Introduction

1. What is a Prop Firm?

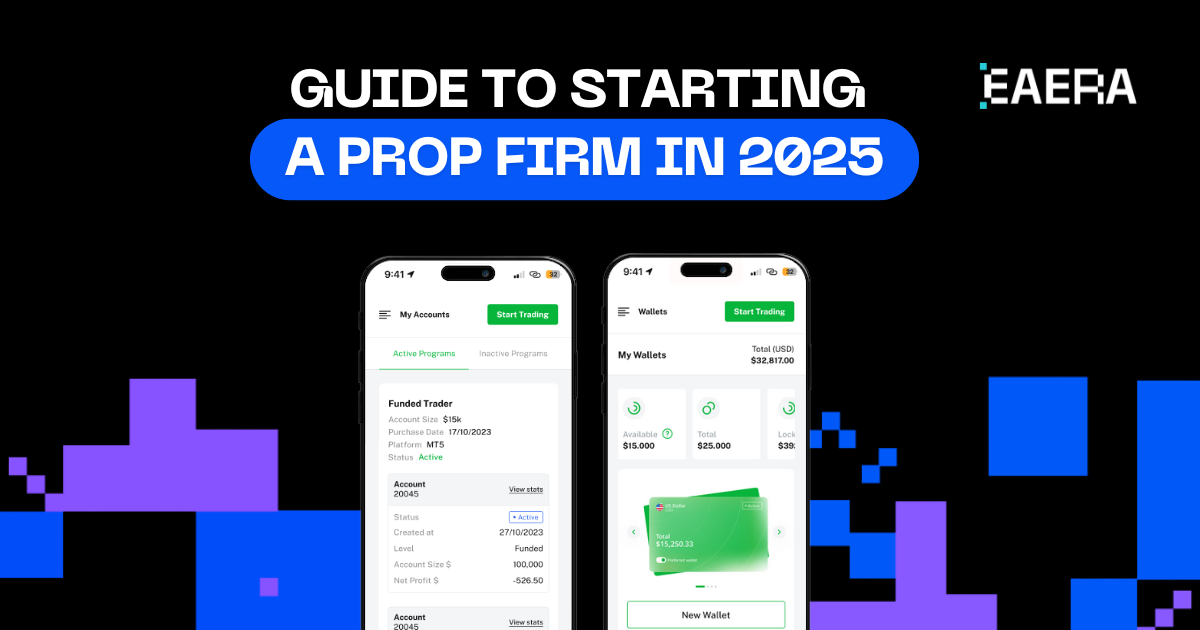

A proprietary (prop) firm is a company that funds skilled traders with its capital, allowing them to trade financial markets such as forex, stocks, or commodities. Unlike retail trading, traders do not risk their personal funds but share a portion of profits with the firm. Many firms, particularly in the prop firm forex sector, leverage advanced technology to provide seamless trading experiences, including real-time tracking through a prop firm dashboard.

2. Why Start a Prop Firm in 2025?

The financial industry is evolving rapidly, with increased demand for innovative trading models and flexible opportunities for traders. Prop firms cater to this need, particularly in the prop firm forex market, where tools like the prop firm dashboard help firms attract and retain top traders. As digital tools advance and regulatory clarity improves, 2025 presents a promising environment for launching a prop firm.

This article will guide you through the essential steps to establish a successful prop firm in 2025. From foundational planning and trading infrastructure to team building, talent management, and marketing, each section offers actionable insights to position your firm for long-term success in the prop firm forex landscape.

The Foundation of a Prop Firm

1. Business Plan and Legal Structure

1.1 Creating a Comprehensive Business Plan

Your business plan should outline the prop firm’s vision, mission, and revenue model. Include specific goals, such as trader onboarding targets and projected growth in the prop firm forex niche. Define KPIs to measure success and ensure the seamless integration of a prop trading dashboard into your operations.

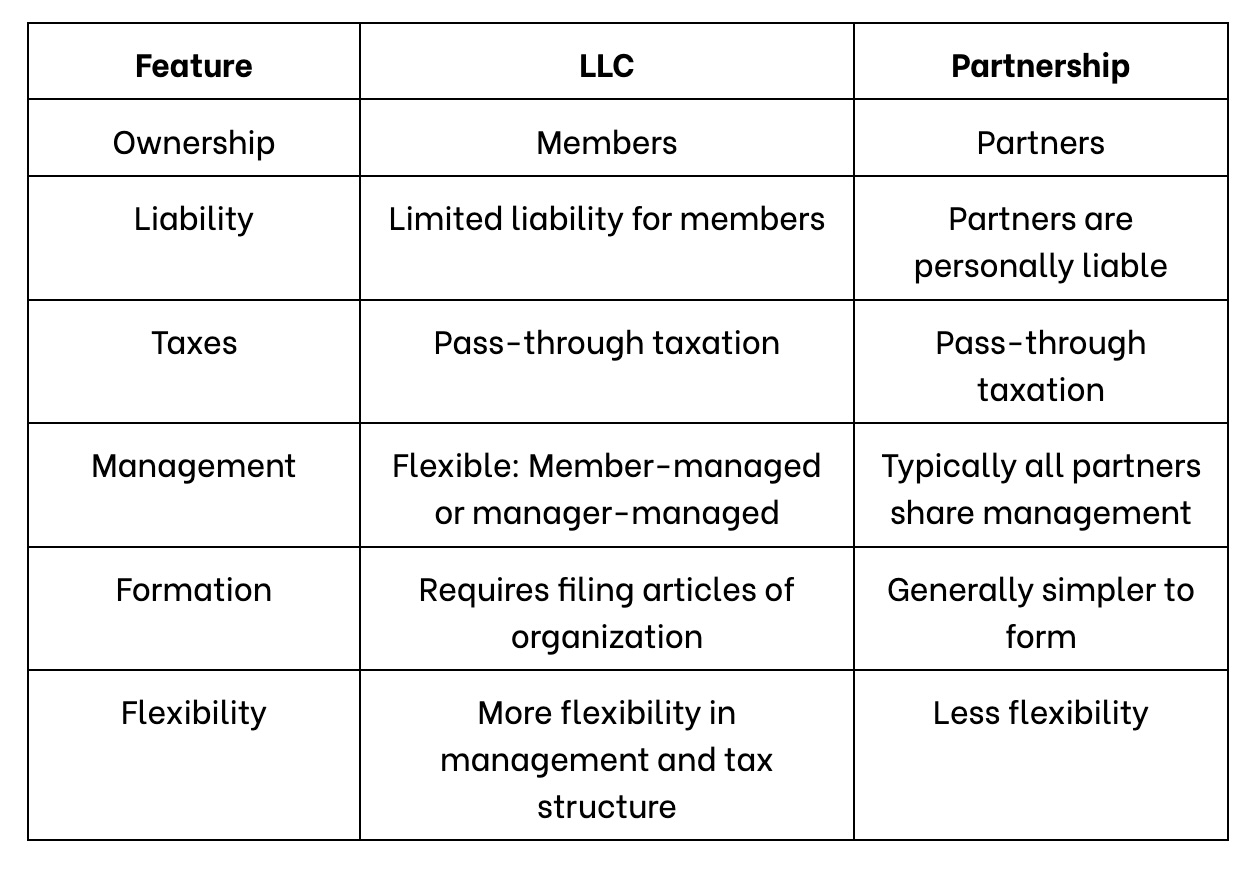

1.2 Choosing a Legal Structure

Select a legal structure that suits your operations. Options include a Limited Liability Company (LLC) or partnership. Each has implications for taxation, liability, and governance. An LLC provides a balance between flexibility and liability protection, ensuring that the personal assets of the firm’s owners are shielded from business debts or legal obligations. Partnerships allow for shared responsibilities and pooled resources, enabling the firm to leverage diverse skills and expertise. More details are listed down below:

1.3 Licensing and Regulatory Requirements

Compliance is critical. Research regulatory requirements in your jurisdiction, especially if you operate in the prop firm forex space. Adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations is essential for building trust and credibility.

2. Financial Planning

2.1 Securing Initial Capital

Starting a prop firm requires significant capital to fund traders and cover operational expenses. Highlight your firm’s focus on the prop firm forex market to attract investors.

2.2 Budgeting for Operational Costs

Allocate budgets for software licenses, such as prop firm dashboard tools, trader payouts, employee salaries, marketing, and compliance costs.

2.3 Financial Projections

Create a detailed financial model that projects your firm’s revenue, operating costs, and profit margins. Highlight how integrating tools such as a prop firm dashboard can streamline operations, improve decision-making, and drive profitability by providing real-time insights and performance tracking.

Building Your Trading Infrastructure

1. Technology Stack

1.1 Trading Platform Selection

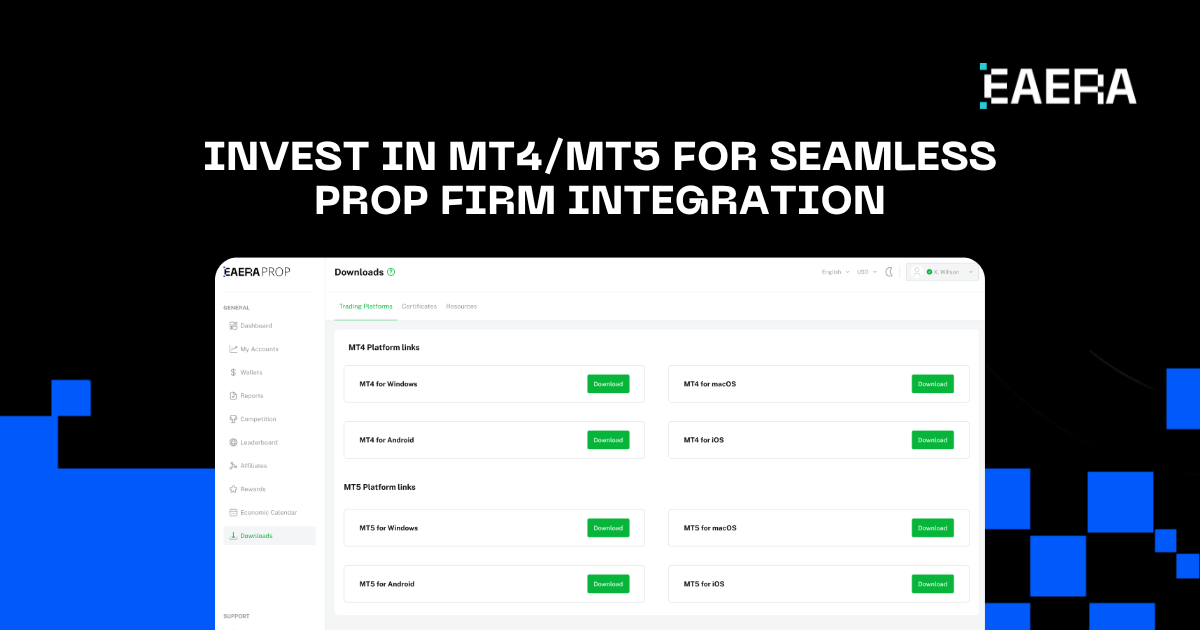

Invest in a reliable trading platform that integrates well with your prop firm dashboard. Popular choices for prop firm forex operations include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Invest in MT4 or MT5 for seamless integration with your prop firm dashboard

1.2 Risk Management Tools

Implement risk management tools to monitor and control trader activities. A prop firm dashboard should display real-time metrics like drawdown limits and profit/loss ratios.

1.3 Data Analytics and Performance Tracking

A robust analytics platform is essential for evaluating trader performance. Integrate these features into your dashboard for streamlined tracking.

1.4 Cybersecurity and Data Privacy

Protect sensitive data related to the firm data and trader operations. Invest in firewalls, encryption, and regular security audits to safeguard your firm.

2. Team Building

2.1 Hiring Key Personnel

Recruit experienced professionals, such as traders, risk managers, and compliance officers, with a background in the forex industry.

2.2 Building a Strong Team Culture

Foster collaboration and accountability. A culture of trust and shared goals enhances productivity and loyalty.

Attracting and Managing Talent

1. Trader Recruitment

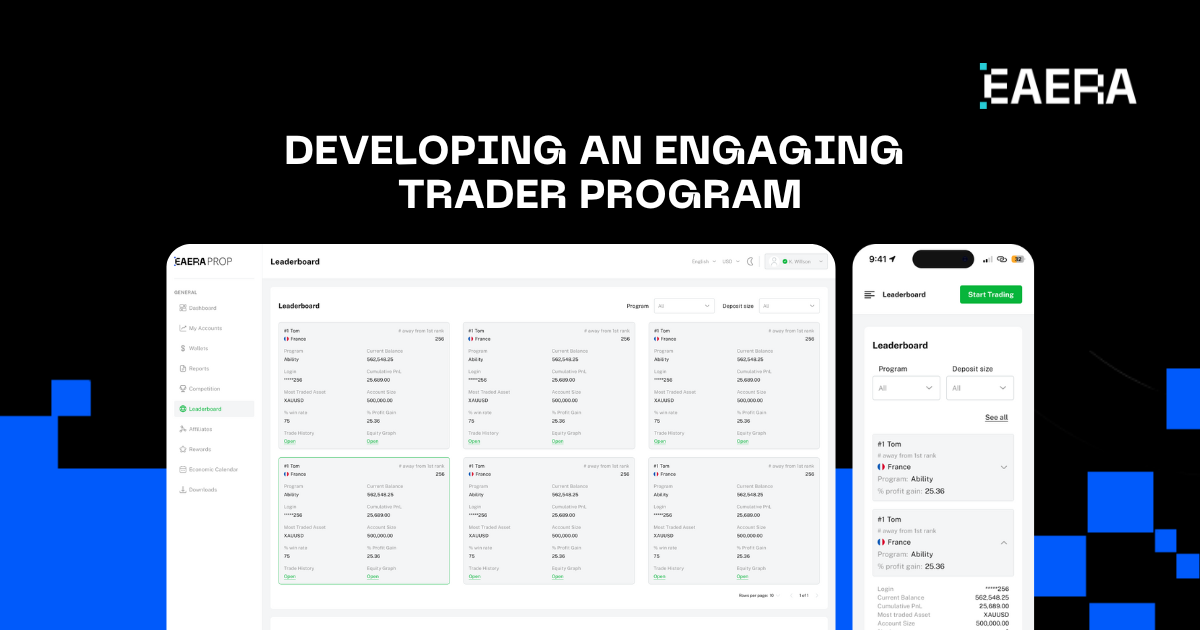

1.1 Creating an Attractive Trader Program

Develop competitive profit-sharing models and transparent terms. Highlight benefits like access to cutting-edge tools and a focus on forex markets.

1.2 Screening and Selection Process

Use rigorous testing and evaluation to identify skilled traders. Emphasize their ability to work within your prop firm forex framework and leverage the prop firm dashboard effectively.

2. Trader Management

2.1 Training and Development

Offer ongoing training programs on forex strategies, risk management, and “prop firm dashboard” usage to help traders improve their skills.

2.2 Performance Evaluation and Incentives

Regularly review trader performance using KPIs displayed on the dashboard. Introduce bonus systems and career advancement opportunities for top-performing traders.

Marketing and Branding

1. Building a Strong Brand Identity

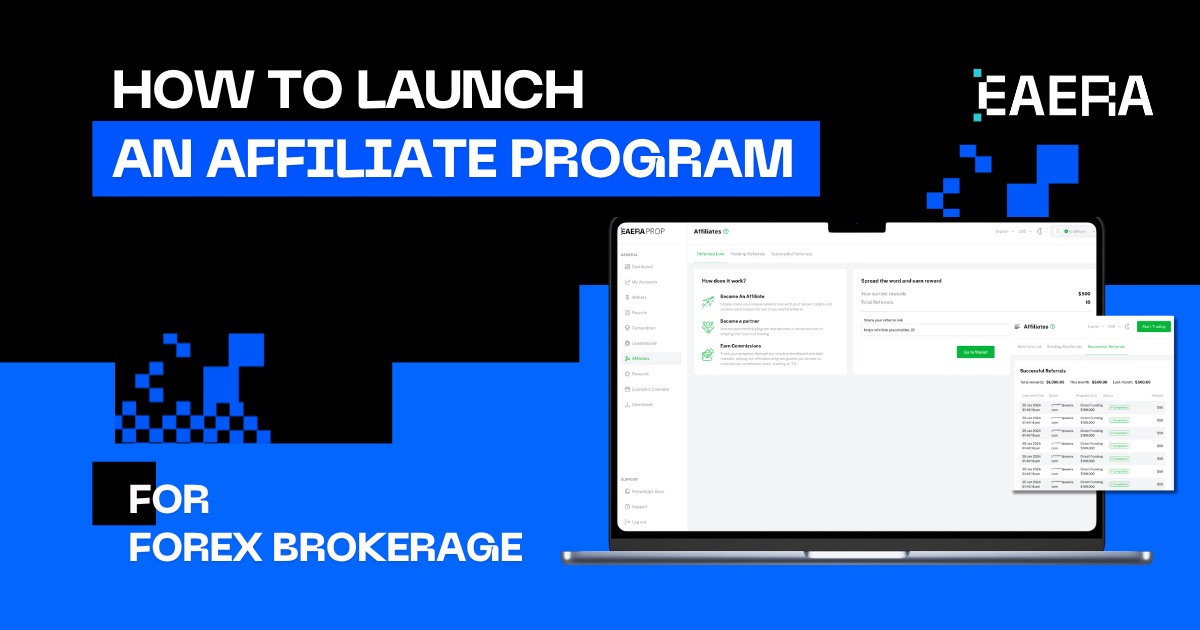

Create a memorable logo and tagline that reflect professionalism and expertise in the prop firm forex space.

2. Leveraging Social Media

Use platforms like LinkedIn, Twitter, and Instagram to share success stories, insights, and updates about your prop firm dashboard and other features that set your firm apart.

Build a strong brand and use social media to attract top traders

3. Content Marketing and SEO

Strategically incorporate keywords that you want to target and rank for, as well as other relevant terms into your website’s content, including titles, meta descriptions, headers, and body text. Create high-quality, informative content such as blog posts, guides, and tutorials that address the needs and interests of forex traders.

Risk Management and Compliance

1. Risk Assessment and Mitigation Strategies

Implement risk controls, such as stop-loss limits and margin requirements, visible through the “prop firm dashboard.” Regularly review and update risk management policies to align with the industry standards.

2. Compliance with Regulatory Requirements

Stay updated on regulations in your region. Compliance is particularly crucial in the “prop firm forex” industry, where trust and transparency drive growth.

3. Fraud Prevention and Detection

Use advanced tools to detect fraudulent activities, such as unauthorized trades or account manipulation. The tool that you are offering should also include alerts for suspicious behavior.

Conclusion

Starting a prop firm requires meticulous planning, financial investment, and adherence to regulations. Integrating tools like a prop firm dashboard and focusing on prop firm forex markets can significantly enhance your firm’s operations and appeal.

By following this guide, you can establish a prop firm that attracts top talent, stands out in a competitive market, and ensures sustainable profitability.

For new prop trading companies in 2025, EAERA provides cutting-edge software solutions to streamline operations and enhance the trader experience. Our products, such as the core brokerage system, PAMM system, and MT5 reporting system, cater specifically to the needs of prop firms..

Ready to take your prop firm to the next level in 2025? Contact us today to learn how our cutting-edge tools can supercharge your trading operations.