The proprietary trading landscape is continually evolving, with emerging technologies reshaping how prop trading firms operate and tackle market challenges. As competition intensifies and market dynamics shift, firms must embrace innovation to stay ahead. By harnessing cutting-edge tools, including AI-driven analytics and algorithmic strategies, prop trading companies whether focused on prop firm forex or diverse markets are better positioned to optimize performance, mitigate risks, and navigate the complexities of modern trading environments. This guide explores the key technologies driving this transformation and how they empower prop trading firms to thrive in an ever-changing industry.

Related articles:

1/ What is Prop Trading?

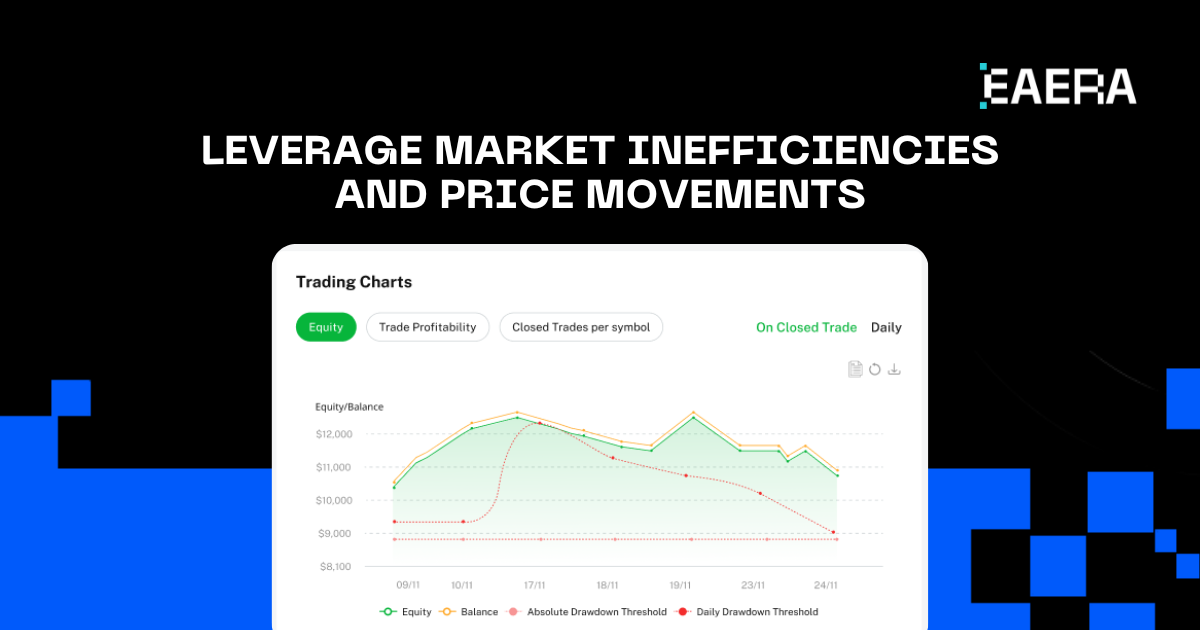

Proprietary trading, or prop trading, involves a prop firm using its own capital to trade securities, differing from brokerages that execute trades on behalf of clients. Prop trading companies directly assume market risk, aiming to capitalize on market inefficiencies and price movements.

Prop trading firms capitalize on market inefficiencies and price movements.

Key Characteristics of Prop Trading Firms

- Proprietary Capital: Prop trading firms leverage their own funds, enabling them to make independent and strategic investment decisions without client constraints.

- Risk-Taking: Operating in volatile markets, these firms embrace significant risk, balancing potential rewards with exposure to market fluctuations.

- Advanced Technology: To maintain competitiveness, prop trading firms utilize cutting-edge trading platforms, data analytics, and algorithmic systems to optimize performance.

- Skilled Traders: Success in prop trading requires expert traders proficient in market analysis, trading strategies, and comprehensive risk management.

Unique Challenges Faced by Prop Trading Companies

- Market Volatility: Prop traders must skillfully navigate unpredictable market conditions influenced by economic, geopolitical, and investor trends.

- Risk Management: Effective frameworks are essential for preserving capital and ensuring operational sustainability in a high-risk environment.

- Regulatory Compliance: Adherence to complex regulations on insider trading, market manipulation, and reporting is non-negotiable for prop trading firms.

- Technological Advancements: Staying ahead in the rapidly evolving tech landscape requires continuous investment in innovative tools and systems.

To overcome these challenges, prop trading firms, including those focusing on prop firm forex operations, must embrace advanced technological solutions. These tools streamline workflows, improve decision-making, and enhance performance, enabling firms to thrive in a competitive and dynamic industry.

2/ Evolution of Technology in Prop Trading

The landscape of prop trading has undergone a profound transformation driven by technological advancements. In its early stages, prop trading firms relied on manual processes and rudimentary tools to execute trades and analyze market data. The introduction of computers and electronic trading platforms revolutionized the industry, offering faster execution and enabling the development of more sophisticated trading strategies.

High-frequency trading (HFT) has further propelled this evolution, as algorithms execute trades at extraordinary speeds to capitalize on market inefficiencies. Prop trading companies leveraging HFT technologies can identify fleeting opportunities and gain a competitive edge in dynamic markets.

In recent years, artificial intelligence (AI) and machine learning have become pivotal in reshaping how prop firms operate. These advanced technologies empower traders to process vast datasets, detect patterns, and make informed, data-driven decisions. AI-powered systems enhance automation, refine risk management practices, and elevate trading performance, providing significant value to modern prop firm forex operations.

As the technological landscape continues to advance, prop trading firms must remain agile and innovative to sustain their competitiveness. By adopting cutting-edge tools and methodologies, prop trading companies can unlock new opportunities, overcome challenges, and achieve long-term success in an ever-evolving industry.

3/ Core Technologies Transforming Prop Trading

The rapid advancement of technology has fundamentally transformed prop trading. Today, several key technologies are crucial for prop trading companies to stay competitive and efficiently execute their strategies.

Advanced Algorithmic Trading

- High-Frequency Trading (HFT): Prop trading firms use sophisticated algorithms to execute trades at lightning-fast speeds, capitalizing on micro-price movements.

- Statistical Arbitrage: Prop trading companies leverage statistical models to identify and exploit pricing inefficiencies across multiple markets.

- Machine Learning: Prop firms employ AI to develop adaptive trading strategies and improve predictive models, enhancing the precision of their trades.

Artificial Intelligence and Machine Learning

- Predictive Analytics: AI enables prop trading firms to forecast market trends, helping traders identify high-probability opportunities.

- Natural Language Processing: By analyzing news and sentiment data, AI helps prop firms forex make informed trading decisions based on current market sentiment.

- Automated Trading Systems: Self-learning algorithms autonomously execute trades, optimizing trading strategies and reducing human error.

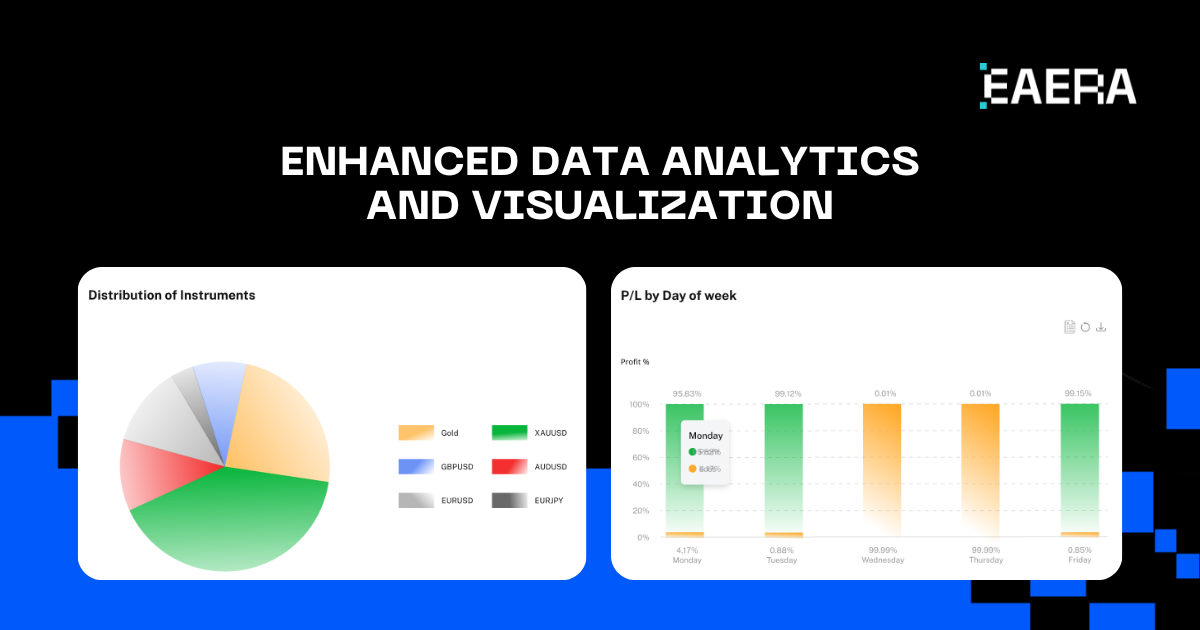

Enhanced Data Analytics and Visualization

Data Analytics and Visualization in EAERA’s Platform

- Real-time Data Feeds: Access to high-quality market data allows prop trading companies to make informed decisions based on real-time information.

- Data Visualization: Visualizing complex data helps prop trading firms identify patterns and trends, improving decision-making processes.

By adopting these cutting-edge technologies, prop trading firms can enhance their trading strategies, improve decision-making, and stay ahead of the competition in the fast-paced world of prop trading.

4/ Key Considerations for Brokers in Choosing Prop Trading Software

When selecting a prop trading software solution, brokers should consider several critical factors to ensure the platform meets the needs of their prop firm:

Scalability and Performance:

- Scalability: The software should be capable of handling increasing workloads as the prop trading company grows.

- Performance: Fast execution speeds, low latency, and reliable performance are essential for effective prop trading.

Security and Reliability:

- Data Security: Robust security measures are necessary to protect sensitive client data in a prop firm forex environment.

- System Reliability: The platform must ensure minimal downtime and consistent performance.

- Compliance: Adherence to regulatory requirements and industry standards is essential for prop trading firms.

Customization and Flexibility:

- Customization Options: The software should be customizable to fit the specific needs of a prop trading company and its workflows.

- Integration Capabilities: Seamless integration with CRM, accounting software, and other essential systems is crucial.

- API Access: API availability for custom development and integrations adds flexibility.

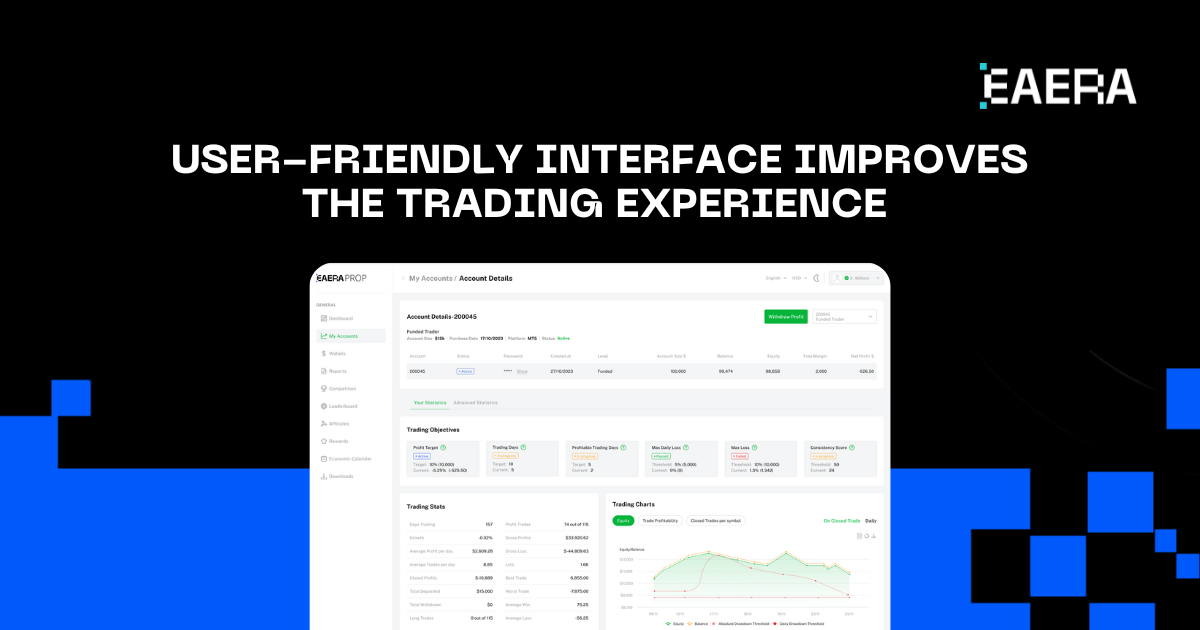

User-Friendliness and Support:

- Intuitive Interface: An easy-to-navigate, user-friendly interface enhances the experience for both brokers and traders in prop trading firms.

- Comprehensive Documentation: Detailed tutorials and documentation support users in navigating the platform effectively.

- Responsive Customer Support: Timely and effective technical support ensures smooth operations for prop firms.

User-friendly interface enhances the experience in prop trading firms

Cost-Effectiveness:

- Licensing Fees: Reasonable licensing fees ensure that the platform is affordable and offers the required functionalities.

- Maintenance Costs: Ongoing maintenance and support costs should be affordable.

- Return on Investment: The software should provide a positive return by improving efficiency and reducing operational costs for prop trading firms.

By evaluating these factors, brokers can select the best prop trading software that aligns with their business objectives and helps drive long-term success.

5/ EAERA PROP – Top Prop Trading Software Solutions for Brokers

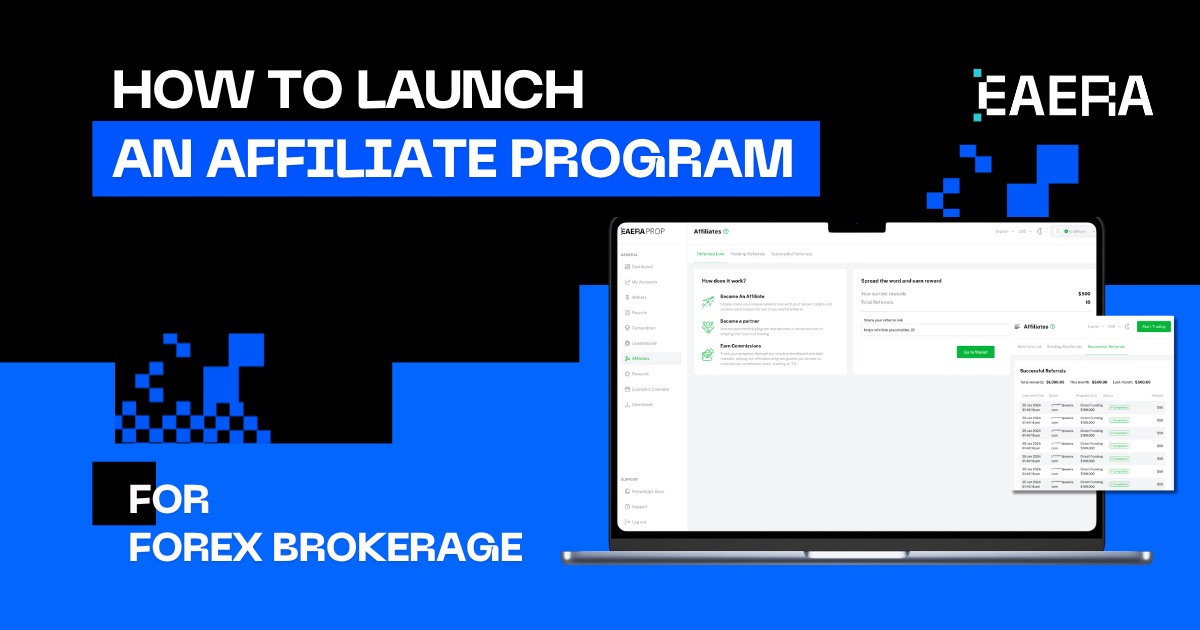

EAERA provides a comprehensive solution designed for prop trading firms, featuring a Client Dashboard for seamless user experience and real-time updates, an efficient CRM System for client management and personalized communication, a robust Backoffice/Funding System for automated funding and risk management, and an IB/Affiliate System for customizable commission plans and real-time performance tracking. By leveraging EAERA PROP, prop trading firms can streamline their operations, enhance client satisfaction, and drive business growth

As the prop trading industry evolves, technology plays a crucial role in shaping its future. By utilizing advanced software solutions, prop trading firms can streamline operations, improve decision-making, and secure a competitive advantage. For prop firm forex and other prop trading companies, understanding key technologies and selecting the right software is essential to navigating market complexities.

EAERA PROP offers a comprehensive suite of tools designed to empower prop trading firms, helping them optimize their strategies and enhance overall performance. By making informed choices, prop trading firms can ensure long-term success in an ever-changing landscape.