In the fast-paced world of forex trading, staying competitive requires more than just market expertise—it demands efficient operations and exceptional client management. At EAERA, we understand this challenge, which is why our forex CRM system, integrated into the EAERA CBS suite, is designed to empower brokerages with streamlined processes and data-driven insights.

Delaying the implementation of a robust forex CRM system can lead to significant hidden costs, from missed revenue opportunities to regulatory risks. This guide explores these costs and demonstrates how EAERA’s forex CRM system can transform your brokerage into a high-performing, client-centric operation. Visit https://eaera.com/ to discover how we help financial institutions thrive.

Related articles:

- Real-Time Risk Monitoring in Prop Firm Forex with CRM Dashboards

- Case Study: Automating Drawdown Alerts with Custom Prop Firm CRM Rules

Why a Forex CRM System is Essential?

A forex CRM system is more than a tool—it’s the backbone of modern brokerage operations. It centralizes client data, automates workflows, ensures compliance, and enhances customer experiences. Without a dedicated forex CRM system, brokerages rely on fragmented tools or manual processes, leading to inefficiencies that erode profitability.

EAERA’s forex CRM system integrates seamlessly with our all-in-one EAERA CBS suite, offering features like client onboarding, KYC/AML compliance, trading analytics, and marketing automation. By delaying adoption, brokerages expose themselves to operational, financial, and reputational risks that can compound over time.

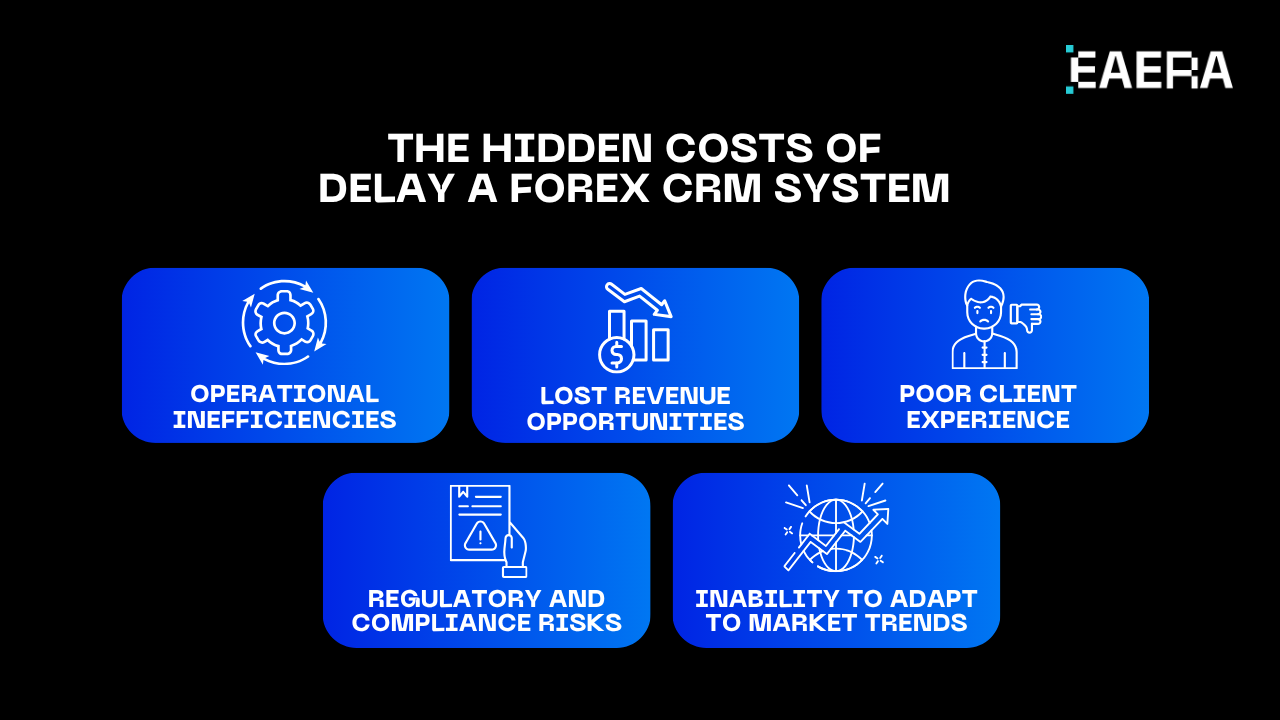

The Hidden Costs of Delay a Forex CRM System

1. Operational Inefficiencies

Without a forex CRM system, brokerages often juggle spreadsheets, emails, and disparate software to manage client interactions. This leads to errors, duplicated efforts, and wasted time. For example, manually tracking client deposits or trade preferences can take hours, diverting staff from high-value tasks like client acquisition. These inefficiencies increase labor costs and reduce scalability.

EAERA’s forex CRM system automates tasks like data entry and client segmentation, freeing your team to focus on growth. Delaying implementation means prolonging these costly inefficiencies, hindering your ability to scale in a competitive market.

2. Lost Revenue Opportunities

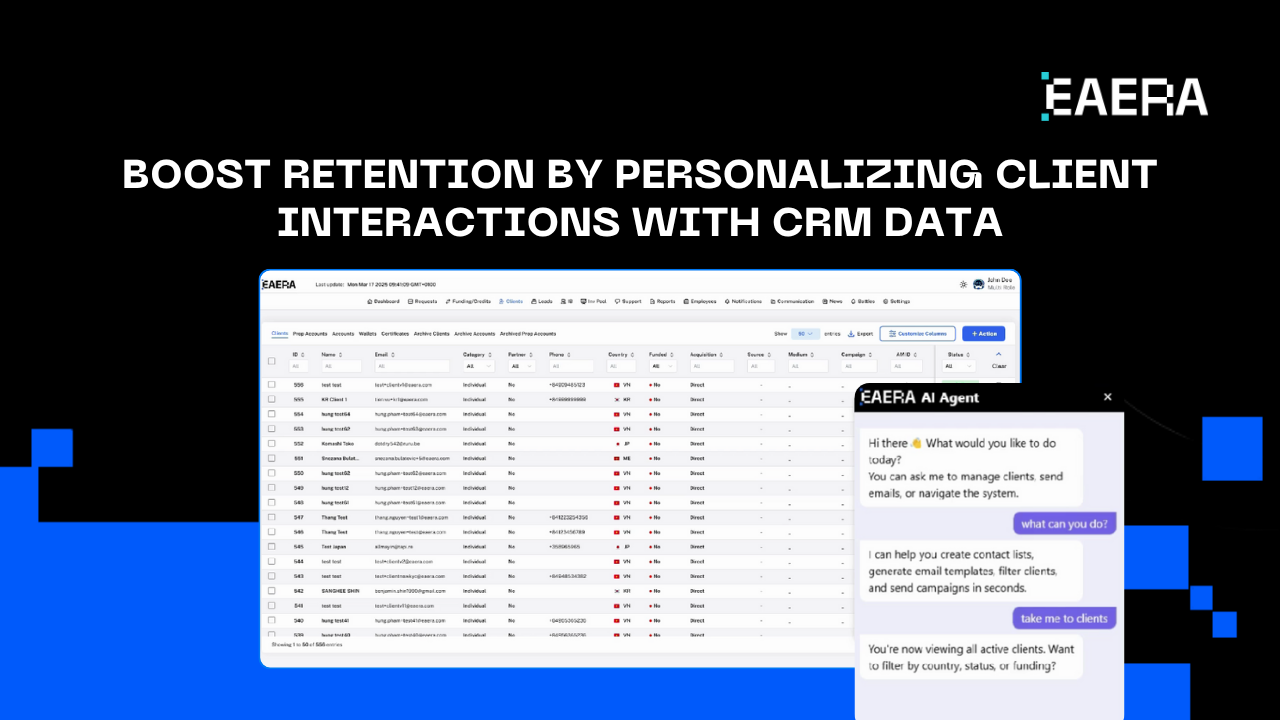

A forex CRM system provides insights into client behavior, enabling targeted marketing and personalized offerings. Without it, brokerages miss opportunities to upsell services, such as premium accounts or crypto lending, which our forex CRM system supports. For instance, failing to identify high-value clients can result in lower retention rates and missed cross-selling opportunities.

EAERA’s forex CRM system uses advanced analytics to track trading patterns and preferences, allowing you to tailor campaigns that boost revenue. Delaying adoption means forgoing these profits, as competitors with robust forex CRM systems capture your market share.

3. Poor Client Experience

Client satisfaction is the cornerstone of a successful brokerage. Without a forex CRM system, inconsistent communication and slow response times frustrate clients, leading to churn. For example, manual onboarding processes can delay account activation, pushing clients to competitors.

EAERA’s forex CRM system offers a seamless client portal for onboarding, account management, and support, ensuring a smooth experience. Delaying implementation risks alienating clients, damaging your reputation, and reducing long-term loyalty in a market where trust is paramount.

4. Regulatory and Compliance Risks

Forex brokerages operate under strict regulatory scrutiny, with requirements for KYC/AML compliance and transaction monitoring. Manual processes or outdated systems increase the risk of non-compliance, leading to fines, legal issues, and reputational damage. EAERA’s forex CRM system integrates robust KYC/AML tools, automating verification and reporting to meet global standards like those in the UAE or EU. Delaying a forex CRM system exposes your brokerage to costly penalties and audits, as regulators demand real-time compliance data that manual systems struggle to provide.

5. Inability to Adapt to Market Trends

The forex industry is evolving, with trends like crypto integration and personalized services gaining traction in 2025. Without a forex CRM system, brokerages lack the agility to adopt these innovations. For example, our forex CRM system supports crypto lending, allowing clients to earn passive income alongside forex trading.

Delaying implementation limits your ability to offer cutting-edge services, leaving you behind competitors who leverage forex CRM systems to stay ahead of market demands.

How EAERA’s Forex CRM System Mitigates These Costs?

EAERA’s forex CRM system, part of the EAERA CBS suite, is designed to address these hidden costs head-on:

- Streamlined Operations: Automate client onboarding, trade tracking, and reporting, reducing manual errors and labor costs. Our forex CRM system centralizes data, enabling your team to work efficiently.

- Revenue Maximization: Use analytics to identify high-value clients and tailor offerings, boosting retention and cross-selling with forex CRM system insights.

- Enhanced Client Experience: Deliver seamless onboarding and personalized support through our client portal, fostering loyalty with forex CRM system features.

- Compliance Assurance: Built-in KYC/AML tools ensure regulatory adherence, minimizing risks with automated checks in our forex CRM system.

- Market Adaptability: Integrate emerging trends like crypto lending, keeping your brokerage competitive with our scalable forex CRM system.

By adopting EAERA’s forex CRM system, you eliminate inefficiencies, capture revenue, and future-proof your operations.

The Strategic Advantage of Early Adoption

Implementing EAERA’s forex CRM system now positions your brokerage as a market leader. Our forex CRM system enables you to:

- Enhance Efficiency: Automate repetitive tasks, saving time and resources with forex CRM system workflows.

- Boost Client Retention: Personalize interactions using data from our forex CRM system, reducing churn.

- Drive Innovation: Offer services like crypto lending, supported by our forex CRM system, to attract diverse clients.

- Ensure Scalability: Handle growing client volumes with our cloud-based forex CRM system, designed for expansion.

Early adoption transforms hidden costs into opportunities, giving you a competitive edge in 2025’s dynamic forex market.

Overcoming Barriers to Implementation a Forex CRM System

Some brokerages delay adopting a forex CRM system due to concerns about cost, complexity, or disruption. EAERA addresses these:

- Cost: Our forex CRM system is a cost-effective investment, with rapid ROI through increased revenue and efficiency.

- Complexity: Our intuitive interface and dedicated support simplify implementation, ensuring a smooth transition for your forex CRM system.

- Disruption: We offer phased rollouts and training, minimizing downtime as you integrate our forex CRM system.

By addressing these barriers, EAERA’s forex CRM system makes adoption seamless and impactful.

Why EAERA’s Forex CRM System Stands Out?

At EAERA, we’ve built our forex CRM system to be the backbone of your brokerage. Unlike fragmented tools, our forex CRM system within EAERA CBS offers an all-in-one solution—client portals, compliance tools, analytics, and crypto lending integration.

Hosted in the cloud, it ensures scalability and security, while our forex expertise guarantees alignment with industry needs. By choosing EAERA’s forex CRM system, you invest in a platform that evolves with your business, mitigating the hidden costs of delay.

Conclusion

Delaying a forex CRM system incurs hidden costs—inefficiencies, lost revenue, poor client experiences, compliance risks, and missed market trends. EAERA’s forex CRM system, part of the EAERA CBS suite, eliminates these risks by streamlining operations, boosting profitability, and enhancing client satisfaction.

Available at https://eaera.com/, our forex CRM system empowers you to lead in 2025’s competitive forex landscape. Don’t let delays erode your success—explore our demo, train your team, and implement EAERA’s forex CRM system today to unlock your brokerage’s full potential.