In today’s competitive trading landscape, brokers must streamline operations, ensure compliance, and retain clients—while continuing to scale. That’s why more firms are relying on forex CRM software to manage leads, automate onboarding, and integrate with platforms like MT4 and MT5. Unlike generic systems, forex CRM software is built specifically for the needs of forex and CFD brokers. In this article, we’ll explore its critical role in optimizing broker operations and driving long-term business growth.

1. What is Forex CRM software?

Forex CRM software is a specialized customer relationship management system built specifically for forex and CFD brokerages. Unlike generic CRMs, it’s designed to handle the unique needs of trading businesses—such as client onboarding, platform integration, compliance (KYC/AML), and affiliate management.

While standard CRMs focus on sales and support, forex CRM software goes further by connecting directly to trading platforms like MT4/MT5, giving brokers real-time insights and full control over client activity and operational workflows.

2. Core Benefits of Forex CRM Software

A robust forex CRM software solution brings significant advantages to brokerage firms by streamlining key processes and enhancing client engagement. Here are the core benefits:

Optimized Lead Management:

Capture, score, and nurture leads through automated workflows, helping your sales team focus on the most promising prospects.

Client Lifecycle Coordination:

From onboarding to retention, forex CRM software enables seamless tracking of client interactions and automates personalized communications.

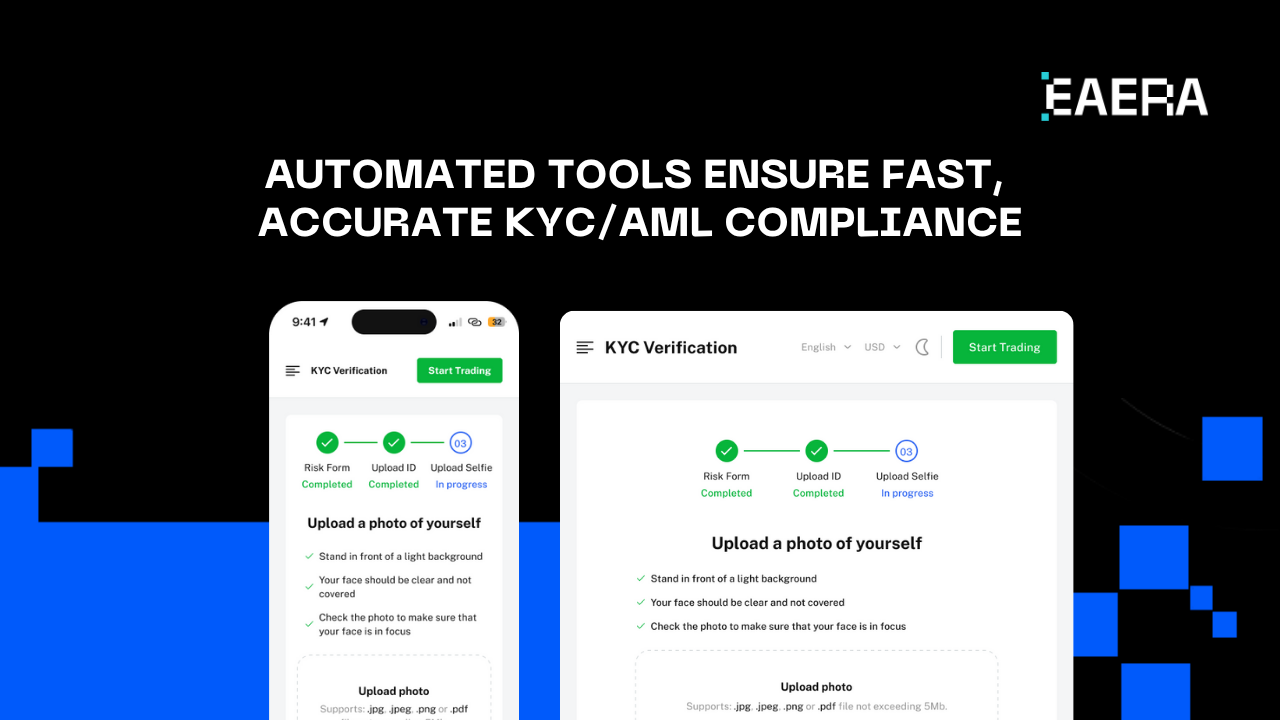

Automated Compliance & KYC/AML:

Built-in tools for identity verification and document tracking ensure you meet regulatory requirements efficiently and accurately.

Platform Integration (MT4/MT5/…):

Connect with trading platforms in real time to monitor client activity, manage accounts, and offer responsive support—all within your forex CRM software.

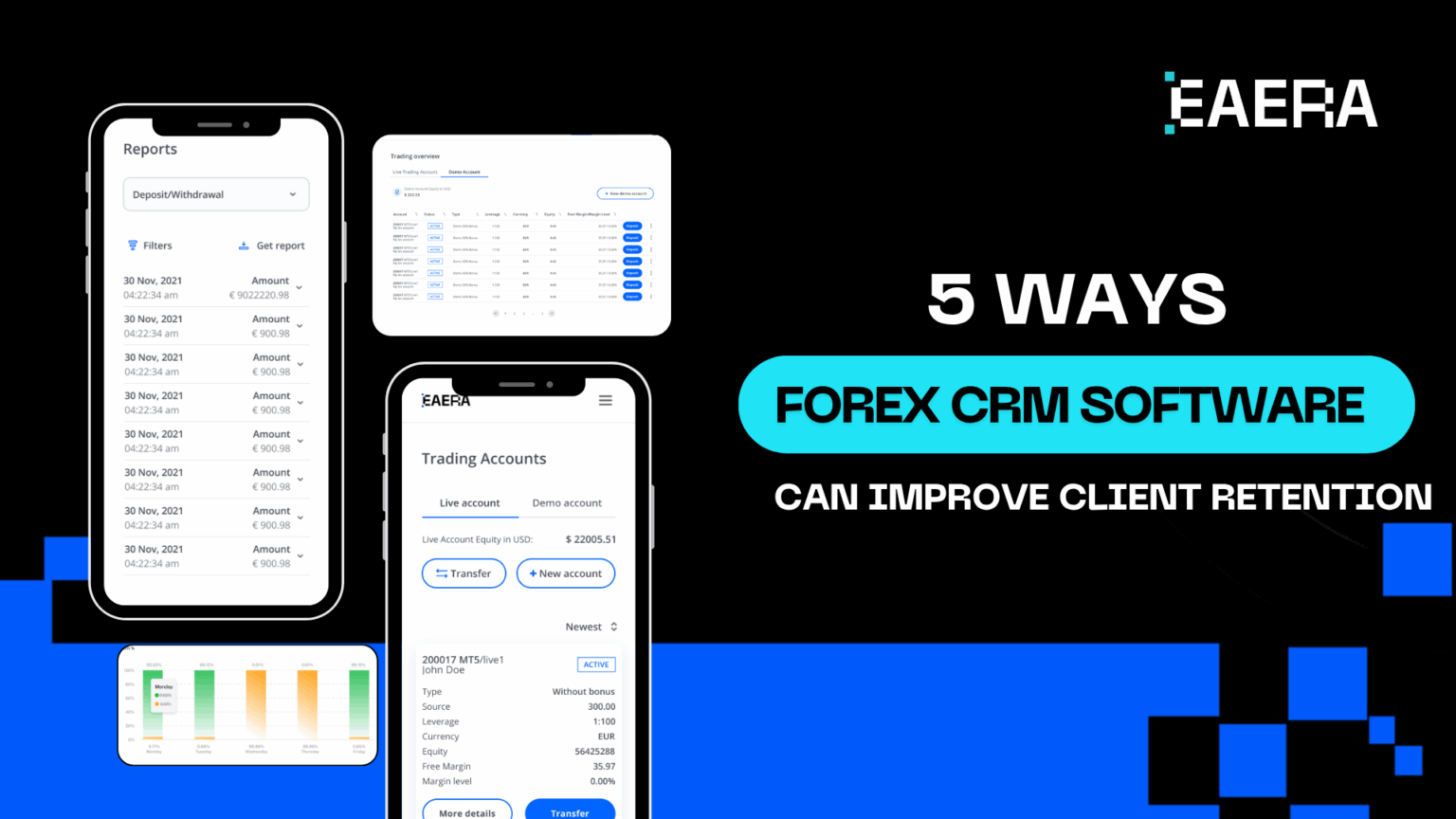

Comprehensive Analytics & Reporting:

Gain insights into trading volumes, client performance, and overall business trends with customizable dashboards and reports.

Affiliate/IB Module Support:

Manage affiliate programs, track referrals, and automate commission payments with integrated tools.

Workflow Automation & Communication:

Use email/SMS triggers, support ticket systems, and chat logs to improve operational efficiency and client service.

By centralizing these functions, forex CRM software helps brokers reduce manual tasks, improve compliance, and scale smarter.

3. Key Features to Look For (Backed by SERP Competitors)

To stay competitive, brokers need forex CRM software equipped with features that support growth, compliance, and seamless user experience. Here are the key features to look for:

- Scalable Lead Pipelines: Quality forex CRM software enables lead capture, scoring, and segmentation, allowing brokers to prioritize and convert leads effectively

- Full-Funnel Client Management: Track client profiles, preferences, and account history to deliver personalized service through every stage of the client journey

- Seamless Trading Platform Bridges: The best forex CRM software integrates directly with MT4, MT5, and cTrader, syncing trade data in real time

- Regulatory Modules: Built-in tools for automated KYC/AML verification and audit logs help maintain compliance efficiently

- Integration with PSPs and Gateways: A reliable forex CRM software connects with major payment service providers to streamline deposits, withdrawals, and funding

- AI-Driven Analytics & Automation: Predictive lead scoring, risk alerts, and smart workflows are essential features of modern forex CRM software

- Custom Dashboards & Reporting: Easily access performance insights and business metrics with agile, customizable reporting tools

- Multi-Language & White-Labeling Support: Expand globally and offer branded experiences with flexible forex CRM software

4. Operational Impact on Broker Workflow

Implementing quality forex CRM software has a direct and measurable impact on a broker’s daily operations. Here’s how it improves workflow efficiency across key areas:

- Streamlining Back-Office Tasks: Forex CRM software automates client onboarding, handles deposits and withdrawals, and simplifies account updates—all from one centralized dashboard

- Boosting Sales & Retention: With real-time tracking and segmentation, forex CRM software enables personalized outreach and timely follow-ups that increase conversion and client loyalty

- Reducing Errors & Enhancing Compliance: Built-in tools for document management, KYC checks, and audit-ready logs ensure fewer manual tasks and stronger regulatory alignment

- Improving Team Collaboration: Forex CRM software connects sales, support, and compliance teams through shared data and integrated communication tools

- Increasing Overall Efficiency: By automating repetitive processes, forex CRM software allows brokers to focus on strategic growth instead of admin-heavy tasks

5. How to Choose the Best Forex CRM Software?

Selecting the right forex CRM software is crucial for long-term success. Here are key factors brokers should consider:

- Fit & Scalability: Choose forex CRM software that aligns with your brokerage’s current size and is flexible enough to support future growth

- Security & Compliance Assurance: Look for built-in data encryption, KYC/AML support, and audit trails to meet regulatory standards with confidence

- Integration Readiness: The best forex CRM software seamlessly connects with trading platforms like MT4/MT5 and major payment gateways

- Automation & AI Capabilities: Smart workflows, predictive analytics, and automated alerts enhance efficiency and reduce manual workload

- Support & Onboarding: Reliable forex CRM software providers offer dedicated support, documentation, and staff training to ensure smooth implementation

- Cost & ROI Considerations: Evaluate licensing fees, setup costs, and potential returns to ensure your forex CRM software delivers measurable value

6. Future Trends in Forex CRM

As technology evolves, forex CRM software is rapidly adapting to meet the demands of a more dynamic and data-driven trading environment. Here are the top emerging trends shaping the future of CRM in the forex industry:

- AI-Powered Predictive Analytics: Advanced forex CRM software will increasingly use artificial intelligence to predict client behavior, identify high-value leads, and automate personalized engagement strategies

- Blockchain-Driven Compliance Transparency: Emerging forex CRM software solutions are exploring blockchain integration to create tamper-proof compliance records, enhancing trust and auditability

- Mobile-First CRM Experiences: With more brokers and traders operating remotely, modern forex CRM software is prioritizing responsive, mobile-first platforms for real-time access and communication

- API-Centric Ecosystems: Future-ready forex CRM software will support rich API integrations, enabling seamless connectivity with trading platforms, liquidity providers, payment systems, and external data sources

- Hyper-Personalization via AI: Leading forex CRM software platforms will offer deeper client profiling and customized dashboards to support broker-specific workflows

In a competitive, regulated market, brokers need efficient tools to grow and comply. The right forex CRM software streamlines operations, enhances client service, and transforms daily workflows—making it a vital asset for any modern brokerage.

At EAERA, we understand the unique challenges forex brokers face. That’s why we’ve developed an intelligent, fully customizable forex CRM software designed to help you optimize every stage of your business. Whether you’re launching a new brokerage or upgrading your existing systems, EAERA’s solutions are built to grow with you—securely, seamlessly, and smartly.

Ready to elevate your operations? Explore how EAERA’s CRM platform can help your brokerage gain a lasting edge in the market.