In the rapidly evolving world of trading, most professional traders and money managers rely heavily on PAMM (Percentage Allocation Management Module) platform. These settings help professionals automate profit distribution, oversee several investor accounts at once, and ensure openness between traders and investors.

Professional traders need a PAMM system that offers speed, scalability, and flexibility as the forex market becomes more competitive and data-driven. This will free them up to concentrate on trading tactics rather than administrative tasks. The article explores the most significant characteristics of PAMM that are suitable for the professional trading environment.

Related articles:

- 5 Ways Forex CRM Software Can Improve Client

- Client Portal Design Enhances FX Forex Broker Experience

How PAMM works?

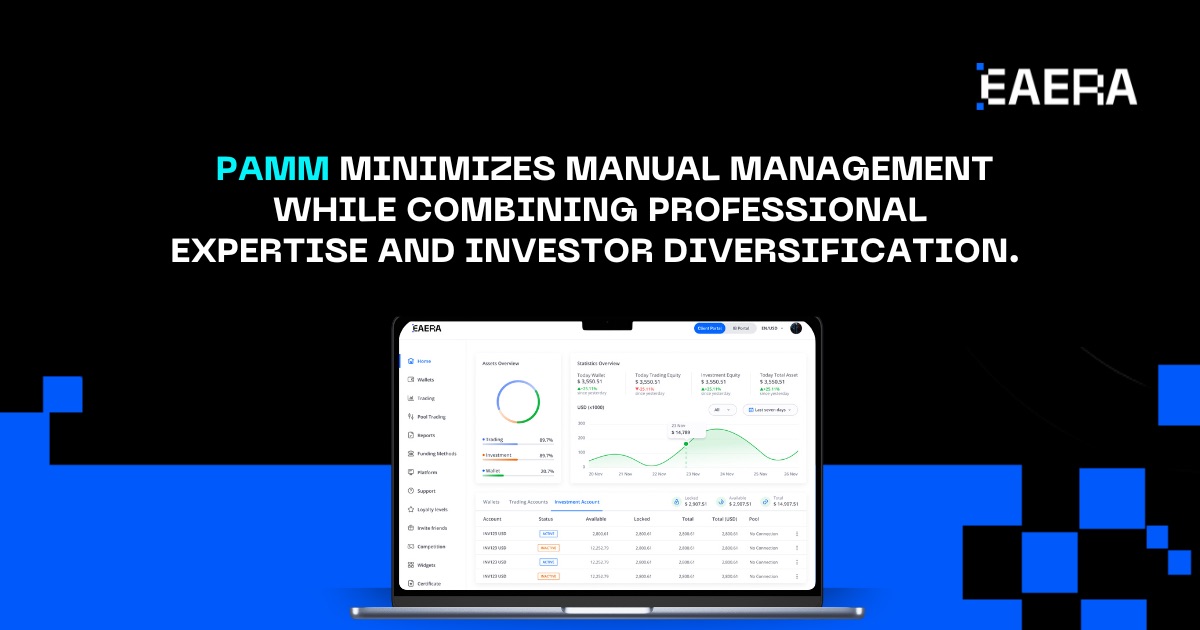

A PAMM system allows traders to oversee multiple investor accounts using a single trading strategy. The system automatically distributes profits or losses in proportion to the percentage of capital that invest ors have allocated to the manager’s account.

For instance, if a professional trader executes a profitable trade, every investor linked to that account receives returns based on their investment ratio. Losses are also dispersed equitably and transparently.

By acting as an intermediary, the broker or platform provider ensures security, adherence to regulations, and precise accounting. This structure makes PAMM trading highly appealing, which minimizes manual management while combining professional expertise and investor diversification.

PAMM minimizes manual management, combines professional expertise and investors

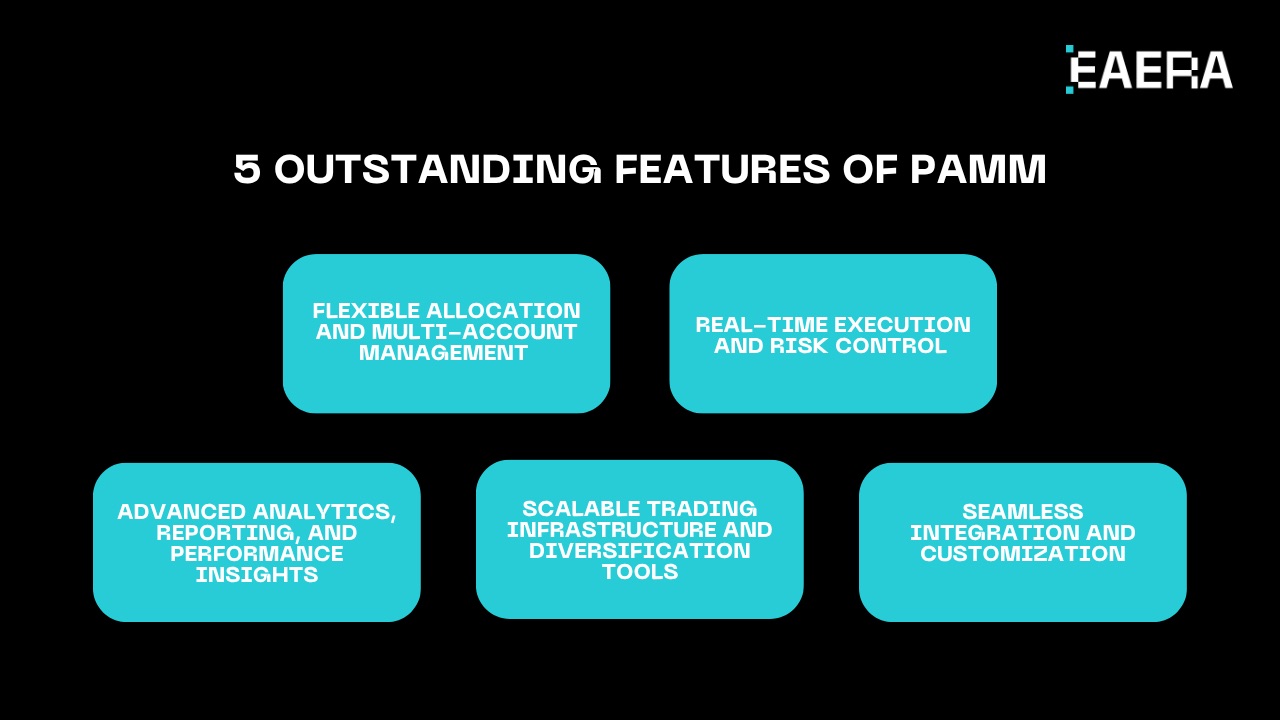

5 Outstanding Features of PAMM for Professional Traders

A top-notch PAMM platform is the operational foundation of contemporary money management for brokers and professional traders, and it is much more than just a tool for distributing funds. Managers can manage several accounts at once, execute trades instantly, stay transparent with investors, and easily scale as trading volumes increase with a well-designed PAMM platform. The primary advantages that make PAMM technology essential for institutional-grade trading environments are outlined in the following five features.

1/ Flexible Allocation and Multi-Account Management

The distribution of gains and losses must be done precisely for professional traders. With its percentage-based allocation, PAMM guarantees that each investor gets returns commensurate with their equity stake. Additionally, money managers can add or remove investors at any time without affecting open positions, providing unmatched flexibility in managing multiple accounts at once.

This ensured seamless fund management and optimal efficiency for managers managing diverse client portfolios.

2/ Real-Time Execution and Risk Control

In professional trading, accuracy and speed are important. With minimal latency and synchronized performance, the PAMM system ensures real-time trade execution across all connected investor accounts.

Moreover, investors can manage their own risk exposure by setting custom loss limits, which helps to maintain capital protection even in the face of volatile market conditions. As a result, investors and managers benefit from tighter risk oversight and faster execution, which ensures more consistent performance.

3/ Advanced Analytics, Reporting, and Performance Insights

Trust in managed accounts is fueled by transparency. For managers and investors alike, the PAMM system offers comprehensive trade analytics, real-time performance monitoring, ROI, drawdown, and Sharpe ratio metrics.

Revenue and commission reports are automatically generated for brokers, facilitating compliance tracking and well-informed business decisions. These insights enable all stakeholders to make more intelligent, data-driven trading and investment decisions.

4/ Scalable Trading Infrastructure and Diversification Tools

High-frequency trading, multi-manger structures, and diversification tools that let investors spread risk across several strategies are all supported by PAMM settings, which are designed for growth.

Its sophisticated order types (market, limit, stop, and trailing stop) and strong scalability ensure stability even under high trading volumes, which is essential for institutional and professional use. This scalability allows fund managers and brokers to expand their operations with confidence as their clientele and trading activity increase.

5/ Seamless Integration and Customizable User Experience

PAMM accounts are integrated seamlessly with widely-used platforms such as MT4, MT5, or cTraders, along with CRM systems to create a connected trading ecosystem.

In addition to a mobile app and web-based interface for real-time monitoring, the platform offers white-label branding choices that enable brokers to provide clients with a customized experience. A well-structured PAMM platform can improve end-user satisfaction and operational efficiency through adaptable integration and user-friendly design.

5 outstanding features of PAMM system

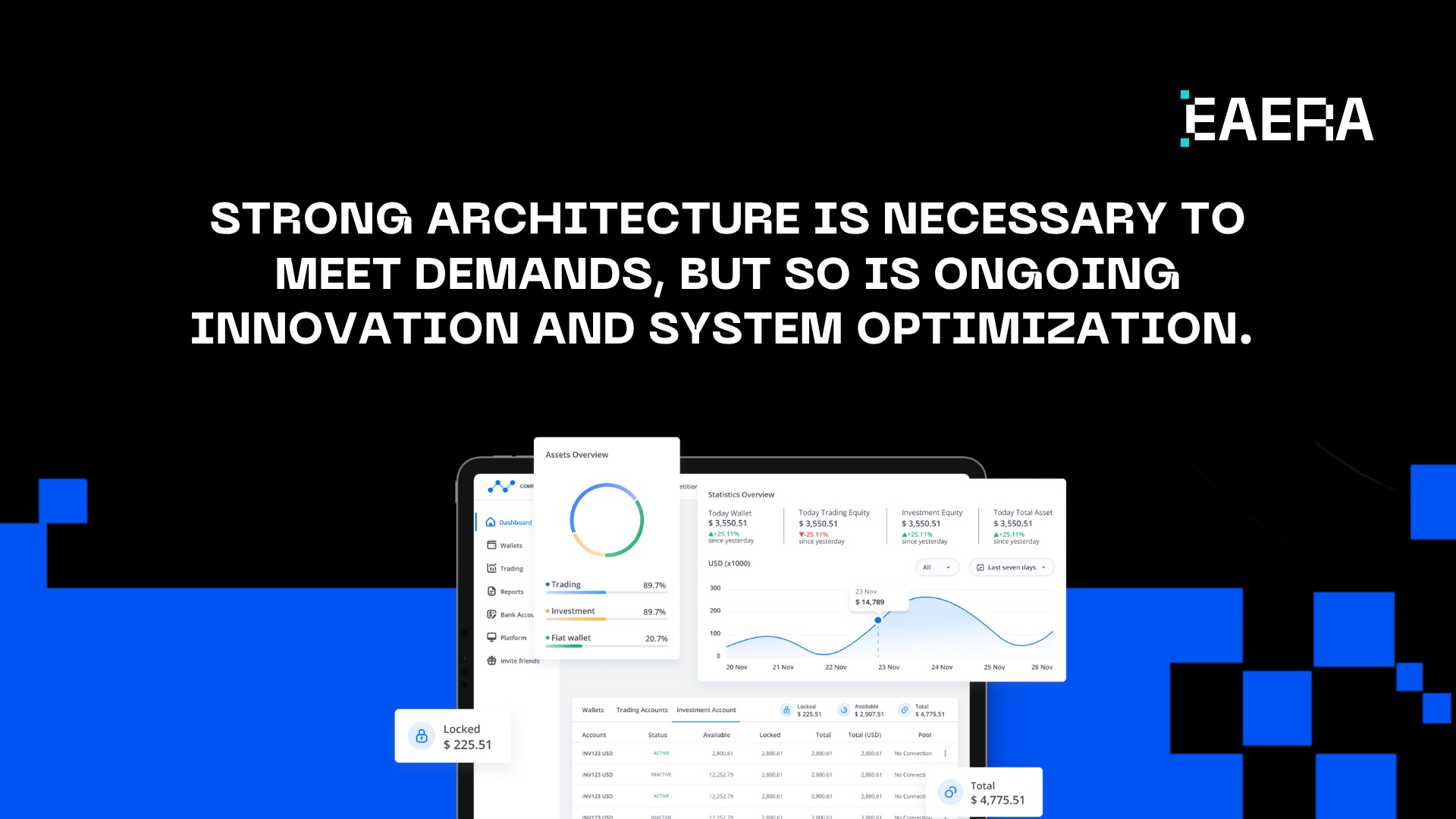

Technical Challenges and Performance Requirements

Even though PAMM systems have many benefits, there are technical difficulties in creating or deploying one for professional use.

- High Scalability: Millions of trade executions and thousands of accounts must be handled concurrently by the platform

- Security & Compliance: Compliance with international financial regulations (FCA, ASIC, etc.), data encryption, and segregated fund management are crucial.

- Latency & Uptime: Consistent execution quality is ensured by continuous operation with almost zero downtime.

- Transparency & Accuracy: All trades, profit splits, and commissions must be precisely computed and traceable.

- User Experience: Expert traders anticipate complete control over investor relationships, automation, and user-friendly dashboards.

Strong architecture is necessary to meet these demands, but so is ongoing innovation and system optimization.

How EAERA’s PAMM Meets Institutional Standards?

EAERA’s PAMM solution was developed specifically to meet the demands of professional trading and institutions. Through carefully designed automation, it delivers a coordinated trading ecosystem that links brokers, investors, and money managers rather than just processing trades.

At the center of EAERA’s architecture is a distributed processing engine, capable of managing large-scale trade replication without latency degradation. Even in times of high market activity, consistent pricing and execution quality are maintained by carrying out-of-reach transactions simultaneously across all investor accounts. Reliable performance and operational resilience are guaranteed by this architecture foundation.

Transparency fund management is another top priority for EAERA. Real-time data synchronization allows every participant, from administrators to investors, to access consistent and validated information. In addition to streamlining compliance reporting and audit requirements, this transparency fosters confidence.

EAERA offers broker an institutional control layer that unifies customization, monitoring, and management into a single interface. The platform easily adjusts to intricate business structures, whether it is establishing fee models, integrating liquidity sources, or enforcing regulatory standards.

EAERA’s forward-thinking scalability is what makes it unique. The system automatically distributes resources to maintain performance and execution accuracy as trading volumes and investor bases grow. EAERA’ s ongoing security improvements and updates ensure that professional traders and brokers can operate with confidence and agility in any market environment.

EAERA offers the performance, security, and innovation that characterize the upcoming generation of professional trading solutions for businesses wishing to improve their fund management infrastructure.