Onboarding speed has emerged as a key differentiator for forex brokers. While regulators require more stringent identity verification and audit readiness, clients anticipate opening accounts and beginning trading right away. Know Your Customer (KYC) is one of the most important – and difficult – processes in brokerage operations because of this tension.

Related articles:

- Forex Broker Solutions: Top 8 Features You Need in 2025

- Best Forex CRM for Modern Brokerage Management

To overcome this difficulty, contemporary forex broker solutions rethink KYC as an automated, structured process as opposed to a manual checkpoint. This article describes how these solutions facilitate quicker KYC, what currently slows down brokers, and how technology allows speed without compromising risk management or compliance.

Why KYC Speed Matters for Modern Forex Brokers?

A client’s initial real interaction with a broker’ system is frequently KYC. Before trading even starts, clients give up onboarding if the process is slow or unclear. High KYC drop-off rates have a direct impact on conversion, acquisition costs, and long-term revenue.

Slow KYC leads to internal backlogs from an operational standpoint. Sales teams lose steam, compliance teams become overburdened, and management is unable to see how well onboarding is going. Simultaneously, there is little opportunity for short cuts due to the growing regulatory scrutiny.

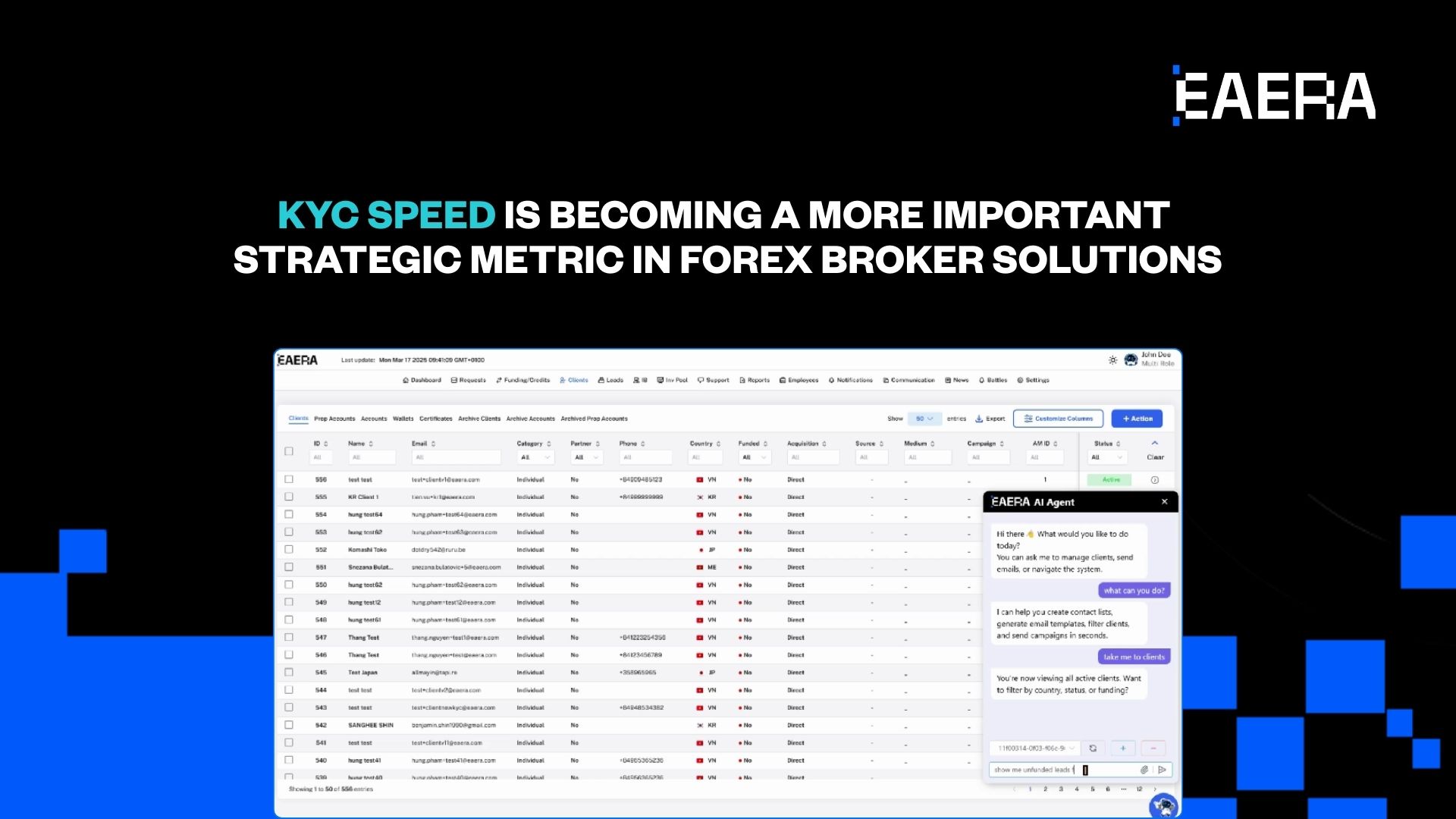

For this reason, KYC speed is becoming a more important strategic metric in forex broker solutions. Faster verification helps brokers scale onboarding volumes without adding more compliance headcount, enhances client experience, and lowers operational friction.

Common KYC Bottlenecks in Traditional Forex Operations

Because brokers’ procedures developed naturally rather than intentionally, many of them experience KYC delays. Typical bottlenecks consist of:

- Uploading documents manually and communicating via email

- Different systems for back-office operations, KYC checks, and CRM

- Data entry that is repeated across departments

- Limited visibility into verification status

- Inconsistent rules across regions or types of account

These problems lead to needless rework and handoffs. Teams may need to manually reconcile information if a document rejected in one system does not update another. Even straightforward onboarding cases may take days rather than minutes in the absence of centralized control.

How Forex Broker Solutions Automate and Accelerate KYC Workflows?

By transforming KYC from a sequence of discrete tasks into an automated, end-to-end workflow, modern forex broker solutions speed up the process.

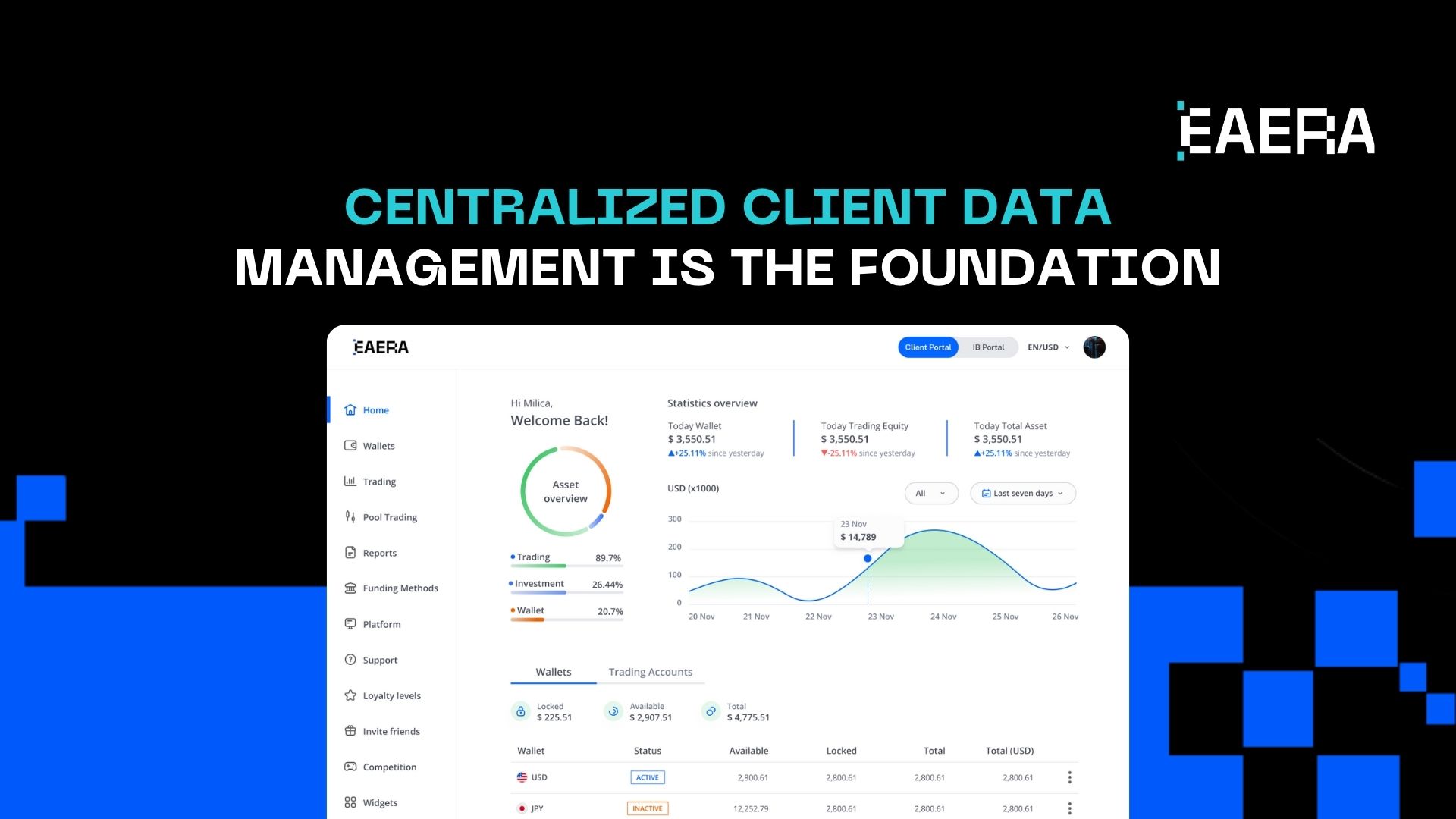

Centralized client data management is the foundation. One system contains all onboarding data, including documents, risk flags, verification status, and personal information. This ensures that all teams use the same data and remove duplication.

Automation is essential. Before documents are sent to a compliance officer, they can be automatically verified for format, completeness, and basic authenticity. Which cases are eligible for immediate approval, and which need manual review are determined by predetermined rules.

Internal collaboration is another key in speeding up the KYC process. With the use of forex broker solutions that have centralized the process of gathering customer data, communication between the sales, compliance, and operations team is more efficient. The different teams will not have to use emails or spreadsheets in following up the progress of the process. This makes it more convenient for the teams, increasing response times to customer inquiries, creating less bottlenecks in situations during peak times.

These structured workflows can be integrated into broader brokerage infrastructure, as demonstrated by integrated platforms like EAERA, which enable KYC to proceed swiftly while maintaining complete traceability.

The Role of Real-Time Data and Integrations in Faster KYC

Automation and system communication are two factors that affect speed. It is crucial that data move in real time between back-office platforms, KYC services, and CRM.

Third-party KYC and AML providers are directly integrated with contemporary forex broker solutions. Sanctions screening, document verification, and identity checks all happen instantly, and the results are automatically fed back into the main system.

Sales, operations, and compliance teams all see the same onboarding progress thanks to real-time status updates. By doing this, misunderstandings are eliminated, and clients are not repeatedly asked for the same information.

Delays brought on by inconsistent data are also lessened by strong integration. Verification is quicker and more dependable when documents, account information, and personal information are consistent across systems.

Faster KYC enhances client transparency. Clients will be more confident with the process if steps for registering, for example, can be tracked. This will ensure that support queries go down. Trust is an overlooked advantage because many forex broker solutions provide this.

Balancing Faster KYC with Compliance and Risk Control

Speed alone is not enough. KYC must remain compliant, auditable, and aligned with regulatory expectations. The best forex broker solutions balance speed with control through structured governance.

Audit trails are essential. Every action, including uploading and approving documents, is recorded with user information and timestamps. Brokers can prove compliance during audits thanks to this transparency, which eliminates the need for manual reconstruction.

Workflows based on risk improve control even more. While higher-risk profiles result in more thorough due diligence, low-risk clients can pass through streamlined verification. Regulations, account types, and regions can all be used to configure rules.

EAERA’s scalable architecture demonstrates how compliance logic can be integrated into onboarding processes. This guarantees that quicker KYC enhances rather than detracts from governance.

What to Look for in Forex Broker Solutions to Improve KYC Speed?

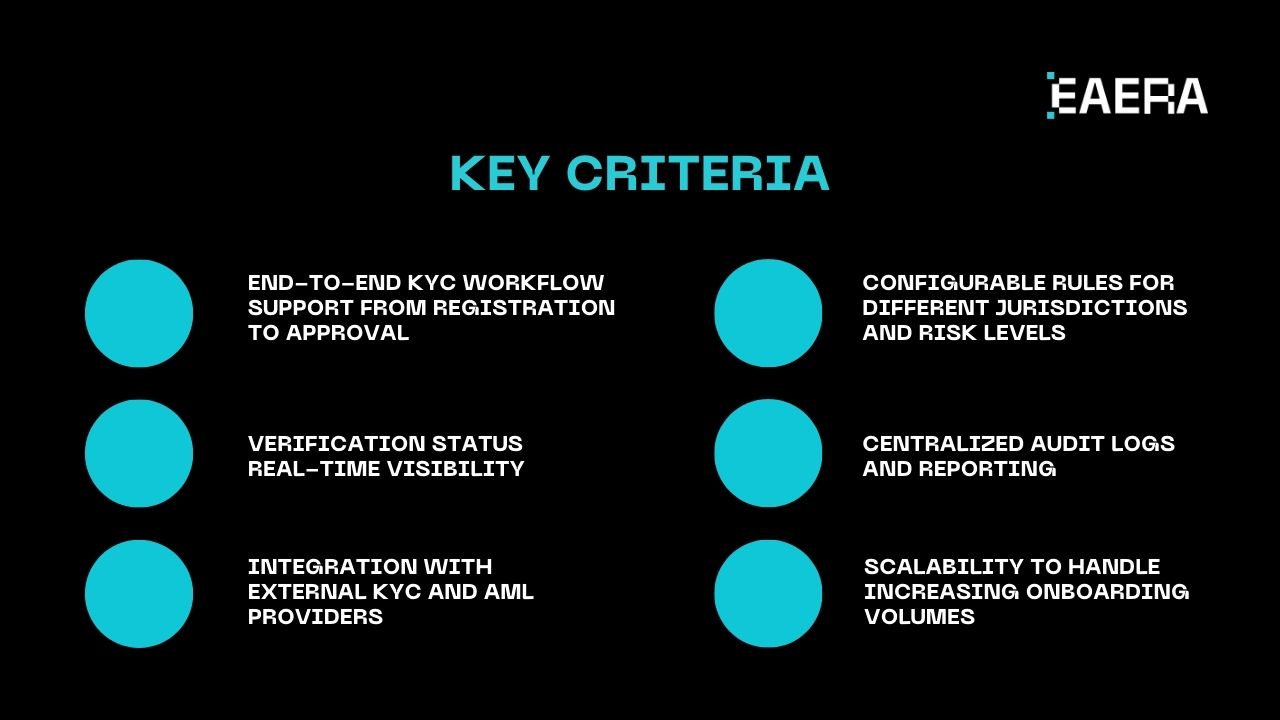

System reviewers, such as brokers, should concentrate on the system’s abilities that have a direct impact on the efficiency of the onboarding process. Key criteria include:

- End-to-end KYC workflow support from registration to approval

- Verification status real-time visibility

- Integration with external KYC and AML providers

- Configurable rules for different jurisdictions and risk levels

- Centralized audit logs and reporting

- Scalability to handle increasing onboarding volumes

Having the appropriate forex broker solutions from the beginning will avoid the costs of rework when there are regulatory requirements or numbers of clients to manage.

The quicker execution of KYC procedures no longer adds efficiency but rather competitiveness. Those brokers who can quickly integrate their customers while ensuring compliance with rules will have a higher rate of converting visitors to customers.

Contemporary forex brokerage solutions accomplish this by automating business processes, leveraging real-time information, and extending risk management functionality throughout the customer onboarding procedure as a whole. By having the proper technology infrastructure in place, KYC becomes a catalyst for, and not a hindrance to, growth in this ever more heavily regulated digital environment.