By 2026, a brokerage’s success will be determined more by its consistency than by how quickly it expands. Software for brokers is no longer just a set of auxiliary tools as client expectations, regulatory pressure, and broker ecosystem complexity all rise. It turns into the operating system that controls the day-to-day operations of the company.

Related articles:

- Forex Broker Software: The Essential Tool for Clear Business Insights

- Choosing the Best CRM for FX Brokers: A Step-by-Step Guide

By concentrating on results and operational maturity – how systems facilitate consistency, governance, and scalable control rather than merely feature availability – this article explores what contemporary software for brokers should provide in 2026.

From Tools to Operating Systems for Brokers

Broker technology stacks were previously constructed using disparate tools. CRM was managed by one system; payments were handled by another, reports were generated by another, and compliance was frequently handled by hand. This strategy is becoming increasingly unsustainable.

In 2026, modern software for brokers must function as a unified operating system.

The evolution looks like this:

- Tool-based setups (past): isolated systems solving isolated problems

- Platform-based setups (present): partial integration, limited automation

- System-led operations (2026): end-to-end orchestration of broker workflows

Broker software coordinates onboarding, risk, funding, reporting, and compliance as interconnected processes because it has an operating-system mentality. This change improves transparency, lowers friction, and lays the groundwork for long-term scalability.

Broker Software Must Enforce Process Consistency

One of the most undervalued benefits a brokerage can offer is consistency. Inconsistent procedures raise operating expenses, pose a risk to regulations, and damage relationships with partners and clients.

Modern software for brokers must enforce consistency across all critical workflows, including:

- Client onboarding and verification

- Account and wallet management

- Funding and withdrawal handling

- Reporting and reconciliation

Errors are unavoidable when procedures differ by area, team, or individual decision-maker. Every rule is applied consistently, and every client is treated fairly.

Consistency enforced by the system also lessens internal reliance on workers. Operations become more resilient when knowledge is integrated into workflows rather than being restricted to individual experiences.

Embedded Intelligence Over Manual Oversight

Manual supervision is not scalable. Relying on human checks for monitoring, approval, and validation causes bottlenecks and raises error rates as broker operations expand. By 2026, software for brokers needs to directly integrate intelligence into operational processes.

Embedded intelligence replaces manual oversight through:

- Automated validations instead of manual reviews

- Rule engines instead of subjective decisions

- Alerts and thresholds instead of reactive monitoring

Human involvement is not eliminated by this. Rather, it moves teams from carrying out tasks to overseeing them. Employees pay more attention to improvements and exceptions than to monotonous work.

Automated onboarding checks, for instance, eliminate the need for manual KYC reviews on each application while still elevating high-risk cases for human review. For operations to be sustainable, a balance between automation and supervision is necessary.

Software Must Support Broker Ecosystems, Not Just Clients

Contemporary brokerages run ecosystems rather than just client lists. The platform is used by affiliates, partners, internal teams, and introducing brokers (IBs). Effective software for brokers must support this complexity without fragmenting data or workflows.

Key ecosystem capabilities include:

- Multi-tier IB and partner management

- Automated commission and rebate calculations

- Role-based access for internal teams

- Shared but controlled data visibility

Conflicts have become frequent in the absence of centralized ecosystem management. Internal teams find it difficult to reconcile data across systems; partners lack transparency, and IBs doubt commissions.

Efficiency and trust are increased by software that supports the whole ecosystem. Consistent information is visible to all stakeholders, which lowers administrative burden and friction.

Auditability, Explainability, and Regulatory Confidence

Regulators are paying more attention to how controls are implemented rather than merely whether policies are in place. By 2026, auditability and explainability must be fundamental design tenets of software for brokers.

Essential governance features include:

- Immutable audit trails

- Versioned rules and configurations

- Traceable actions across users and systems

- Clear explanations for automated decisions

Audits are less disruptive when all decisions are traceable and explicable. Brokers can provide organized, system-generated evidence rather than reconstructing events after the fact.

Regulatory confidence is increased by this degree of openness. It illustrates how compliance is integrated into routine business processes as opposed to being addressed after the fact.

Platforms such as EAERA exemplify this governance-oriented approach by integrating audit readiness and traceability directly into broker workflows.

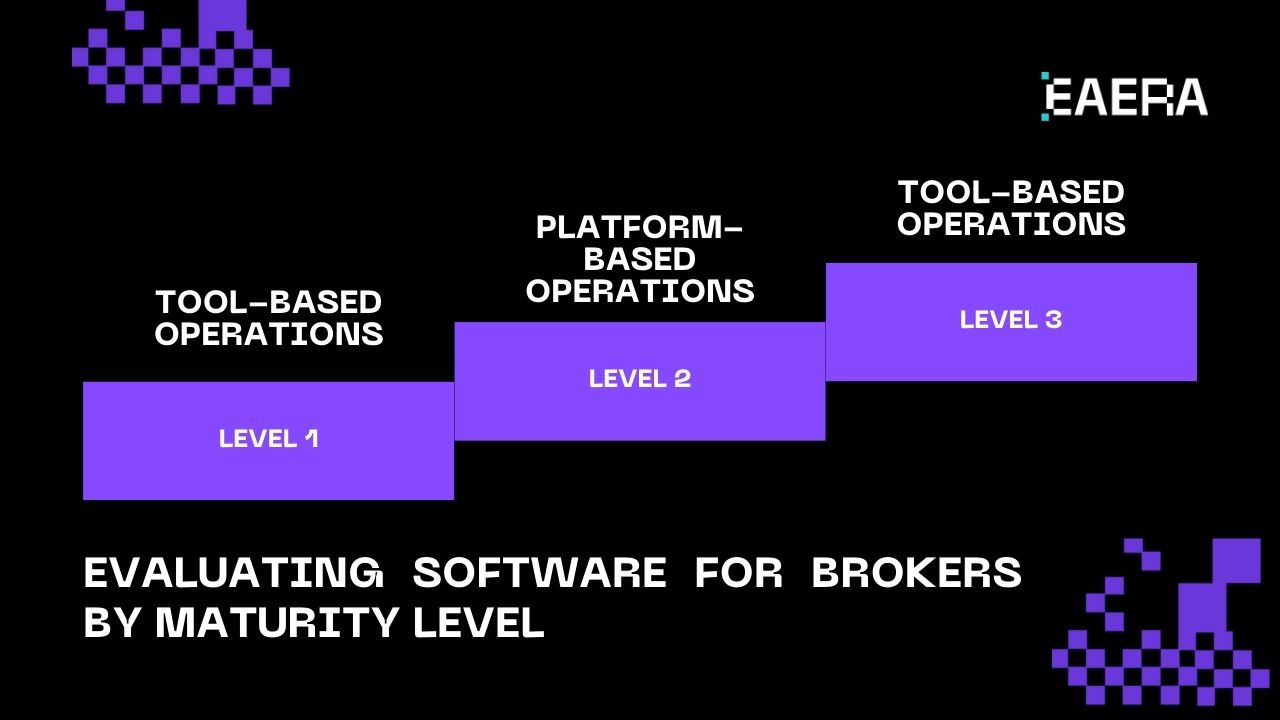

Evaluating Software for Brokers by Maturity Level

Not all broker platforms are equally prepared for 2026. One effective way to assess software for brokers is through an operational maturity framework.

Level 1: Tool-Based Operations

- Manual workflows

- Siloed data

- Reactive compliance

This setup may work on a small scale but breaks down as complexity increases.

Level 2: Platform-Based Operations

- Partial automation

- Basic integration between systems

- Limited governance controls

Many brokers operate at this level today, but scaling further becomes costly and risky.

Level 3: System-Led Operations (2026-Ready)

- Automation-first design

- Embedded compliance and governance

- Centralized data and rule enforcement

- Scalable by architecture, not headcount

Level 3, where software controls operations uniformly across regions, products, and user groups, is where a brokerage that is prepared for 2026 operates.

Providers like EAERA concentrate on facilitating this system-led maturity by providing software for brokers that adapts to changing operational and regulatory requirements.

Why Operational Maturity Outweighs Feature Count?

Platforms with lots of features frequently conceal underlying flaws. On the other hand, established software for brokers places more emphasis on explainability, consistency, and dependability than on innovation.

Operational maturity delivers:

- Lower long-term operational cost

- Faster response to regulatory changes

- Reduced dependency on manual processes

- Stronger trust with clients and partners

Brokers will compete in 2026 based on their operational predictability and transparency rather than the number of features they promote.

Software as a Long-Term Strategic Asset

Software for brokers nowadays is a long-term investment. It outlines how the company adjusts to change over a period of years rather than months.

A strategic platform supports:

- Expansion into new regions

- Introduction of new asset classes

- Evolving compliance requirements

- Growth in client and partner networks

Brokers become more adaptable and resilient when software is viewed as infrastructure as opposed to tooling. As market conditions and regulatory frameworks continue to change, this viewpoint is crucial.

By 2026, broker software needs to be an operating system rather than a set of tools. Software for brokers serves as the cornerstone of scalable, reliable operations by facilitating audit-ready governance, supporting complex ecosystems, integrating intelligence, and enforcing consistency. Today’s brokers are developing the maturity needed to confidently compete in a sector that is becoming more demanding by investing in system-led platforms.