerage and streamline operations, EAERA’s advanced forex CRM software is the perfect fit. Contact us today and discover how our technology can transform your fx trade broker business.