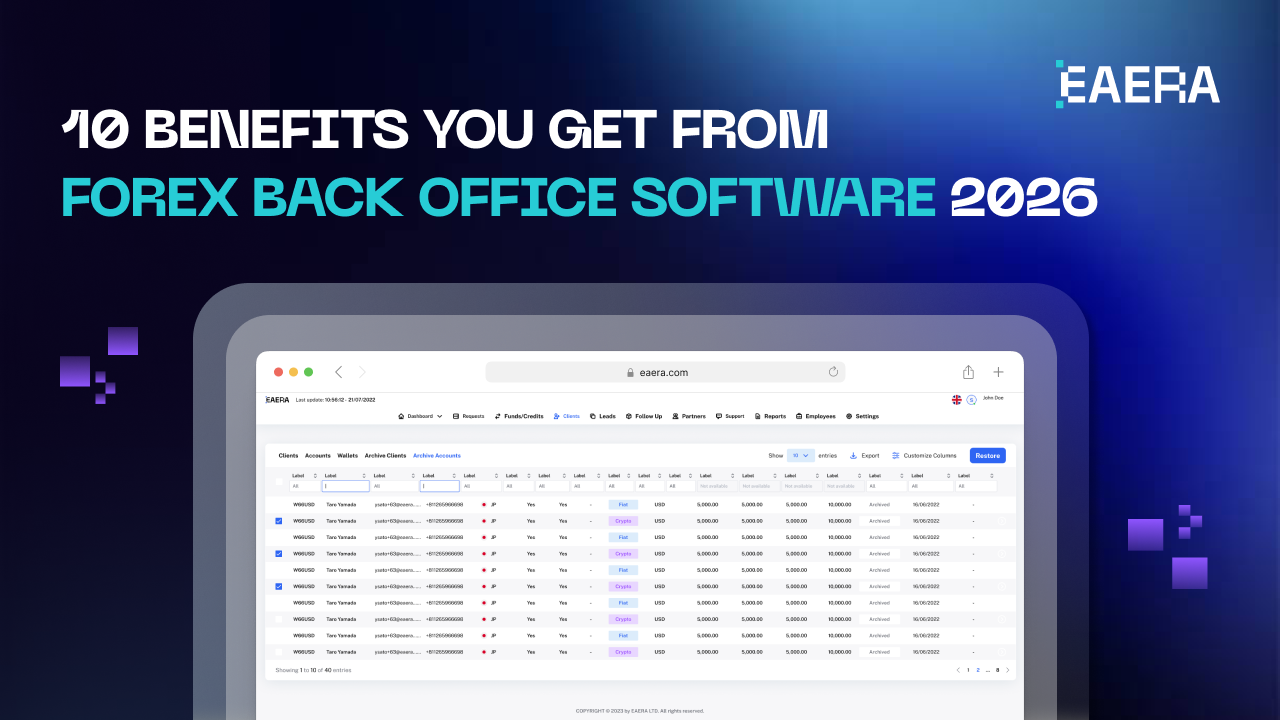

Growth in the forex market is now determined by brokers’ ability to handle complexity rather than market demand as 2026 approaches. Internal systems are under pressure from increased trading volumes, more stringent compliance regulations, multi-region operations, and growing client expectations. In this context, forex back office software has evolved from a supplementary tool to a strategic basis for long-term expansion.

Related articles:

- Top Features Every CRM for Forex Brokers Needs in 2026

- 5 Best Practices FX Brokers Must Know for Back Office Software

The 10 most significant benefits that contemporary forex businesses receive from utilizing forex back office software are broken down in this article along with an explanation of how these benefits translate into actual operational and financial impact.

Why Forex Back Office Software Is a Growth Enabler in 2026 ?

Today’s forex brokers are operating in an environment in which speed, precision, and control all have to coexist. Manual processes or spreadsheets simply are not equipped to handle the level of forex trading and regulation in real-time activity and regulatory oversight. When businesses grow and scope, fragmentation leaves blind spots in their process chains.

Contemporary forex back office brings data related to operations into one place, enables automation of key business activities, and gives real-time business-wide visibility. This means that instead of waiting to respond to problems after they arise, forex brokers can proactively address risk management, compliance, and business performance. These changes, moving from a reactive to a planned method of business operations, make the user of forex back office software a catalyst for business growth in 2026.

The 10 Core Benefits of Forex Back Office Software

The following are the top 10 most valued advantages that benefit the broker when a modern forex back office system is implemented.

1. Centralized Client, Account, and Transaction Visibility

Forex back office software integrates all customer profiles and trading accounts, including balances and trade history. This streamlines the offices by eliminating any disparity in information being stored in the sales, operations, finance, and compliance departments.

Rather than searching for information in various tools, the teams get immediate access to the correct information about their clients and accounts.

2. Automated Reconciliation of Trades and Funds

Manual reconciliation is one of the main sources of operational inefficiency. The modern forex back office automatically matches trades, deposits, withdrawals, and balance on multiple platforms.

In this case, it ensures that there are no delays in settlement, it eradicates accounting inconsistencies, and it reduces errors to a significant extent.

3. Real-Time Operational and Financial Reporting

In fast-moving markets, delayed information causes delays in decision-making. Forex back office solutions support the generation of real-time dashboards for balances, P&L, liquidations, and operational information.

It allows management to monitor this performance on a continuous basis rather than waiting for the end-of-day or end-of-month reports that are now outdated.

4. Stronger Risk Exposure Monitoring

Risk management has turned from a reactive process into a proactive exercise. A new-generation forex back office system now measures risk exposure metrics such as margin, leverage, equity, and drawdown while trading.

Early detection of unusual patterns enables brokers to act before risks to materialize, safeguarding both capital and reputation even in fluctuating markets.

5. Built-In Compliance and Audit Readiness

Behind its expectations, regulations keep growing worldwide. Forex back office software has inherent support for structured KYC, AML, transaction recording, and audit trials.

This will allow brokers, instead of collecting data on compliance by hand, to immediately access full records, easing regulatory woes.

6. Fraud Prevention and Operational Safeguards

Fraud and abuse can be seen through behavior patterns rather than one-time occurrences. The centralized forex back office for transactions helps in creating alerts and behavior monitoring based on rules set.

This proactive protection helps brokers safeguard funds, enforce internal policies, and build trust with both regulators and clients.

7. Reduced Manual Workload and Human Error

Automation in funding, reconciliation, reporting, and compliance eliminates repetitive work. It lessens labor pressure and prevents expensive errors that come with manually entering numbers.

As efficiency is gained in operations, teams are then able to focus on strategic projects and not just fight fires in terms of operational administration.

8. Faster, Data-Driven Decision-Making

The timely provision of accurate data empowers the leadership to take immediate, well-informed decisions. Whether while modifying risk policies, assigning or reassigning resources, or acting upon market fluctuations, the decisions are not guesswork but data-driven key decisions.

This capability becomes increasingly valuable as businesses scale and decision complexity grows.

9. Compatibility with Trading Platforms and CRMs

A modern forex back office is expected to have seamless integration capabilities with MT4, MT5, CRMs, payment systems, and analytics platforms.

They do this by reducing the duplication of effort. Secondly, they simplify reporting. Finally, they facilitate a more unified operational strategy.

10. Scalable Infrastructure for Multi-Brand and Multi-Region Growth

Growth introduces complexity. Scalable forex back office systems support multiple brands, multiple regions, and multiple business models.

Enterprise-grade platforms like the ones developed by EAERA are designed to cope with this level of complexity, making it possible for the brokers to scale with ease.

How These Benefits Translate into Operational and Financial Impact?

The power of the forex back office system lies in the compounding effect that all the above advantages bring to the fore. This is because data management made easier is key to making the entire system flawless.

In terms of operations, they work more efficiently because they share the same information and processes. Financially, it helps because there are fewer losses due to mistakes, delays, or failures in compliance. In terms of strategy, it helps because there is visibility for the executives or leaders of the insurance companies.

Through the alignment of technology and business needs, the forex back office ceases to be a cost center and instead becomes a profit driver. Solutions developed with modern architecture, such as what EAERA can provide, are designed for this long-term operating efficiency.

How to Maximize Value from Forex Back Office Software?

The implementation of forex back office software alone is not a solution. The brokers must use the software successfully. To successfully utilize the software in 2026, they must:

- Make accuracy in real-time data more importantly than complicated customizations

- Align back office processes with business flows

- Avoid over-engineering in initial stages of growth

- Ensure the platform is developed specifically for forex operations

- View the back office as a strategic layer, not just an admin tool

When applied properly, forex back office software can be a bedrock of systematic growth rather than an ad-hoc means relating to many different issues.

The year 2026, and the key to success in the forex market comes from operational understanding, as well as trading understanding. The forex back office solution brings operational understanding with centralizing information, workflow automation, an improved level of compliance, and scalable development.

Contrary to considering the back office as a support function, a progressive broker views the back office as a strategic resource which not only secures their capital but also helps them remain more resilient in the complex technological environment.