Introduction

Expanding into new global markets is a dream for many forex brokers—but without the right tools, it can quickly turn into a nightmare. In the high-stakes world of online trading, every second counts, and compliance requirements never sleep. This is where forex CRM software proves its worth. In this real-world case study, we’ll explore how a mid-sized brokerage scaled beyond its home region by implementing EAERA’s advanced Forex CRM, achieving faster onboarding, airtight compliance, and seamless market entry.

Related articles:

- Building Trust in Trading: The Strategic Impact of Forex Broker Solution

- EAERA CBS: All to know about our Core Brokage System

Why Forex CRM Software is a Game-Changer For New Brokerages?

Before diving into the case study, it’s worth understanding why forex CRM software has become a must-have for brokers of all sizes.

- Compliance Without Chaos: Global regulations tighten every year. Manual KYC (Know Your Customer) and AML (Anti-Money Laundering) processes are slow and prone to human error. A specialized Forex CRM automates ID verification, flags suspicious activity, and generates regulator-ready reports—reducing costly mistakes and penalties.

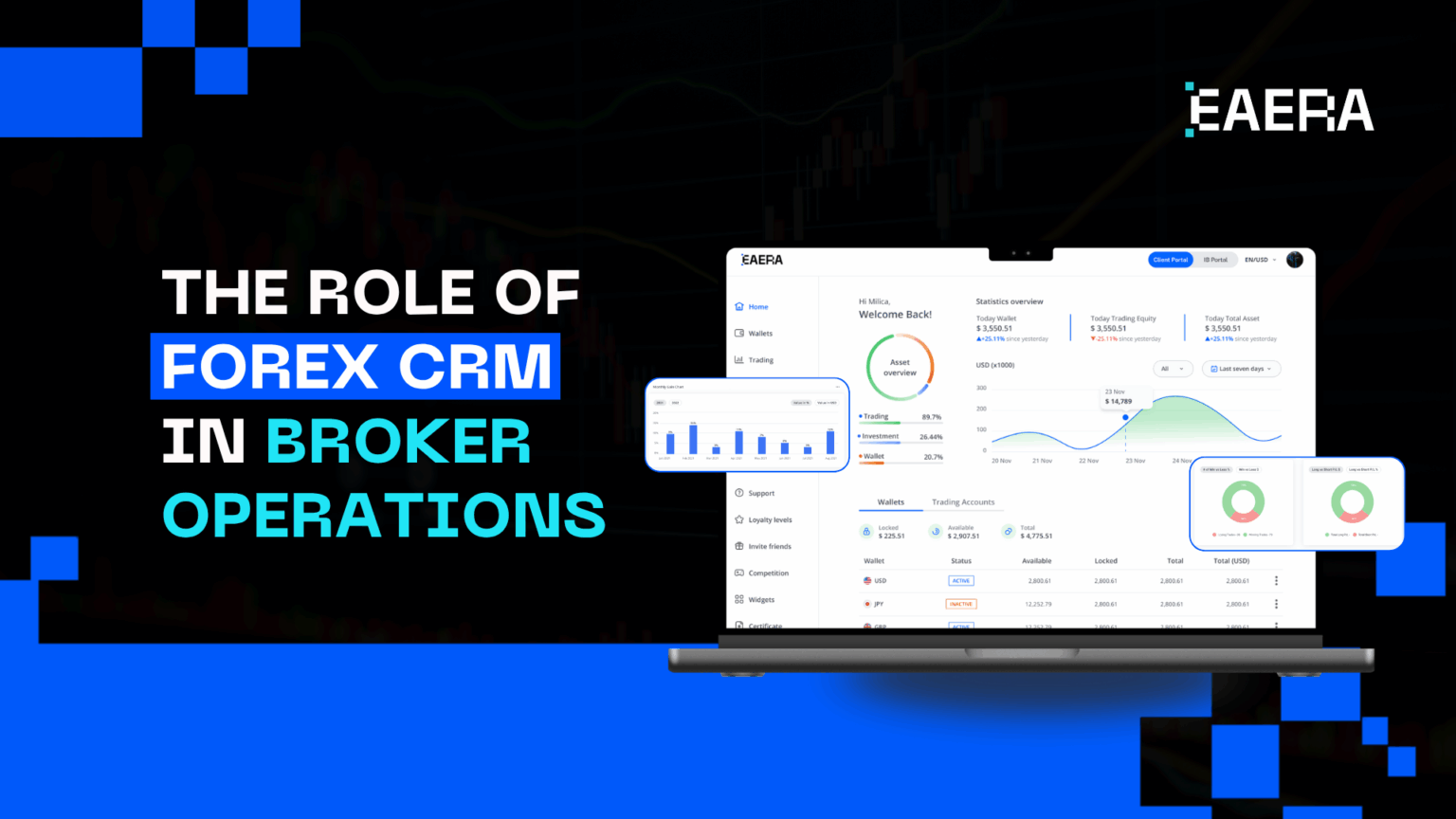

- Unified Client Management: A forex brokerage juggles thousands of accounts, each with complex trading and payment histories. A CRM acts as a central hub, consolidating data from MT4/MT5 platforms, payment gateways, and KYC tools so that sales, support, and compliance teams work from a single source of truth.

- Scalability at Speed: Entering new markets means higher volumes of clients and transactions. Forex CRM software allows brokers to grow without adding administrative overhead by automating repetitive tasks and integrating smoothly with trading and payment systems.

With these strengths in mind, let’s look at how one brokerage leveraged EAERA’s Forex CRM software to go global.

Case Study: A Local Brokerage Want to Go Global

Client Profile

This client is a fast-growing, mid-sized forex brokerage headquartered in Asia and now aiming to expand globally. After years of managing operations with spreadsheets and basic trading platforms, the firm has reached a point where manual workflows can no longer keep pace with rising trading volumes and cross-border ambitions. Its business model already supports steady revenue across multiple Asian markets, with dedicated teams for sales, marketing, compliance, and client service.

Yet customer data remains fragmented across emails, Excel files, and disconnected systems, making it difficult to gain a single, real-time view of each client’s activity. Onboarding new traders is slow because Know Your Customer (KYC) checks and Anti-Money Laundering (AML) compliance are still handled by hand—an obstacle that grows with every new market and regulation. Marketing and sales functions lack integrated lead scoring, automated email campaigns, and conversion tracking, causing promising prospects to drop out before funding accounts.

With ambitions to support multiple currencies, languages, and payment methods, the company recognizes that a dedicated forex CRM platform is essential to centralize client records, automate compliance, and deliver seamless experiences to traders worldwide.

Key Challenges and Technology Needs

The brokerage’s most urgent pain points stem from its manual and siloed operations. Compliance processes are labor-intensive and prone to errors, raising the risk of regulatory penalties and client dissatisfaction. Data silos across trading platforms, payment gateways, and marketing tools hinder accurate reporting and limit the ability to personalize service. Marketing and sales teams struggle to coordinate campaigns or measure ROI effectively, while disconnected systems force repeated data entry and increase transaction errors.

As the firm plans entry into highly regulated regions such as the EU and Middle East, the need for scalable infrastructure becomes critical. An industry-specific forex CRM can address these gaps by providing centralized, real-time client data; automated KYC/AML workflows tailored to each jurisdiction; integrated marketing and sales automation; and seamless connections to trading platforms and payment providers. By investing in such a solution, the brokerage can accelerate global expansion, reduce operational costs, comply with diverse regulatory regimes, and create a frictionless onboarding and trading experience that boosts client lifetime value.

EAERA’s Solution: Forex CRM Software Built for Global Expansion EAERA’s Solution: Forex CRM Platform for Scalable Global Growth

The brokerage chose EAERA’s Forex CRM software, purpose-built for FX brokers pursuing rapid international expansion. EAERA worked side-by-side with the client’s leadership and compliance teams to deliver a seamless, future-proof solution that addressed every challenge in their growth plan.

1. Comprehensive Needs Assessment

EAERA’s consultants began with in-depth workshops to map all client touchpoints and regulatory requirements across Asia, the EU, and the Middle East. This diagnostic phase highlighted pain points such as manual KYC/AML checks, fragmented client data, and marketing systems that could not track lead conversions. From the start, EAERA configured the CRM to handle multi-jurisdiction KYC/AML rules and support multi-currency, multi-language operations.

2. Seamless Platform Integration

The new CRM was integrated with MT4/MT5 trading servers, major payment gateways, and identity verification providers. This eliminated duplicate data entry and ensured real-time synchronization of deposits, withdrawals, trades, and compliance updates—creating a single, accurate source of truth for every client relationship.

3. Custom Feature Configuration

EAERA tailored key modules to meet the brokerage’s expansion goals:

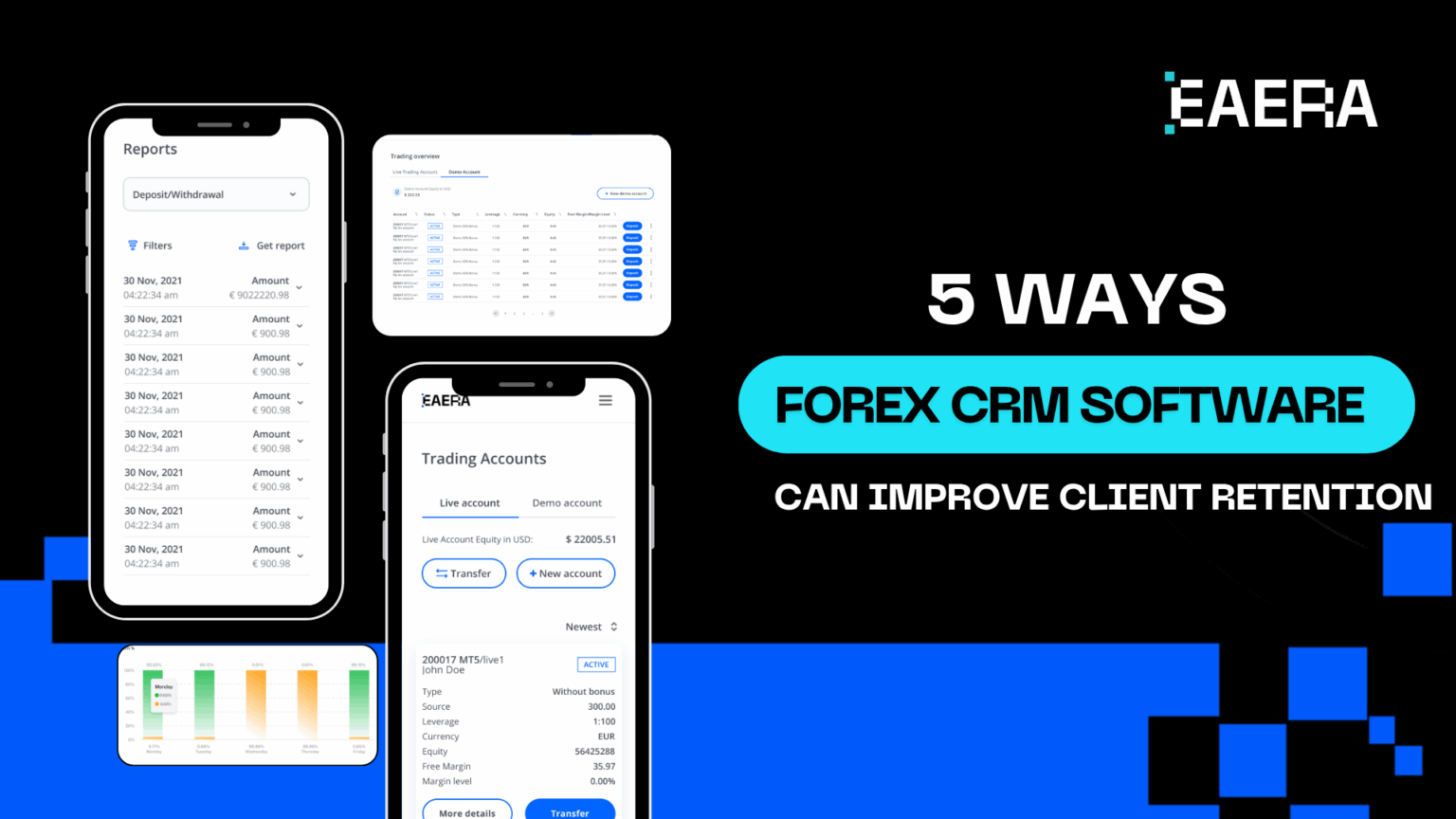

- Centralized Dashboard – Single-screen visibility of onboarding status, trading activity, and account funding.

- Automated KYC/AML Verification – Smart risk scoring and instant alerts to cut onboarding time and reduce compliance risk.

- Transaction Handling – Supports multi-currency and cryptocurrency deposits/withdrawals with built-in safeguards.

- Lead & IB Management – Tracks every lead, introducing broker, and conversion path, enabling sophisticated partner programs.

- Advanced Reporting – One-click, regulator-ready compliance and revenue reports across multiple regions.

- Role-Based Access Control – Protects sensitive data while allowing flexible team collaboration.

- Marketing & Sales Automation – Integrated lead scoring, drip email campaigns, and ROI tracking to convert prospects faster.

Together, these features replaced scattered spreadsheets and siloed tools with a single, automated operating hub.

4. Training & Ongoing Support

EAERA delivered hands-on training for sales, compliance, and operations teams, backed by detailed user guides and responsive help channels. Continuous updates keep the CRM aligned with evolving regulations and market requirements.

Business Impact

By centralizing client data and automating compliance, the brokerage reduced onboarding time by over 50%, cut operational costs, and minimized regulatory risk. Integrated marketing automation improved conversion rates, while real-time analytics gave management actionable insights for each region.

Lessons Learned and Best Practices for Brokers

This success story highlights several lesson learnt and practices for brokers wanted to go global:

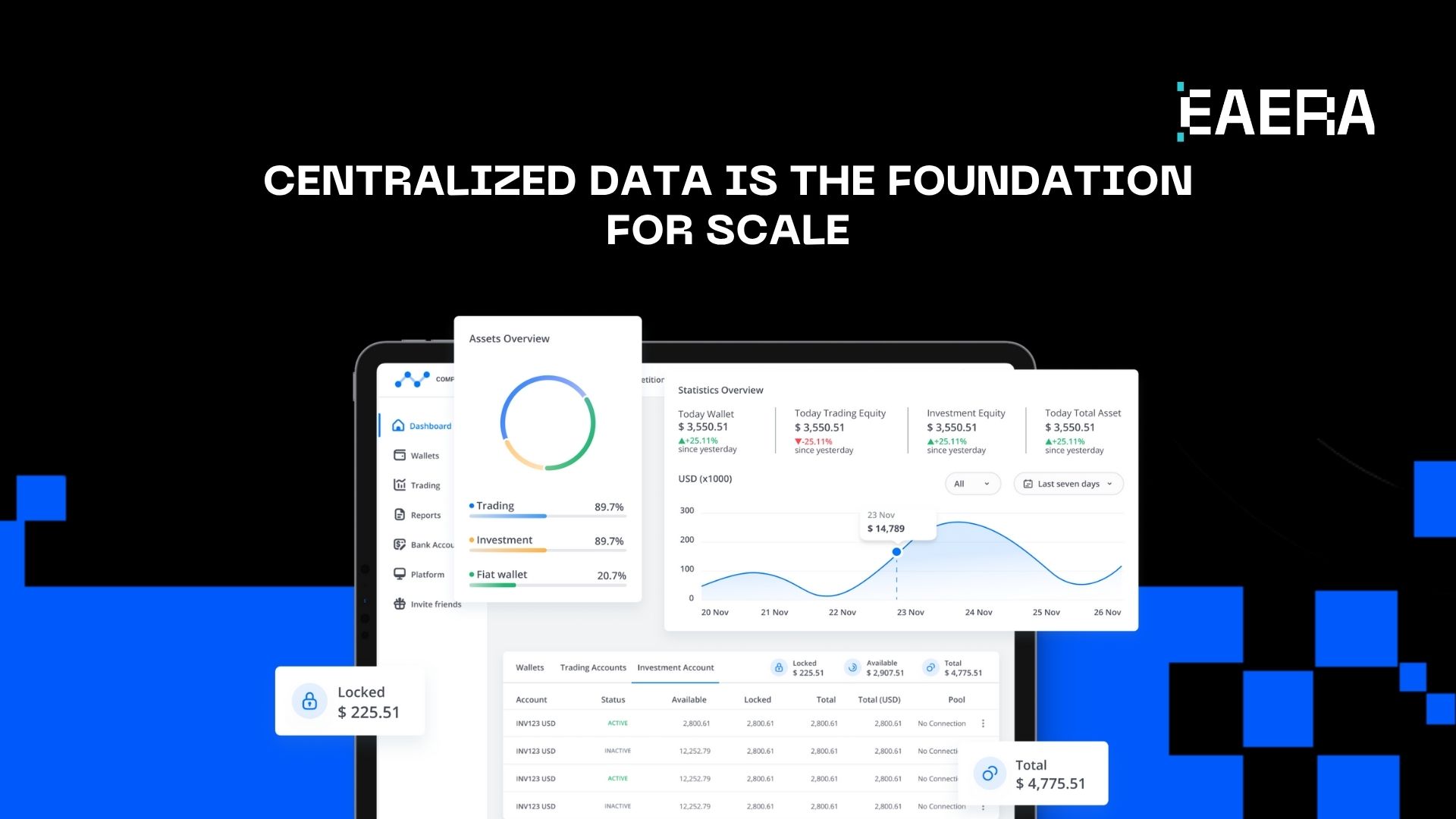

- Centralized Data Is the Foundation for Scale

Relying on spreadsheets and disconnected systems made it impossible to gain a single, real-time view of each trader. The project confirmed that investing early in a unified CRM drastically reduces errors, speeds up decision-making, and enables global growth.

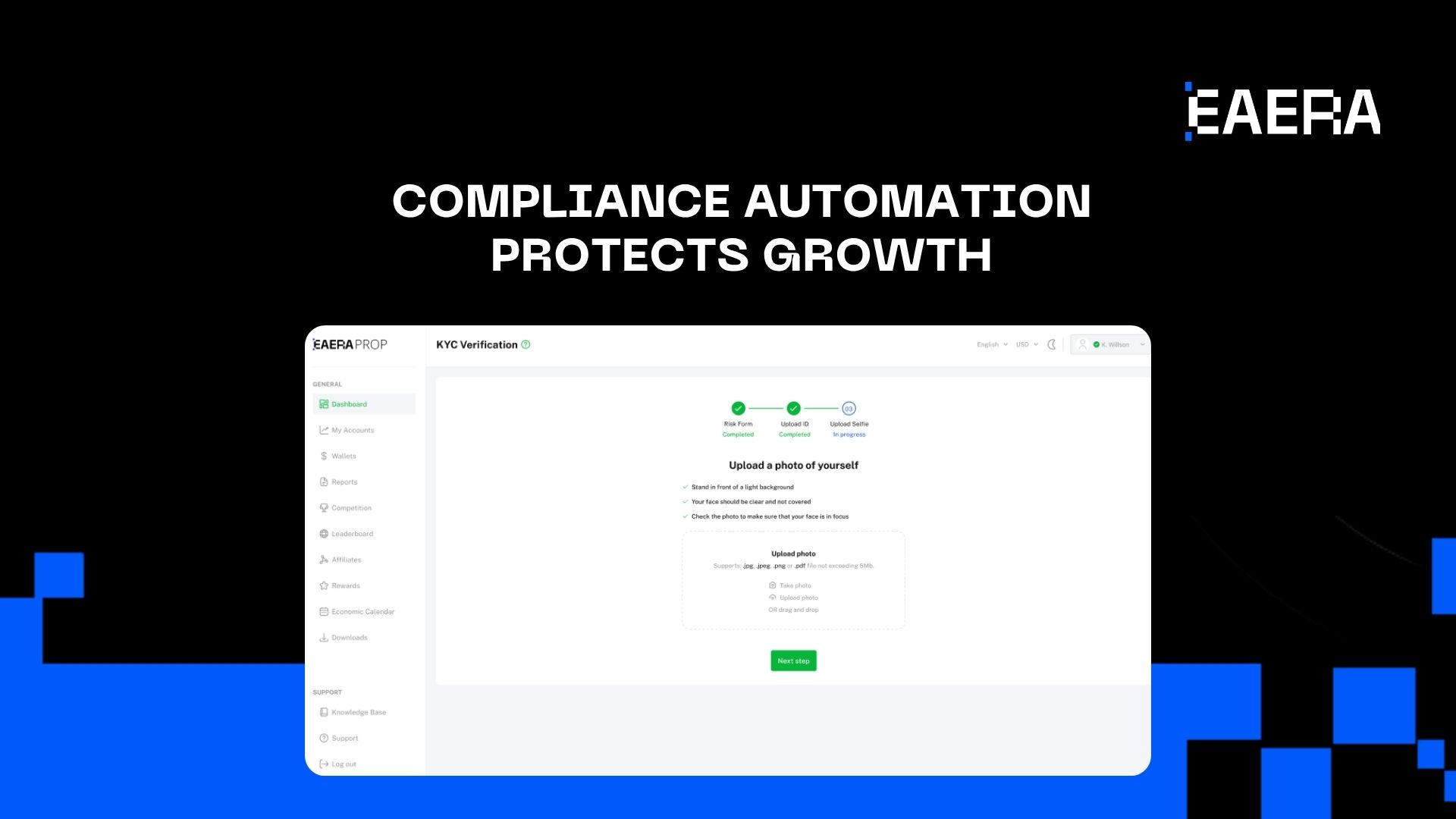

- Compliance Automation Protects Growth

Manual KYC/AML checks were the biggest drag on onboarding. Automating these processes not only accelerated account activation but also reduced regulatory risk – essential for entering tightly regulated markets such as the EU and Middle East.

- Cross-Team Collaboration Ensures Success

Engaging leadership, compliance, sales, and operations from day one allowed EAERA to map every workflow and avoid downstream rework. Open communication between the broker’s teams and EAERA consultants was a key factor in delivering on time and within budget.

- Scalable Architecture Outperforms Quick Fixes

Choosing a purpose-built Forex CRM over patching existing tools gave the brokerage room to expand into new regions, add trading servers, and support multiple payment channels without costly migrations later.

CONCLUSION

In today’s fast-evolving forex landscape, operational excellence and regulatory compliance are non-negotiable for brokers with global ambitions. As this case study demonstrates, investing in a purpose-built forex broker solution – anchored by advanced forex CRM software – empowers brokerages to centralize client data, automate KYC/AML processes, and seamlessly scale into new markets. The result is faster onboarding, reduced operational costs, and a superior client experience that drives long-term growth.

Ready to future-proof your brokerage? Contact EAERA today to schedule a personalized demo of our forex CRM software and see how our all-in-one forex broker solution can accelerate your global expansion.

Have questions or want to discuss your unique challenges? Reach out to our experts for a free consultation and discover the best path to sustainable, compliant growth.