In the competitive world of forex trading, PAMM (Percentage Allocation Management Module) accounts have emerged as a powerful tool for connecting professional traders with investors seeking passive income opportunities.

For PAMM managers, attracting and retaining investors is critical to growing their managed funds and enhancing their reputation.

At EAERA, we understand the pivotal role performance analytics play in this process. By leveraging advanced analytics, PAMM managers can showcase their expertise, build trust, and demonstrate value to potential investors.

This blog explores how PAMM managers utilize performance analytics to attract investors and how EAERA’s cutting-edge solutions support this endeavor.

Related articles:

- Hidden Costs of Delaying Your Forex CRM System

- Case Study: Automating Drawdown Alerts with Custom Prop Firm CRM Rules

The Role of Performance Analytics in PAMM Accounts

PAMM accounts allow professional traders, or PAMM managers, to manage funds from multiple investors within a single account, with profits and losses distributed proportionally based on each investor’s contribution.

To attract investors, PAMM managers must provide transparent, data-driven insights into their trading performance. Performance analytics serve as the backbone of this transparency, offering quantifiable metrics that highlight a manager’s skill, consistency, and risk management capabilities.

Analytics provide a clear picture of a PAMM manager’s track record, including key performance indicators such as returns, drawdowns, and trading volume. By presenting these metrics in an accessible format, managers can differentiate themselves in a crowded market and appeal to investors who prioritize data-driven decision-making.

EAERA’s PAMM solution integrates robust analytics tools to help managers effectively communicate their performance to potential investors.

Key Metrics PAMM Managers Use to Attract Investors

To build investor confidence, PAMM managers rely on a range of performance metrics that showcase their trading prowess. Here are the primary analytics that resonate with investors:

1. Historical Performance and Returns

Investors are naturally drawn to PAMM managers with a strong history of consistent returns. Performance analytics provide detailed reports on monthly and annual returns, allowing managers to demonstrate their ability to generate profits over time. For example, a PAMM manager who consistently achieves 8-12% annual returns with minimal volatility is likely to attract risk-averse investors. EAERA’s platform enables managers to present these metrics through interactive charts and graphs, making it easy for investors to assess historical performance.

2. Maximum Drawdown

Maximum drawdown is a critical metric that indicates the largest percentage loss a PAMM account has experienced from its peak value. A low drawdown signals effective risk management, which is a key factor for investors evaluating a PAMM manager.

Analytics tools allow managers to highlight their ability to minimize losses during volatile market conditions, fostering trust among prospective investors. EAERA’s PAMM system includes a built-in rating module that showcases drawdown statistics, helping managers stand out.

3. Risk-Reward Ratio

The risk-reward ratio measures the potential profit of a trade relative to its risk. PAMM managers who maintain a favorable risk-reward ratio demonstrate their ability to balance profitability with caution. By presenting this metric, managers can appeal to investors who seek steady growth without excessive exposure to market fluctuations.

EAERA’s analytics suite provides real-time insights into risk-reward ratios, enabling managers to fine-tune their strategies and present compelling data to investors.

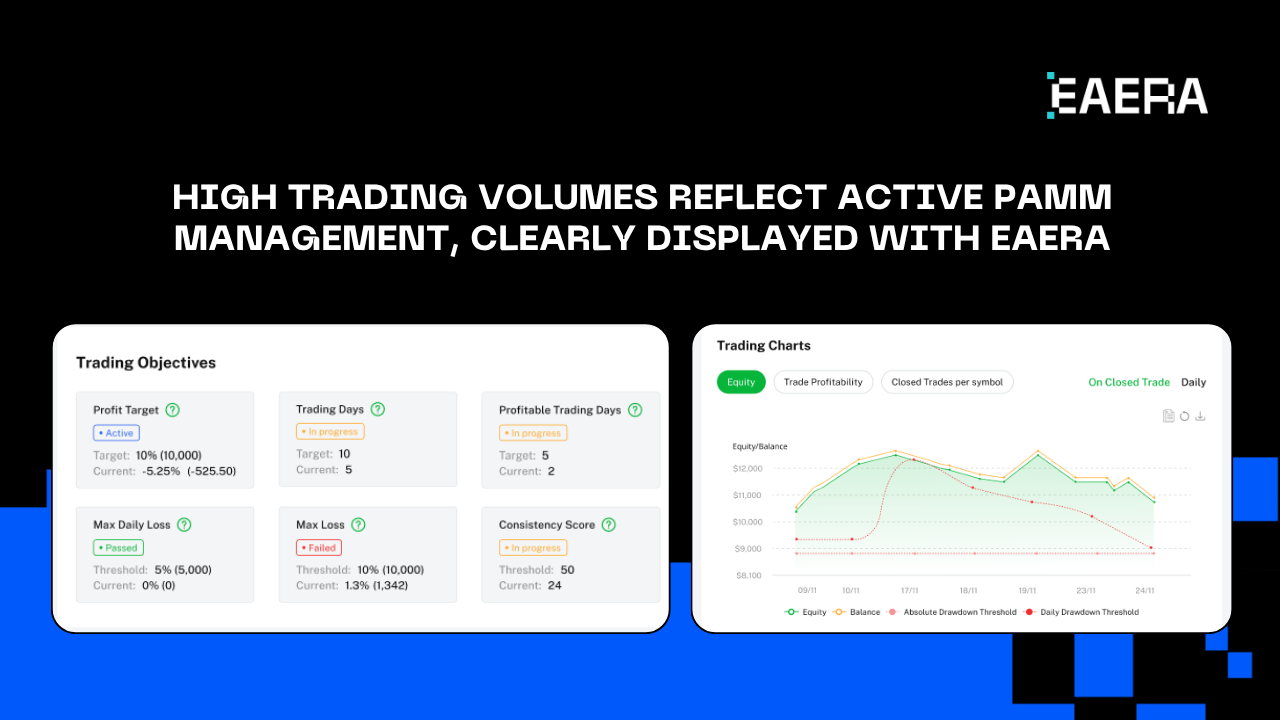

4. Trading Volume and Activity

High trading volumes often indicate an active and engaged PAMM manager, which can be appealing to investors. Performance analytics track trading frequency, average trade size, and overall activity, offering a glimpse into a manager’s dedication and market involvement.

EAERA’s platform allows managers to display these metrics on a user-friendly dashboard, giving investors a clear view of their trading activity.

5. Consistency and Longevity

Investors value consistency and longevity in a PAMM manager’s track record. Analytics that highlight a manager’s ability to deliver stable returns over an extended period can significantly boost investor confidence. EAERA’s PAMM solution includes a trader profile section where managers can showcase their account age and consistent performance, reinforcing their reliability.

How PAMM Managers Leverage Analytics to Build Trust?

Transparency is the cornerstone of investor trust in the PAMM ecosystem. By providing real-time access to performance analytics, PAMM managers can demonstrate accountability and openness. For instance, EAERA’s PAMM platform includes a client portal where investors can access detailed trade histories, performance reports, and automated revenue updates. These tools empower investors to monitor their investments closely, fostering confidence in the manager’s abilities.

Moreover, PAMM managers can use analytics to create leaderboards that highlight top-performing traders. EAERA’s built-in rating module allows managers to showcase their rankings based on key metrics like returns and drawdowns. By appearing on a leaderboard, managers can attract attention from potential investors browsing the platform, increasing their visibility and credibility.

Strategies for PAMM Managers to Attract Investors Using Analytics

To maximize their appeal, PAMM managers must strategically use performance analytics to engage and convert potential investors. Here are some effective strategies:

1. Showcase Performance Through Visuals

Investors are more likely to engage with data presented in a clear, visually appealing format. Interactive charts, graphs, and performance dashboards make complex metrics accessible and engaging. EAERA’s PAMM solution offers customizable widgets that managers can integrate into their profiles or brokerage websites, showcasing their performance in real time.

2. Highlight Risk Management Practices

Risk-averse investors prioritize managers who demonstrate robust risk management. By using analytics to highlight low drawdowns, controlled volatility, and effective stop-loss strategies, PAMM managers can appeal to this demographic.

EAERA’s platform includes tools like the Stop Loss function, which automatically closes investments when predefined loss thresholds are reached, reassuring investors of their capital’s safety.

3. Provide Regular Performance Updates

Consistent communication is key to retaining investor interest. PAMM managers can use automated reporting tools to send regular performance updates via email or the client portal. EAERA’s PAMM system streamlines this process, allowing managers to schedule detailed investment reports that keep investors informed and engaged.

4. Leverage Trader Profiles

A well-crafted trader profile can set a PAMM manager apart from the competition. By including detailed performance analytics, trading strategies, and risk profiles, managers can create a compelling narrative that resonates with investors. EAERA’s trader profile section allows managers to display their statistics prominently, attracting investors seeking proven expertise.

5. Educate Investors on PAMM Benefits

Many investors are unfamiliar with PAMM accounts and may perceive them as risky. Managers can use analytics to educate potential investors about the benefits of PAMM investing, such as diversified portfolios and professional management.

By sharing educational content backed by performance data, managers can demystify PAMM accounts and build trust. EAERA supports this by offering tools to create webinars and informational content that highlight the value of PAMM investing.

Overcoming Challenges with Performance Analytics

While performance analytics are powerful, attracting investors to PAMM accounts comes with challenges. One common hurdle is the perception of risk in forex trading. Managers can address this by using analytics to demonstrate a conservative trading approach and consistent returns. Additionally, the competitive PAMM market requires managers to differentiate themselves. EAERA’s advanced analytics tools help managers stand out by providing precise, real-time data that highlights their unique value proposition.

Another challenge is ensuring investor trust in a crowded market. By offering transparent, automated reporting and real-time performance tracking, EAERA’s PAMM solution helps managers build credibility and foster long-term relationships with investors.

The Future of PAMM and Performance Analytics

As the financial industry evolves, the role of advanced analytics in PAMM accounts will only grow. Emerging technologies like artificial intelligence and machine learning are enabling managers to analyze vast datasets, predict market trends, and optimize trading strategies. EAERA is at the forefront of this transformation, integrating AI-powered analytics into our PAMM platform to provide managers with deeper insights and investors with greater confidence.

By staying ahead of technological trends, PAMM managers can continue to attract investors by offering cutting-edge tools and data-driven strategies. EAERA’s commitment to innovation ensures that our clients have access to the latest advancements in performance analytics, empowering them to succeed in the competitive PAMM landscape.

Why Choose EAERA for Your PAMM Needs?

At EAERA, we are dedicated to empowering PAMM managers with the tools they need to attract and retain investors. Our cloud-based PAMM solution offers a comprehensive suite of analytics, including real-time performance tracking, automated reporting, and interactive leaderboards.

With features like the built-in rating module and customizable trader profiles, EAERA enables managers to showcase their expertise and build investor trust. Whether you’re a seasoned PAMM manager or just starting, our platform provides the transparency, reliability, and scalability needed to grow your managed funds.

Contact our sales team today to learn how EAERA can elevate your PAMM strategy and help you achieve your financial goals.