I. Introduction

1. What Are Proprietary Trading Firms?

Proprietary trading firms, or prop firms, are financial institutions that fund traders to trade various asset classes like forex, stocks, and commodities. In return, traders share a portion of their profits. Unlike hedge funds, which manage investor capital, prop firms trade using their own funds, focusing on short-term strategies.

2. Why Focus on Forex Prop Firms?

The forex market, the most liquid global financial market, provides unique opportunities for prop trading. Forex prop firms specialize in currency trading, offering capital to traders while tailoring evaluations, risk tools, and trading platforms to forex’s fast-paced environment.

3. Importance of Choosing the Right Firm

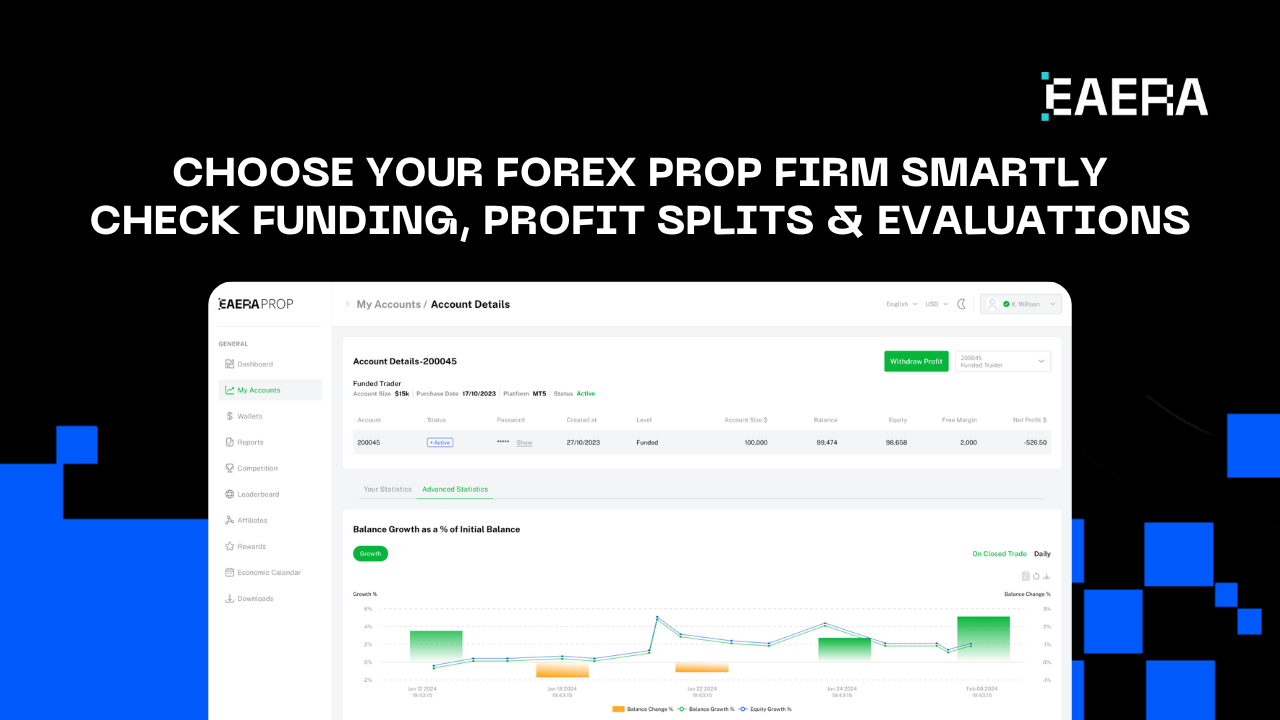

Choosing the right prop firm forex is critical for success. Factors like funding amounts, profit splits, and evaluation processes affect profitability and risk management. Conduct thorough research before deciding.

Choose your forex prop firm wisely, considering funding, profit splits, and evaluations

II. Key Factors When Choosing a Prop Firm

- Funding Amounts: Firms offer funding from thousands to millions. Larger funding allows traders to take bigger positions if they adhere to risk management rules.

- Profit Splits: Typical splits range from 50%-90%, with higher splits benefiting traders more.

- Evaluation Processes: Firms require evaluations to test trading skills. These may include trading challenges or simulated accounts.

- Trading Platforms: A reliable forex trading platform with tools like prop trading dashboards is essential. Compare platforms to find one that meets your needs.

- Other Factors: Consider trading rules, risk management tools, educational resources, and customer support for a holistic trading experience.

III. List of Top Prop Firms

1. High-Funding Firms:

- FTMO: Rigorous evaluation, funding up to $200,000, profit splits up to 90%.

- MyForexFunds: Flexible evaluations, funding up to $300,000, low entry fees.

- The5%ers: Focused on swing trading, funding up to $50,000, supportive community.

2. Beginner-Friendly Firms:

- BluFX: No evaluation required, structured learning, funding up to $50,000.

- FundedNext: Multiple funding tiers, high splits (up to 90%), emphasis on consistency.

3. Other Notable Firms:

- Funded Trading Plus: Tiered funding system, funding up to $250,000.

- TopstepFX: Subscription-based evaluation, funding up to $150,000, strong risk management.

- Lux Trading Firm: Long-term evaluations, mentorship, funding up to $150,000.

IV. Side-by-Side Comparison of Prop Firms

| Firm | Funding Amount | Profit Split | Evaluation Process | Trading Platform | Key Features |

| FTMO | Up to $200,000 | Up to 90% | Two-step challenge | Proprietary | Rigorous evaluation, advanced analytics, strong community support. |

| MyForexFundsv | Up to $300,000 | Up to 85% | Flexible or instant funding | MetaTrader 4/5 | Multiple funding programs, low fees, flexible trading styles. |

| City Trader Premium | Up to $100,000 | Up to 80% | One-step evaluation | MetaTrader 4/5 | Offers real capital trading, no simulated accounts, and a simple evaluation model. |

| Audacity Capital | Up to $500,000 | 50% – 70% | No evaluation, direct funding | Proprietary platform | Immediate access to capital but requires a monthly fee for participation. |

| FundedNext | Up to $200,000 | Up to 90% | Evaluation or consistency | MetaTrader 4/5 | Robust risk management, multiple funding tiers, high profit splits. |

| Funded Trading Plus | Up to $250,000 | Up to 80% | Tiered funding progression | MetaTrader 4/5 | Gradual responsibility increases, diverse asset support. |

| TopstepFX | Up to $150,000 | Up to 80% | Subscription-based evaluation | MetaTrader 4/5 | Emphasizes risk management, structured path to funding. |

| Lux Trading Firm | Up to $150,000 | Up to 75% | Long-term evaluations | MetaTrader 4/5 | Comprehensive mentorship, long-term trader development focus. |

V. Tips for Success with Prop Firms

- Risk Management Strategies: Set stop-loss orders and calculate proper position sizes to manage risk effectively.

- Trading Psychology: Avoid emotional decisions by staying disciplined and focusing on strategy execution.

- Educational Resources: Leverage books like Trading in the Zone and online courses to continuously improve trading skills.

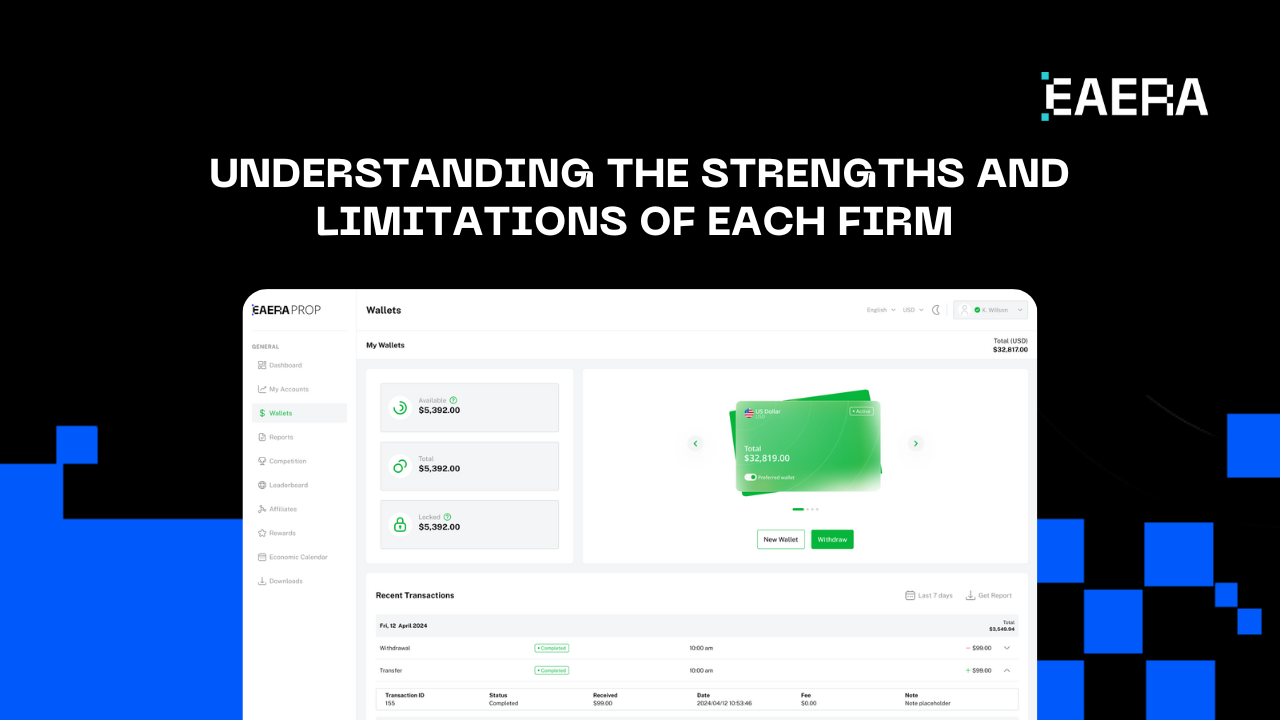

Detailed comparisons aiding traders in finding firms that align with their individual goals

VI. Conclusion

Choosing the right prop firm forex depends on funding amounts, profit splits, and trading platforms. A detailed comparison helps traders find firms that align with their goals.

At EAERA , we support new and established prop trading firms with innovative tools like advanced CRM systems, a user-friendly prop trading dashboard, and comprehensive MT5 reporting solutions. Let us help you build a thriving trading environment with cutting-edge solutions tailored to your needs.

Contact us today for a personalized consultation and elevate your prop trading journey!