By 2026, trading software will be judged on its ability to support governance, scalability, and disciplined operations rather than its feature count. Firms and traders are expecting more as the industry moves toward system-led proprietary trading models. For any smart prop firm, trading software has become the operating system that defines risk control, efficiency, and trust.

Related articles:

In contrast to surface-level functionality, this article highlights architecture, automation, risk management, and transparency as the key factors to consider when assessing trading software in 2026.

Why Trading Software Requirements Are Changing in 2026?

A fundamental shift in software expectations is being driven by the development of proprietary trading models. The foundation of traditional platforms was reporting and execution. A smart prop company, on the other hand, needs software that controls behavior, upholds regulations, and scales operations in a predictable manner.

Several forces are shaping this shift:

- Higher trader volumes across multi-phase programs

- Increased reliance on automation to reduce operational risk

- Stronger emphasis on consistency and fairness

- Growing expectations for auditability and explainability

Trading software is no longer a support tool. It is the backbone of how a smart prop firm operates, grows, and maintains credibility.

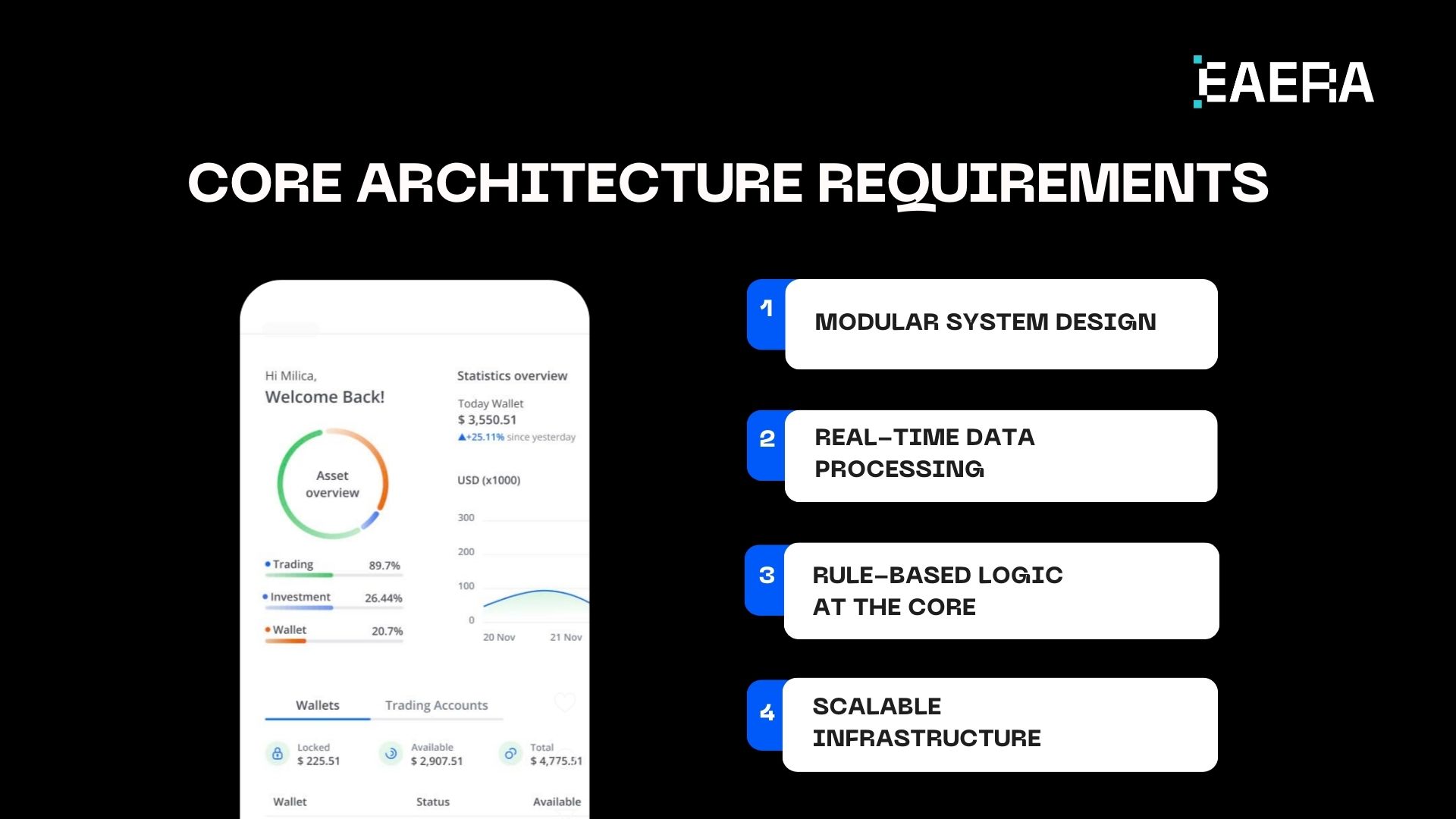

Core Architecture Requirements for a Smart Prop Firm

Architecture will be more important in 2026 than specific features. System design that can change without constant rework must be a top priority for a contemporary smart prop company.

Key architectural requirements include:

- Modular system design

Allows firms to introduce new programs, rules, or workflows without disrupting existing operations. - Real-time data processing

Risk limits, drawdowns, and performance metrics must update instantly, not on delayed intervals. - Rule-based logic at the core

Business rules should be encoded into the system, not enforced manually. - Scalable infrastructure

The platform must support growth in traders, accounts, and regions without performance degradation.

Because legacy systems were not built to meet these demands, they suffer. The software architecture of a smart prop company determines whether growth is controlled or uncontrolled.

Risk Management and Rule Enforcement Capabilities

In 2026, trading software’s primary purpose will be risk management. Risk controls for a smart prop firm need to be consistent, automated, and proactive.

Essential capabilities include:

- Automated drawdown enforcement

- Daily loss and exposure limits

- Phase-aware risk logic for evaluation, verification, and funded stages

- Immediate account state transitions when rules are breached

Inconsistencies and delays are introduced by manual risk checks. Automated enforcement guarantees that all traders are subject to the same rules, without exceptions or bias.

With this method, risk management is reframed as a structural advantage rather than a reactive procedure. Businesses that use automated rule enforcement report less operational stress, fewer disputes, and more predictable results.

Automation and Operational Efficiency

Automation isn’t about cutting employees. Its goal is to lessen reliance on human judgment in high-risk, repetitive workflows. By 2026, a smart prop firm will need to assess trading software according to the extent to which automation is integrated into day-to-day operations.

Key automation areas include:

- Automated phase transitions

- Capital allocation logic based on performance consistency

- Payout and funding workflows

- Audit-ready logs and traceability

Without automation, operations teams have to spend time fixing preventable problems. Teams concentrate on oversight and improvement rather than fighting fires when automation is in place.

Instead of depending on human intervention, platforms like EAERA are built with automation-first principles, guaranteeing that operational rules run consistently at scale.

Transparency, Compliance, and Trust-Building

System behavior, not marketing, is what builds trust. By 2026, traders and regulators will look to trading platforms for explainability, consistency, and clarity. Software for a smart prop company needs to be transparent by design.

Key trust-building capabilities include:

- Explainable system decisions

- Immutable audit trails

- Role-based access control

- Consistent rule application across all accounts

Even in the face of negative results, traders’ confidence rises when they comprehend the decision-making process. Audits are less disruptive when regulators can easily track actions.

Additionally, transparency lowers internal friction. Because the system offers precise answers, teams no longer argue over “what happened.”

Automation as a Foundation for Fairness

One of the most underappreciated advantages of robust trading software is fairness. If a smart prop company wishes to grow without running the risk of damaging its reputation, it cannot rely on subjective judgment.

Automation ensures:

- Identical rule enforcement for all traders

- No hidden overrides or undocumented exceptions

- Consistent handling of breaches and progression

It is challenging to accomplish this degree of fairness by hand. Confidence that results are determined by rules rather than discretion is fostered by system-led enforcement.

This fairness eventually turns into a competitive advantage, drawing in traders who prefer predictability and clarity to ambiguity.

How to Evaluate Trading Software for Long-Term Fit?

Selecting trading software is a long-term choice. By 2026, companies will need to assess platforms more on alignment with strategic objectives than on immediate convenience.

A practical evaluation checklist includes:

- Built specifically for prop firm workflows

- Automation-first design, not manual overlays

- Scalable across programs, regions, and currencies

- Clear product roadmap aligned with future requirements

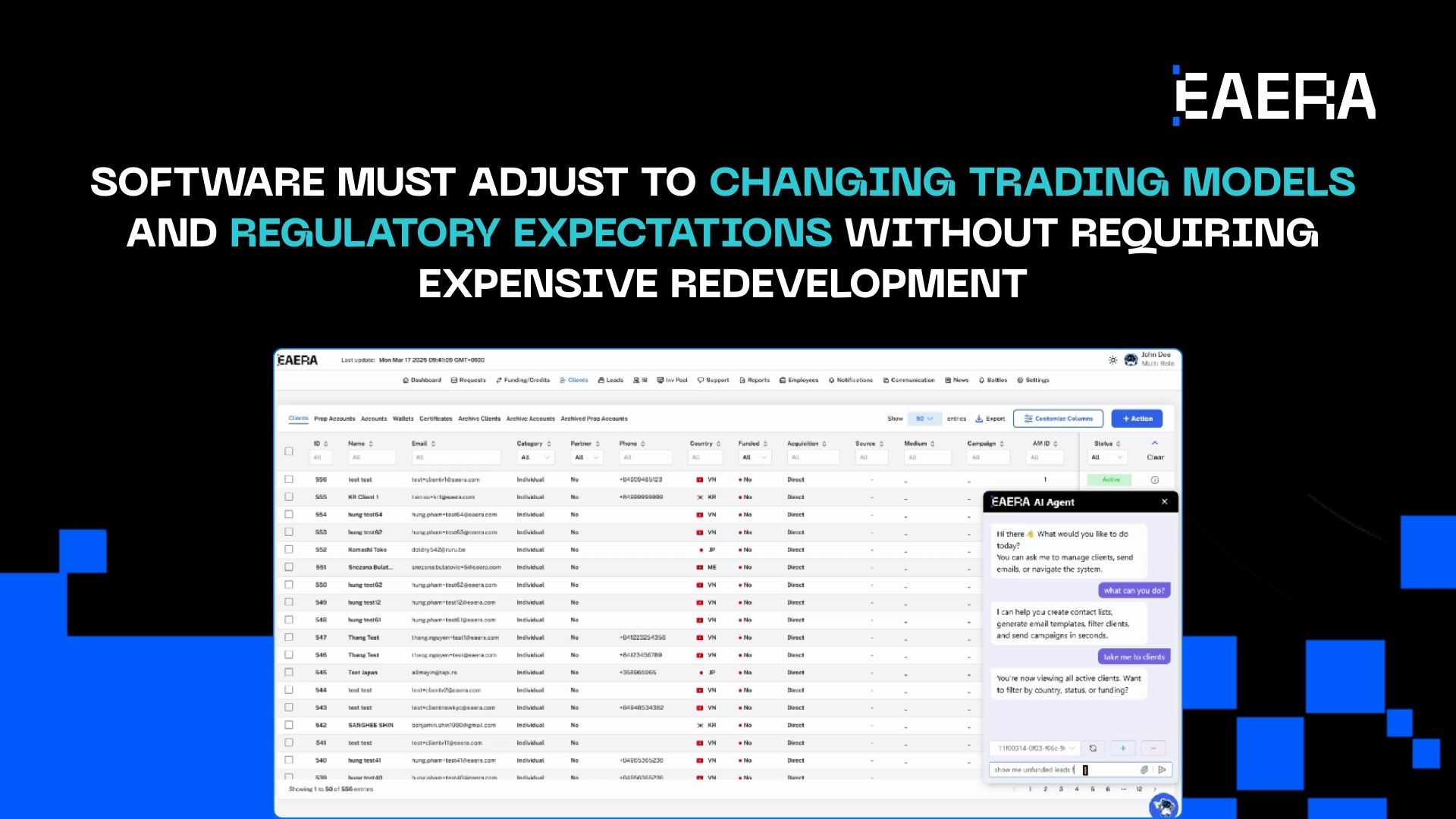

Firms should also evaluate the ease of updating rules. Software must adjust to changing trading models and regulatory expectations without requiring expensive redevelopment.

A smart prop firm can stay resilient as market and compliance demands change with the support of providers like EAERA, who prioritize long-term adaptability.

Businesses should assess a platform’s ability to support operational discipline over time in addition to its technical features. Software that promotes manual overrides or short cuts frequently compromises governance, whereas systems built on automation and logical reasoning strengthen accountability, consistency, and long-term growth throughout the trading operation.

The Strategic Role of Trading Software in 2026

Trading software is no longer just an execution interface. For a smart prop firm, it is the system that defines:

- How risk is controlled

- How traders are evaluated

- How capital is allocated

- How trust is built

Firms that understand software infrastructure and not just tooling are more likely to scale appropriately. Patchwork solutions will only compound in complexity as time goes on.

The gap between system-led firms and discretionary operators will be greatly widened by 2026.

In 2026, trading software needs to support much more than execution-governance, automation, and trust. For any smart prop firm, the right platform will enable disciplined growth, consistent risk management, and operational clarity. The firms investing in system-first trading software now are building the bedrock upon which long-term resilience in this increasingly exacting industry will rest.