Introducing Broker (IB) networks continue to be one of the forex industry’s most potent growth engines. Managing IB relationships gets more difficult as brokers grow internationally and use multi-tier partner models. Spreadsheet-based commissions, manual tracking, and disjointed systems can easily lead to operational risk, payout disputes, and gaps in transparency.

Related articles:

- Best Forex CRM for Modern Brokerage Management

- Top 10 Forex CRM Features Every FX Broker Needs to Succeed

IB management is changed from a reactive administrative procedure to a structured, automated, and scalable framework by a specially designed forex CRM system. Brokers can centralize commission logic, apply rules consistently, and give partners real-time transparency rather than depending on manual oversight.

Why IB Networks Are Operationally Complex?

Modern IB programs no longer typically use straightforward one-tier referral models. Many brokers operate multi-level structures, including hybrid commission agreements, regional entities, master IBs, and sub-IBs.

Common IB challenges include:

- Multi-tier commission hierarchies

- Revenue share and lot-based hybrid models

- Cross-border payout currencies

- High trading volume reconciliation

- Dispute resolution over unclear calculations

- Limited visibility into sub-IB performance

Without structured governance, these complexities lead to delayed payouts and mistrust. A forex CRM system addresses this by embedding commission logic, hierarchy mapping, and reporting into a centralized operational environment.

Core Functions of a Forex CRM System in IB Management

The operational foundation of partner programs is a contemporary forex CRM system. It transforms from a straightforward contact database into the intelligence layer that links commission rules, trading data, and IB performance indicators.

-

Multi-Tier IB Hierarchy Management

The system automatically structures IB relationships, mapping parent and sub-IB connections with dynamic overrides. This ensures:

- Clear tier definitions

- Automated commission splitting

- Transparent performance attribution

Blind spots are eliminated because the downstream network and client base of each IB are visible in a single interface.

-

Commission Logic Engine

At the heart of any IB program lies accurate payout calculation. A structured forex CRM system supports:

- Lot-based commission models

- Revenue-share structures

- Hybrid and custom payout agreements

- Real-time calculation using live trading data

Commissions are computed continuously and consistently rather than manually at month’s end.

-

Centralized IB Dashboards

Transparency drives trust. A forex CRM system provides real-time dashboards showing:

- Active clients per IB

- Trading volume

- Commission earned

- Conversion metrics

Broker-IB relationships are strengthened, and disputes are decreased because of this visibility.

Automation Improves Accuracy and Reduces Disputes

Errors can occur when commission tracking is done by hand. Reconciliation takes time; data imports fail, and spreadsheet formulas to malfunction. By automating the process, a forex CRM system removes these vulnerabilities.

Manual IB Management Often Leads To:

- Delayed commission calculations

- Inconsistent rule enforcement

- Increased administrative workload

- Higher probability of payout disputes

With a Forex CRM System:

- Commissions are calculated automatically

- Statements are generated instantly

- Rules are applied consistently across tiers

- Audit trails are maintained

Every payout is guaranteed to adhere to predetermined logic thanks to automation. Structured commission engines lower friction while preserving operational clarity, as shown by enterprise platforms like EAERA.

A forex CRM system does not simply speed up payouts; it standardizes governance.

Scaling Multi-Tier IB Networks Without Operational Chaos

IB programs grow in tandem with the growth of brokers. If the infrastructure isn’t scalable, adding more partners makes mistakes more likely.

A scalable forex CRM system supports:

- Unlimited IB tiers

- Multi-currency commission handling

- Regional rule customization

- Brand or entity-based configuration

- Real-time visibility into sub-IB performance

Brokers deal with data fragmentation in the absence of structured scalability. A centralized forex CRM system makes growth more manageable than unmanageable.

The system adapts through configuration rather than restructuring with each expansion phase, as opposed to rebuilding processes.

Compliance and Auditability in IB Programs

The regulatory requirements for reporting and transparency are still rising. Commission structures need to be auditable, defendable, and traceable.

Compliance controls are directly integrated into IB management workflows by a contemporary forex CRM system.

Key compliance capabilities include:

- Immutable audit trails of commission calculations

- Time-stamped rule changes

- Role-based access control

- Structured payout reporting

- Data export for regulatory review

Brokers are safeguarded during audits by this arrangement, which also guarantees commission transparency independent of manual explanation.

Every IB payout can be tracked back to its source of logic and trading data thanks to audit-ready architecture, which is emphasized by infrastructure providers such as EAERA.

Thus, a forex CRM system improves regulatory posture and operational efficiency.

Real-Time Trading Integration Strengthens IB Oversight

Trading platforms like MT4, MT5, or proprietary engines can be directly connected to a robust forex CRM system. Commission computations are directly linked to confirmed trading activity thanks to this integration.

Integration allows brokers to:

- Monitor trading behavior per IB client

- Detect abnormal patterns

- Align commission payouts with verified trades

- Reduce reconciliation errors

CRM systems function independently of actual financial data in the absence of trading integration. By integrating operational data with real-time trading activity, a specialized forex CRM system bridges this gap.

This unified structure prevents discrepancies and increases accountability.

Performance Analytics for Smarter IB Growth

In addition to calculating commissions, analytics assist brokers in strategically optimizing IB networks.

A well-designed forex CRM system provides:

- Conversion rate tracking per IB

- Client lifetime value metrics

- Volume performance analysis

- Retention indicators

- Sub-IB contribution breakdown

These insights allow brokers to:

- Identify top-performing IB segments

- Adjust commission incentives

- Allocate marketing resources more efficiently

- Detect underperforming networks

Brokers can proactively maximize performance rather than reactively managing IB relationships.

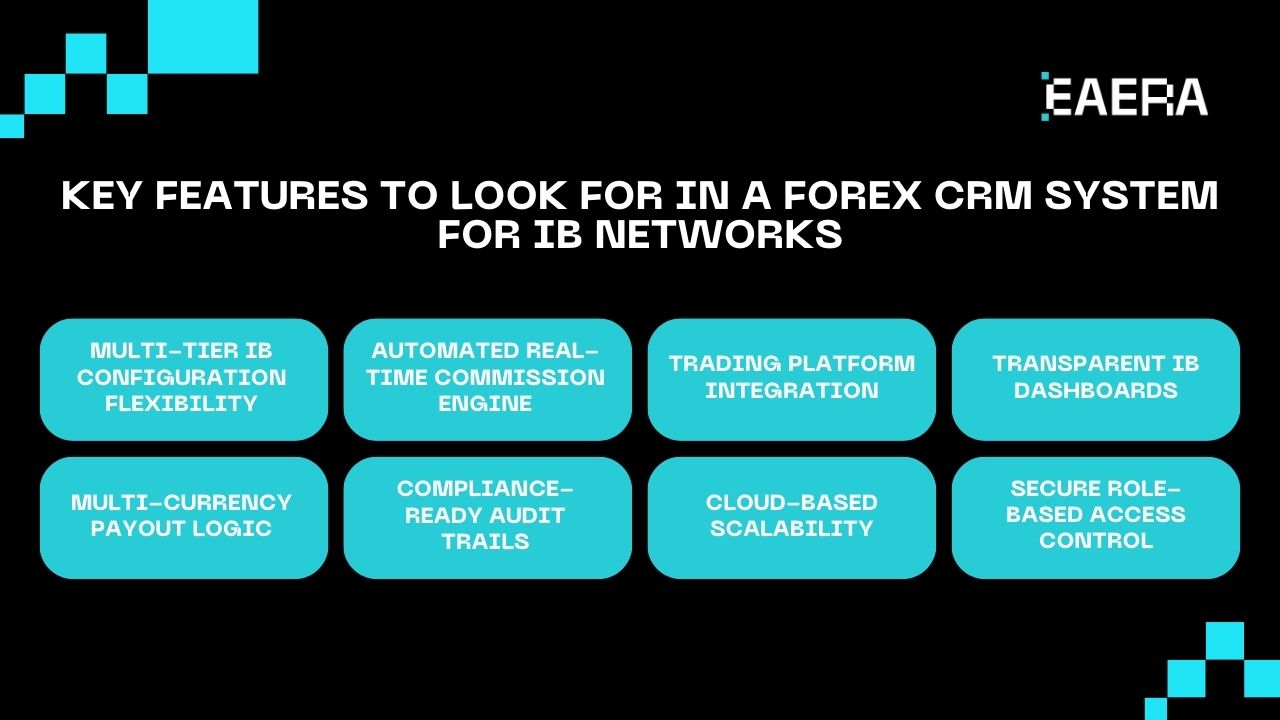

Key Features to Look for in a Forex CRM System for IB Networks

When selecting infrastructure, brokers should evaluate whether the forex CRM system includes:

- Multi-tier IB configuration flexibility

- Automated real-time commission engine

- Trading platform integration

- Transparent IB dashboards

- Multi-currency payout logic

- Compliance-ready audit trails

- Cloud-based scalability

- Secure role-based access control

The structural design required for IB commission governance is absent from generic CRM platforms. Trading, automation, and compliance cannot all be combined into one operational environment without a dedicated forex CRM system.

Long-Term Strategic Impact

Trust is the foundation of IB networks. Accurate payouts, openness, and predictable procedures are necessary for trust. By integrating discipline into infrastructure, a structured forex CRM system strengthens these components.

Over time, this leads to:

- Reduced administrative overhead

- Lower dispute rates

- Faster commission cycles

- Improved IB retention

- Scalable partner expansion

Brokers are increasingly viewing the forex CRM system as mission-critical infrastructure that supports revenue generation and operational stability, rather than as a sales tool.

Although IB networks spur out expansion, they also add operational complexity that is too great for manual management. A dedicated forex CRM system facilitates multi-tier scalability, automate payouts, centralizes commission logic, and upholds transparency.

Brokers lower risk, improve IB relationships, and build a scalable partner ecosystem that can sustain long-term growth in cutthroat international markets by integrating structured governance into routine business processes.