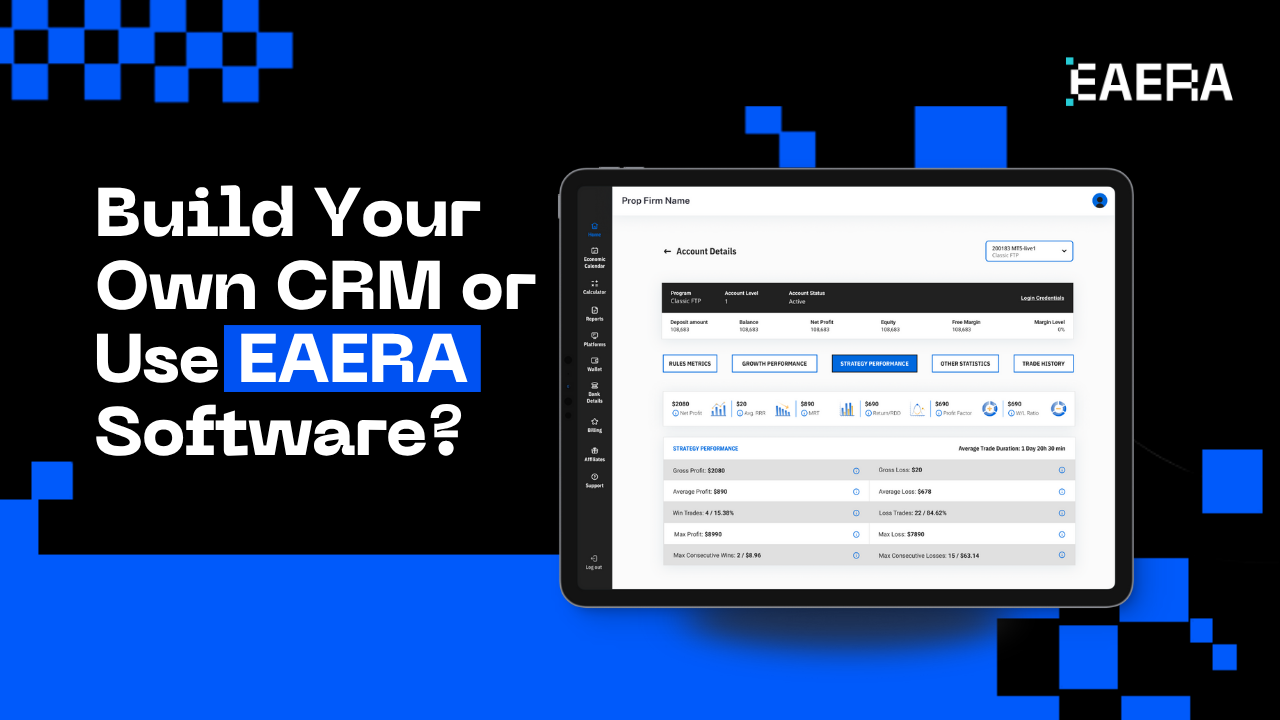

For FX brokers, choosing the right CRM can make or break operational efficiency. A robust CRM system is vital for lead management, automation, and onboarding. But should FX brokers invest time and money into building a custom forex CRM? Or is using a leading platform like EAERA the smarter, faster route?

While developing an in-house CRM offers flexibility, it also brings high costs, longer timelines, and risks. On the other hand, EAERA’s forex CRM software is built for performance, integration, and security—making it a reliable option for most FX brokers.

1. Why Building a Custom CRM Is Challenging for FX Brokers?

1.1. High Development Costs for FX Brokers

Creating a CRM from the ground up requires a major financial investment. FX brokers must cover costs for development, testing, infrastructure, and security. Many FX brokers underestimate ongoing maintenance expenses, which often leads to budget overruns and missed growth opportunities.

1.2. Long Development Timeline Hurts FX Brokers

Custom CRMs can take 6–12 months to launch. During this time, FX brokers risk losing valuable leads and operational efficiency. Delays in onboarding, tracking, and communication can negatively impact client retention.

Building a forex CRM requires significant development, testing, and maintenance costs

1.3. Compliance and Security Challenges for FX Brokers

To remain compliant with global standards like KYC and AML, FX brokers must implement robust security features such as encryption and multi-factor authentication. Developing this in-house can be time-consuming and complex, increasing the risk of non-compliance and data breaches.

1.4. Scalability Limitations for Growing FX Brokers

As FX brokers scale, custom CRMs often struggle to keep up. Integrating new trading platforms, analytics tools, and payment gateways becomes costly and time-consuming, slowing down operations and limiting flexibility.

2. Why Some FX Brokers Still Prefer Building Their Own CRM

While using a pre-built CRM like EAERA is often more efficient, some FX brokers choose to build their own systems for greater control and customization. For FX brokers with sufficient resources, a custom CRM can offer specific advantages that align with their unique business models.

2.1. Full Customization

A self-developed CRM enables FX brokers to fully customize features, dashboards, and workflows. Every aspect can be tailored to meet specific operational needs, giving FX brokers total freedom over their platform’s design and functionality.

2.2. Complete Data Control

Building an in-house CRM gives FX brokers complete ownership of their data. They can set their own security protocols, manage compliance internally, and reduce reliance on third-party storage providers.

2.3. Integration with Proprietary Systems

Some FX brokers run proprietary trading platforms or have unique workflows. A custom CRM ensures seamless integration with these systems, providing more efficiency than off-the-shelf solutions.

2.4. Competitive Advantage

By developing a CRM tailored to their exact needs, FX brokers can create a unique user experience. This can serve as a strategic differentiator in a highly competitive market, helping them stand out and attract more clients.

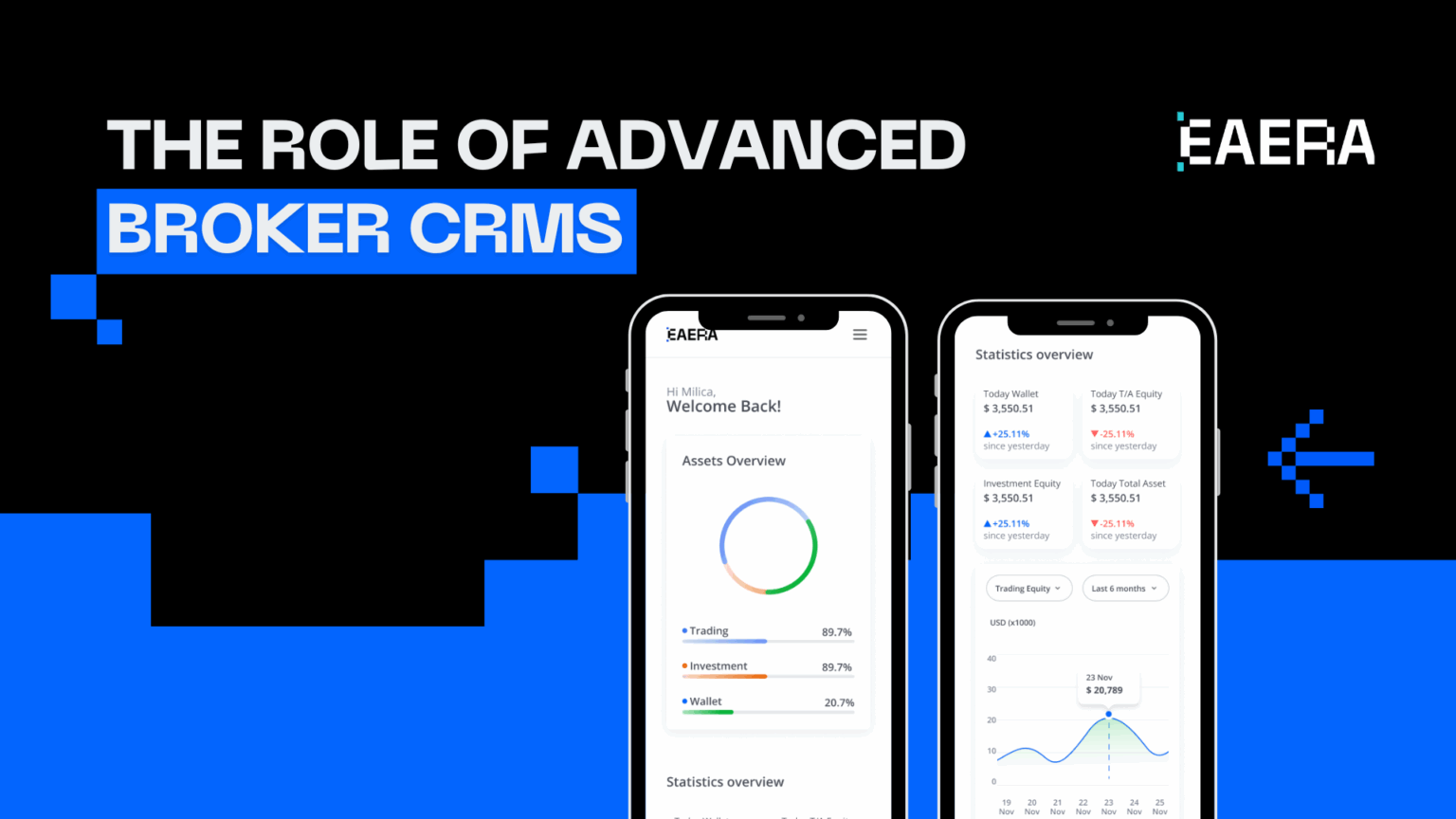

3. Why EAERA’s Forex CRM Software Is a Game-Changer for FX Brokers

EAERA offers a complete CRM solution tailored to the unique needs of FX brokers. From instant deployment to built-in automation, it eliminates the complexity and cost of building a system from scratch. For modern FX brokers looking to scale, streamline operations, and stay compliant, EAERA delivers a reliable edge.

3.1. Cost-Effective and Ready-to-Use

EAERA removes the need for expensive development and IT infrastructure. With subscription-based pricing, FX brokers can scale affordably without compromising quality, security, or functionality.

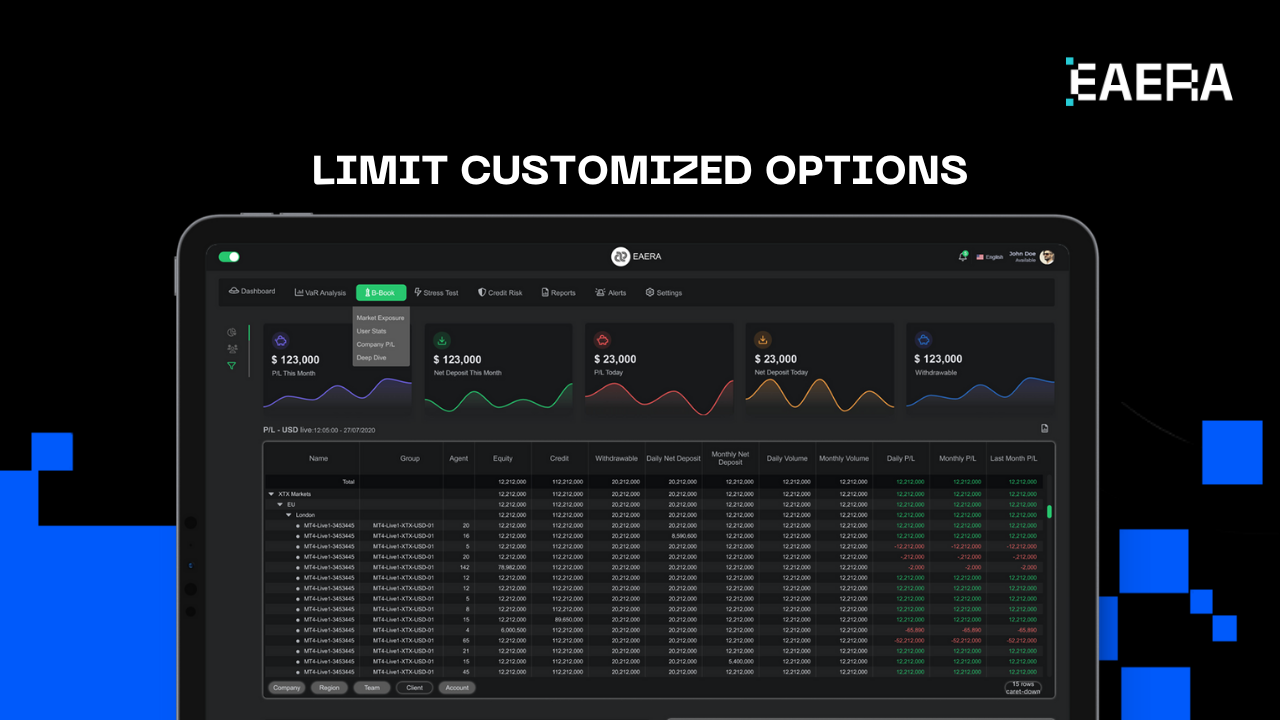

3.2. Seamless Integration

EAERA’s forex CRM easily connects with major trading platforms like MT4, MT5, and cTrader. This allows FX brokers to sync data, payments, and analytics in real time through robust API support.

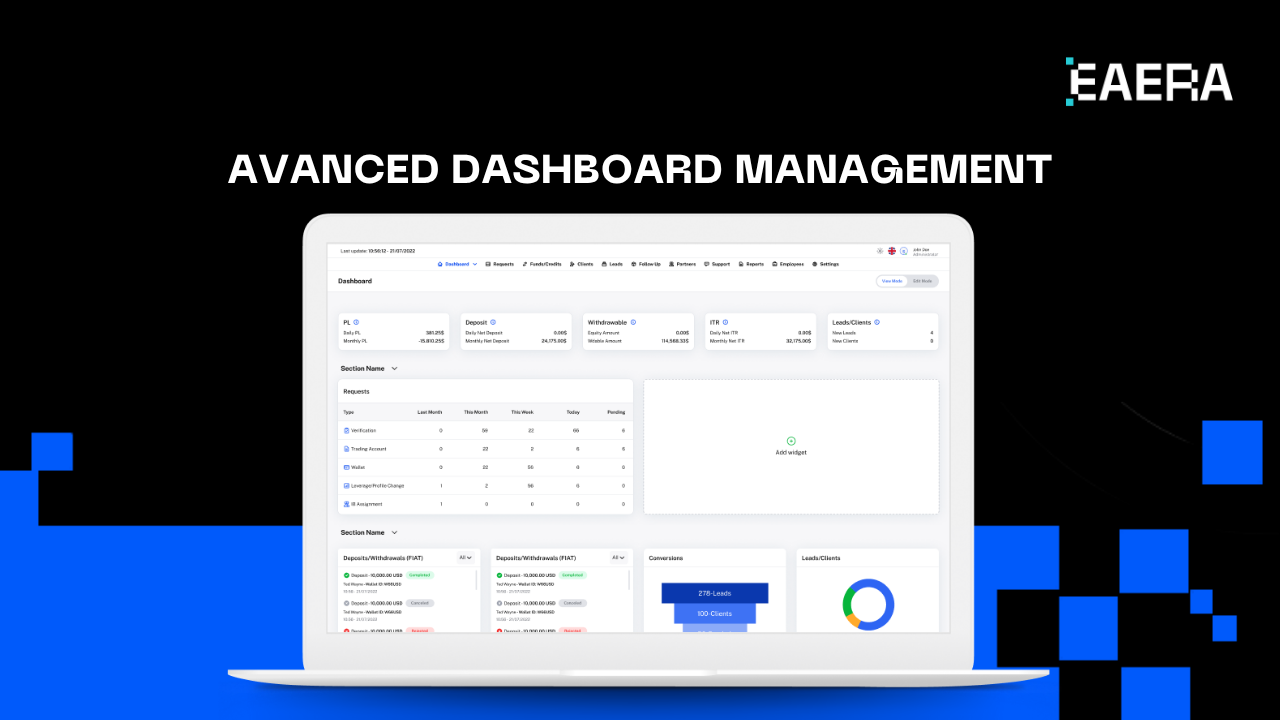

3.3. Powerful Client Management for FX Brokers

Lead tracking, automated follow-ups, built-in KYC/AML, and IB management tools give FX brokers full control over client onboarding and performance analytics—right from one dashboard.

Monitor client trading activity in real-time with performance analytics

3.4. Security and Compliance Built for FX Brokers

With multi-layered security features and GDPR compliance baked in, EAERA helps FX brokers stay protected and ahead of regulatory demands. Automated reporting tools also reduce manual compliance work.

3.5. Scalable and Customizable

EAERA’s modular CRM allows FX brokers to personalize their FX platform dashboards, apply their own branding, and adapt features as they grow. Continuous updates ensure long-term competitiveness.

3.6. AI-Driven Automation for Better Efficiency

AI tools in EAERA’s CRM predict trader behavior, optimize marketing, and automate workflows. For FX brokers, this means higher efficiency, smarter retention, and data-driven growth strategies.

4. Drawbacks of Using EAERA Forex CRM Software

EAERA provides a top-tier CRM solution, but like any software, it has some limitations. While the advantages far outweigh the downsides, FX brokers should be aware of a few potential challenges before fully committing to the platform.

4.1. Limited Customization Compared to In-House CRM

Although EAERA offers a flexible CRM system, FX brokers with highly specific workflows may find it lacks the full customization options of an in-house solution. Advanced features or proprietary integrations might require additional API work to align with unique operational needs.

EAERA may not provide the full level of personalization that a custom-built CRM allows

4.2. Learning Curve for New Users

New users may need time to understand and navigate EAERA’s comprehensive features. While EAERA provides onboarding support and training, FX brokers unfamiliar with CRM software may experience a brief adjustment period before maximizing its full potential.

5. Which Option Is Better? Final Verdict

The best forex CRM solution depends on your brokerage’s needs. However, EAERA offers the best balance of cost, efficiency, and scalability, making it the ideal choice for most brokers.

6. Conclusion

Building a custom forex CRM software is time-consuming, expensive, and risky. EAERA provides a superior, ready-to-use alternative that scales with your brokerage’s needs.

Why Choose EAERA?

- Seamless FX platform integration – Supports MT4, MT5, cTrader, and more.

- Built-in compliance & security – GDPR-compliant with automated KYC/AML tools.

- AI-powered automation – Smart reporting, trader insights, and marketing automation.

- Scalable solution – Suitable for small brokers and large enterprises alike.

- 24/7 support – Dedicated customer support team to assist your brokerage.

With EAERA’s forex CRM software, your brokerage can maximize efficiency, automate workflows, and scale faster than ever. Contact us today and experience the power of EAERA’s all-in-one CRM solution! https://eaera.com/contact-us/