Smart Portfolio Management

Made Simple

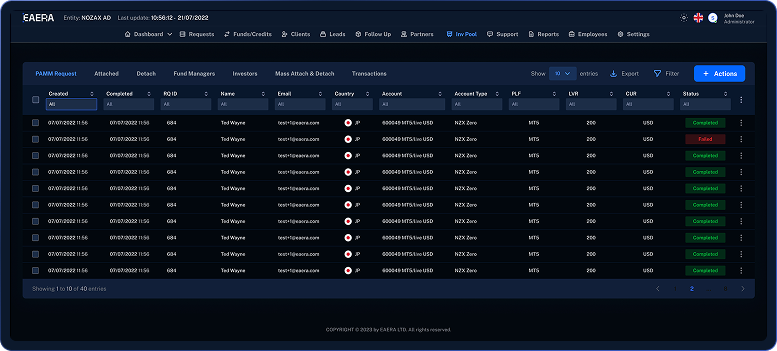

Optimize portfolio management with EAERA's PAMM/MAM solution, offering flexible allocation models, real-time trade execution, investor risk control, advanced reporting, and seamless integration with MT4, MT5, and cTrader.

Smart Portfolio Management

Made Simple

Optimize portfolio management with EAERA’s PAMM/MAM solution, offering flexible allocation models, real-time trade execution, investor risk control, advanced reporting, and seamless integration with MT4, MT5, and cTrader.