The rise of prop trading has introduced a new dynamic to the forex market, offering a path that differs significantly from traditional retail trading. Through a prop firm forex structure, traders are granted access to company-funded capital, allowing them to grow their strategies without personal financial exposure. With the aid of advanced technologies such as prop trading dashboards and modern prop firm CRM systems, this model is becoming more efficient, transparent, and scalable.

Related articles:

- Forex CRM: How to Choose the Best Provider for Your Brokerage

- 10 Reasons Why You Should Get a Forex Broker CRM

An increasing number of forex traders are gravitating toward prop trading companies due to better funding access, defined progression paths, and access to institutional-grade tools.

What is Prop Trading in Forex?

In a traditional retail forex model, traders use their own money to speculate on currency movements. In contrast, a prop trading firm provides traders with the company’s capital. Profits are split based on pre-agreed terms, and traders can scale their operations without taking on personal financial risk.

A prop trading forex model supports traders with risk parameters, funding programs, and structured evaluations. Instead of trading alone, traders work within a system designed to maximize their potential while protecting the firm’s capital.

Key Drivers Behind the Shift to Prop Trading

1. Access to More Capital

One of the biggest barriers to success in forex prop trading is limited capital. Many skilled traders never fully realize their potential because they can’t access sufficient funds.

Prop trading companies eliminate this barrier. By providing access to larger capital pools, firms allow traders to open bigger positions, diversify across markets, and maximize returns without risking personal funds.

A success story comes from a prop trading firm in London, where a young trader scaled his monthly profits by 300% within one year simply by moving from retail trading to a funded prop trading firm account.

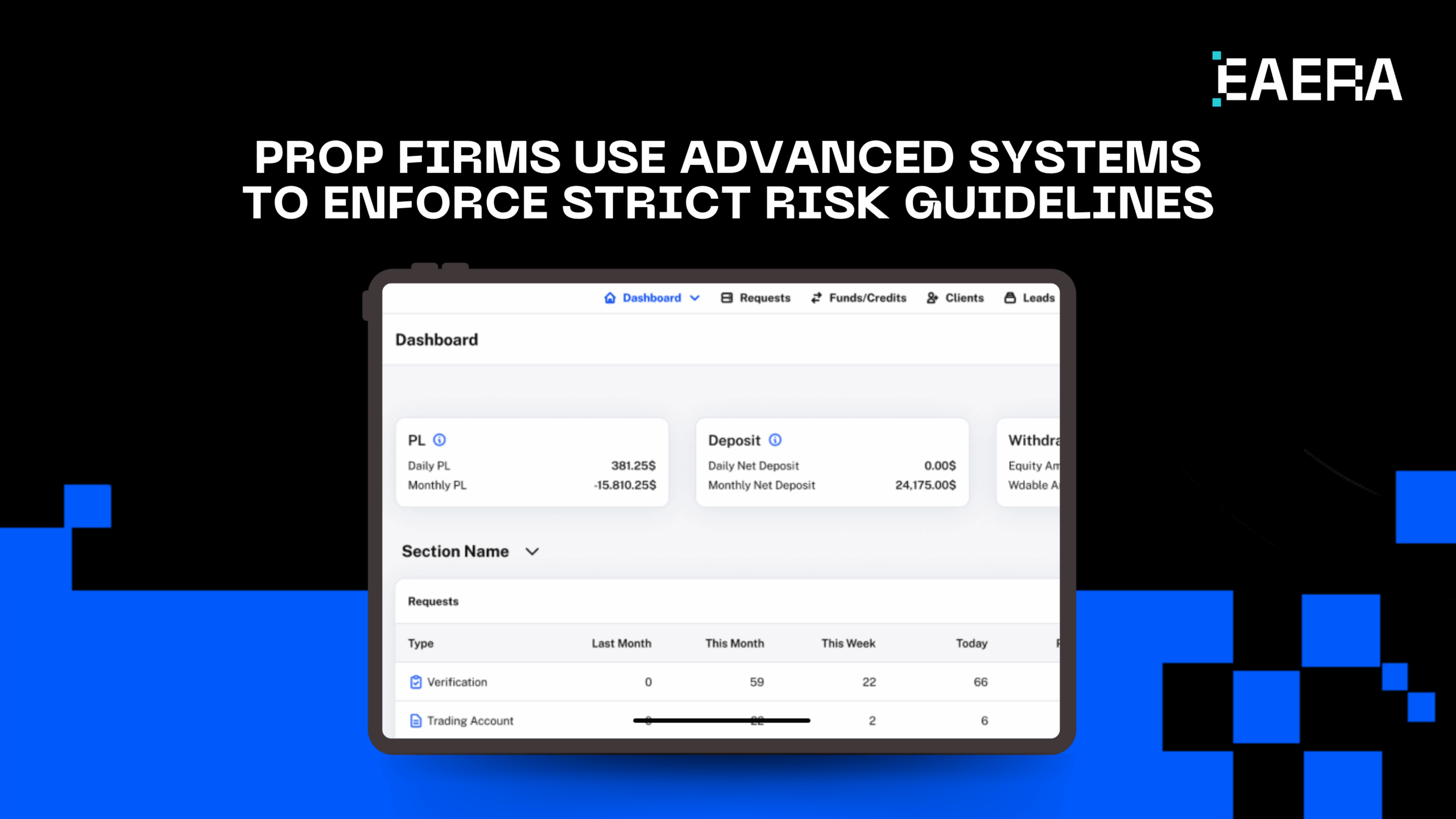

2. Structured Risk Management

Retail traders often struggle with poor risk management. Prop firms use advanced prop firm CRM systems and prop trading dashboards to enforce strict risk guidelines such as maximum daily losses, leverage limits, and stop-loss enforcement.

For example, a Dubai-based prop trading company reduced its trader failure rate by 25% after integrating automated risk control systems. This structured environment helps traders focus on strategy execution rather than worrying about catastrophic losses.

3. Career Growth Opportunities

A prop trading company often provides traders with clear career pathways. Traders can progress from evaluation stages to full funding, and in some firms, even become team leads or educators.

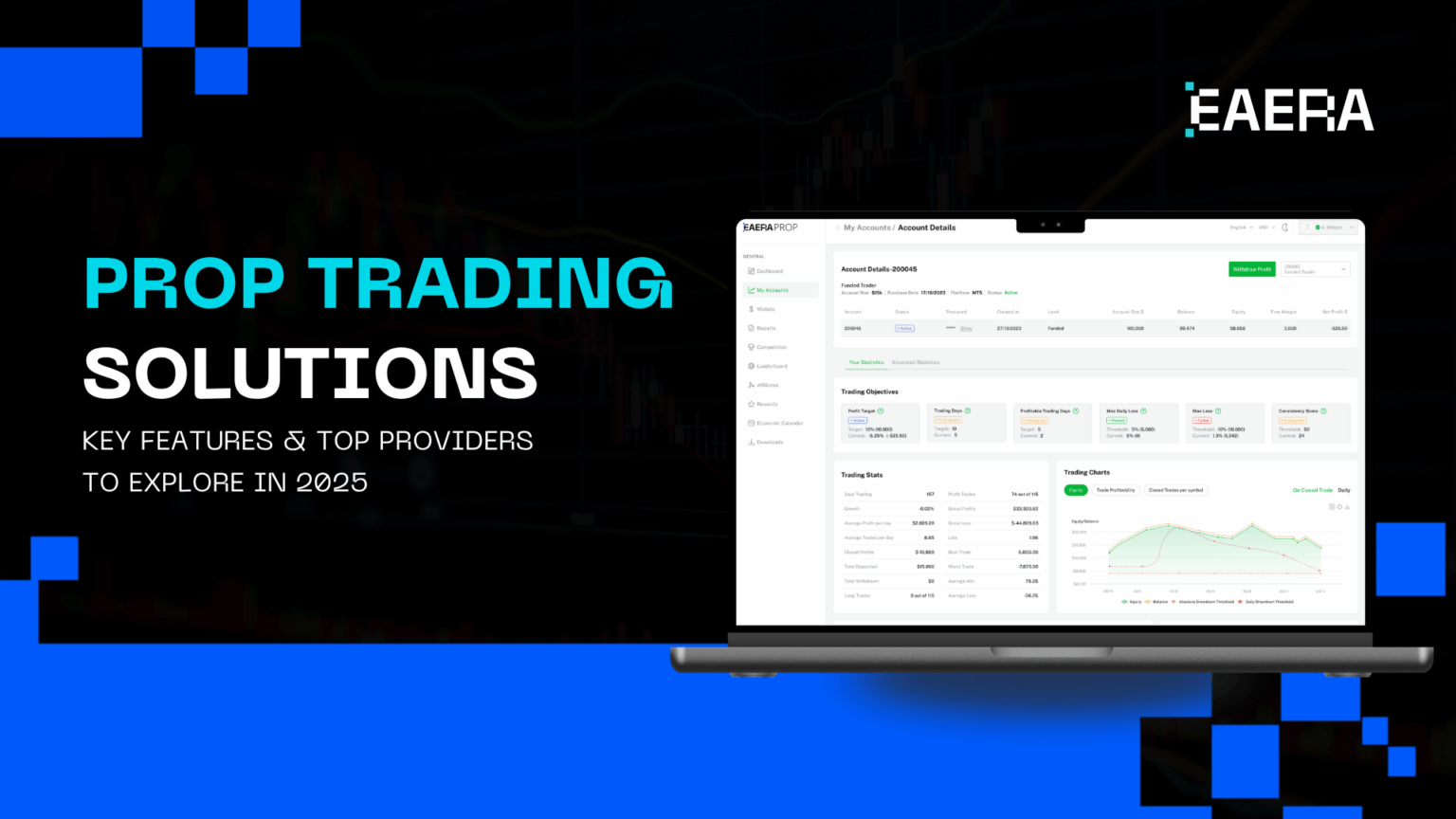

Prop firms use their prop trading dashboards to track performance metrics like win rate, risk-to-reward ratios, and average hold times. Traders can access detailed feedback that helps them continuously improve and move up the funding ladder.

One real-world example is FundedNext, a prop trading firm forex operation that introduced a clear multi-stage funding program, leading to a 40% increase in trader retention over 12 months.

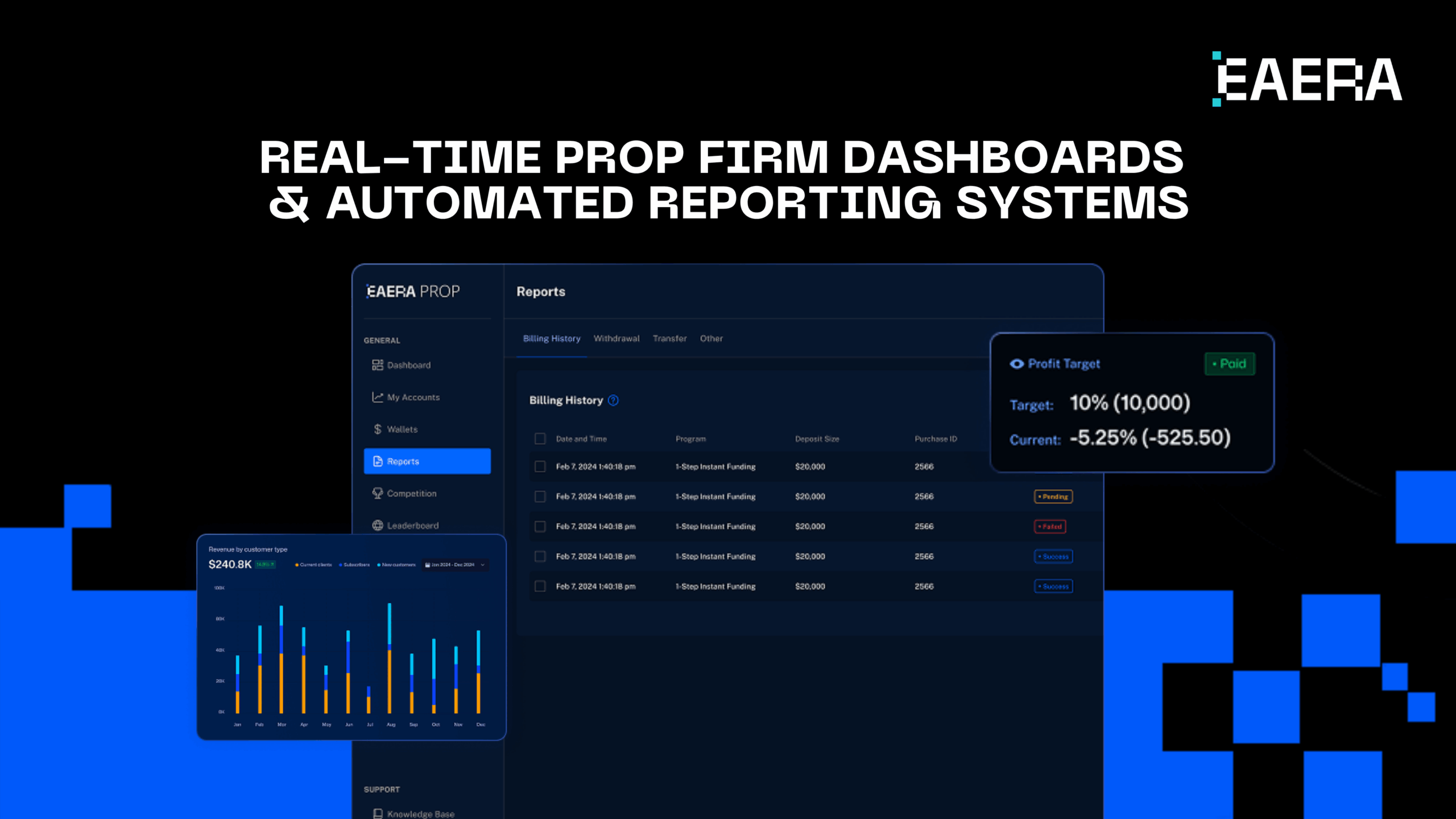

4. Access to Professional Trading Tools

Prop trading software offers a serious upgrade over standard retail platforms. Many firms provide access to proprietary analytics tools, real-time prop trading firm dashboards, and automated reporting systems. These resources help traders analyze performance, spot inefficiencies, and adapt strategies quickly.

A New York-based prop firm reported a 30% increase in monthly trading volumes after offering its traders an AI-enhanced prop trading dashboard that automatically suggested optimal position sizing based on historical trade data.

5. Psychological Advantages

Trading with personal money can lead to emotional decisions, overtrading, and fear-based exits. Prop trading firm models create an environment where capital preservation is critical, and emotional discipline is encouraged.

Because traders operate under predefined risk parameters and know they won’t lose their personal savings, they are more likely to stick to their prop trading plans and execute strategies objectively.

The Role of Technology: CRM, Dashboards, and Automation

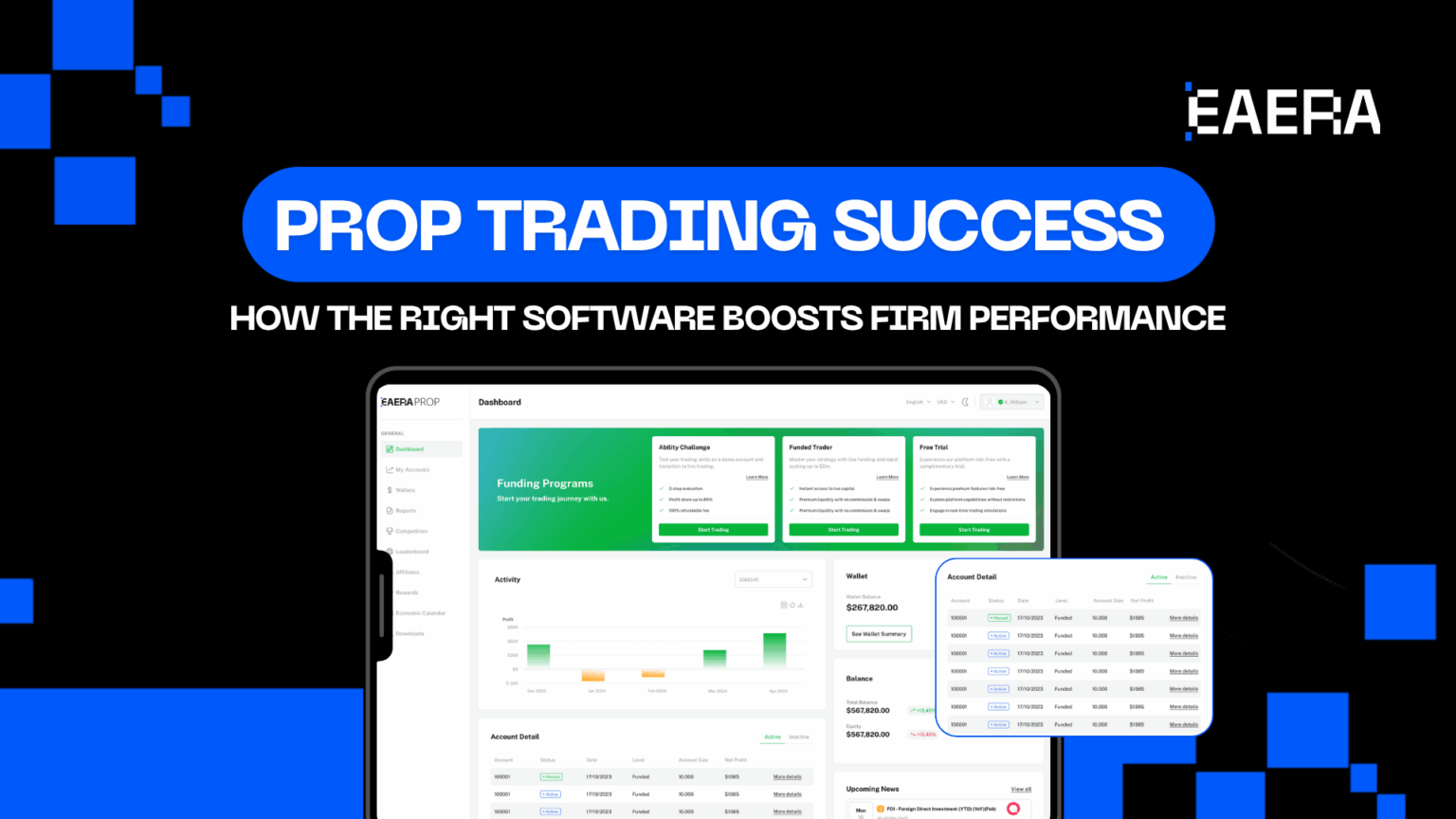

Prop firms today leverage cutting-edge technology to manage their operations and empower traders.

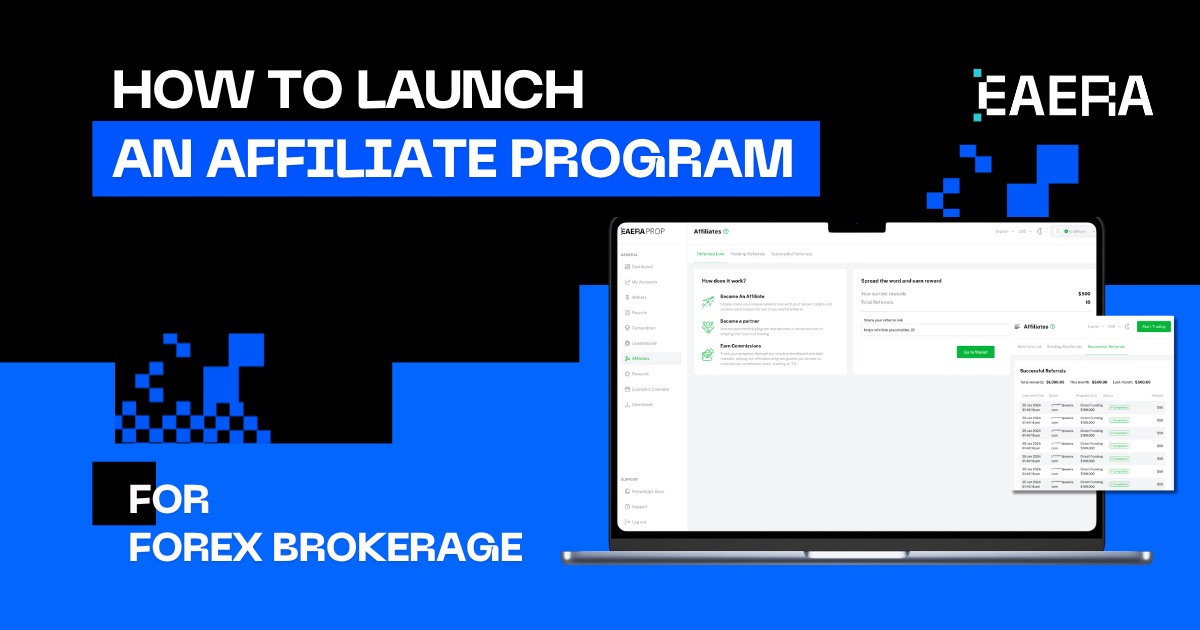

- A prop trading firm CRM centralizes trader information, tracks evaluation progress, and manages communications efficiently.

- Prop firm dashboards display real-time statistics, such as drawdowns, open positions, and equity curves, ensuring transparency.

- Prop trading software integrates risk parameters, evaluation tracking, and payout management into a single ecosystem.

For instance, EAERA’s prop firm CRM solutions offer seamless integration with prop trading dashboards, giving firms a bird’s-eye view of all trader activities and performance metrics.

Challenges Forex Traders Face in Prop Trading

Although prop trading offers many advantages, it also comes with challenges:

- Evaluation Phases: Traders must often pass evaluation stages before accessing live capital.

- Strict Risk Rules: Breaking a firm’s risk rules can lead to account termination.

- Profit Split Models: Traders need to accept that a portion of their profits goes to the firm.

However, successful traders see these as fair trade-offs for gaining access to funding, mentorship, and a structured trading environment.

Real-World Examples of Prop Trading Firms Changing Forex Trading

FTMO

FTMO pioneered the modern two-phase evaluation model. Traders undergo a Challenge and Verification phase to prove their skills before being funded. With a comprehensive prop firm dashboard, traders can track their evaluation in real-time.

MyForexFunds

This prop trading company caters to all levels of traders with flexible account types. Their prop trading software includes automatic progress tracking, ensuring that traders always know where they stand during evaluations.

FundedNext

FundedNext emphasizes psychological coaching, offering workshops and 24/7 mentor support through their prop firm CRM. This holistic approach led to a 30% trader performance improvement across their funded accounts.

How EAERA Supports Prop Trading Firms and Traders

EAERA specializes in providing prop trading companies with world-class CRM and dashboard solutions. Our technology empowers prop firms to:

- Manage trader evaluations, risk settings, and payouts automatically.

- Offer a seamless prop trading dashboard experience to traders.

- Integrate compliance and performance tracking into one platform.

Whether you are an emerging prop firm or an established player, EAERA’s customizable CRM and prop trading software can help you scale operations efficiently while maintaining full visibility and control.

If you’re a prop trading firm looking to streamline operations, improve trader experience, and grow sustainably, contact EAERA today to discover how our solutions can transform your success.