As brokerage operations become more complex, selecting a forex CRM best suited for long-term success is no longer a technical issue – instead, it has become a strategic move. For 2026 and beyond, brokerage firms must contend with a larger client base, increased regulation and compliance demands, high speed of execution required, and high operational risk in a single process.

In the article, readers will discover the top 10 forex CRM best features brokers need to know – not a list, but rather a criteria-based way. No longer do readers need to know what is included in a particular feature; rather, they will learn why it’s important, what it is solving, and how it affects their broker in a hands-on way.

Why Forex Brokers Need More Than a Basic CRM?

While a generic model might fit a basic sales model, it crumbles in a forex model. This is due, in part, as mentioned above, as forex is the intersection of finance, regulation, technology, and data. Client actions, account balances, trade history, regulation, all work in hand.

When a CRM is not designed specifically for brokerage operations, brokers face:

- Fragmented data across systems

- Manual reconciliation between departments

- Delayed risk visibility

- Inconsistent client experiences

The forex CRM best platforms operate as a backbone, rather than a contact management system. They are comprehensive solutions that consolidate sales, operation, risk management, as well as legal compliances.

What Defines a “Forex CRM Best” Standard in 2026?

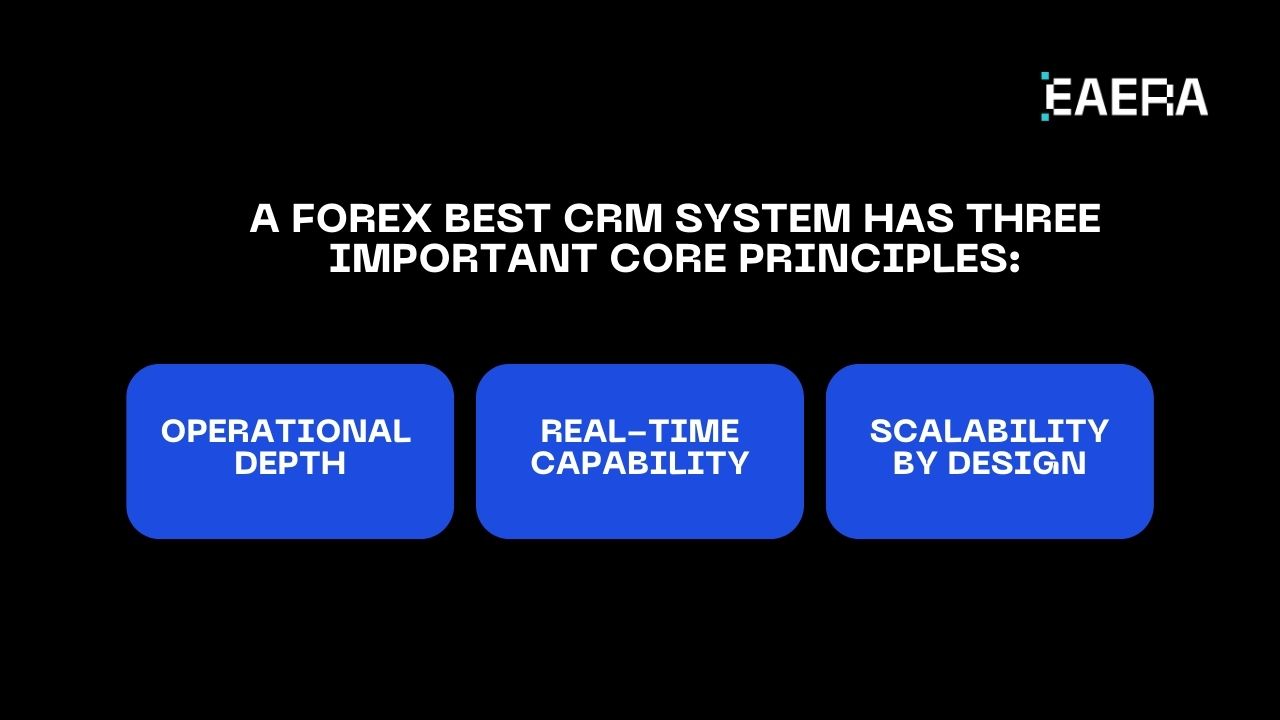

Before discussing individual features, it is also critical to know and understand how a good CRM differentiates itself from an average one. A forex best CRM system has three important core principles:

- Operational depth: Align with real brokerage workflows, not generic use cases

- Real-time capability: Supports live trading and financial data without delays

- Scalability by design: Grows with the broker without requiring system reconstruction

With these principles in mind, the following 10 features form the foundation of a future-ready forex CRM.

Top 10 Forex CRM Best Features Every Broker Needs

The following 10 essential features can also be considered as an integrated system rather than a collection of tools. Each of the features has a particular operational value.

1. Centralized Client Profile Across the Full Lifecycle

A unified client profile combines onboarding information, KYC verification, trading accounts details, transactions, communication history, and support tickets.

Value: Provides a non-silos approach by ensuring all departments operate from a single source.

2. Real-Time Account, Balance, and Transaction Visibility

Brokers require real-time awareness about deposits, withdrawals, equity, and account activity.

Value: Permits faster decision making, minimizes errors in reconciling accounts, and increases control over business finances.

3. Integrated KYC and Compliance Workflows

The presence of built-in verification steps, document tracking, and approval processes minimizes manual process.

Value: Speeds up onboarding while ensuring regulatory consistency and auditability.

4. Automated Lead Routing and Segmentation

Leads should be assigned automatically based on geography, campaign source, client behavior, or value tier.

Value: Improves conversion rates and ensures sales teams focus on the right opportunities.

5. Multi-Platform Trading System Integration

Seamless integration with MT4, MT5, or other trading platforms allows data to flow directly into the CRM.

Value: Removes manual imports and provides a real-time operational view of trading activity.

6. Risk and Exposure Visibility Dashboards

A centralized dashboard showing client exposure, margin usage, and abnormal behavior is critical.

Value: Helps brokers identify issues early and protect capital before problems escalate.

7. Rule-Based Automation and Workflow Control

Automated actions triggered by predefined rules—such as account status changes or compliance flags—reduce human error.

Value: Improves operational consistency and lowers staffing overhead.

8. Integrated Payment and Wallet Management

Unified tracking of deposits, withdrawals, fees, and internal transfers simplifies financial operations.

Value: Reduces delays, improves transparency, and strengthens client trust.

9. Multi-Brand and Multi-Region Support

Brokers operating across regions need flexible configuration for brands, currencies, and regulations.

Value: Enables expansion without duplicating systems or teams.

10. Audit Logs and Compliance-Ready Reporting

Every action should be logged and traceable for internal reviews and external audits.

Value: Minimizes regulatory risk and ensures accountability across operations.

Together, these features define what a forex CRM best solution truly delivers: operational clarity, risk control, and scalability.

How These Features Translate Into Real Business Value?

Features are not enough to make an impact; however, the outcomes are the ones that do the work. By correctly executing the features introduced above, a forex CRM is bound to make a positive impact by offering the advantages:

- Faster decisions through real-time visibility

- Lower operational costs by automation

- Reduced compliance risk with structured workflows

- Higher client retention from consistent experiences

These platforms, such as EAERA, are built with such characteristics, enabling the broker to go “from reactive management of the broking business to proactive control.” The broker is then not required to react to issues when they arise but prevent them.

Common Mistakes Brokers Make When Evaluating Forex CRM Features

Many brokers still select CRM systems based on surface-level criteria. Common mistakes include:

- Selecting systems that look impressive in demos but fail under real workloads

- Ignoring integration depth with trading and payment systems

- Underestimating the importance of compliance automation

- Selecting rigid platforms that cannot adapt to growth

The forex CRM best choice is not based on the software with the greatest list of features, but rather on the software that can fulfill real business needs.

Choosing a Forex CRM for Long-Term Brokerage Success

A CRM decision should be considered within a three-to-five-year time frame. Brokers should consider the following:

- Will this system grow as our clients and areas grow?

- Does it support real-time operations and risk control?

- Is it flexible enough to evolve with changing rules and markets?

Similarly, infrastructure-focused platforms such as EAERA place significant emphasis on extensibility, data integrity, and long-term durability as opposed to short-term accessibility.

Besides internal efficiency, a well-executed forex CRM best solution also increases broker credibility. Improved processes, data, and reporting enable better broker relationships, ultimately leading to better long-term competitive position. It is nearly impossible for a disorganized broker to achieve these process improvements.

Determining the forex CRM best solution in 2026 should, therefore, be a strategic investment decision, as opposed to a technical solution upgrade. A good CRM system will allow a brokerage firm to operate in a state of clarity, risk management, as well as confidence in a competitive environment.

By focusing on the real value proposition for features instead of quantity, brokers are working to ensure future growth, better compliance efforts, and stronger client relationships.