In today’s competitive Forex trading landscape, FX brokers encounter numerous operational hurdles directly influencing profitability and client satisfaction. One often underestimated but critical issue is poor withdrawal management. Implementing an advanced Forex CRM (Customer Relationship Management) system, such as EAERA, with integrated automated withdrawal control and approval capabilities, offers FX brokers an essential tool to overcome these challenges and significantly enhance profitability and efficiency.

1. Understanding the Role of a Forex CRM in FX Brokerage Success

A Forex CRM is a specialized platform designed explicitly for FX brokers to manage their unique operational demands effectively. Key functionalities include client onboarding, compliance management (Know Your Customer – KYC and Anti-Money Laundering – AML), trade transaction monitoring, detailed reporting, client relationship management, and automated communication.

Deploying a robust Forex CRM represents more than an operational upgrade—it is a strategic investment crucial for sustainable brokerage growth. An effective CRM allows FX brokers to automate routine tasks, streamline client interactions, adhere seamlessly to complex regulations, and consistently deliver excellent client service. Enhanced customer satisfaction directly leads to increased trader retention and competitive advantages in the global marketplace.

To understand the real impact of a Forex CRM, consider this simple comparison:

| Before CRM | After CRM | |

| Withdrawal Speed | Manual, delayed by 24–48 hours | Automated, often under 2 hours |

| Fraud Risk | High, no detection rules | Rule-based detection, reduced risk by 70% |

| Compliance | Manual checks prone to errors | Automated KYC/AML workflows |

| Client Trust | Low – inconsistent experience | High – reliable, transparent processes |

| Operational Cost | High – more staff needed | Lower – automation reduces headcount |

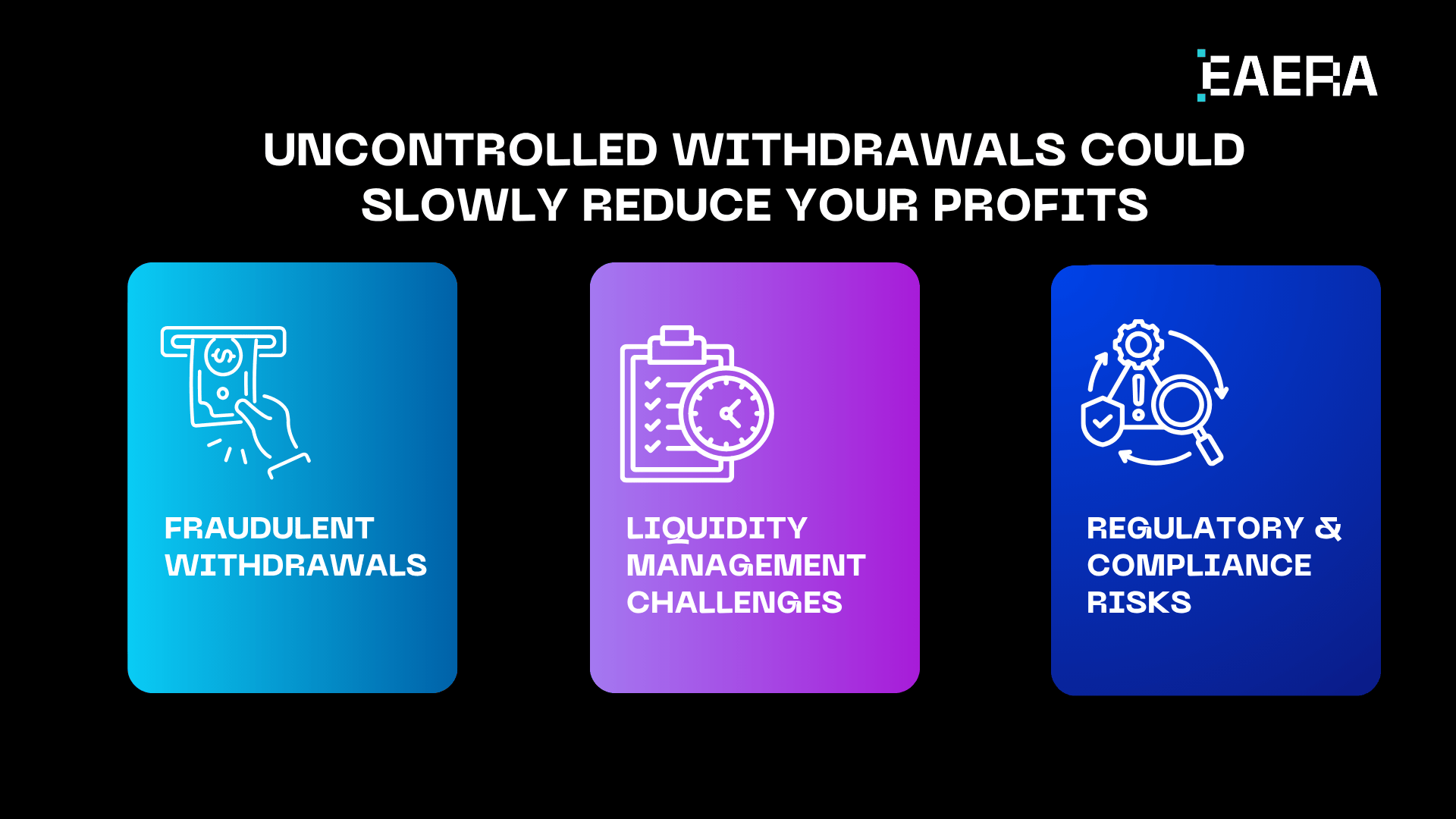

2. The Hidden Drain: How Uncontrolled Withdrawals Erode Your Margins

Uncontrolled withdrawal management significantly impacts the operational efficiency and financial health of FX brokerages. Brokers often underestimate the depth of these hidden costs and risks, including:

- Fraudulent Withdrawals: Without automated monitoring, brokers risk approving fraudulent transactions, resulting in direct financial losses.

- Liquidity Management Challenges: Unmanaged withdrawals disrupt liquidity planning, causing cash flow inconsistencies and operational risks.

- Regulatory and Compliance Risks: Poor withdrawal practices expose brokers to compliance violations, leading to substantial financial penalties, reputational damage, and legal repercussions.

Moreover, when traders experience delayed or rejected withdrawals, trust erodes—impacting brand reputation, triggering bad reviews, and increasing churn. Thankfully, these risks are avoidable. By using a Forex CRM with automated withdrawal management, FX brokers can regain operational control and maintain client confidence.

3. Lifehack Unlocked: Automating Withdrawal Control with Approval Systems

Integrating an automated withdrawal approval system within your Forex CRM provides a critical competitive advantage. Automation boosts profitability and efficiency, offering FX brokers several critical advantages:

- Robust Fraud Detection and Prevention: Automation enables brokers to set up rule-based approval workflows, swiftly identifying and preventing irregularities, fraudulent withdrawals, and other suspicious activities.

- Enhanced Liquidity Control: Automated systems enable precise withdrawal management, systematically controlling cash flow, and preventing liquidity crunches or operational disruptions.

- Increased Client Trust and Satisfaction: Automated approvals provide clients with predictable and transparent withdrawal experiences, significantly improving customer satisfaction, loyalty, and trust.

- Streamlined Operational Efficiency: Automation significantly reduces manual administrative workloads, freeing up valuable resources for strategic growth initiatives, marketing efforts, and improved client service delivery.

To implement automated withdrawal management effectively, brokers should adopt best practices including:

- Customizable Approval Workflows: Clearly define responsibilities, authorization levels, and criteria for transaction approvals, tailored to transaction size, client status, and risk profiles.

- Comprehensive Risk Assessment Protocols: Set clear criteria to detect, investigate, and manage potentially fraudulent activities rapidly and accurately.

- Seamless Integration: Integrate withdrawal automation seamlessly into existing platforms, trading systems, banks, and payment gateways to minimize disruptions and ensure operational efficiency.

4. EAERA’s Forex CRM: A Solution Built for Profitable Brokerages

As a recognized global leader in Forex CRM solutions, EAERA delivers a sophisticated CRM system specifically tailored to address FX brokers’ complex operational demands. EAERA’s CRM solution uniquely features advanced withdrawal control and approval capabilities, ensuring brokerage profitability and compliance.

Key advantages of EAERA’s CRM solution include:

- Flexible Multi-Level Approval Workflows: EAERA provides customizable workflows adaptable to any brokerage size, from small transactions requiring minimal approvals to large withdrawals necessitating multi-stage authorization processes.

- Built-In Risk and Compliance Management Tools: The CRM features advanced screening algorithms designed to detect and mitigate withdrawal-related risks, significantly reducing fraudulent activities and ensuring rigorous regulatory compliance.

- Real-time Reporting and Analytics: Brokers benefit from instant access to detailed data analytics, providing insights into withdrawal patterns, liquidity positions, client behavior, and operational effectiveness, empowering strategic decision-making and business growth.

EAERA’s CRM accommodates FX brokerages of all sizes, from large institutions managing extensive client portfolios to smaller brokerages poised for significant growth. Its scalable, flexible design ensures robust performance, efficiency, and enhanced profitability.

5. Practical Considerations for Adopting a Forex CRM

When selecting and implementing a Forex CRM like EAERA, brokers must consider several critical factors to ensure effective integration and optimal results:

- Ease of Implementation and Integration: Evaluate how seamlessly the CRM integrates with existing brokerage platforms and infrastructure to minimize disruption during deployment.

- Customization and Flexibility: Confirm that the CRM provides flexible, customizable features capable of precisely meeting specific brokerage needs.

- Continuous Customer Support and Training: Prioritize CRM solutions offering extensive customer support, continuous training, and readily available resources to ensure staff proficiency and effective system utilization.

By carefully addressing these considerations, brokers maximize their investment in CRM technology, ensuring significant improvements in operational efficiency, client satisfaction, compliance, and overall profitability.

6. FAQs: What FX brokers should ask before choosing a Forex CRM?

6.1 What makes a Forex CRM different from regular CRMs?

A Forex CRM is designed specifically for FX brokers and includes tools like KYC, AML checks, trading account integration, withdrawal automation, and regulatory reporting.

6.2 Can a Forex CRM help small FX brokers too?

Absolutely. Systems like EAERA are scalable and offer modular features tailored for brokers at all stages.

6.3 How quickly can you get started with EAERA’s CRM?

With proper onboarding support, most FX brokers can integrate and go live within 2–4 weeks.

6.4 Is EAERA secure for handling sensitive financial data?

Yes. EAERA follows top industry standards for data encryption, user access control, and compliance security.

6.5 How does a Forex CRM improve trader retention?

By automating communications, personalizing client engagement, and providing smooth transaction processing, a Forex CRM increases trader satisfaction and reduces churn.

Achieving sustained profitability in FX brokerage extends beyond merely attracting new clients—it involves efficient internal management of critical processes, particularly withdrawals.

A sophisticated Forex CRM with automated withdrawal approval capabilities represents a strategic tool, driving substantial profitability, client trust, regulatory compliance, and operational efficiency.

Ready to unlock the full potential of your brokerage?

Explore EAERA’s powerful Forex CRM solution today. Ready to automate? Request your personalized demo now!