Prop firms operate in a fast-moving, high-stakes environment where precision and efficiency are everything. CRM systems are meant to streamline trader onboarding, challenge tracking, payouts, and compliance. But off-the-shelf solutions often fall short.

Skipping CRM customization might seem like a shortcut—but it can cost a prop firm dearly. From lost trader engagement to compliance risks and operational bottlenecks, the gaps add up quickly.

In this article, we’ll uncover what a prop firm risks when it overlooks CRM customization—and how to fix it.

1. Why CRM Customization Matters to Every Prop Firm

A customized CRM isn’t just a tech upgrade—it’s a strategic necessity for any prop firm aiming to scale. Unlike traditional brokerages, a prop firm manages unique workflows like trader challenges, performance evaluations, and profit splits. A generic CRM often can’t accommodate these specialized processes.

If a prop firm relies on default CRM setups, they’re likely to face manual workarounds, system incompatibility, and missed performance insights. Customization ensures that the CRM supports every unique stage of the trader lifecycle—from application to funding.

2. What Happens When Prop Firms Skip CRM Customization

Skipping CRM customization can quietly stall the growth of any prop firm. Here’s what often goes wrong:

- Limited performance insights: Without tailored dashboards, a prop firm can’t track critical trader metrics like drawdowns, pass rates, or P&L trends—making it harder to identify top talent or intervene early.

- Disconnected trading and CRM systems: Many prop firms operate separate tools for trading and management. Without CRM integration, staff waste time manually syncing data between platforms like MT4 and the CRM.

- Compliance risks increase: A generic CRM can’t monitor or flag unusual trading activity. This puts the prop firm at risk of missing key compliance events and failing audits.

- Missed sales and retention opportunities: If your CRM doesn’t track a trader’s lifecycle—failed evaluations, re-entries, inactivity—you’re missing easy wins. A customized system can automate re-engagement campaigns and upsells.

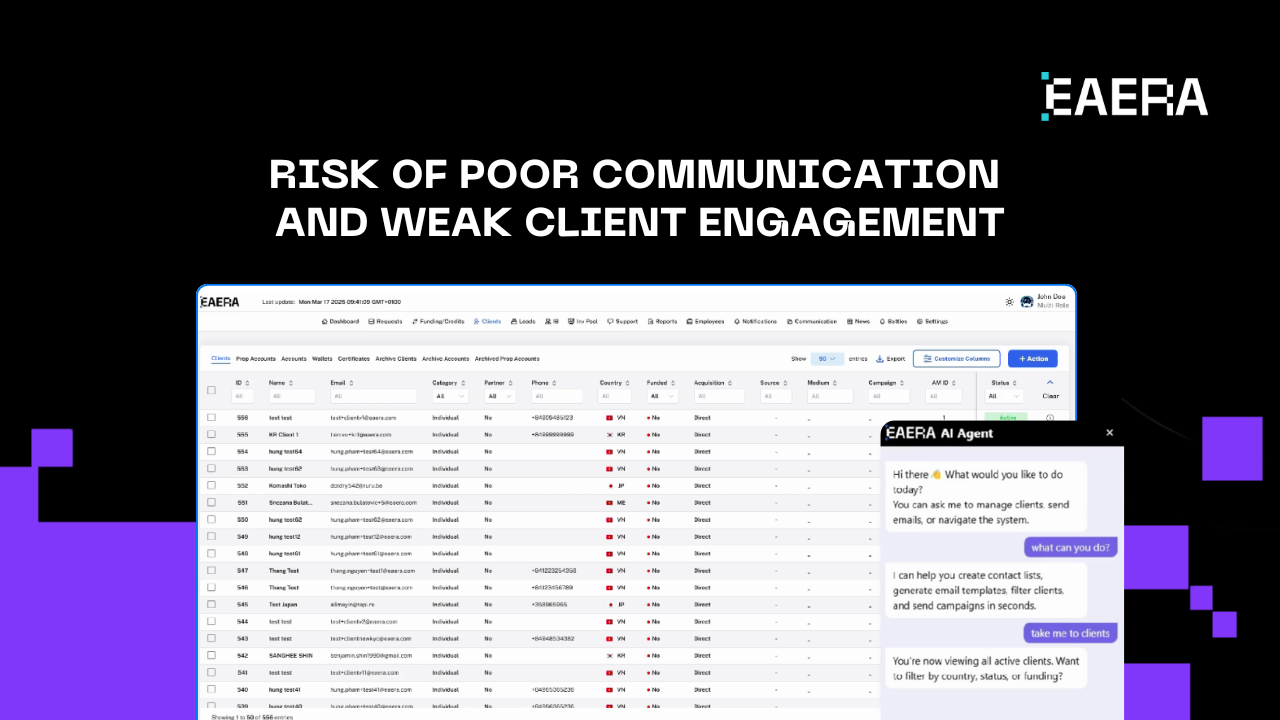

- Poor communication and client experience: A prop firm that can’t segment and personalize trader communication risks losing trust, leading to higher churn.

For a prop firm aiming to grow, a one-size-fits-all CRM just won’t cut it. Customization ensures every workflow supports your traders, staff, and bottom line.

3. Must-Have CRM Customizations for Prop Trading Firms

To stay competitive, a prop firm needs more than a generic CRM—it needs customization tailored to trading operations, compliance, and client experience. Here are essential features every prop firm should prioritize:

- Custom dashboards: Display real-time trader KPIs such as P&L, drawdown, pass/fail status, and risk metrics. This allows your prop firm to monitor performance and act quickly when needed.

- Trading platform integration: Connect your CRM with MT4, MT5, or your proprietary system to automatically sync trades, account data, and activity—reducing manual work and data mismatches.

- Automated workflows: Streamline onboarding, evaluations, funding approvals, and payouts. Automation saves time and keeps your prop firm agile and efficient.

- Real-time alerts and notifications: Get instant alerts for compliance issues, inactivity, or underperformance. This helps your team stay proactive and reduce risk.

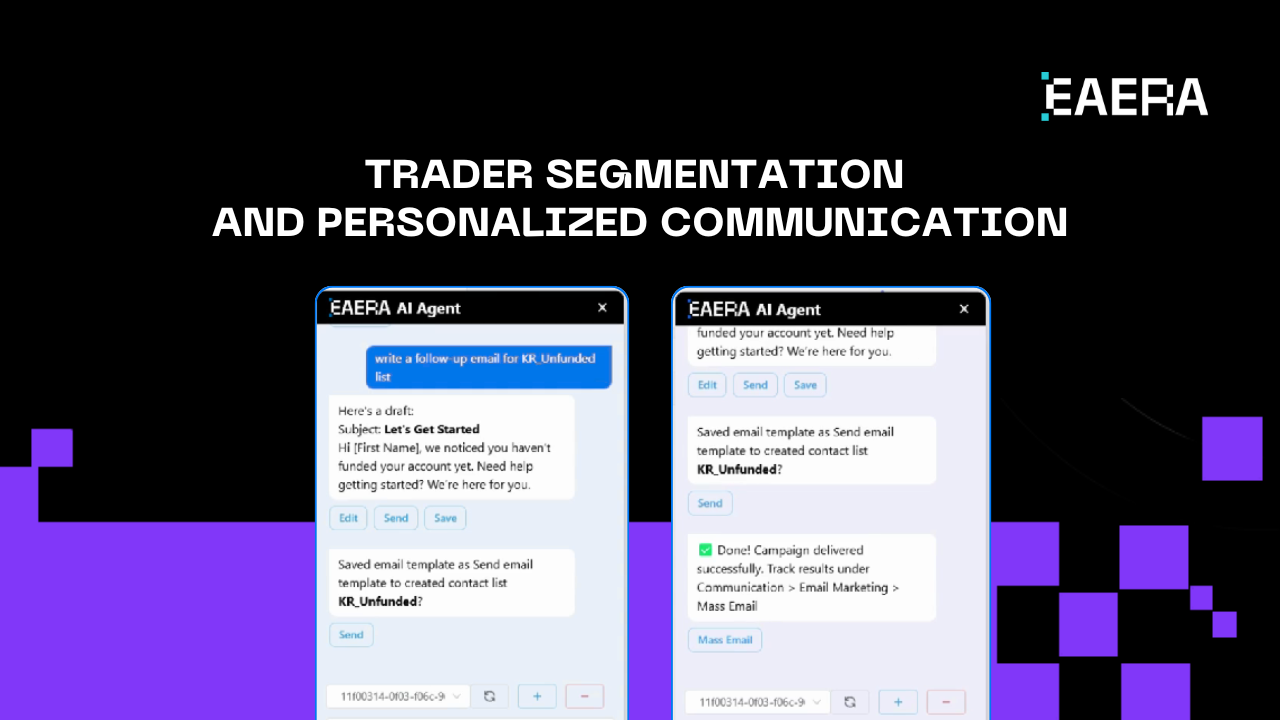

- Trader segmentation and personalized communication: Group traders by stage (e.g., prospects, funded, retry) to send relevant updates, promotions, or guidance. It enhances engagement and retention.

A well-customized CRM aligns with how your prop firm actually operates—unlocking smarter workflows, better decisions, and faster growth.

4. Benefits of a Customized CRM for Prop Firms

A customized CRM can transform the way a prop firm operates—helping teams move faster, make smarter decisions, and scale more effectively. Here are the core benefits your prop firm can expect:

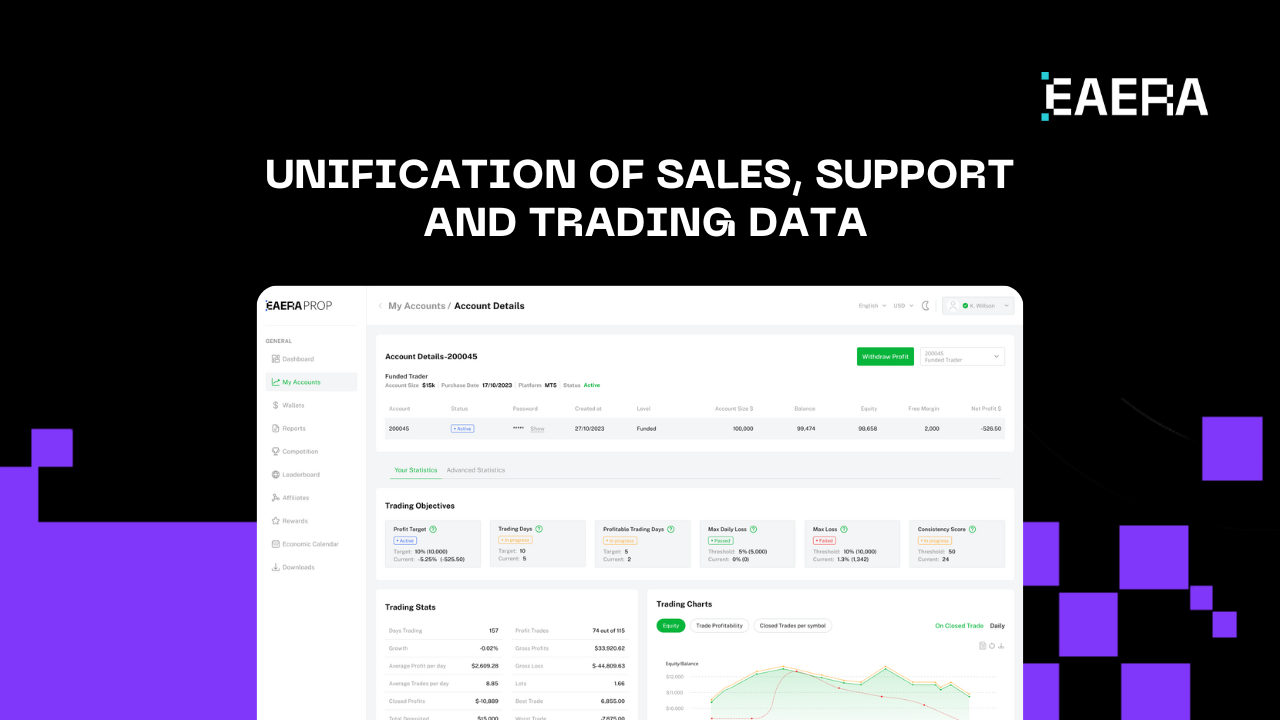

- Faster decision-making: With real-time dashboards and trading data integrated into your CRM, a prop firm can instantly assess performance, identify risk, and respond without delays.

- Improved trader retention and satisfaction: Custom workflows, automated support, and personalized messaging improve the trader experience—leading to higher retention rates and a stronger reputation for your prop firm.

- Greater scalability and internal efficiency: As your trader base grows, automation handles repetitive tasks like onboarding, funding, and evaluations—freeing up staff and allowing your prop firm to scale without adding headcount.

- Better risk control and compliance readiness: Customized CRMs can trigger alerts for suspicious behavior, failed challenges, or inactivity—ensuring you stay compliant and reduce exposure.

- Unification of sales, support, and trading data: A centralized view of each trader’s life-cycle helps your teams work collaboratively—from first contact to funding and beyond.

For any modern prop firm, a customized CRM isn’t just a nice-to-have—it’s a strategic advantage that supports growth, compliance, and operational excellence.

5. How to Approach CRM Customization the Right Way

Customizing a CRM is a strategic move that can elevate your prop firm—but only if it’s done methodically. Here’s how to approach it the right way:

- Map out key workflows and data touchpoints: Every prop firm has unique processes—from lead capture and trader onboarding to account funding and evaluations. Start by identifying what needs to be tracked and automated.

- Choose a CRM provider with open APIs or modular design: Flexibility is critical. Your prop firm needs a CRM that can integrate with trading platforms like MT4/MT5 and scale as operations grow.

- Align CRM metrics with business goals: Track KPIs that matter to your prop firm, such as pass rates, time to fund, trader ROI, and churn. Custom reports should reflect both operational and performance metrics.

- Pilot your setup and gather feedback: Before going all-in, test the customized CRM with a small group. Collect insights from traders and staff to refine usability and workflows.

- Train your team for adoption and consistency: Even the best CRM fails without proper usage. A prop firm must invest in onboarding and ongoing training to maximize system value.

A thoughtful rollout ensures your prop firm gets the full return on its CRM investment.

Prop firms operate in a fast-paced, data-heavy environment where one-size-fits-all CRMs often fall short. Without tailored customization, you’re likely missing key insights, losing efficiency, and risking trader churn.

If you’re serious about scaling your prop firm, investing in a CRM that’s customized to your unique needs isn’t optional—it’s essential.

At EAERA, we specialize in CRM solutions built specifically for prop trading firms. From platform integrations and custom dashboards to compliance automation and trader lifecycle tracking, we help you streamline operations and make smarter decisions.

👉 Want to see what a purpose-built CRM can do for your prop firm?