In the ever-evolving world of forex trading, proprietary trading firms, or prop firms, have become a cornerstone for traders seeking both flexibility and resources. With their unique business model, these firms allow traders to leverage firm capital rather than their own, fostering innovation and risk-taking in the global forex market. However, with this comes the challenge of managing operations, traders, and risks efficiently.

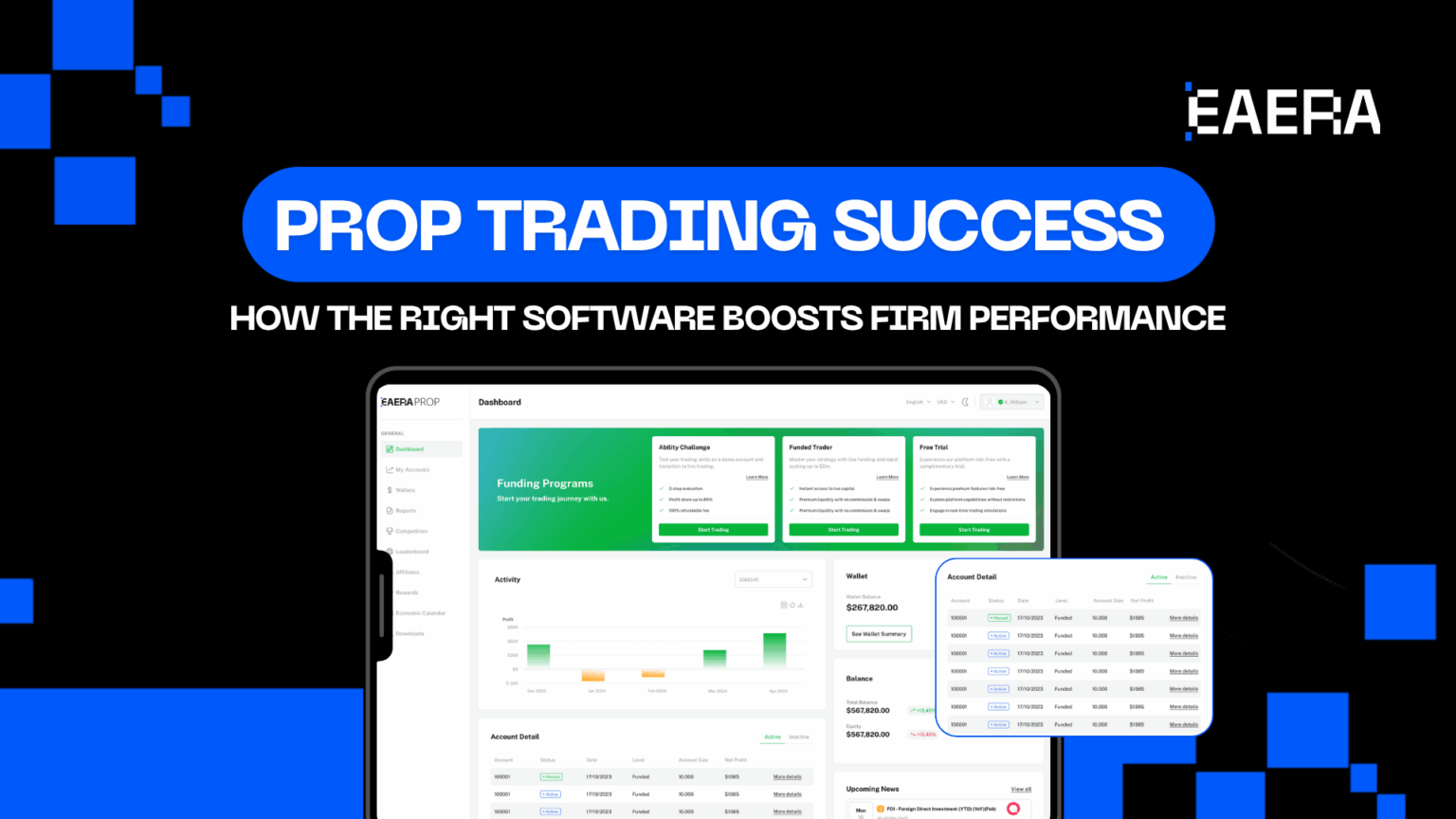

Success in prop trading isn’t just about skilled traders; it’s about equipping them with the right tools. Advanced software solutions are revolutionizing the way prop firms operate, enabling them to enhance performance, minimize risks, and scale effectively. Among these solutions, EAERA stands out as a transformative tool, tailored to meet the unique needs of prop trading firms.

Related articles:

- What Is Prop Trading? Everything You Need to Know

- Advantages of Trading with Prop Firms in the Forex Market

1. Understanding Prop Trading and Prop Firms

What is Prop Trading?

Proprietary trading, or prop trading, is a form of trading where firms use their own capital to trade financial instruments, aiming to generate profits directly from the markets. Unlike traditional brokerage models where profits are derived from commissions, prop trading focuses on market speculation and arbitrage opportunities.

Forex brokers, in particular, are increasingly gravitating towards prop trading due to its potential for high returns. By leveraging proprietary capital, traders gain the flexibility to make larger trades without the personal financial risk, aligning interests with the firm.

What is a Prop Firm?

A prop firm is a company that provides traders with capital, resources, and infrastructure to trade financial markets. These firms profit by taking a share of the trader’s earnings, making their success intertwined with the traders they support.

Despite the lucrative nature of prop trading, firms face significant challenges, including:

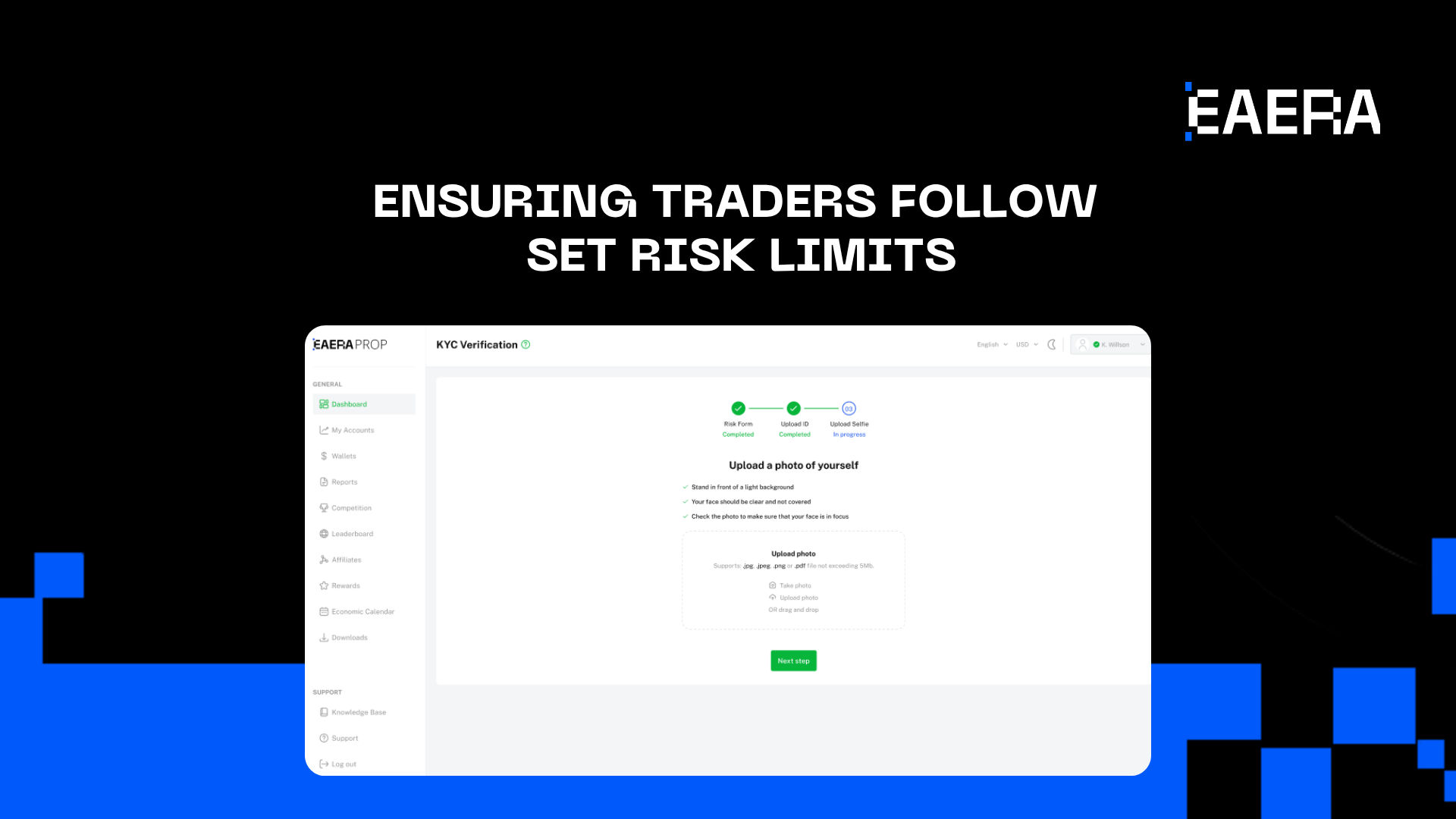

- Risk Management: Ensuring that traders operate within predefined risk parameters.

- Performance Monitoring: Evaluating and optimizing trader performance.

- Operational Scalability: Managing diverse teams and operations across multiple geographies.

2. The Role of Software in Prop Firm Success

Key Functions of Prop Firm Software

Effective software is the backbone of any successful prop trading firm. Here’s how it helps:

- Trade Execution Optimization: Ensuring trades are executed quickly and accurately, even in volatile markets.

- Risk Management: Monitoring and enforcing trading limits, reducing the likelihood of catastrophic losses.

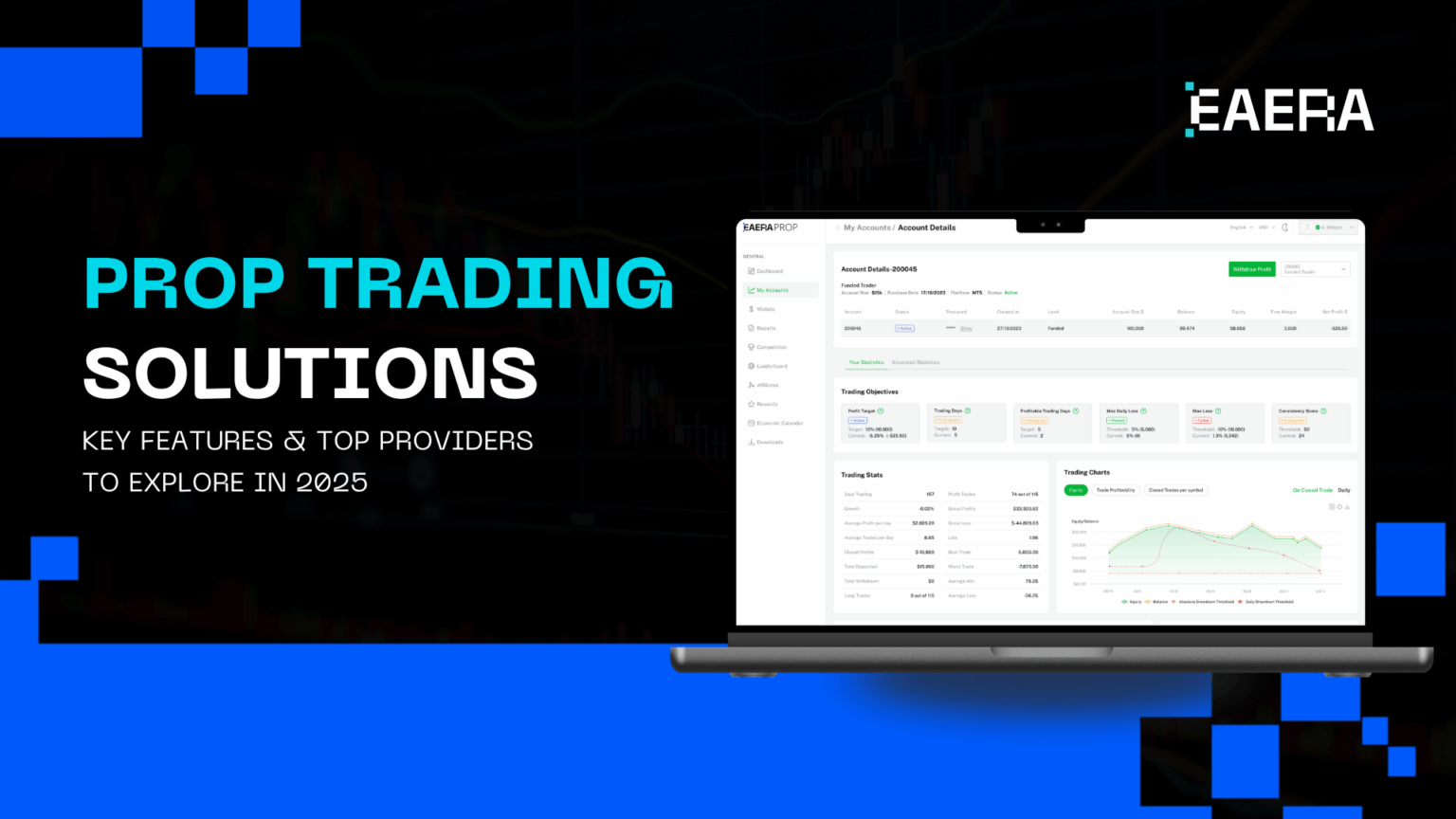

- Trader Evaluation: Analyzing individual and team performance to identify top-performing traders and areas for improvement.

- Scalability: Managing operations seamlessly across global teams and markets.

How Software Solves Common Prop Firm Challenges

- Improved Decision-Making: Advanced analytics provide real-time insights, enabling firms to make data-driven decisions.

- Enhanced Transparency: Automated reporting tools ensure accountability and trust between firms and their traders.

- Cost Efficiency: By automating routine tasks, software reduces administrative overhead, freeing up resources for strategic growth.

3. Why the Right Software Matters

Boosting Trader Performance

The success of a prop firm hinges on the performance of its traders. Advanced software solutions empower traders with:

- Algorithmic Support: Automating repetitive tasks and analyzing market trends to provide actionable insights.

- Real-Time Feedback: Offering instant performance metrics and feedback to help traders refine their strategies.

Enhancing Risk Management

Risk management is critical in the high-stakes world of forex trading. The right software provides:

- Risk Mitigation Tools: Features like stop-loss settings and exposure limits to protect the firm’s capital.

- Compliance Enforcement: Ensuring traders adhere to regulatory and firm-specific guidelines.

Improving Firm-Wide Efficiency

Efficient software streamlines operations by:

- Integrating Workflows: Connecting departments like trading, risk, and compliance for seamless collaboration.

- Reducing Errors: Automating processes reduces the likelihood of costly human mistakes.

4. Choosing the Right Software for Your Prop Firm

Key Factors to Consider

Choosing the right software for your prop firm is a critical decision that can significantly impact your success. Here are the essential factors to consider:

- Scalability: As your firm grows, the software must handle increased trading volumes, additional traders, and expanded operations seamlessly.

- Customization: Every prop firm has unique needs. Opt for software that offers customizable features to align with your specific trading strategies and workflows.

- Integration: Ensure the software can integrate effortlessly with your existing systems, including trading platforms, Forex CRM tools, and risk management frameworks.

- Data Security: Protecting sensitive financial and operational data is paramount. Choose software with robust encryption and cybersecurity measures.

- Real-Time Analytics: Advanced analytics capabilities enable firms to monitor performance, risks, and market trends instantly, helping you stay ahead of the competition.

- Support and Training: Reliable customer support and thorough training resources ensure smooth onboarding and efficient use of the software.

Evaluating Long-Term Benefits

When selecting software, consider how it contributes to long-term goals such as:

- Enhancing Competitive Advantage: The right tools can give your firm an edge by enabling faster decision-making and improved trader performance.

- Cost Efficiency: While high-quality software may require an upfront investment, it often reduces operational costs by automating tasks and minimizing errors.

- Compliance and Risk Mitigation: Regulatory compliance is non-negotiable in forex trading. Robust software simplifies adherence to global standards and minimizes exposure to penalties.

5. EAERA: A Game-Changer for Prop Firms

What Makes EAERA Stand Out?

EAERA is more than just software; it’s a comprehensive solution tailored specifically for prop trading firms. Key features include:

- Advanced Analytics: Providing real-time data to optimize trading strategies and evaluate trader performance.

- Risk Management Tools: Offering robust risk assessment and mitigation functionalities.

- Customizable Interfaces: Allowing firms to adapt the software to their unique needs and workflows.

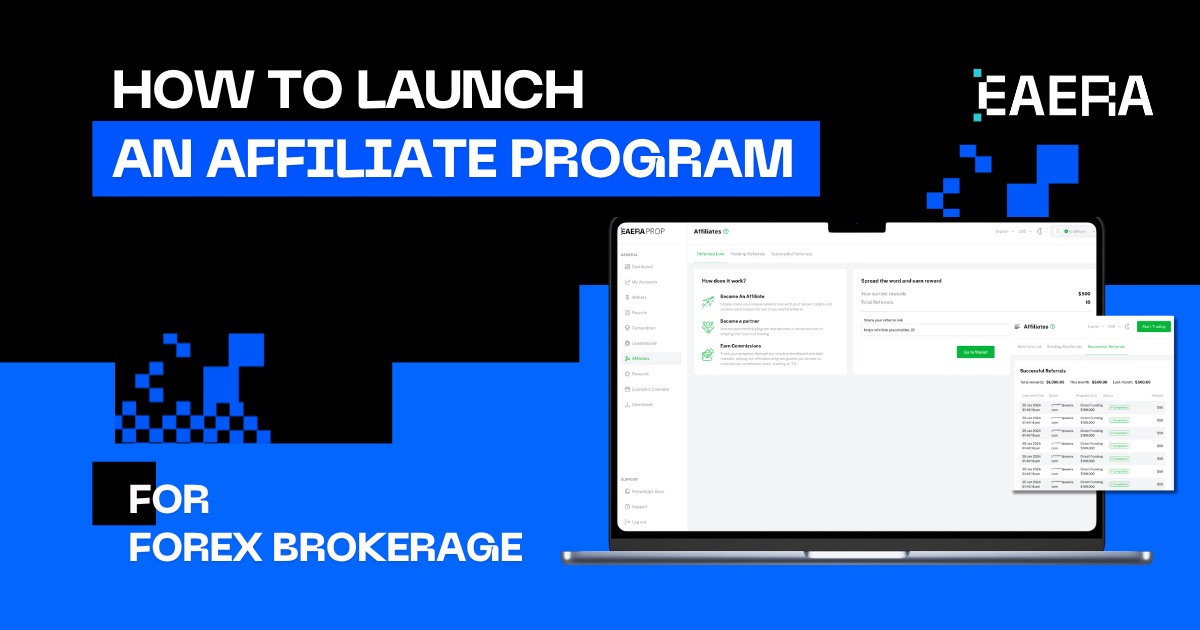

How EAERA Benefits Forex Brokers Worldwide

- Simplifying Cross-Border Operations: With multilingual support and compliance features for different regions, EAERA makes managing global teams easier.

- Scaling Performance: EAERA’s cloud-based infrastructure ensures that firms can grow without worrying about system limitations.

EAERA checks all the boxes. Its advanced features, user-friendly interface, and commitment to customer success make it the ideal choice for prop trading firms looking to thrive in the competitive forex market.

Prop trading success is about more than just talented traders; it’s about equipping them with the tools they need to excel. The right software can transform a prop firm’s operations, boosting trader performance, enhancing risk management, and improving overall efficiency.

EAERA stands out as the go-to solution for prop trading firms, offering unparalleled features and support. Don’t let outdated systems hold your firm back. Explore EAERA’s capabilities and see the difference it can make for your business.

Ready to take your prop firm to the next level? Schedule a demo with EAERA today and experience the future of prop trading firsthand.